Is Binance Safe to Use in 2026: Beginner Guide to Security and Risks

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Binance

Binance provides deep liquidity and offers the $1B SAFU insurance fund, mandatory anti-phishing codes, strict withdrawal whitelists, and monthly Proof of Reserves as their primary safety precautions.

The Bottom Line

Binance has been the world’s largest exchange since 2017, handling more trading volume than any other exchanges. It has transitioned from a “move fast” startup to a compliance-heavy giant. You can use robust safety features like YubiKey support, Anti-Phishing Codes, and a $1B insurance fund (SAFU) to protect your assets. The platform provides monthly Proof of Reserves (PoR) to verify it holds 1:1 custody of all customer funds.

- $1B+ SAFU Insurance Fund (covers extreme events)

- Monthly Proof of Reserves (100% backing of user funds)

- AA Security Rating (ranked 22 by CER.live)

- Regulatory complexity in some regions (US/Canada restrictions)

- High phishing target due to global popularity

- Customer support can be slow during peak market activity

On this page

We tested Binance from a beginner view and explained how to stay safe in 2025. In our opinion, Binance is a solid choice if you enable core protections: passkeys or 2FA, Anti-Phishing Code, and a withdrawal whitelist. We also cover phishing traps, when to use self custody, and a simple checklist for your first secure buy.

Platform Overview & Background

Is Binance safe for beginners? Yes. In our testing, Binance proved to be a robust, beginner-friendly choice for your first spot purchase – provided you use the “Lite” interface and follow basic security hygiene.

Founded in 2017, Binance is the world’s largest centralized exchange by trading volume. Over the years it has evolved from a rapid-growth startup to a financial giant, shifting its focus toward stricter compliance and user-protection measures like the SAFU fund. For a first BTC or ETH buy, the mobile app’s “Binance Lite” mode feels closer to a standard fintech app than a trader‑only terminal.

For beginners, registration and identity checks (KYC) are mandatory and strict, but bank and other fiat rails are clearly labeled. The default Lite screen shows only the essentials until you switch into Pro mode. In our tests, that reduced decision overload on a first purchase.

To get started, we recommend a simple path: sign up, complete verification, enable Passkeys/2FA, and learn the flow and fees; and if you plan to hold long term, withdraw to your own wallet once you feel confident.

Binance’s Core Security Tools & Protections

Our testing shows that Binance combines large-scale infrastructure with several opt-in protections that beginners should enable immediately. Below is what each option does and why it’s useful.

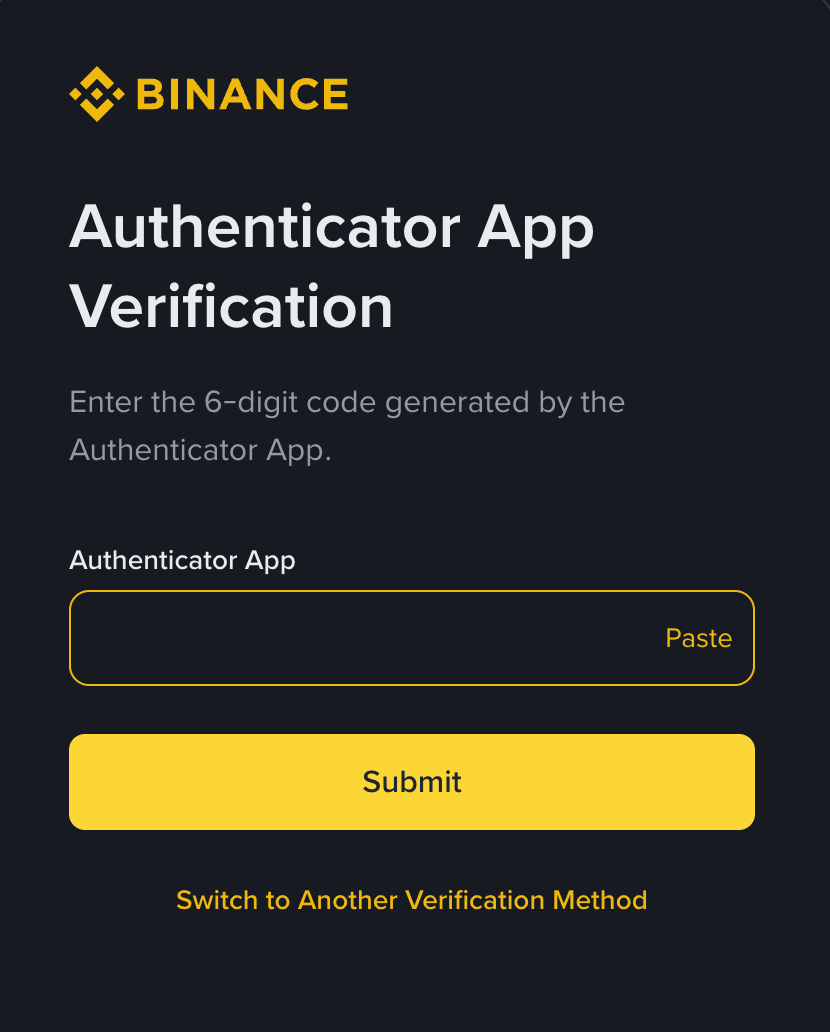

Binance supports robust sign-in options including app-based 2FA and hardware Passkeys (YubiKey). When we tried them, the setup was intuitive, allowing you to use your fingerprint or a physical key to authorize access. However, simply having these options isn’t enough; the real question “is Binance safe?” is answered by whether you actually enable these security layers. We strongly recommend using Passkeys or an authenticator app rather than SMS, which is vulnerable to SIM swaps.

For communication and withdrawals, Binance offers a unique “Anti-Phishing Code” and a strict withdrawal whitelist. Practically speaking, the Anti-Phishing Code lets you set a secret word that appears in every official email, instantly identifying fake messages. The whitelist restricts funds to specific addresses you trust, and importantly, Binance imposes a 24-hour lock on withdrawals if you add a new address, preventing hackers from draining funds quickly.

What to enable from day one (practical checklist):

- Anti-Phishing Code (set this immediately to spot fake emails).

- Passkeys (or Google Authenticator) for login and withdrawals.

- Withdrawal Whitelist (lock your funds to your own wallet).

- Device Management (review and kill suspicious sessions).

These tools are effective, but only if you enable them early.

Past Security Events and Platform Transparency

Binance has been operating since 2017and has faced several significant security incidents that would have bankrupted smaller exchanges. The platform’s most notable incident occurred in May 2019, when hackers used phishing and viruses to steal 7,000 BTC (worth ~$40M at the time) from Binance’s hot wallet.

Critically, no user lost money. Binance immediately covered the entire loss using its SAFU (Secure Asset Fund for Users), an emergency insurance fund built from trading fees. This response answers the common question “Binance is it safe?” by showing that the exchange absorbed the loss rather than passing it to users.

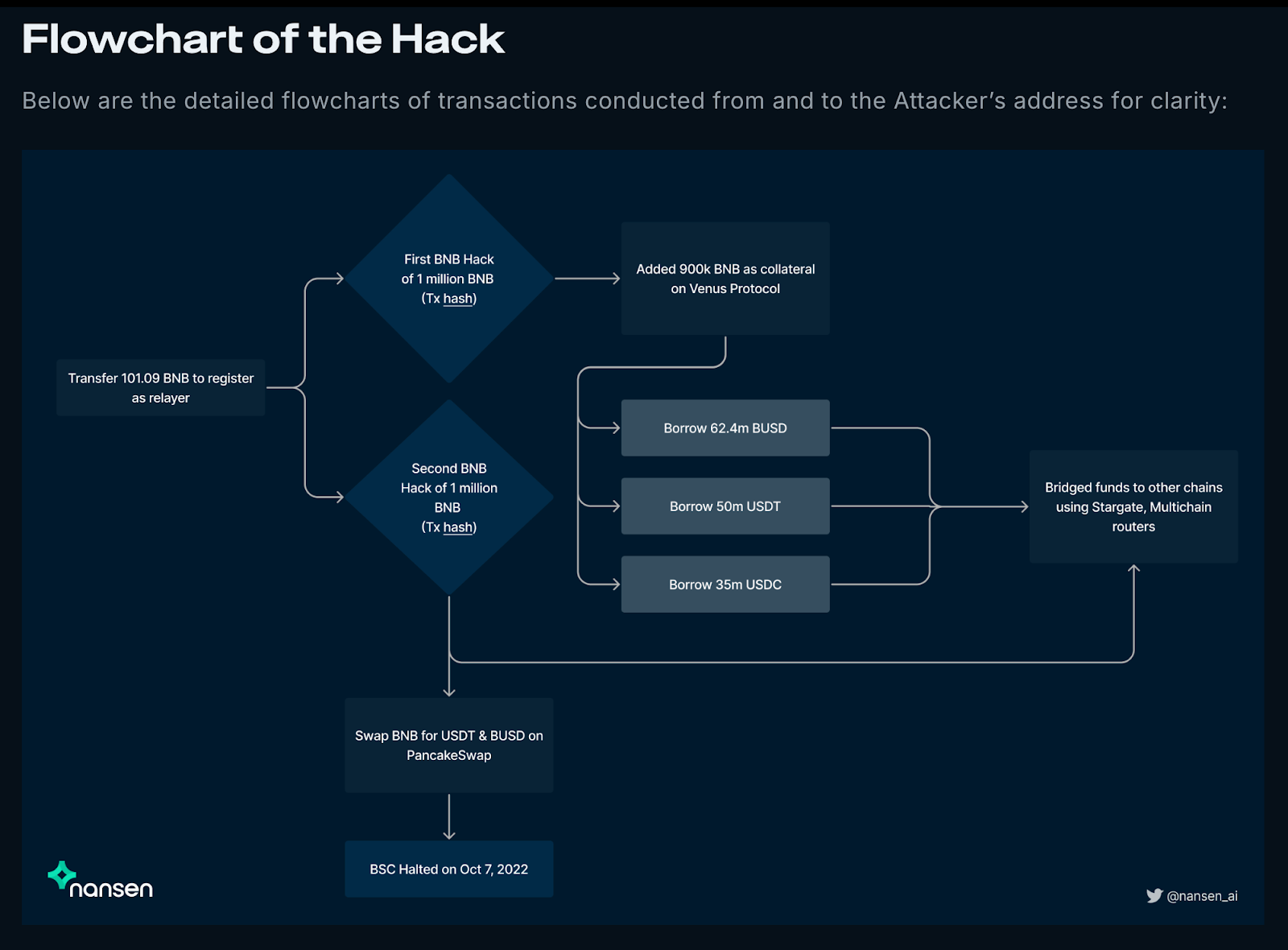

In October 2022, the BNB Smart Chain (a blockchain developed by Binance) suffered a bridge exploit where hackers minted ~$570M in BNB. This incident targeted the network rather than the exchange itself. Client funds held on Binance.com were never at risk, and validators suspended the network to contain the damage.

Proof of Reserves & Independent Audits

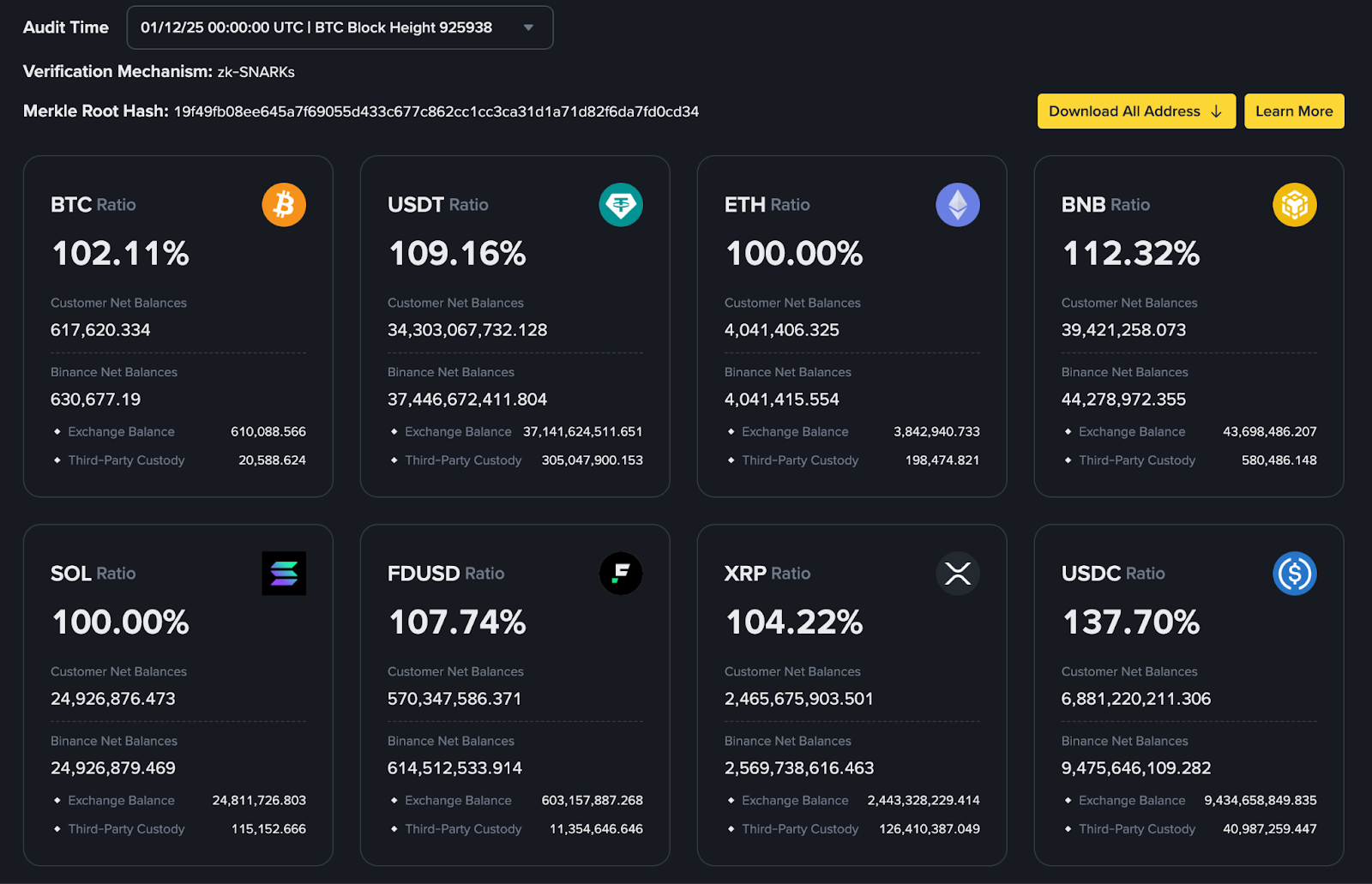

Binance publishes monthly Proof of Reserves (PoR) reports, using a combination of Merkle Tree cryptography and zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge).

The latest data from late 2025 shows reserve ratios exceeding 100% for all major assets: BTC 103.5%, ETH 100%, USDT 106.8%, and USDC 148.3%. Unlike many other exchanges, Binance shares both its assets and client liabilities, giving users a clear view of its solvency. Each user can also independently verify their balance using the open-source verification tool found on the official PoR page.

These audits cover spot holdings, margin positions, and staking balances. Binance pioneered the self-service verification model and now uses zk-SNARKs to ensure that user data remains private while proving that the total net balance of user assets is non-negative. While this level of transparency is industry-leading, it is important to note that these are “snapshots” of holdings at a specific point in time, though the frequency (monthly) is higher than the quarterly standard.

Regulatory and Compliance Overview for Binance

A common question for new users is: is Binance legit in my country? The answer depends on the licenses and regulatory approvals Binance holds in your region.

The exchange has evolved from an unregulated startup into a heavily regulated global platform in 2024 and 2025, securing licenses in key global markets to ensure long-term stability.

- Europe (MiCA Compliance): As of late 2025, Binance is aligning its European operations with the Markets in Crypto-Assets (MiCA) regulation. This includes delisting non-compliant stablecoins (like USDT) for EEA users and replacing them with regulated alternatives like USDC and EUR-backed tokens. Binance is fully registered in France, Italy, and Poland, ensuring it operates legally within the EU’s strict new framework.

- Global Licenses: Binance holds full regulatory licenses in Dubai (VARA), Japan (JFSA), Abu-Dhabi (ADGM) and Bahrain, allowing it to offer regulated services to millions of users in these regions. In India, Binance successfully re-entered the market in mid-2024 after registering with the Financial Intelligence Unit (FIU) and paying a settlement to resolve past compliance issues.

- US & Canada Status: Binance.com does not operate in the US or Canada due to strict securities laws. US users must use Binance.US, a separate entity with a more limited selection of assets. In Canada, Binance withdrew completely in 2023 due to regulatory hurdles.

- Regulatory Settlements: In 2024, Binance settled historical investigations with the US DOJ, paying substantial fines to clear the slate. This “regulatory reset” has allowed the company to stabilize its banking partnerships and focus on acquiring new licenses globally.

Insurance & Fund Protection

Binance does not carry FDIC insurance, which is standard for crypto exchanges, nor does it claim government backing for deposits. In fact, updated terms for Binance.US explicitly state that USD deposits are not FDIC-insured and encourage users to convert fiat to stablecoins.

However, Binance compensates for this with its own private emergency reserve known as the SAFU (Secure Asset Fund for Users).

- The $1B SAFU Fund: Unlike competitors who rely on vague “crime insurance” policies, Binance maintains a dedicated fund valued at over $1 billion. In a significant 2024 update, Binance converted the majority of this fund into USDC (a regulated stablecoin) to ensure the fund’s value remains stable even if the crypto market crashes.

- Coverage: This fund is designed to cover losses from platform-side breaches (e.g., if Binance itself is hacked). It does not cover losses if you are individually phished or lose your password.

Storage & Custody: the vast majority of client assets are held in cold storage (offline wallets), completely separated from the internet-connected “hot wallets” used for daily trading. This air-gapped structure significantly reduces the attack surface. However, because there is no government safety net, users bear the risk if their personal account is compromised. For substantial long-term holdings, Binance officially recommends withdrawing funds to a personal hardware wallet.

Possible User‑Side Risks & Platform Considerations

If you are wondering whether Binance is safe for your daily use, our view is yes – provided you use the built‑in protections and avoid common pitfalls. Safety in 2025 depends partly on the exchange and partly on your own actions.

Storage and when to withdraw. For frequent trading and active staking, leaving funds on Binance is practical due to its deep liquidity. However, for long‑term holdings (HODLing), we strongly recommend withdrawing to self‑custody (hardware wallet) once you are comfortable managing backups. As the saying goes, “not your keys, not your crypto.”

Phishing and impostors. Newcomers are the #1 target for “Binance Support” impostors on Telegram and X (Twitter). In 2025, scammers will use AI to create realistic fake video calls or “account lockout” emails.

Defense: Always verify the Anti-Phishing Code in every email. If an email doesn’t have your secret code, it is a scam. Never type your password into a link sent via DM.

Devices, passwords, networks. Your account is only as safe as your device. Use a unique password and enable Passkeys (YubiKey/Fingerprint). Avoid logging in from public Wi-Fi or shared computers. If you use trading bots, never grant “Withdrawal” permissions to your API keys and always use IP whitelisting.

P2P Trading Risks. If you use Binance P2P to buy crypto with cash, be wary of “fake payment proofs” where a buyer sends a photoshopped receipt without actually sending money. Always check your actual bank app balance before releasing crypto – never rely solely on a screenshot or SMS notification.

Our take on Binance: for everyday spot trading, the platform works reliably when core protections are enabled. We would start without API keys, leverage, or P2P until you are confident in the basics.

Tips to stay safe and safeguard your funds:

- Enable Anti-Phishing Code immediately.

- Use YubiKey/Passkeys instead of SMS 2FA to stop SIM swaps.

- Verify URLs: Only log in at binance.com (bookmark it).

- Run a test withdrawal: Send $10 to your private wallet to learn the process before moving large sums.

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.