Gemini Crypto Exchange Review 2026: Testing Spot, Fees and Safety

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Gemini

Gemini is a good pick for spot trading if you prioritize security, regulatory compliance, and a user-friendly interface. However, our testing showed that fees for smaller trades are above average, the asset selection is limited, and the Android app leaves room for improvement.

GNcrypto's Verdict

We tested Gemini with a $200 deposit and a handful of real trades. The exchange gives off a “bank-style” vibe – secure, structured, and steady. Liquidity on major pairs was solid, and the platform is easy to navigate. On the downside, fees on small trades add up, the asset list is relatively tight, and the Android app crashed on us twice.

- Regulated platform with strong custody standards and regular third-party audits.

- Full support for limit, market, and stop-limit orders via the ActiveTrader interface with integrated order book and charting tools available.

- Straightforward deposits and withdrawals.

- Low fees for some stablecoin pairs on ActiveTrader (maker 0.00%, taker ~0.01%).

- The iOS ran smoothly throughout our tests and felt noticeably more polished than the Android version.

- During testing, the Android app crashed several times – something that’s also reflected in its poor Google Play ratings.

- No real-time support: we had to submit a form and wait for an email response, and other users report similar friction.

- Asset selection is narrower than major global exchanges; derivatives and advanced instruments are limited.

- Trading fees on Gemini are relatively high for small trades (maker 0.20%, taker 0.40%), noticeably steeper than Binance, where standard rates are just 0.10% and even lower with BNB discounts.

On this page

At GNcrypto, we ran live spot trades on Gemini to measure actual trading costs, spreads, liquidity depth, fiat on-ramps, and custody standards. After testing these features, we assigned a 3.5/5 rating, pointing out who Gemini works well for today – and where cheaper or larger competitors may be the better fit.

Gemini Trading Platform Overview

In this Gemini crypto exchange review, we examine the U.S.-based centralized cryptocurrency exchange which, in Gemini’s own words, aims to prioritize security, regulatory compliance, and transparency. The platform supports a moderate selection of liquid cryptocurrencies, including core assets such as BTC and ETH, as well as its native stablecoin, GUSD. Customer funds are primarily held in cold storage, withdrawals require two-factor authentication, and according to Gemini, it keeps all customer funds fully backed, with 1:1 reserves and instant access.

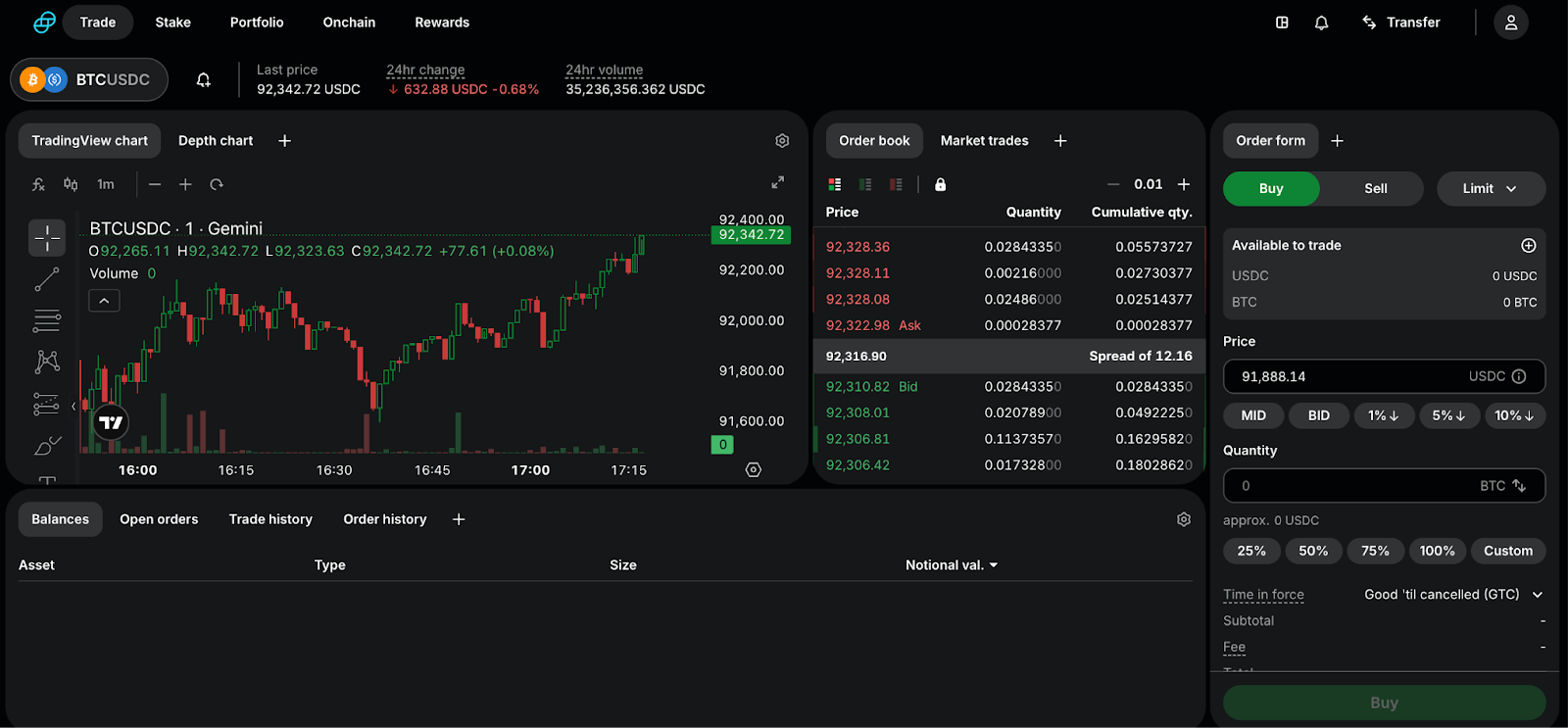

On Gemini’s main page, hitting the “Trade” button doesn’t take you to a traditional trading terminal like you might expect. Instead, it opens a page for buying crypto with fiat. To access ActiveTrader, you need to click your profile icon and switch modes – something that wasn’t immediately obvious to us. ActiveTrader then gives you charts, order-book depth, flexible order types, and a tiered maker/taker fee structure that becomes more favorable as trading volume increases.

As of mid-2025, Gemini holds approximately $21 billion in assets under custody and serves over 500,000 monthly active users, along with around 10,000 institutional clients worldwide. Over its lifespan, the exchange has processed more than $285 billion in cumulative trading volume. However, its share of the global spot-trading market remains modest at around 0.2–0.3%, meaning that while Gemini is trusted and regulated, it does not offer the same liquidity depth as the largest global exchanges.

Key Platform Features (Spot)

- ActiveTrader: order book, charts, trading form on one screen;

- Order types: limit, market, stop-limit;

- Fees: tiered maker/taker rates;

- Fiat on/off-ramps: easy USD deposits and withdrawals;

- Security: U.S. regulation, cold storage, 2FA.

Fees and Costs

Multiple Gemini crypto exchange reviews line up with what we experienced ourselves: a standard tiered maker/taker setup on ActiveTrader, starting at 0.20% (maker) and 0.40% (taker) for lower-volume traders, with fees dropping once your monthly volume climbs. Spreads on big pairs like BTC/USD and ETH/USD hovered around 0.02%–0.05% in our evening tests. That’s perfectly fine for casual trading, though still wider than what you’d usually see on Binance or OKX.

Instant buys on the standard interface come with extra “convenience” fees, and they add up fast – definitely pricier than placing a normal order on the book. Pricing is predictable and transparent, but overall trading costs still end up above what you get on Binance and Kraken.

Pros and Cons of Using Gemini

In this Gemini cryptocurrency exchange review, we tested spot liquidity, fees, execution speed, and overall ease of use. The order book for major pairs (BTC/USD, ETH/USD) has enough depth for everyday traders, and the 80+ supported assets cover most mainstream needs.

ActiveTrader feels built for people who actually trade – proper charts, proper order controls, and the familiar tiered fee model. Beginners and long-term holders will probably appreciate how simple the onboarding and fiat ramps are, plus the comfort of regulated custody. Whether you care about it or not, the Winklevoss brand does add a layer of trust for some users.

Strengths:

- Security & compliance: regulated custody, cold‑storage and institutional‑grade asset protection.

- Trading flexibility: limit, market, stop‑limit orders + order‑book + charts for efficient trading.

- ActiveTrader: advanced interface for experienced traders, with tiered maker/taker fees.

- Fiat on/off‑ramps: bank/ACH transfers for deposit & withdrawal – friendly for fiat ↔ crypto flows.

- Stablecoin trading: for some stable‑pairs via ActiveTrader – maker fees may be zero, taker as low as ~0.01%.

- Convenient Mobile App: Highly rated iOS app (~4.8★ from over 107,000 reviews), offering a smooth and user-friendly experience for trading on iPhone.

Weaknesses:

- Asset selection: although improved (~80+ assets), still narrower than the largest global exchanges.

- Android App Woes: Low-rated Android app (~2.6★) with reports of bugs, crashes, and unintuitive navigation.

- Customer service is often slow, with reported delays in withdrawals and verification, as reflected in a low overall rating (~1.4★) on Trustpilot.

- Cost for small trades / instant buys: Cost for small trades and instant buys can be surprisingly high. When we tried a quick web purchase of around $200 using a debit card, the fees came out to roughly 3.5-4.5%, which quickly adds up to modest amounts. This makes Gemini less attractive for very small transactions compared to standard spot trading.

- Custody‑to‑exchange transfers (if using custodial product) incur a significant fee (e.g. $125).

- Withdrawal fees unpredictable: In our tests, sending crypto like Ethereum or Bitcoin showed network fees ranging roughly from 0.1% to 0.3% of the withdrawal amount, depending on network congestion. Even on modest transfers, the cost varied noticeably, so it’s something to watch if you plan frequent withdrawals.

- Tools vary by region: margin, derivatives or staking – may be available only to certain user geographies (e.g. EU users), not universally.

One night, we noticed the BTC/USD spread swinging between $0.10 and $0.40. It’s not a big deal if you’re placing limit orders, but something active traders might want to be aware of.

In this review, we find a platform suited for users who appreciate a clean, straightforward interface and strong regulatory compliance. Beginners and long-term holders will find fiat on- and off-ramps easy to use, while more experienced traders can take advantage of ActiveTrader. That said, fees and occasional liquidity limits can frustrate active day traders. Overall, we rate Gemini 3.5/5: stable and secure, but behind global leaders in asset variety and trading costs.

Trustworthiness Check

Below are notable public cases, regulatory claims, and resolutions related to Gemini that are important to consider before choosing the exchange:

- January 12, 2023 – The U.S. Securities and Exchange Commission (SEC) officially accused Gemini and its partner Genesis Global Capital of illegally offering unregistered securities through the Gemini Earn product. The allegations centered on crypto loans offered to retail investors, which the SEC considered investment contracts that should have been registered.

- February 2024 – Gemini reached a settlement with the New York Department of Financial Services (NYDFS), agreeing to pay a fine and return funds to customers. As part of this settlement, Gemini committed to pay $37 million and ensure the return of at least $1.1 billion in cryptocurrency to Gemini Earn users. For most retail customers using the exchange for regular trading, this likely had little direct impact, though it was a significant development for those who had invested in Gemini Earn.

- January 6, 2025 – The U.S. Commodity Futures Trading Commission (CFTC) closed a long-standing dispute with Gemini, requiring the exchange to pay a $5 million fine and accept a permanent injunction related to statements made in 2017 while attempting to launch a Bitcoin futures contract. Gemini did not admit wrongdoing but agreed to the settlement.

- July 2024 – Gemini reported a data compromise incident via its banking partner. Between June 3–7, 2024, some clients’ banking details and routing numbers may have been exposed. Gemini notified users on June 25, 2024. The exchange stated that Gemini accounts and on-platform account data were not affected.

- April 2, 2025 – Both the SEC and Gemini requested the court to pause litigation on the Gemini Earn case for 60 days to discuss a potential settlement. The lawsuit remains open, but a resolution may soon be reached.

- September 2025 – According to statements from both parties, an agreement was reached regarding the Gemini Earn case; final settlement documents are expected to be filed by December 15, 2025.

GNcrypto’s Overall Gemini Rating

| Criteria | Rating (out of 5) |

|---|---|

| Liquidity & Volume | 3.5 |

| Fees & Total Cost to Trade | 2.5 |

| Asset Selection & Trading Pairs | 3 |

| Execution Quality / Market Quality | 3.5 |

| Tools & Order Controls | 3.5 |

| Fiat Access & Minimum Trade Size | 4 |

| Reliability & Transparency | 4 |

Methodology – Why You Should Trust Us

We use a weighted, category-based model, collect standardized data from each platform (open data + hands-on testing), and convert that into a 1.0–5.0 star score in 0.1 increments.

Our focus is spot trading quality: real fees, minimum trade size, crypto availability, market quality, and the user-facing experience.

How We Collect Data

- Public sources: fee schedules, supported asset/pair lists, proof‑of‑reserves or reserve disclosures, and system status pages.

- First-hand testing: we place test spot trades, observe effective fees (fee + spread), measure slippage/spreads on majors, and evaluate UI speed and order controls.

We do not rate solvency or make guarantees about financial stability. These ratings reflect user experience, access, and trading quality – not a balance‑sheet audit.

Categories & Weights

– Liquidity & Volume – 25%

– Fees & Total Cost to Trade – 25%

– Asset Selection & Trading Pairs – 15%

– Execution Quality (Market Quality) – 10%

– Tools & Order Controls – 10%

– Fiat Access & Minimum Trade Size – 5%

– Reliability & Transparency – 10%

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.