Gemini Vs Coinbase Review 2026: Which Crypto Exchange To Choose?

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Gemini vs Coinbase

Coinbase (4/5) won our comparison. Better liquidity ($2.18B daily volume vs Gemini’s $93M), wider coin selection (354 vs 94), and faster fiat onboarding. Gemini (3.5/5) works if you prioritize bank-style custody and don’t mind paying more on small trades (0.20%/0.40% vs Coinbase’s tiered rates).

The Bottom Line

We deposited $200 into each exchange and ran spot trades on BTC/USDT and ETH/USDT. Coinbase dominated on execution quality: spreads stayed under 0.05% during evening tests, limit orders filled within seconds, and the Advanced Trade interface felt cleaner than Gemini’s ActiveTrader. Gemini impressed on regulatory clarity but cost more – our $200 instant card purchase carried 3.5-4.5% total fees vs Coinbase’s 2.8-3.2%.

- Gemini: A regulated platform with a focus on custody, audits, and a “bank-style” user experience. We appreciated the regular SOC 2 compliance reports – more transparency than most exchanges offer.

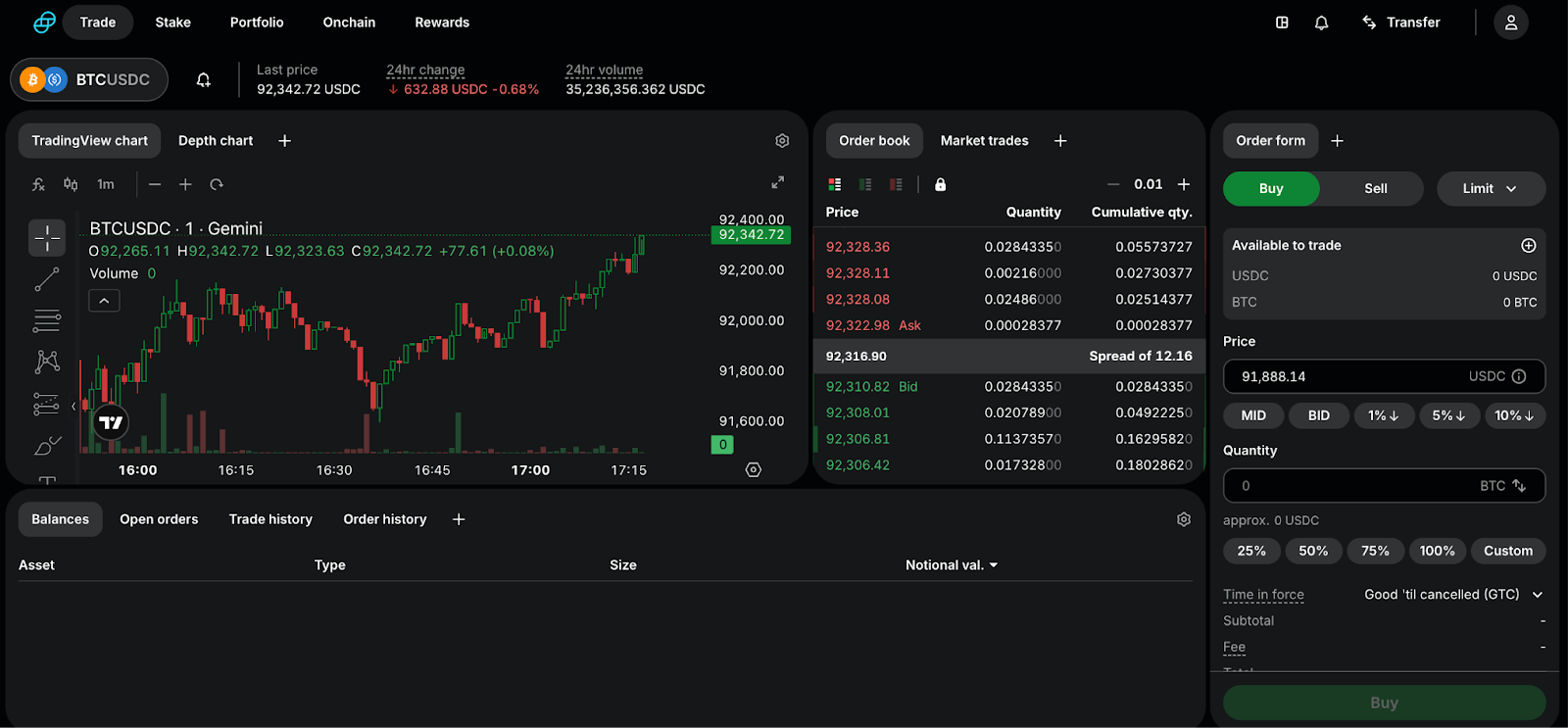

- Gemini: ActiveTrader provides order book visualization, charts, and basic order types (limit, market, stop-limit).

- Coinbase: Strong liquidity on BTC and ETH with consistent execution and minimal slippage. Our BTC/USDT limit order filled in under 10 seconds during a 2% price move – no partial fills.

- Coinbase: Easy fiat onboarding and intuitive UX, plus Advanced Trade for manual trading.

- Gemini: High fees on small trades and instant buy; Android app crashed twice during our 3-day test (once while placing an order). iOS version worked smoothly.

- Gemini: Limited asset list (80+); customer support is form-based with delayed response times.

- Coinbase: Higher fees for smaller volumes, especially with instant buy. A $100 purchase via debit card cost us $103 total (3% fee) – Advanced Trade would’ve been $0.80.

- Coinbase: Some features depend on region, and the asset selection doesn’t include thousands of altcoins.

On this page

Gemini vs Coinbase – we compared two leading U.S. crypto exchanges using our methodology, analyzing fees, coin selection, fiat deposits, mobile apps, and overall spot trading experience. Here’s which platform fits you best.

After testing both platforms, the differences are clear. Choose Coinbase if you value quick fiat access, a simple interface, and reliable trading of major assets through Advanced Trade. Choose Gemini if compliance and a “bank-style” level of security are your priorities, and you’re comfortable with higher costs on small trades and a narrower asset selection.

Coinbase vs Gemini at a Glance

| Category | Coinbase | Gemini | Winner |

|---|---|---|---|

| Overall GNcrypto rating | 4.0 / 5 | 3.5 / 5 | Coinbase (overall) |

| Daily spot turnover (approx.) | ~$2.18B (24h) | ~$0.093B (24h) | Coinbase |

| Tradable assets (spot) | 354 | 94 | Coinbase |

| Liquidity & volume rating | 5 / 5 | 3.5 / 5 | Coinbase |

| Fees & total cost rating | 2 / 5 | 2.5 / 5 | Gemini |

| Asset selection rating | 4 / 5 | 3 / 5 | Coinbase |

| Tools & order controls | 4 / 5 | 3.5 / 5 | Coinbase |

| Fiat access & minimum trade size | 5 / 5 | 4 / 5 | Coinbase |

| Reliability & transparency rating | 4 / 5 | 4 / 5 | Coinbase |

Coinbase vs Gemini Overview

Coinbase vs Gemini – both are U.S.-based, regulated, and offer straightforward fiat access, but they differ significantly in fees, liquidity, and asset selection. We tested both with a $200 deposit and real spot trades to assess fees, liquidity on major pairs, and overall user experience.

Coinbase, a publicly listed exchange, focuses on seamless onboarding and robust fiat support for users in the U.S. and Europe. In our test, base trading fees reached up to 0.40% for makers and 0.60% for takers. We paid $1.20 on a $1,000 Advanced Trade order – higher than Kraken or Binance, but execution was instant with zero slippage. Still, Coinbase ranks among the most liquid exchanges for major assets – LiquidityFinder gives it a score of 735, reflecting fast execution on BTC and ETH trades, even for retail users.

Gemini, by contrast, feels more like a bank-style platform, with a structured interface, strong compliance standards, and regular custody audits. In our test, liquidity on major pairs was solid, but fees for smaller trades were higher than average (0.20% maker and 0.40% taker). Quick card purchases of around $200 carried total costs of roughly 3.5–4.5%. Gemini supports more than 80 assets and handles about $150 million in daily volume, though the Android app crashed twice in 3 days (once mid-trade, once while loading the order book). The iOS version ran smoothly with no issues.

Asset Variety

We evaluated the Gemini vs Coinbase comparison from a spot trader’s perspective: how many coins each platform offers, how broad their listings are, and how quickly assets can be purchased with fiat without extra steps.

In our test, Gemini proved to be the more conservative exchange, with a narrower selection of about 80 assets. It suits traders who focus on BTC, ETH, and a few major altcoins and prefer to avoid sorting through hundreds of lesser-known tokens.

Gemini’s key trading feature is the ActiveTrader mode, which provides a professional interface. However, fiat purchases and product availability vary by region – some features may be restricted depending on your country, and small instant purchases typically carry higher fees.

Coinbase offers a much broader range with 354 assets and strong liquidity on major pairs. For traders seeking a wide selection of coins on a single platform, Coinbase is the better option. We found multiple DeFi tokens, Layer 2 projects, and newer listings on Coinbase that weren’t available on Gemini. Its Advanced Trade mode offers clearer fees and an intuitive setup for placing limit orders. Still, simple fiat purchases for smaller amounts often cost more than through Advanced Trade – something to note if you buy frequently in smaller sums.

Our verdict: Coinbase wins on asset variety – 354 coins vs 94 isn’t close. Gemini works if you trade only BTC, ETH, and top-20 altcoins and prioritize regulatory clarity over selection.

User Experience

We tested the interface, order execution, and mobile apps using a realistic scenario: a $200 deposit, buying and selling on spot, placing a limit order, and checking fees across different modes.

Coinbase stands out for its quick onboarding and clarity. The app makes it easy to find fiat purchases and transaction history, while Advanced Trade provides a proper order book and order ticket for manual trading. Execution on major pairs is stable, and slippage for retail users is minimal. Our $150 ETH/USDT market order moved the price less than 0.01% – better than Gemini’s 0.03% slippage on a similar $150 trade.

The main risk for beginners is overpaying in the simple buy mode – in the Coinbase vs Gemini fees comparison, the biggest difference often appears in instant buy transactions rather than standard exchange trading.

Gemini offers a cleaner, more structured interface, with its ActiveTrader mode for full order book trading. However, in our test, the path to completing a trade felt less seamless – it took 4 taps to reach ActiveTrader from the home screen, vs 2 taps on Coinbase to reach Advanced Trade. Again, cost is a factor: in the “quick small purchase” scenario, Gemini fees vs Coinbase showed a clear difference: $207.20 total on a $200 card purchase (Gemini) vs $206.00 (Coinbase).

Our verdict: If you value simplicity, a stable app, and a fast path to execution, choose Coinbase. If compliance and a more “bank-like” experience matter more – and you’re willing to trade via ActiveTrader to avoid overpaying on instant buys – Gemini is a better fit.

Which Platform Is the Better Choice?

Coinbase or Gemini? The answer depends on how you trade and what size orders you place. Here’s what we found during testing:

If you’re a beginner buying crypto with fiat

Choose: Coinbase

Onboarding is faster, the first purchase is simpler, and you can switch to Advanced Trade as you gain experience. For major pairs, liquidity is strong enough that slippage isn’t an issue.

If you trade manually and want fee control

Choose: Gemini

Using ActiveTrader provides clearer fees than quick-purchase mode. It’s a better fit if you prefer trading through the exchange interface instead of instant buy.

If you want a wide selection of coins in one account

Choose: Coinbase

Our review found Coinbase offers a far broader asset range (300+ vs 80+ on Gemini), reducing the need to rely on a second exchange to access specific coins.

If your priority is compliance and a conservative risk profile

Choose: Gemini

Gemini takes a stricter approach to regulation and asset custody. It’s the right choice if you value a “bank-style” platform and don’t mind paying more for extra security and oversight.

How We Tested Coinbase vs Gemini

We evaluated both exchanges using the GNcrypto spot trading methodology to ensure the Coinbase vs Gemini comparison followed a consistent standard.

The framework includes seven categories: liquidity and volume, fees and total trading cost, asset and pair selection, order execution quality, tools and order types, fiat options and minimum trade size, and reliability and transparency.

Scores were normalized on a 1.0–5.0 scale in 0.1 increments and combined into a final rating (4.0 for Coinbase and 3.5 for Gemini). Our analysis drew on public data – including fees, asset and pair listings, status pages, proof-of-reserves, security materials, and regulatory filings – and was verified manually through registration, KYC, a $200 deposit, and test spot trades.

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.