Top 4 Alternatives to Coinbase You Should Consider Today

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Kraken - Best Coinbase Alternative

GNcrypto's Verdict

We put Kraken to the test against other Coinbase alternatives and it quickly proved the most dependable. It combines Coinbase-level security with Pro fees at just 0.16%, deep order books with minimal slippage on larger trades, and responsive 24/7 support.Binance and Bybit shine for hundreds of altcoins or leverage, while eToro is perfect for beginners learning through copy-trading. For most leaving Coinbase, Kraken offers a smooth, trustworthy, and cost-efficient trading experience.

- Unmatched security: One of the few major exchanges that has never suffered a custodial wallet breach.

- Lower fees: Pro interface starts at ~0.16% (Maker) / 0.26% (Taker), significantly cheaper than Coinbase base rates.

- Real support: Access to 24/7 live chat with human agents rather than bots.

- Asset depth: Wider selection of altcoins and flexible staking options compared to Coinbase.

- The “instant buy” trap: The simple widget charges high fees (~1.5%) if you don’t use the Pro view.

- Funding friction: Bank transfers (ACH) can be slower than the instant options available on Coinbase.

On this page

Coinbase is a giant, but it’s not the only player in town. Whether you’re tired of high transaction costs or just want more control, we’ve compiled a list of platforms that offer a better bang for your buck.

Let’s be honest: for many of us, Coinbase was the gateway into the world of crypto. It’s polished, it’s user-friendly, and it feels safe. It’s the brand your friends mention when they finally decide to buy their first fraction of Bitcoin.

But as you get deeper into the ecosystem, the cracks start to show. Maybe you’ve noticed those trading fees eating into your profits, or perhaps you’ve been left frustrated by a generic response from customer support when you really needed help. We’ve been there, too.

While Coinbase is great for beginners, it isn’t always the best fit for someone looking to maximize their returns or explore a wider variety of assets. That’s why we decided to look elsewhere. We wanted to find platforms that don’t just compete with the giant but actually outperform it in the areas that matter most – fees, privacy, and feature sets.

Below, we’ve put together a list of the best alternatives that have the guts and the suite of tools to compete. These are the exchanges we use, trust, and recommend when you’re ready to graduate from the “starter pack.”

What Makes a Strong Coinbase Alternative?

Coinbase is often called the “Apple” of crypto – slick and easy, but you pay a premium for it. To make this list, an exchange had to do more than just lower the bill. When we started rigorously testing the market for a viable Coinbase alternative, we focused on five specific non-negotiables:

- Fee structure. This is usually the dealbreaker. While Coinbase charges upwards of 0.60% per trade, we prioritized platforms with maker/taker fees starting at 0.10% or less.

- Asset diversity. Coinbase is conservative. We looked for exchanges listing 300+ coins, giving you access to new projects before they hit the mainstream.

- Trading tools. We demanded real utility – deep charting (TradingView integration) and advanced order types, not just simple “buy” buttons.

- Ease of use: A strong competitor shouldn’t look like a fighter jet cockpit. We valued interfaces that offer a simple “Lite” mode for quick swaps alongside professional dashboards.

- Fiat gateways. You need to get your money in easily. We only selected exchanges with reliable local bank transfers and instant card deposits minus the excessive “convenience” fees.

Kraken

Among sites like Coinbase, we would recommend Kraken for its unblemished security record (“dinosaur” status since 2011 without a hack) and significantly lower fees on its Pro interface. In our analysis, it mirrors Coinbase’s trustworthiness while fixing the main complaint: high costs.

Kraken stands out for its “security-first” culture and full Proof of Reserves, rivaling major banks in safety. The Kraken Pro interface drastically cuts trading costs (starting around 0.16% maker / 0.26% taker) compared to Coinbase’s standard rates. Additionally, the platform offers 24/7 live chat with actual human agents, avoiding the frustration of automated support loops found elsewhere.

The main downside is the “Instant Buy” trap: if you use the simple widget on the main page, fees are high (approx. 1.5%), similar to Coinbase. Furthermore, funding via ACH or bank transfer, while reliable, can sometimes be slower or less seamless than Coinbase’s instant integration.

Security-conscious users and beginners ready to switch to a “Pro” interface to save money.

Strengths:

- Unmatched security: One of the few major exchanges that has never suffered a custodial wallet breach.

- Lower fees: Pro interface starts at ~0.16% (Maker) / 0.26% (Taker), significantly cheaper than Coinbase base rates.

- Real support: Access to 24/7 live chat with human agents rather than bots.

- Asset depth: Wider selection of altcoins and flexible staking options compared to Coinbase.

Weaknesses:

- The “instant buy” trap: The simple widget charges high fees (~1.5%) if you don’t use the Pro view.

- Funding friction: Bank transfers (ACH) can be slower than the instant options available on Coinbase.

Binance

Among the companies like Coinbase, Binance is the heavyweight champion for users who want raw power over simplicity. If Coinbase is the “Apple” of crypto (sleek, expensive), Binance is the “Amazon” – a massive, slightly chaotic marketplace where you can find almost anything for a fraction of the price.

The primary draw is the fee structure: standard trading fees start at just 0.10%, which is significantly lower than Coinbase’s standard rate. Users can reduce this further by paying with BNB (Binance Coin). The platform offers unparalleled liquidity and a massive selection of 350+ assets (globally), ensuring you can trade obscure altcoins long before they hit US-centric exchanges.

The sheer number of features (futures, staking, launchpads, trading bots) can be overwhelming for a first-time user. Additionally, Binance faces frequent regulatory scrutiny; the US version (“Binance.US”) is much more limited than the global site, offering fewer coins and features to comply with local laws.

High-volume traders and international users who prioritize low fees and access to the widest possible range of assets.

Strengths:

- Lowest fees: Starts at 0.10% (maker/taker) with further discounts for using BNB.

- Massive asset list: Lists hundreds of coins that you simply cannot find on Coinbase.

- Deep liquidity: As the world’s largest exchange by volume, orders fill instantly without slippage.

- Advanced features: Offers staking, savings accounts, and launchpads for new tokens.

Weaknesses:

- Regulatory uncertainty: Frequently faces regulatory hurdles and bans in various jurisdictions.

- Steep learning curve: The interface is packed with charts and data, which can scare off total beginners.

- Limited US version: Binance.US is a stripped-down version of the global platform with fewer assets.

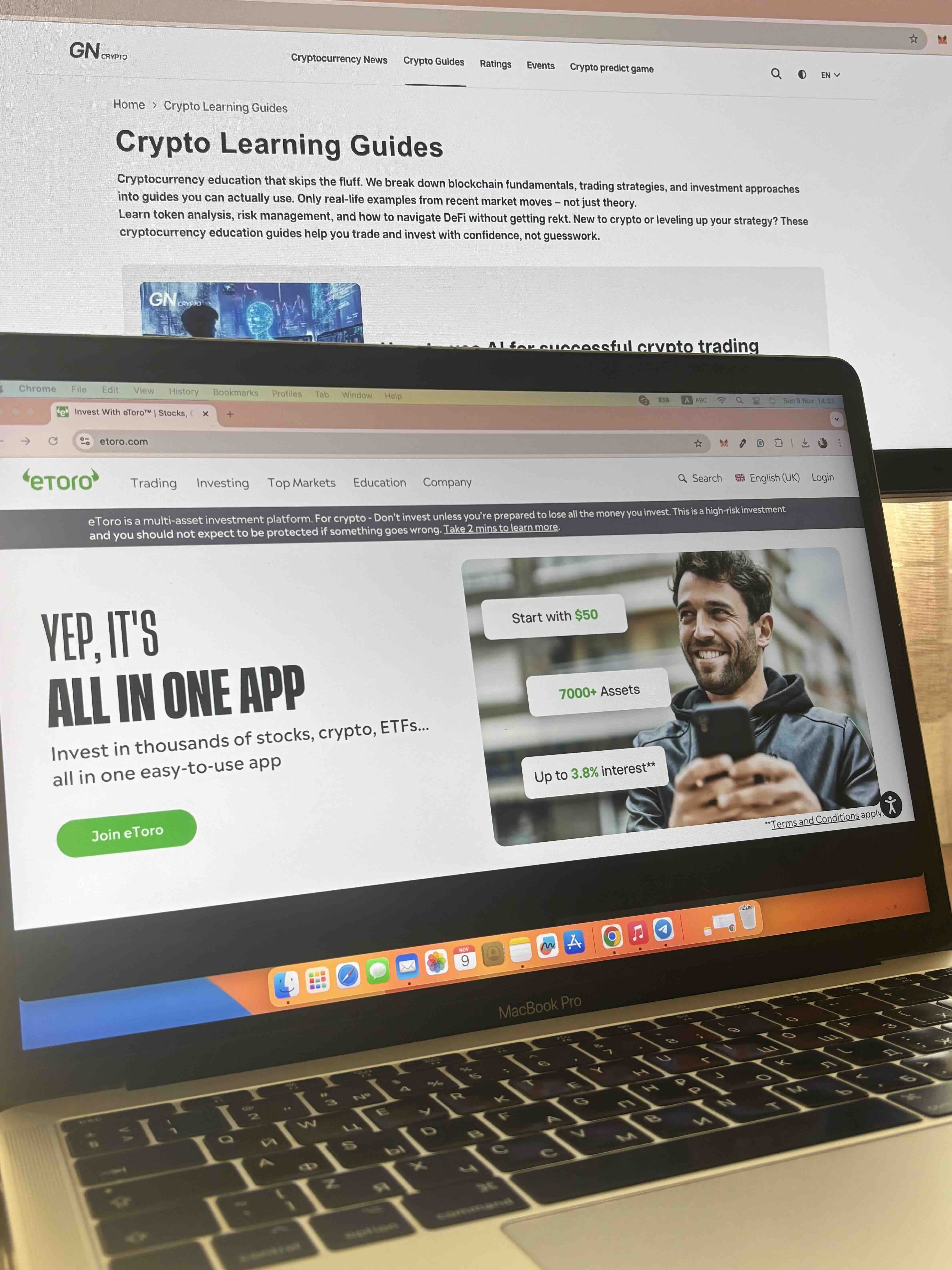

eToro

eToro is a hybrid platform that functions as part broker and part social media network. If you have ever found yourself asking what is better than Сoinbase for a beginner who wants to learn from the pros, this is the answer. While Coinbase isolates you in a private wallet, eToro drops you into a massive community where you can discuss strategies and automatically mirror the moves of successful investors.

The standout feature is CopyTrader™, which allows you to allocate funds to copy the trades of top performers instantly – perfect for those who don’t know when to sell. It serves as an all-in-one dashboard for trading stocks, ETFs, and crypto without switching apps, all wrapped in a colorful, intuitive interface. Additionally, the $100,000 virtual portfolio lets you practice with play money before risking real cash.

Moving crypto off the platform is a hassle, requiring the separate “eToro Money” app and incurring transfer fees (approx. 2% capped at $100). The fixed 1% fee is transparent but becomes expensive for active traders compared to pro-tier exchanges. Furthermore, because the platform operates natively in USD, depositing EUR or GBP triggers currency conversion fees.

Beginners and social traders who want to copy experienced investors or trade multiple asset classes in one place.

Strengths:

- CopyTrader™: The ultimate tool for beginners, allowing you to automate trades based on pro strategies.

- All-in-one dashboard: seamless access to stocks, ETFs, and commodities alongside your crypto holdings.

- User interface: Highly visual and designed for people who find traditional charts intimidating.

- Virtual portfolio: Includes a $100,000 demo account for risk-free practice.

Weaknesses:

- Wallet friction: Withdrawing crypto requires a secondary app and involves extra steps and fees.

- Fixed 1% fee: Higher than “Pro” exchange tiers; costs add up quickly for frequent traders.

- Currency conversion: Non-USD deposits face conversion charges as the platform is USD-native.

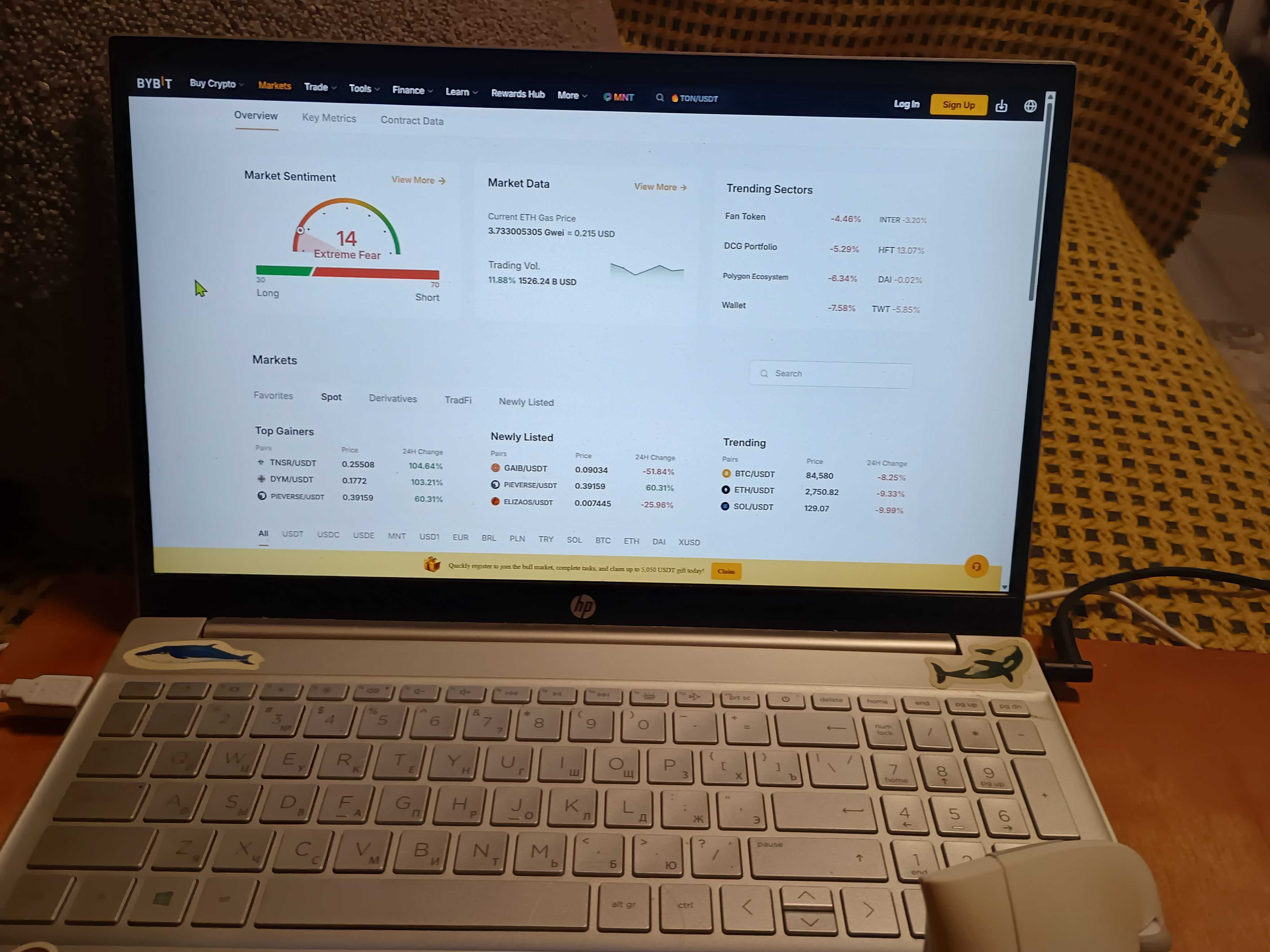

Bybit

If Coinbase is the “starter pack” for crypto, Bybit is where you go when you are ready to turn pro. It is arguably the most powerful, and the best alternative to Сoinbase, designed specifically for traders who have outgrown simple buy buttons and high fees. While it requires a steeper learning curve, the payoff is access to a professional derivative and spot market that moves at the speed of light.

Bybit’s crown jewel is the Unified Trading Account (UTA), which allows you to use your entire portfolio as collateral for trades – a level of capital efficiency Coinbase simply doesn’t offer. Fees are razor-thin, starting at 0.10% for spot trading and dropping even lower for derivatives. It also features a robust Copy Trading platform that rivals eToro, letting you automate your strategy by mirroring top performers.

The biggest catch is availability: due to strict regulatory stances, Bybit is currently unavailable to users in the USA, UK, and Canada. Additionally, the interface is packed with advanced charts, margin data, and order books, which can easily overwhelm a complete beginner looking for a simple “buy Bitcoin” experience.

Active traders and international users seeking advanced leverage, derivatives, and automated trading bots.

Strengths:

- Competitive fees: Spot trading starts at just 0.10%, with even lower rates for futures and options.

- Asset variety: Lists over 1000+ coins and trading pairs, catching trends long before mainstream exchanges.

- Unified account: Capital efficiency that lets you use all assets as margin without moving funds between wallets.

- High performance: Claims 99.99% uptime with a matching engine capable of 100,000 transactions per second.

Weaknesses:

- Regional lockouts: Not available to residents of the United States, United Kingdom, or Canada.

- Complex UI: The dashboard is data-dense and designed for professionals, not casual investors.

- Risky features: Easy access to high leverage (up to 100x) can lead to fast losses for inexperienced users.

How to Pick the Right Coinbase Alternative

Choosing a new home for your crypto assets can feel overwhelming because every exchange claims to be the “fastest” and “safest.” To cut through the marketing noise, you need to look at two specific engines that drive these platforms: the fee model and the utility belt.

When we evaluate alternatives to Coinbase, we don’t just look at the landing page; we dig into the fine print. Here is how you should compare them effectively:

The Fee Check: Flat Rate vs Maker/Taker

Coinbase often relies on a “Flat Fee” or “Spread” model for its main app, which is why you end up paying $2.99 on a small $100 purchase.

- The Pro Standard: Look for exchanges that use a Maker/Taker model.

- Makers (You place a limit order that sits on the books) usually pay the lowest fees, sometimes even 0%.

- Takers (You buy instantly at market price) pay slightly more, but rarely above 0.40%.

- The Math: If an exchange charges you more than 0.50% per trade, you are overpaying.

The Tool Check: “Buy Buttons” vs”Trading Terminals”

Does the platform only have a “Buy Now” button? That’s a red flag for high fees.

- Chart Quality: A good alternative must integrate TradingView charts, allowing you to draw trend lines and use indicators like RSI or MACD.

- Order Types: You need more than just “Market Buy.” Ensure the platform supports Stop-Loss (to protect funds) and Limit Orders (to buy at your specific price).

Quick Decision Criteria

If you are still on the fence, use this cheat sheet to match your personality to the exchange:

- If you want the best balance of safety and low cost: choose Kraken (Pro interface).

- If you want the absolute lowest fees and most coins: choose Binance.

- If you are a beginner who wants to copy the pros: choose eToro.

- If you are a pro trader looking for derivatives and speed: choose Bybit.

| Exchange | Standout | Fees (Maker/Taker) | Assets | Fiat | Security / PoR | Best For |

|---|---|---|---|---|---|---|

| Kraken | #1 Pick: Lowest fees & perfect security record | 0.16% / 0.26% (Pro) | 500+ | USD, EUR, GBP, CAD | 100% PoR, Never Hacked | Overall Best Value & Cost Cutters |

| Binance | Massive volume & “Amazon-like” selection | 0.10% / 0.10% | 350+ | Varies by region | Merkle PoR (Self-Published) | Fee Hunters & Altcoin Traders |

| eToro | Social features & “CopyTrader” tool | Flat 1% | Crypto + Stocks | USD (others convert) | Regulated Broker Status | Beginners & Social Traders |

| Bybit | Unified Trading Account & Derivatives | 0.10% / 0.10% | 1,000+ | Varies (No US/UK) | Merkle PoR Hub | Active Traders & Bot Users |

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.