How Safe is Kraken in 2026: Beginner Guide to Security and Risks

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Kraken

Kraken is stable and rock-solid in terms of security. They offer name passkeys, 2FA, whitelists, quarterly audits, and cold storage for most funds as their safety precautions.

The Bottom Line

Kraken has been around since 2011. Long enough to safeguard user funds against all kinds of threats and risks. You can use helpful safety features like passkeys (or fingerprint login on supported devices) and approved withdrawal lists to be on the safe side. The platform regularly provides proof that it holds enough crypto to cover all customer accounts (Proof of Reserves).

- Long, clean track record

- Strong account-level protections

- High level of transparency on solvency

- Security protections are largely opt-in, not default

- Proof of Reserves is still a snapshot, not real-time assurance

- High user-side responsibility

On this page

We tested Kraken from a beginner view and explained how to stay safe in 2026. In our opinion, Kraken is a solid choice if you enable core protections: passkeys or 2FA, Global Settings Lock, and a withdrawal whitelist. We also cover phishing traps, when to use self custody, and a simple checklist for your first secure buy.

Platform Overview & Background

Is Kraken safe for beginners? Yes. In our testing, Kraken proved to be a safer, beginner-friendly choice for your first spot purchase – provided you follow basic security hygiene.

Founded in 2011, Kraken is one of the longest‑running centralized exchanges. Over the years it has built a safety‑first reputation, with clear onboarding and availability in major jurisdictions. For a first BTC or ETH buy, the interface feels closer to a standard fintech app than a trader‑only terminal.

For beginners, registration and identity checks are straightforward, bank and other fiat rails are clearly labeled, and the default spot screen shows only the essentials until you switch into advanced mode. In our tests, that reduced decision overload on a first purchase.

To get started, we recommend a simple path: sign up, complete verification, enable strong 2FA, and make a small test purchase (around $20–$50) to learn the flow and fees; and if you plan to hold long term, withdraw to your own wallet once you feel confident.

Kraken’s Core Security Tools & Protections

Is Kraken exchange safe? Our testing shows that Kraken combines strong default controls with several opt‑in protections that beginners can enable in minutes. Here’s what you can actually switch on and how it helps.

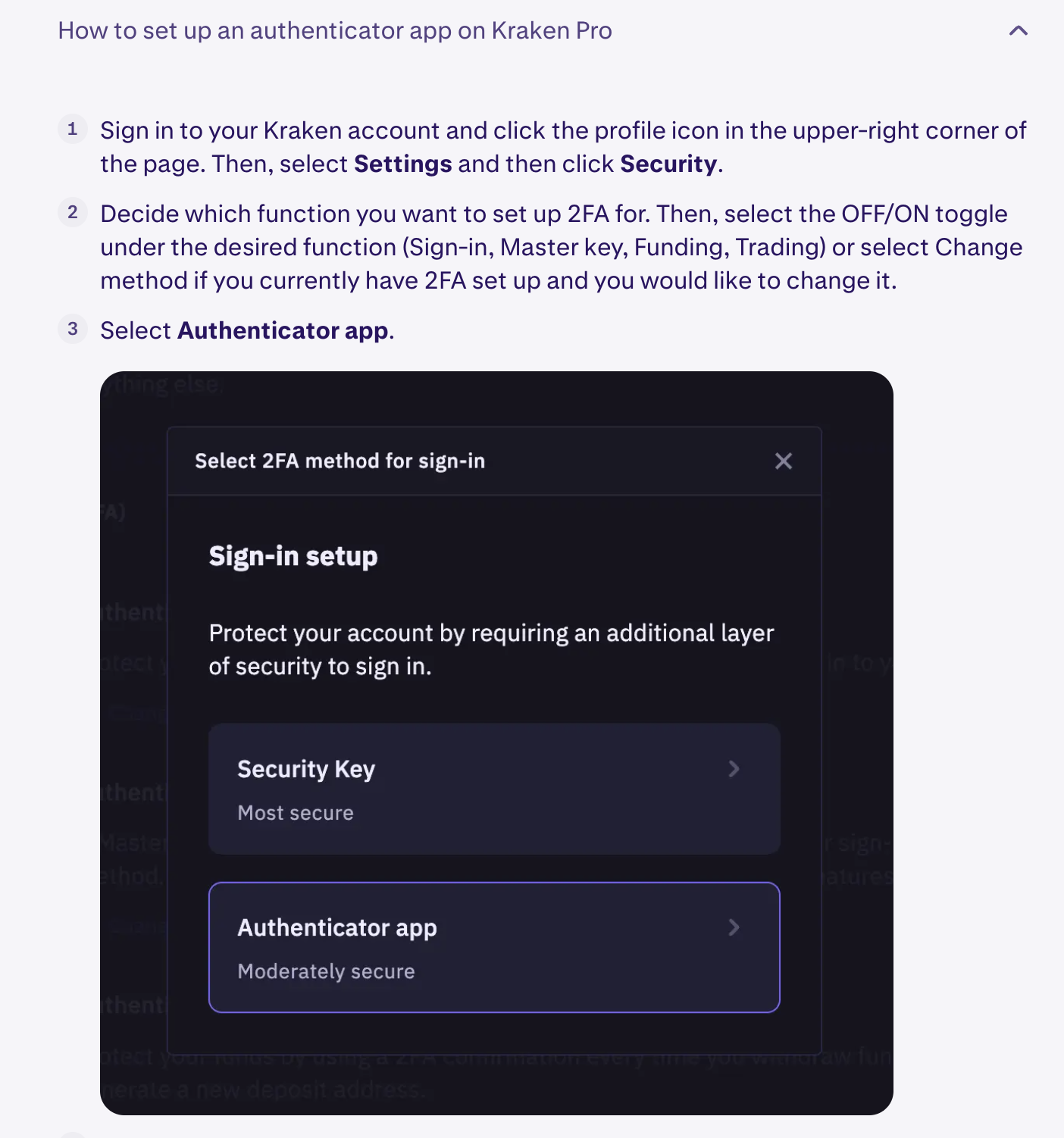

Kraken supports two strong sign‑in options: app‑based 2FA codes and passkeys (FIDO/WebAuthn). When we tried both, they worked smoothly, but for day‑to‑day use we would recommend passkeys on devices that support them and an authenticator app as a backup. SMS‑based codes are better than nothing, yet we would avoid them due to SIM‑swap risk.

For account changes and withdrawals, Kraken lets you verify email authenticity (PGP-signed mail and a verified @kraken.com sender), set a withdrawal address whitelist, and enable the Global Settings Lock (GSL). In plain language, whitelisting limits where funds can go, and GSL freezes sensitive settings for a set period; for email, verifying the sender domain and PGP signature makes fake messages easier to spot. We view this trio as essential for new users.

On the custody side, Kraken states that the majority of client crypto is kept in cold storage, separated from online systems, with operational monitoring and incident response. That design reduces the attack surface versus keeping everything hot. The platform also maintains public service communications (status and announcements) so you can check for maintenance or degraded performance before trading.

What to enable from day one (practical checklist):

- Passkeys (or an authenticator app) for sign‑in and funding actions

- Global Settings Lock (after you finish initial setup)

- Withdrawal address whitelist (add your own wallet, then lock it in)

- Email security: verify the @kraken.com sender, enable PGP-signed mail where supported, and keep login/withdrawal notices on

Bottom line: the tools are there and, in our opinion, they are easy enough for beginners. Turn them on early, then keep them on – good habits are just as important as the exchange’s security features.

Kraken’s Security Track Record

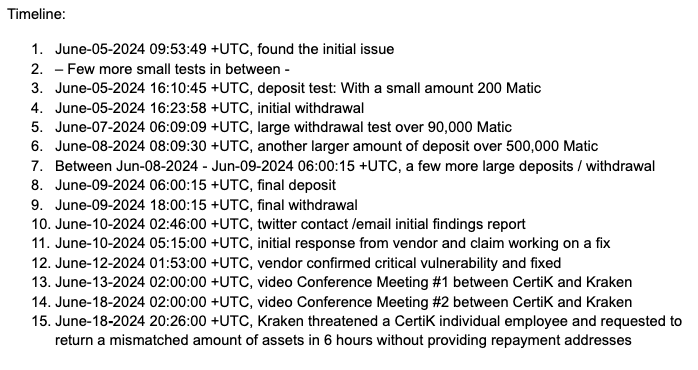

Kraken has been operating since 2011 without any loss of customer funds due to security breaches. The platform’s only notable incident happened in June 2024, when security researchers from CertiK exploited a deposit bug to extract $3 million – from Kraken’s treasury, not client accounts.

The vulnerability, which arose after a recent UI update, was patched within an hour, and all funds were returned within days. This spotless 14-year track record is one reason Kraken was chosen to manage Mt. Gox bankruptcy assets and continues to be trusted by institutions.

That said, the 2024 incident exposed some gaps in bug bounty enforcement. The researchers initially refused to return the funds, prompting Kraken to involve law enforcement and publicly describe the action as extortion rather than responsible disclosure.

Proof of Reserves & Independent Audits

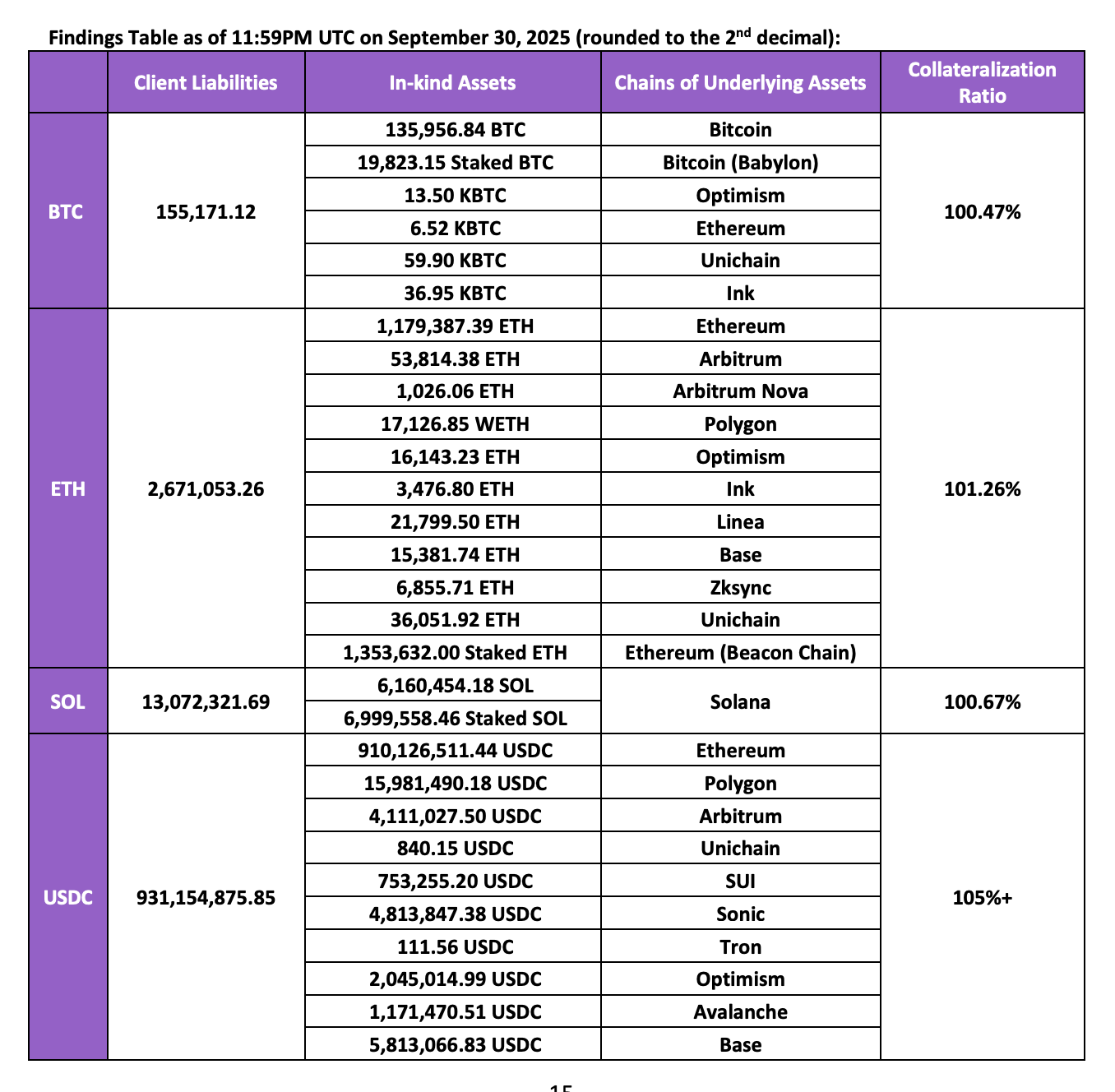

Kraken publishes quarterly Proof of Reserves (PoR) audits, conducted by The Network Firm, an independent CPA. The latest report, dated September 30, 2025, shows reserve ratios above 100% for all major assets: BTC 100.4%, ETH 101.2%, SOL 100.6%, and stablecoins over 105%. Unlike many other exchanges, Kraken shares both its assets and client liabilities, giving users a clear view of its solvency. Each user can also independently verify their balance using Merkle tree cryptography via Kraken’s open-source verification tool.

These audits cover spot holdings, margin positions, futures balances, and staked assets – not just cold storage wallets. Kraken pioneered PoR back in 2014 and moved to quarterly reporting in 2025, aligning the practice more closely with standard financial disclosures. While this level of transparency exceeds what most exchanges provide, it’s important to note that the audits reflect holdings at a specific point in time, not a continuous real-time guarantee.

Insurance & Fund Protection

Kraken does not carry FDIC insurance, which is standard for crypto exchanges, nor does it maintain separate crime insurance to cover losses from platform negligence. This differs from some competitors, like Coinbase, which offer additional insurance for customer deposits. As a result, users are responsible for enabling available security features – such as passkeys, 2FA, Global Settings Lock, and withdrawal whitelists – to protect their accounts.

The majority of client crypto is held in cold storage, separated from online systems, which reduces the attack surface. However, without insurance coverage, users bear the risk if their account is compromised through phishing, credential theft, or other user-side vulnerabilities. For long-term holdings, Kraken recommends withdrawing funds to self-custody wallets.

Possible User‑Side Risks & Platform Considerations

If you are wondering is Kraken Pro safe, our view is yes – provided you use the built‑in protections and avoid common pitfalls. Safety depends partly on the exchange and partly on your own actions.

Storage and when to withdraw. For frequent trading and small balances, leaving funds on the exchange can be practical. For long‑term holdings, we would withdraw to self‑custody once you are comfortable managing a wallet and backups. Start with a small test withdrawal before moving larger amounts.

Phishing and impostors. Newcomers are often targeted by fake support in messengers and look-alike websites. We recommend typing Kraken’s URL manually, using bookmarked links, and verifying the @kraken.com sender and PGP signature where supported so real emails are recognizable.

Devices, passwords, networks. Keep your OS and browser updated, use a password manager with unique, strong passwords, and avoid public Wi‑Fi for account changes or withdrawals.

Fees, networks, and dry‑runs. Always check the network you are withdrawing on, confirm addresses carefully, and consider a small “dry‑run” transaction to the destination wallet to validate the path and fees.

Our take on Kraken Pro: in normal spot use, the platform is safe for beginners who keep core protections enabled. We would start without API keys, leverage, or bots until you are confident.

Tips to stay safe and safeguard your funds: confirm 2FA/passkeys, GSL, and whitelists are enabled; run a $5–$20 test withdrawal; store recovery info securely.

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.