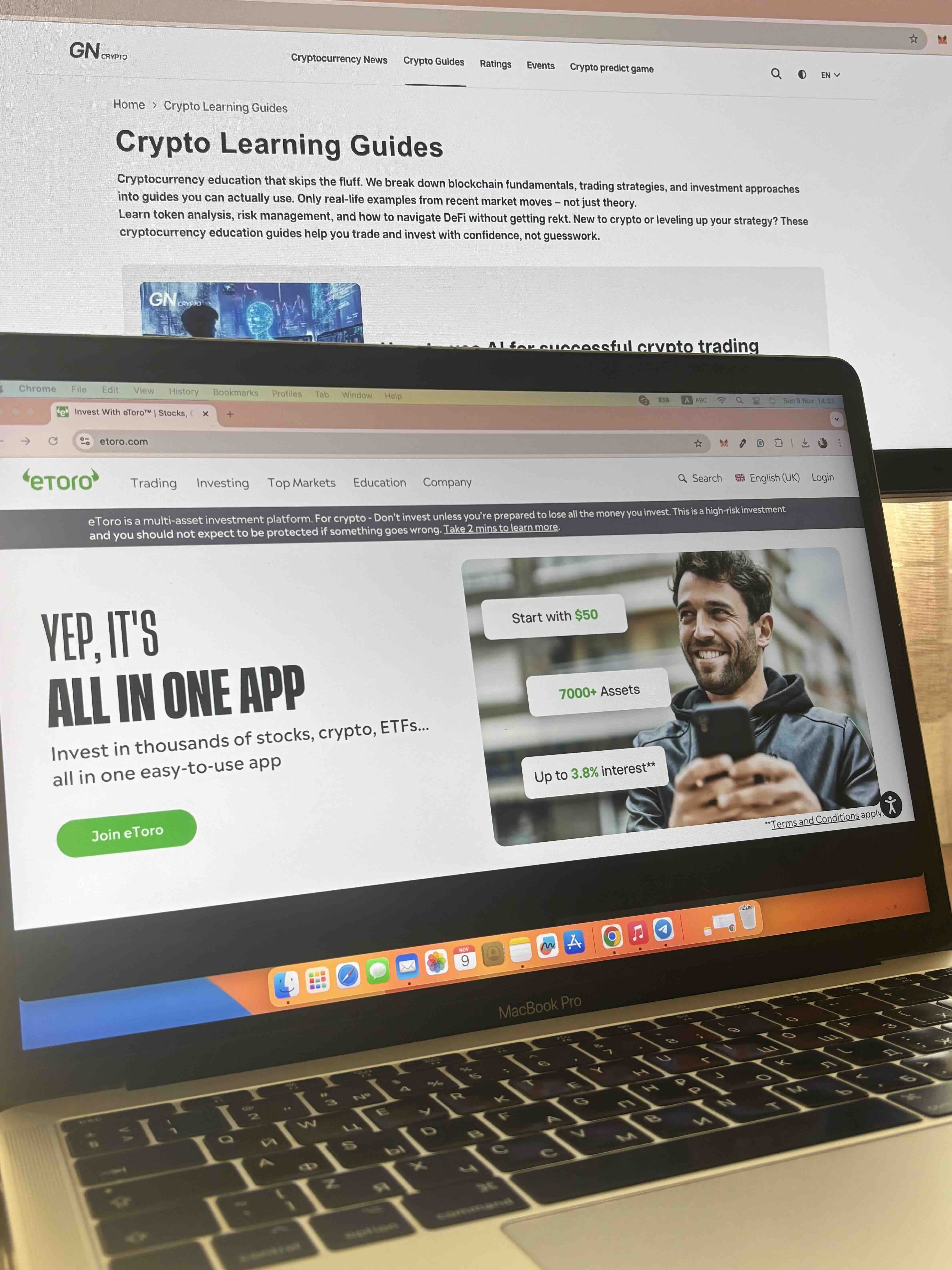

eToro Review 2026

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

eToro

We liked that eToro is a beginner-friendly, multi-asset “all-in-one” investing app with strong regulation. However, its fees, and only mid-tier crypto depth set limits as to what you can expect.

GNcrypto's Verdict

eToro is a multi-asset trading platform built around social investing, offering stocks, ETFs, commodities, forex, and cryptocurrencies in an intuitive, beginner-friendly interface with copy-trading tools. Its strong regulatory footprint and clear, mostly commission-free pricing add to its appeal. However, crypto fees are relatively high and the coin list limited, so advanced crypto traders may prefer deeper, lower-cost exchanges.

- Multiple assets: stocks, ETFs, crypto, commodities, indexes etc

- Licensed globally

- Easy onboarding for beginners

- Fees including withdrawal and inactivity fees

- Limited customer support

On this page

eToro offers a user-friendly platform with social trading and a broad range of assets, but fees and availability can be limiting.

Key Features That Make eToro Stand Out

What is eToro and what are its key features? Here’s a quick rundown.

eToro is a Nasdaq-listed trading app available in over 75 countries, including the UK, Malta, USA, UAE, Portugal, Poland, Israel, and others. It is currently blocked in Canada, Ukraine, Cuba, El Salvador, and several other countries. According to recent updates, eToro has over 40 million registered users and offers investing in more than 100 cryptocurrencies, as well as options, stocks, and ETFs.

Based on our experience, eToro offers a variety of tools and features. It may take some time to familiarize yourself with the app’s functionalities, but the interface is generally clear and easy to navigate. Fees vary depending on the asset type; for cryptocurrencies, eToro charges a minimal fee of $1 per trade.

Here are some of eToro’s distinguishing features:

- CopyTrader. With this social trading feature, we were able to follow and replicate strategies from experienced traders, which made learning new markets much easier.

- Web and mobile apps. Both versions are intuitive and sync seamlessly. We could check our portfolio, place trades, and monitor market movements on any device.

- AI assistant Tori. Chatting with this AI companion provided helpful market insights and guidance.

- eToro Academy. We found the Academy to be a helpful starting point, especially for beginners. It offers courses, webinars, and tutorials that explain trading basics, platform features, and risk management strategies.

- Smart Portfolios. Pre-built portfolios group assets by theme or strategy, making diversification simple.

- Demo account. eToro offers a $100K demo account to practice trading without risk before committing real funds.

- ProCharts. Advanced charting tools helped us analyze market trends and make informed decisions quickly.

- Automated monthly investing. Setting up recurring investments makes it easy to build positions over time without manual intervention.

Pros and Cons of Using eToro

Here are the main takeaways from our eToro review, based on our testing and user feedback from social media, review platforms, and app marketplaces.

Strengths:

- Multiple assets: eToro offers stocks, ETFs, crypto, commodities, indexes, and more.

- Security and regulation: eToro is licensed by several financial authorities globally

- User-friendly interface: both web and mobile apps are intuitive and easy to navigate.

- Fractional shares: investors can hold portions of stocks or ETFs, making diversification easier.

- Social learning: features like CopyTrader let beginners follow pros without deep analysis.

Weaknesses:

- Various fees: $5 withdrawal fee for USD accounts, $10 monthly inactivity fee after 12 months, plus conversion fees.

- Availability restrictions: eToro is blocked in certain countries, limiting access.

- Customer support: assistance can be limited and often relies on a ticketing system.

- Learning curve: beginners may need time to get familiar with all features and tools.

Trustworthiness Check

Here’s an overview of legal cases, regulatory actions, and compliance news related to eToro.

- In September 2024, eToro USA LLC paid a $1.5 million penalty to the U.S. SEC for operating without proper registration, which limited its crypto offerings in the U.S.

- In August 2023, the Australian Securities and Investments Commission (ASIC) took action against eToro Aus Capital Limited, claiming it offered high-risk CFD products too broadly and did not screen clients adequately.

- In 2023, Italy’s Competition Authority (AGCM) fined eToro €1.3 million for misleading “zero-commission” advertising, noting that some costs and risks weren’t clearly disclosed.

GNcrypto’s Overall eToro Rating

| Criteria | Rating (out of 5) |

|---|---|

| Liquidity & Volume | 3 |

| Fees & Total Cost to Trade | 3 |

| Asset Selection & Trading Pairs | 3.5 |

| Execution Quality / Market Quality | 3.5 |

| Tools & Order Controls | 4 |

| Fiat Access & Minimum Trade Size | 4 |

| Reliability & Transparency | 4 |

Methodology – Why You Should Trust Us

We use a weighted, category-based model, collect standardized data from each platform (open data plus hands-on testing), and convert that into a 1.0–5.0 star score in 0.1 increments.

Our focus is around spot trading quality. We evaluate real fees, minimum trade size, crypto availability, customer-facing experience and other features that matter most to the average investor.

How We Collect Data

– Public data: fee schedules, supported pairs, proof-of-reserves statements, status pages.

– First-hand testing: we place test trades, measure slippage and spreads, check UI features, and speed.

We do not rate solvency or make any guarantees about financial stability. Our ratings reflect user experience rather than solvency.

Categories & Weights

– Liquidity & Volume – 25%

– Fees & Total Cost to Trade – 25%

– Asset Selection & Trading Pairs – 15%

– Execution Quality (Market Quality) – 10%

– Tools & Order Controls – 10%

– Fiat Access & Minimum Trade Size – 5%

– Reliability & Transparency – 10%

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.