Bybit vs Phemex: Which Crypto Exchange Is Better for Spot Trading Now?

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Bybit vs Phemex

Bybit and Phemex both scored 4.3/5 in our spot tests. Bybit wins on liquidity and trust; Phemex suits those wanting lower fees and a slightly larger coin list.

The Bottom Line

As a result of testing Bybit and Phemex for spot trading, we found that both deliver pro-grade terminals and earned 4.3/5 overall in GNcrypto’s spot ratings. If you value raw liquidity, unified accounts and a slightly stronger trust profile, Bybit is usually the more solid pick. If you care more about driving explicit spot fees toward zero and want a slightly larger coin list, Phemex can be the better fit.

- Bybit: top-tier liquidity and depth on majors like BTC/USDT and ETH/USDT.

- Bybit: unified trading account that links spot balances with derivatives collateral.

- Phemex: premium membership offering 0% spot trading fees for active users.

- Phemex: 600+ spot assets and a customizable, pro-grade trading terminal.

- Bybit: limited fiat rails and reliance on third‑party processors and P2P.

- Bybit: complex, feature-dense interface that can overwhelm beginners.

- Bybit: The $1.5 billion Bybit cold-wallet breach in February 2025; users fully compensated.

- Phemex: lower Reliability & Transparency score after the 2025 hot-wallet breach.

- Phemex: high costs on fiat card purchases and offshore, unregulated status.

On this page

- Bybit vs Phemex: Quick Comparison Overview of Both Exchanges

- GNcrypto Category Ratings: Bybit vs Phemex

- Trading Markets, Products & Tools Compared

- Interface and Order Types

- Tools, Automation, and APIs

- Which Platform Fits Your Trading Style?

- Key Features and Trading Experience Compared

- Trading Interfaces and Order Types

- Automation, APIs and Extras

- Supported Assets and Market Access

- Asset Coverage

- Geographic Reach and Restrictions

- Fees & Costs Breakdown

- Bybit Fee Structure

- Phemex Fee Structure

- Fiat Context

- Bybit vs Phemex – Which Should You Choose?

- How We Tested Bybit vs Phemex

Bybit vs Phemex: Quick Comparison Overview of Both Exchanges

As a result of testing Phemex vs Bybit for spot trading, we found that both deliver pro-grade terminals and earned 4.3/5 overall in GNcrypto’s spot ratings. If you value raw liquidity, unified accounts and a slightly stronger trust profile, Bybit is usually the more solid pick. If you care more about driving explicit spot fees toward zero and want a slightly larger coin list, Phemex can be the better fit.

GNcrypto Category Ratings: Bybit vs Phemex

| Category | Bybit | Phemex | Winner |

|---|---|---|---|

| Overall GNcrypto rating | 4.3 / 5 | 4:3 / 5 | Draw |

| Daily spot turnover (approx.) | ≈$3,4B | ≈$700М | Bybit |

| Tradable assets (spot) | 496 | 600+ | Phemex |

| Liquidity & volume rating | 5 / 5 | 4 / 5 | Bybit |

| Fees & total cost rating | 4 / 5 | 4 / 5 | Draw |

| Asset selection rating | 4 / 5 | 4 / 5 | Draw |

| Tools & order controls | 5 / 5 | 5 / 5 | Draw |

| Fiat access & minimum trade size | 3 / 5 | 4 / 5 | Phemex |

| Reliability & transparency rating | 4 / 5 | 3 / 5 | Bybit |

Bottom line on the quick overview: if you prioritize maximum liquidity, market depth and a slightly higher trust score, Bybit pulls ahead. If your primary concern is minimizing explicit trading fees while keeping fast execution and a larger raw coin count, Phemex becomes very compelling.

Trading Markets, Products & Tools Compared

In this section we compare the core trading markets, products and tools that shape day-to-day experience on both platforms. While Bybit vs Phemex fees are explored in detail later, many cost differences actually come from how you route orders, use bots and APIs, and choose between spot and derivatives on each exchange. These features are what ultimately determine how efficiently active traders can turn market views into executed trades.

Interface and Order Types

Bybit

- Dense, professional-style desktop layout with integrated order book, depth chart, recent trades and TradingView charting in one pane.

- Supports the full professional order suite: Market, Limit, Stop, OCO, Reduce-Only, Post-Only and bracket TP/SL from the ticket.

- Unified Trading Account architecture allows spot and derivatives positions to be managed from a single collateral pool.

- Interface assumes technical confidence: better suited to traders who already know order types and risk controls.

Phemex

- Classic derivatives-style terminal with a TradingView-centered layout and side-by-side order book and recent trades.

- Full-featured order ticket including Conditional (trigger) orders and bracket TP/SL, similar in depth to Bybit.

- Highly customizable desktop workspace where modules can be moved and resized for personalized setups.

- Mobile apps emphasize clarity with separate Spot and Contract tabs to reduce the risk of accidental leveraged orders.

Verdict: From a pure interface and order-control perspective, the experience is broadly equivalent. Both exchanges feel like professional terminals rather than casual apps. Bybit is slightly denser out of the box, while Phemex leans into layout customization and a cleaner separation between spot and derivatives.

Tools, Automation, and APIs

Bybit

- Built-in Grid Bots and Copy Trading aimed at semi-automated strategies without external tools.

- Deep integration with TradingView for charting, plus a Unified Trading Account for multi-market portfolio management.

- Strong support for API-driven strategies, with Bybit positioned as a “technological fortress” for power users.

Phemex

- High-speed “CrossEngine” matching engine (claimed 300,000 TPS) designed to handle volatile markets without lag.

- Premium membership model tailored to high-frequency or high-volume spot traders who can exploit 0% explicit fees.

- Emphasis on pro-level customization and efficient workflow over built-in social-trading features.

Verdict: Bybit is better if you want an all-in-one toolkit with built-in bots, copy trading and a unified margin system. Phemex is better if your focus is systematic high-volume trading where execution speed and fee optimization via membership matter more than native automation features.

Which Platform Fits Your Trading Style?

For newcomers, neither exchange is truly ideal as a first stop, but Phemex’s cleaner separation between spot and contracts may feel slightly less intimidating. That said, both platforms expect users to understand order types, leverage and basic risk controls.

For users who prioritize liquidity, Bybit is the safer bet. GNcrypto rates its liquidity and volume 5/5, and the exchange is described as the second-largest globally by volume. This usually translates into tighter spreads and deeper books, especially on majors. For the full scoop, head to Bybit reviews.

For altcoin hunters, Phemex has marginally more coins listed (600+ versus Bybit’s 496). Both exchanges, however, curate active markets rather than listing every illiquid token available, so the practical difference is most noticeable on niche or innovation-zone assets. Additional insights are available in the area categorized as Phemex reviews.

Security-focused users face a nuanced trade-off. Bybit scores higher on Reliability & Transparency (4/5 vs 3/5), but both platforms have experienced serious security incidents in 2025 yet reimbursed users. Neither is a fully regulated Tier-1 venue with a long-standing clean record and independent financial audits.

For fee-sensitive high-volume traders, Phemex’s Premium membership can be a mathematical winner: paying a fixed subscription in exchange for 0% spot fees will undercut Bybit’s 0.10% base rate once volumes are high enough. Lower-volume or occasional traders may not justify the membership cost and will see smaller differences.

Final verdict on fit:

- Pick Bybit if you value maximum liquidity, a unified multi-market account and a slightly stronger trust/reliability profile.

- Pick Phemex if you plan to trade spot frequently enough for 0% Premium fees to make a significant difference and you want a larger coin catalog with a flexible, customizable workspace.

Key Features and Trading Experience Compared

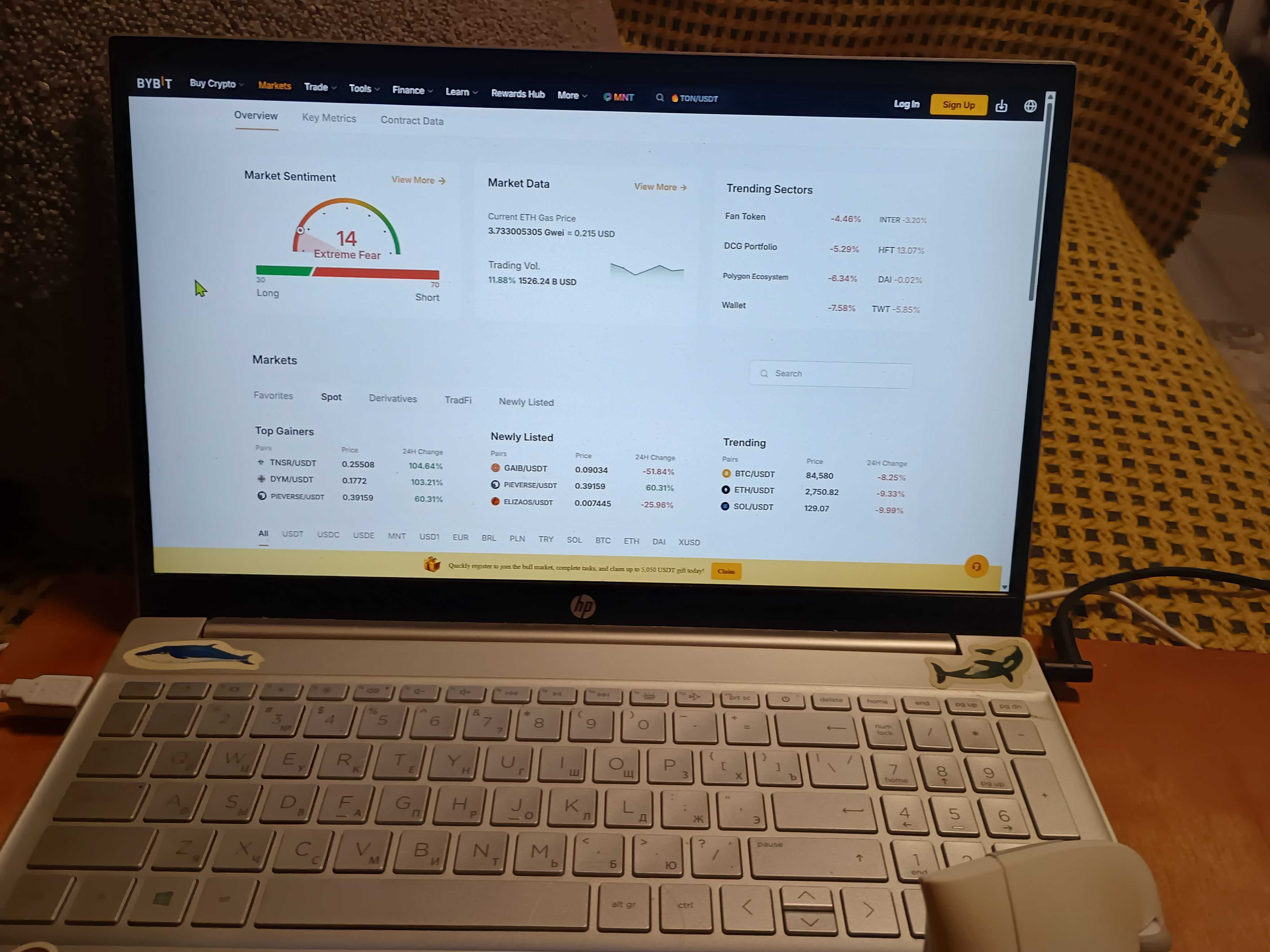

Bybit and Phemex were both tested using a $200 BTC/USDT spot trade, with GNcrypto measuring spreads, slippage, fee impact and terminal responsiveness. The result: both delivered fast execution with negligible slippage on major pairs.

Trading Interfaces and Order Types

Bybit

- Execution in the $200 test trade matched top-of-book prices with no noticeable slippage, confirming strong depth on BTC/USDT.

- The terminal shows Level 2 order book, depth chart and trade history alongside TradingView charts, supporting detailed intraday analysis.

- Professional order-routing features like OCO, Reduce-Only and Post-Only are built in, supporting sophisticated risk management.

Phemex

- The desktop dashboard loads instantly and remains responsive while switching between markets, even under volatility.

- Offers a standard pro layout with TradingView charts, order book and trade tape, similar to Bybit and other derivatives venues.

- Conditional and bracket orders are supported directly in the ticket, making it easy to pair entries with take-profit and stop-loss levels.

Our verdict: Both exchanges are at or near the top of the market for active spot trading UX. Bybit feels slightly more integrated into a broader ecosystem (Earn, Web3 wallet, unified margin), while Phemex emphasizes raw speed and customizability.

Automation, APIs and Extras

Bybit

- Strong focus on power-user tools like Grid Bots and Copy Trading baked into the platform.

- Unified Trading Account lets spot traders pivot into derivatives without moving collateral manually.

- Broad ecosystem around listings, Launchpool and ByStarter offers early access to new tokens.

Phemex

- Focuses on speed and membership economics rather than on-platform social trading.

- Premium 0% spot fee model is a clear differentiator for algorithmic or high-frequency strategies.

- Expanding into a hybrid CeFi/Web3 model with Proof-of-Reserves efforts to rebuild trust after the 2025 breach.

Our verdict: If you want integrated bots and copy trading without third-party tools, Bybit is stronger. If you already have your own tooling or strategies and primarily care about execution speed and net costs, Phemex’s design is more attractive.

Supported Assets and Market Access

Asset Coverage

- Bybit: Our team notes 496 coins and 664 spot pairs, with a focus on deep markets rather than sheer listing count. BTC/USDT and ETH/USDT books are described as exceptionally deep, with spreads competitive with top-tier platforms.

- Phemex: Over 600 spot cryptocurrencies plus 150+ perpetual contracts, including majors and an Innovation Zone for niche assets like memecoins and AI tokens.

In practice, both exchanges comfortably cover mainstream and mid-cap altcoins. Phemex has the edge in total coin count, but Bybit’s emphasis on liquidity depth means that many traders will experience better conditions on core markets despite the smaller catalog.

Geographic Reach and Restrictions

- Bybit: Not available to residents of major markets, including the US, UK, Canada and France. Additional regulatory actions in France, Canada, Malaysia and Japan underscore ongoing jurisdictional risk and periodic service changes.

- Phemex: Strictly unavailable in the US, with mounting regulatory pressure in the UK and Canada. It operates as an unregulated offshore platform, which may limit access or create uncertainty for users in sensitive jurisdictions.

Our verdict: From a market-access perspective, both platforms are best suited to users in permissive jurisdictions comfortable with offshore venues. Bybit has more explicit historical run-ins with regulators but scores higher on Reliability & Transparency; Phemex offers more coins and a growing fiat toolkit but remains firmly in a regulatory grey zone.

Fees & Costs Breakdown

To compare Phemex vs Bybit fees in real trading conditions, GNcrypto used a $200 BTC/USDT spot trade on each exchange to estimate total costs, including explicit commissions and observed slippage. Both platforms ended up with a 4/5 score on “Fees & Total Cost to Trade,” but the underlying pricing models are very different.

Bybit Fee Structure

- Standard spot trading fee of 0.10% in the GNcrypto test, with negligible slippage on major pairs.

- Fees can be reduced through maker/Post-Only orders and periodic promotional discounts.

- No membership requirement: occasional traders pay only per-trade commissions.

In practical terms, this means:

- Low- to medium-volume traders can treat Bybit’s cost structure as predictable and competitive without committing to subscriptions.

- Active traders who optimize order placement and exploit promotions can bring effective costs down further, but never to 0%.

Phemex Fee Structure

- Baseline spot fees around 0.10% maker / 0.10% taker for regular users.

- Premium membership unlocks 0% spot trading fees on all pairs, designed for active traders willing to pay a fixed subscription.

- Fiat purchases via credit card carry high effective costs (~3.5% including spreads and fees), making crypto deposits or P2P the preferred funding method.

The result:

- For casual or low-frequency traders, net spot costs on Bybit and Phemex are broadly similar around the 0.10% baseline (ignoring fiat card fees).

- For high-volume spot traders, Phemex’s Premium membership can decisively undercut Bybit’s per-trade commissions once volumes exceed the subscription breakeven.

Fiat Context

- Both platforms lean heavily on third-party providers and P2P for fiat access.

- Bybit’s fiat options vary by jurisdiction and often require P2P or external processors.

- Phemex has introduced what appears to be native fiat accounts (SWIFT, SEPA, FPS), but card-based purchases remain expensive, and bank transfers are slower than integrated rails on top-tier regulated exchanges.

Our verdict: If you are a fee-obsessed high-volume spot trader willing to manage a subscription, Phemex’s 0% Premium model is structurally cheaper.If you are a moderate-volume trader who prefers simpler pricing without subscription overhead and comparable total costs, Bybit’s standard 0.10% framework is easier to live with.

Bybit vs Phemex – Which Should You Choose?

If you’re a beginner or first-time buyer

Choose: Phemex

A slightly cleaner separation between spot and derivatives, plus a more straightforward terminal layout, makes Phemex a bit less intimidating for your first BTC, ETH or blue-chip altcoin purchases. It still feels like a pro platform, but the interface is less cluttered than Bybit’s dense unified account view.

If you’re an active, fee-sensitive spot trader

Choose: Phemex (Premium)

With a Premium membership, Phemex offers 0% spot trading fees, which can dramatically reduce your effective cost per trade if you place many orders each week. Bybit’s 0.10% base rate is competitive, but over time Phemex’s membership model is usually kinder to the P&L of high-volume spot traders.

If you mainly want deep liquidity on majors

Choose: Bybit

GNcrypto rates Bybit 5/5 for liquidity and volume and describes it as one of the largest global exchanges by turnover. If you care more about tight spreads and depth on BTC, ETH and a handful of liquid altcoins than having every niche token, Bybit is generally the safer, more robust choice.

If you want maximum asset variety and room to explore

Choose: Phemex

With 600+ spot cryptocurrencies and 150+ perpetual contracts, Phemex edges ahead on raw listing count and gives you more room to experiment with innovation-zone assets, memecoins and thematic plays. Bybit’s catalog is still broad, but Phemex is better suited if you enjoy exploring a wide range of markets from a single account.

How We Tested Bybit vs Phemex

We evaluated both exchanges using the same GNcrypto methodology, which is why a Bybit vs Phemex comparison is consistent across all key categories. Our team opened live accounts on each platform, completed KYC where required, funded balances and placed $200 BTC/USDT spot trades to see how they behave in real conditions – from order entry and execution speed to spreads, slippage and the real fees paid by a typical spot trader.

GNcrypto employs a standardized rating framework with seven major categories: liquidity & volume, fees & total cost to trade, asset selection & trading pairs, execution quality, tools & order controls, fiat access & minimum trade size, reliability & transparency. Scores in each category are normalized into a 1.0–5.0 rating in 0.1-point steps and then rolled into an overall score – in this case, 4.3/5 for both Bybit and Phemex. For each exchange we combined our first-hand trading experience with public data: fee schedules, supported asset lists, status pages, proof-of-reserves and security documentation, as well as relevant regulatory disclosures where available.

This comparison is based entirely on GNcrypto’s independent reviews of Bybit and Phemex and is intended for information purposes only. It reflects the platforms as they appeared at the time of testing and should not be treated as financial advice; always do your own research and consider local regulations before trading.

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.