Gemini vs Kraken: Side-by-Side Feature Breakdown

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Gemini vs Kraken

Kraken (3.6/5) came out on top in our experience. Lower fees (0.16%/0.26% vs Gemini’s 0.20%/0.40%), a wider asset selection (450+ vs 80+), and better liquidity on major pairs make it our go-to for active trading. Gemini (3.5/5) is a solid choice if you prioritize security, regulatory clarity, and custody audits over fees or token depth.

The Bottom Line

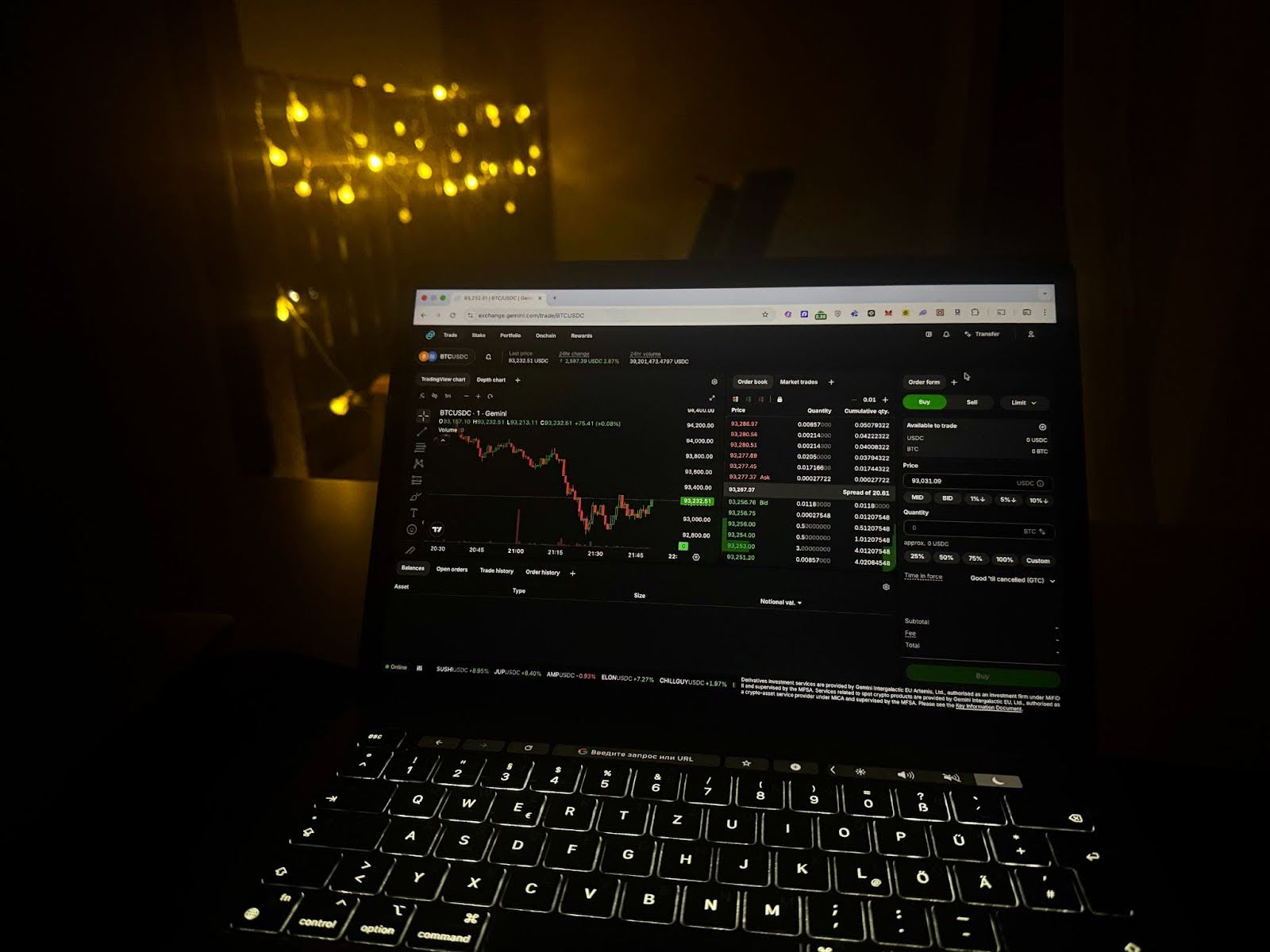

We deposited $200 into each and ran spot trades on majors and mid-caps. Kraken felt more versatile: iceberg orders helped split a $100 BTC buy without moving the market, and we verified spot balances using the Merkle tree checker against quarterly Proof of Reserves. Lower fees (0.16%/0.26% vs 0.20%/0.40%) and 450+ coins covered everything we needed.

Gemini impressed with regulatory transparency and smooth fiat rails, but the 80-coin list limited options – several L2 tokens weren’t listed. ActiveTrader’s order book helped gauge ETH/USD depth before placing limits.

- Kraken: Broad asset selection (450+ cryptocurrencies) with strong liquidity across major pairs. We checked the BTC/USDT order book – depth showed $10K+ buy orders with spreads under 0.02%, even during evening hours.

- Kraken: During hands-on testing, trading fees stayed competitive and the range of order types – including market, limit, stop‑loss, take‑profit, trailing stop and iceberg orders. We used a market order to buy $150 worth of ETH in $30 chunks, avoiding visible impact on the order book.

- Gemini: High security and regulatory compliance with cold storage and 2FA, and SOC 2 Type 2 audits. We appreciated the quarterly custody reports – they break down exactly how spot assets are stored (cold vs hot wallet percentages).

- Gemini: Exploring the platform showed onboarding is straightforward, fiat deposits and withdrawals work smoothly, and the curated list of major cryptocurrencies keeps trading simple and manageable.

- Kraken: Testing the platform showed that security features like 2FA and withdrawal whitelist are not automatic – activating them is up to the user, making personal vigilance essential.

- Kraken: No deposit insurance; minor tokens may have thinner liquidity. We checked FET/USD – spreads widened to 0.15% vs 0.02% on majors, and the order book showed only $5K total depth (vs $50K+ on BTC/USDT).

- Gemini: Limited asset selection compared to global exchanges. We wanted to test a few mid-cap altcoins and newer Layer 2 projects – most weren’t available.

- Gemini: In practice, small trades feel more expensive due to higher fees, and testing the Android app revealed occasional glitches that can interrupt trading.

On this page

We have tested both platforms with a real $200 spot trading experience. Kraken vs Gemini: Which one fits your strategy? Let’s investigate.

After running live trades on both exchanges, the differences are clear. Choose Gemini if you value a secure, regulated environment with simple onboarding and fiat ramps. For broader market access, competitive fees, and advanced trading features, Kraken stands out. Gemini focuses on security and market quality; Kraken prioritizes variety and trading flexibility.

Gemini vs Kraken: Side-by-Side Feature Breakdown

In this Gemini vs Kraken comparison, both exchanges focus on spot trading but target slightly different users. Gemini emphasizes regulatory compliance, institutional custody, and simple fiat on/off ramps, offering a curated set of major cryptocurrencies and a clean ActiveTrader interface. Kraken, by contrast, provides broader asset coverage, more advanced security controls, and a flexible trading experience through Kraken Pro.

From our testing, Gemini feels more streamlined for users who want a controlled, compliance-first environment, while Kraken offers greater depth in features, fee efficiency, and market access. Both platforms prioritize security, but Kraken places more control in the hands of the user, whereas Gemini enforces stricter defaults and a more conservative product lineup.

Features and Trading Tools Compared

Here’s a Kraken vs Gemini comparison summarizing the key features, fees, and security measures of both exchanges.

| Category | Gemini | Kraken | Winner |

|---|---|---|---|

| Overall GNcrypto rating | 3.5 / 5 | 3.6 / 5 | Kraken (overall) |

| Daily spot turnover (approx.) | ≈$48.6M | ≈$505M | Kraken |

| Tradable assets (spot) | 80+ | 450+ | Kraken |

| Liquidity & volume rating | 3.5 / 5 | 3.5 / 5 | Kraken |

| Fees & total cost rating | 2.5 / 5 | 3 / 5 | Kraken |

| Asset selection rating | 3 / 5 | 4 / 5 | Kraken |

| Tools & order controls | 3.5 / 5 | 4 / 5 | Kraken |

| Fiat access & minimum trade size | 4 / 5 | 4 / 5 | Kraken |

| Reliability & transparency rating | 4 / 5 | 4.5 / 5 | Kraken |

Platform Overviews

Among U.S. cryptocurrency exchanges, Gemini and Kraken are popular choices, and we conducted hands-on testing on each:

- Gemini, founded in 2014 by the Winklevoss twins, positions itself as a “bank-style” platform. It serves over 500,000 monthly users and 10,000 institutional clients, offering strong custody standards, cold storage, and 2FA. Its ActiveTrader interface supports limit, market, and stop-limit orders with tiered maker/taker fees, though smaller trades can be costly. Asset selection is moderate (80+ cryptos), daily spot volumes hover around $150M, and liquidity is solid but limited compared to global giants. iOS users experience a smooth interface, while the Android app is prone to crashes. Gemini has faced regulatory scrutiny, including settlements with the SEC and NYDFS over Gemini Earn, yet continues to maintain transparency and security.

- Kraken, founded in 2011, emphasizes long-term stability and transparency. It supports strong account protections – passkeys, 2FA, withdrawal whitelists, and Global Settings Lock – while publishing quarterly Proof of Reserves with Merkle verification. Its interface balances beginner accessibility with advanced trading via Kraken Pro. Kraken has a spotless track record for safeguarding client funds, aside from a minor June 2024 treasury bug, quickly resolved. Asset selection is broader than Gemini, and spot trading fees are competitive. Unlike Gemini, Kraken relies on user-side diligence for security, as no deposit insurance is offered, but the platform remains trusted by beginners and institutions alike.

Supported Cryptos, Volume, Trading Markets

Our team analyzed Gemini and Kraken from the perspective of a hands-on spot trader.

Gemini offers a clean, bank-style interface that prioritizes security and regulatory compliance. During our tests, the ActiveTrader platform handled order books, charts, and tiered maker/taker fees smoothly on iOS, though the Android app occasionally crashed under load. The exchange supports roughly 80+ cryptocurrencies with daily spot volumes around $150M. While fiat on/off ramps are simple and reliable, the asset list is smaller than most global competitors, and smaller trades incur higher fees.

Kraken takes a different approach with a balance of beginner-friendly onboarding and advanced trading via Kraken Pro. The platform supports a broader selection of cryptos, with robust liquidity across majors. We tested security features including passkeys, 2FA, and withdrawal whitelists – all of which functioned reliably, though setup required manual configuration (no guided wizard for new users). Spot trading fees are competitive, and quarterly Proof of Reserves adds a layer of transparency uncommon among U.S. exchanges. The interface is slightly denser than Gemini for beginners but provides strong tools for users who gradually move into advanced trading modes.

Our Verdict: Gemini stands out for regulatory compliance, simple fiat integration, and security-first design; Kraken excels on asset variety, transparency, and a mix of beginner-friendly and advanced trading capabilities.

Supported Assets and Market Access

When considering Gemini or Kraken for portfolio building, the trade-off is selection versus depth.

Gemini takes a curated approach. With roughly 80+ cryptocurrencies and a focus on core liquid assets like BTC, ETH, and GUSD, the platform prioritizes market quality and security over sheer quantity. Liquidity on major pairs is solid, allowing larger trades without significant slippage, but smaller or niche tokens are largely absent.

Kraken offers broader access. Supporting over 450 cryptocurrencies with multiple trading pairs, it provides a wider variety of assets, including both major and mid-cap tokens. While liquidity is generally strong on core pairs, some smaller or newer tokens can have thinner markets. The platform balances accessibility with transparency, giving traders detailed information on fees, order books, and Proof of Reserves.

Our Verdict: Kraken wins for asset variety and broader market access; Gemini wins for liquidity depth and market quality on core, high-demand cryptocurrencies.

Fees and Pricing

Every trader wants to keep costs low. In the case of Gemini vs Kraken, the fee structures take different approaches.

Gemini has a tiered maker/taker model on its ActiveTrader platform. For lower-volume traders, fees start at 0.20% (Maker) and 0.40% (Taker), dropping as monthly volume increases. Instant buys on the standard interface carry extra convenience fees – our $200 card purchase cost $207.50 total (3.75% fee), making small trades noticeably more expensive than using ActiveTrader. Stablecoin pairs can offer 0% maker fees and taker fees as low as ~0.01% – we tested a GUSD/USD spot trade and paid just $0.02 on a $180 order (0.01% taker). But on non-stablecoin pairs, casual spot trading costs run higher than Kraken.

Kraken offers competitive spot trading fees, starting at 0.16% (Maker) and 0.26% (Taker) for standard users, with discounts as volume increases. Fees are consistent across fiat and crypto pairs, and its Pro platform supports advanced order types to optimize costs. There are no additional “instant buy” fees like Gemini charges. If you use Kraken Pro instead of the simple buy option, you pay only the 0.16%/0.26% trading fee – no markup.

Our Verdict: Kraken is cheaper and more predictable for the average retail trader, while Gemini’s costs are higher on small trades but can become competitive for high-volume or stablecoin-focused trading.

Final Verdict

If you’re a beginner deciding between Gemini vs Kraken

Choose: Gemini

Gemini’s straightforward onboarding, simple fiat on/off ramps, and polished iOS app make it easy for newcomers to buy their first BTC or ETH. The platform guides users through KYC and trading without overwhelming them with advanced options.

If you’re an active, fee-sensitive spot trader

Choose: Kraken

Kraken’s competitive fees, broader asset selection, and advanced Kraken Pro interface make it ideal for frequent traders. Tiered maker/taker rates and a stable trading engine allow for efficient execution and deeper liquidity on core pairs.

If you mainly want a curated list of major cryptos

Choose: Gemini

Focusing on high-liquidity assets like BTC, ETH, and GUSD, Gemini ensures that major trades execute with minimal slippage. Its curated approach reduces noise for users who prioritize market quality over quantity.

If you want maximum asset variety and broader market access

Choose: Kraken

Supporting 450+ cryptocurrencies and multiple trading pairs, Kraken offers more options for portfolio diversification. Its transparent Proof of Reserves and regulatory compliance make it a reliable choice for traders seeking both variety and security.

How We Tested Gemini vs Kraken

We evaluated both exchanges using the same GNcrypto methodology, which is why a Gemini vs Kraken comparison is consistent.

GNcrypto employs a standardized rating framework with 7 major categories: liquidity & volume, fees & total cost, asset selection & trading pairs, execution quality, tools & order controls, fiat access & minimum trade size, reliability & transparency.

Scores are normalized into a 1.0–5.0 star rating in 0.1-point steps, and then rolled into an overall rating (3.5 for Gemini, 3.6 for Kraken). For both exchanges we looked at public data: fee schedules, supported pairs/asset lists, status pages, proof-of-reserves and security documentation, regulatory filings. And then we evaluated it against our first-hand testing, which included: opening accounts, completing KYC, funding balances and placing spot trades.

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.