Kraken Alternatives 2026: Top Safe Low Cost Crypto Exchange Options

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Binance - Best Kraken Alternative

We tested the top Kraken alternatives with real trades. Binance stands out as the strong overall choice, offering 0.1% fees (vs Kraken’s 0.16%/0.26%), deeper order books, and 500+ assets. Coinbase suits US users by prioritizing simplicity, Bybit fits frequent BTC/ETH traders, and OKX appeals to automation-focused users.

GNcrypto's Verdict

We compared Kraken alternatives across fees, liquidity, asset range, fiat access, and safety. Binance stands out as the strongest option: our $200 BTC test trades executed instantly at 0.1% fees (much lower than Kraken’s 0.16%/0.26%), order books showed good depth, and the platform supports 500+ assets with full pro trading tools.

For those valuing regulatory transparency, Coinbase provides audited financials and reliable US banking rails. Bybit offers the deepest BTC/ETH books with regular fee promotions, while OKX suits traders seeking built-in automation. Overall, Binance provides a solid balance of low cost, liquidity, and broad market coverage for most traders we tested.

- Orders fill instantly

- Low fees

- Full pro toolset

- Watch for limits by jurisdiction

- Somewhat lacking in terms of public audits

On this page

GNcrypto team reviews the best Kraken alternatives for 2026. Binance ranks first for lowest fees (0.1% vs Kraken’s 0.16%), deepest liquidity, and 500+ assets. We also compare Coinbase for US simplicity, Bybit for BTC/ETH depth, and OKX for automation tools.

Why Traders Seek Alternatives to Kraken

If you are comparing the best Kraken alternatives, the reasons are usually practical. First, total cost: some traders want lower on‑book fees for small, frequent orders. Second, regional access: fiat rails and certain products differ by country or state. Third, asset breadth: you may need more altcoins or specific quote pairs. Fourth, transparency and compliance posture.

We tested the top Kraken alternatives with real $200 BTC trades to see how they compare. After evaluating fees, liquidity, execution speed, and transparency, Binance ranks as the best overall choice for most traders – it offers 0.1% fees (vs Kraken’s 0.16%/0.26%), deeper order books, and 500+ assets. For users with specific needs, Coinbase works best for US regulatory transparency, Bybit for BTC/ETH depth, and OKX for built-in automation.

Below, we break down each platform in detail.

Binance

Among the best alternatives to Kraken crypto exchange, we would recommend Binance for its very deep liquidity on BTC and ETH, low base maker/taker fees at 0.1%/0.1% (with further reductions via BNB or volume), and a massive asset list. In our tests, orders filled instantly at retail sizes and the pro terminal exposed full L2 depth, OCO/stop/limit tools, and copy or bot hooks where available.

Strong order book depth and execution speed; low effective on‑book costs; complete pro toolset

Regional differences in fiat rails and product access (availability varies between Binance global and Binance.US); self-published Proof of Reserves (PoR) snapshots rather than a classical GAAP/IFRS audit; some legal and regulatory overhang in certain jurisdictions.

Active spot traders who prioritize low costs and broad market coverage

Strengths:

- Top global spot liquidity on BTC, ETH and USDT pairs; orders fill instantly at retail size.

- Very low standard maker/taker (0.1%/0.1%) and frequent 0%/rebate campaigns → 5/5 on costs.

- Huge market coverage: 500+ assets and frequent listings/delistings.

- Full pro toolset: advanced orders, L2/depth, TradingView-style charting, public REST/WebSocket, copy and bot hooks.

- Transparent PoR page and recurring reserve snapshots; SAFU described and wallets shown publicly.

Weaknesses:

- Fiat ramps and limits still vary strongly by jurisdiction – it’s not as uniform as on a single-country, single-license U.S. exchange.

- PoR is recurring and Merkle-based but still self-published; not all regulators count that as a full audit.

Coinbase

What are good alternatives for Kraken? For US traders, Coinbase is the obvious pick. It’s publicly traded, offers audited financials, and connects directly to your US bank account. We tested it and found the onboarding dead simple – you can start with basic buys and switch to Advanced Trade when you’re ready.

Audited financial reporting as a public company, very simple onboarding and clear UX, reliable infrastructure and brand trust.

Base trading fees are higher than fee-first offshore rivals; listings are more conservative; some products are limited by region.

Cautious first-time buyers who want maximum simplicity, strong fiat on-ramps, and transparency – even if the absolute lowest fee is not the top priority.

Strengths:

- Top-tier spot liquidity on majors (BTC, ETH) at fair prices for U.S./EU users.

- Clear, beginner-friendly UI and mobile apps.

- Strong fiat access for the U.S. and Europe.

- Advanced Trade mode for those who need order types and charts.

- Large, reputable brand with public reporting.

Weaknesses:

- Retail/low-volume fee is not the cheapest and often higher than competitors’ instant-buy fees.

- Asset selection sits in the mid/high tier, but not at the “thousands of altcoins” level.

- Features remain geo-restricted.

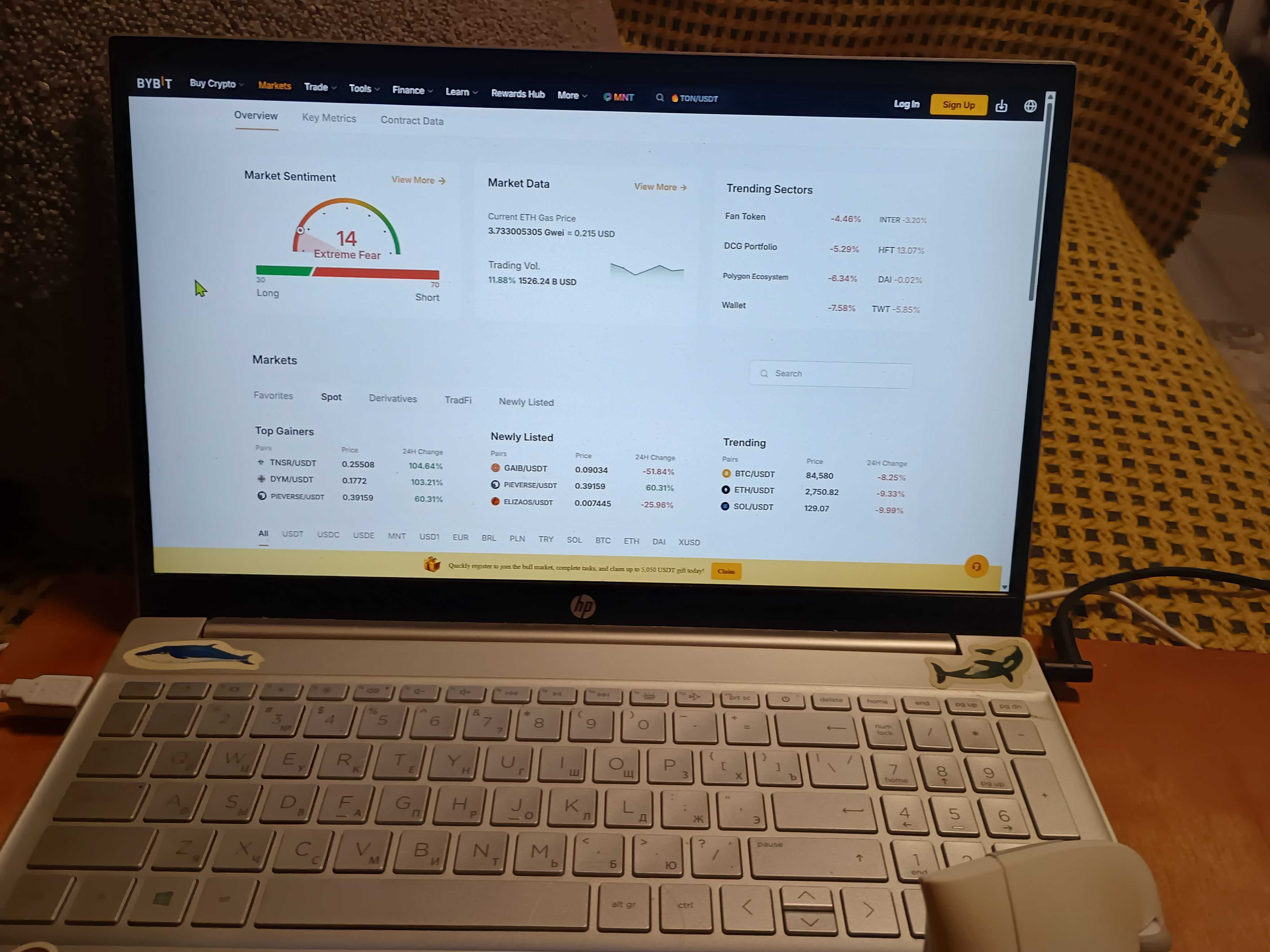

Bybit

If you need alternatives to Kraken for active BTC/ETH trading, Bybit fits. We placed test orders and saw consistently deep books on major pairs. Fee promos are frequent, and the terminal layout feels familiar if you’ve used pro interfaces before.

Low effective trading costs on the book (especially during promos), deep books on major pairs, a good range of order types and bot integrations. Monthly independent audits by Hacken: third-party PoR verification since June 2024 with 100%+ reserve ratios confirmed (stronger transparency than Binance/OKX self-published snapshots).

Country-specific fiat rails and product availability. Execution felt generally fast, though very small orders may see slightly higher fees in certain regions.

Active spot traders hunting for consistently low costs and deep books on BTC/ETH.

Strengths:

- High Market Quality: We experienced instant fills and tight spreads on majors (BTC/ETH) during our $200 test orders.

- Competitive Costs: Low 0.10% base fees, which can be further reduced via “Post-Only” orders and frequent promotions.

- Power User Terminal: A complete toolkit featuring native OCO orders, Grid Bots, Copy Trading, and TradingView charts.

- Asset Depth: An aggressive listing cadence (496+ coins) that provides early liquidity for altcoin hunters.

Weaknesses:

- Geo-Restrictions: The platform is strictly blocked in major markets, including the U.S., UK, Canada, and France.

- Fiat Friction: Direct bank deposits are limited; funding often relies on P2P markets or pricier third-party gateways.

- Audit Status: While Bybit publishes a self-reported Proof of Reserves, it lacks a fully independent, external financial audit.

- Learning Threshold Complexity: The feature-dense interface is often overwhelming for absolute beginners.

OKX

OKX makes most lists of top Kraken alternatives because of built-in automation – grid bots, DCA, arbitrage tools all included. We tested the interface and found it fast with solid BTC/ETH depth. One catch: EEA fees run higher than the global rate, so check your region’s pricing first.

Competitive global spot fees, good liquidity on major pairs, and native automation tools where available.

In the EEA the Regular tier starts higher than global (making tiny orders pricier); some products/features are unavailable in certain countries; self-published Proof of Reserves (PoR) snapshots.

Users outside higher‑fee regions who place disciplined limit orders and want automation in a pro‑grade interface.

Strengths:

- Low baseline spot fees on the global schedule: 0.08% maker / 0.10% taker; additional discounts via VIP tiers and when paying in OKB.

- High liquidity on top pairs (BTC/USDT, ETH/USDT) and a broad lineup of assets.

- Regular Proof‑of‑Reserves (monthly snapshots; “primary assets” expanded in 2025).

- VARA in the UAE: in 2025 – a pilot for retail derivatives in a regulated environment.

Weaknesses:

- Legal risk (US and parts of the EU). In February 2025, the OKX operator pleaded guilty to AML violations; an external compliance monitor was appointed through 2027.

- Geographic unevenness: Exit from Canada (2023), limited CeFi services in India (2024), local restrictions in the EEA. OKX US rolls out gradually with a reduced product set.

- EEA fees above global baseline: Since 01.10.2025, the Regular spot tier is 0.20% maker / 0.35% taker with no volume discounts; VIP and OKB fee rules differ from the global schedule.

Final Verdict

If you are looking for an alternative to Kraken, it really comes down to what you value – low fees, simple banking, or clear regulation.

For most traders, Binance ends up on top: fees at 0.1% beat Kraken’s 0.16%/0.26%, liquidity is deeper, and our test trades consistently fill faster.

Bybit suits frequent BTC/ETH traders thanks to tight spreads and fast execution outside the US.

OKX is the pick if you want built-in trading bots, though fees vary by region, especially in Europe.

Whatever you choose, test with a small amount first – deposit $100, make a quick trade, try a withdrawal. It’s the easiest way to see real fees, execution speed and whether the platform actually works in your country before putting in larger capital.

Top Kraken Alternatives – Quick Comparison

| Exchange | Standout | Fees | Assets | Fiat | PoR | Best for |

|---|---|---|---|---|---|---|

| Kraken | Security-first, clear UX | Pro tiers, competitive | ≈560 | US/EU bank rails | PoR + disclosures | Beginners, safety-focused users |

| Binance | Lowest cost + deepest books | 0.10% / 0.10% | ≈500 | Varies by region | Self-published PoR | Active spot traders |

| Coinbase | Public company transparency | ~0.40% / ~0.60% base | ≈475 | Strong ramps | Audited financials (no routine PoR) | First-time buyers |

| Bybit | Very deep BTC/ETH books | ~0.10% / ~0.10% | ≈500 | Varies by country | Merkle PoR hub | Active spot traders |

| OKX | Pro-grade UI + bots | 0.08% / 0.10% (global); EEA higher | Hundreds | Jurisdiction dependent | Monthly PoR snapshots | Limit-order users outside high-fee regions |

| KuCoin | Broad altcoin variety | ~0.10% | 1,000+ | Uneven | Merkle PoR | Altcoin hunters |

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.