Bybit vs MEXC Comparison: Fees, Assets, and Reliability

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Bybit vs MEXC

Bybit (4.3/5) is superior for professional traders who seek elite-grade liquidity and stability, while MEXC (3.6/5) fits fee-sensitive traders hunting rare altcoins.

The Bottom Line

As a result of testing two major crypto exchanges for spot trading, we can say that if you value elite liquidity, professional-grade stability, and advanced account management, Bybit is the superior pick. If you care more about rock-bottom trading fees and accessing thousands of early-stage altcoins before they hit the mainstream, MEXC is the better fit.

- MEXC: Extremely low trading fees (0% Maker)

- MEXC: Massive asset list (2,000+ coins) and early listings

- Bybit: World-class liquidity and order execution speed

- Bybit: Unified Trading Account (UTA) for capital efficiency

- MEXC: Weaker regulatory oversight and lower trust score

- MEXC: Higher risk on low-cap assets

- Bybit: Stricter regional restrictions (No US/UK/Canada users)

- Bybit: Higher base fees compared to MEXC

On this page

We have tested both platforms with a real $200 spot trading experience. Bybit vs MEXC: Which one fits your strategy? Let’s investigate.

After running a live test on both platforms, the distinction is sharp. Choose Bybit if you demand a professional-grade engine – its liquidity on majors is elite, and the Unified Trading Account is a game-changer for active strategies. However, if your goal is to snipe early-stage tokens with near-zero fees, MEXC is the clear winner. Bybit is built for stability; MEXC is built for variety.

MEXC vs Bybit at a Glance

| Category | Bybit | MEXC | Winner |

|---|---|---|---|

| Overall GNcrypto rating | 4.3 / 5 | 3.6 / 5 | Bybit (overall) |

| Daily spot turnover (approx.) | ≈$3.5B | ≈$3.2B | Bybit |

| Tradable assets (spot) | ~500 | 2,000+ | MEXC |

| Liquidity & volume rating | 5 / 5 | 3 / 5 | Bybit |

| Fees & total cost rating | 4 / 5 | 4 / 5 | Draw (MEXC cheaper, Bybit more stable) |

| Asset selection rating | 4 / 5 | 5 / 5 | MEXC |

| Tools & order controls | 5 / 5 | 4 / 5 | Bybit |

| Fiat access & minimum trade size | 3 / 5 | 2 / 5 | Bybit |

| Reliability & transparency rating | 4 / 5 | 3.5 / 5 | Bybit |

Platform Overviews

When people search for exchange comparisons, they are usually comparing two offshore giants that dominate the non-US market. We have done the research to see how their reputations stack up in 2026. Moreover, MEXC vs Bybit fees graph offers a draw, so we will jump straight into trustworthiness check:

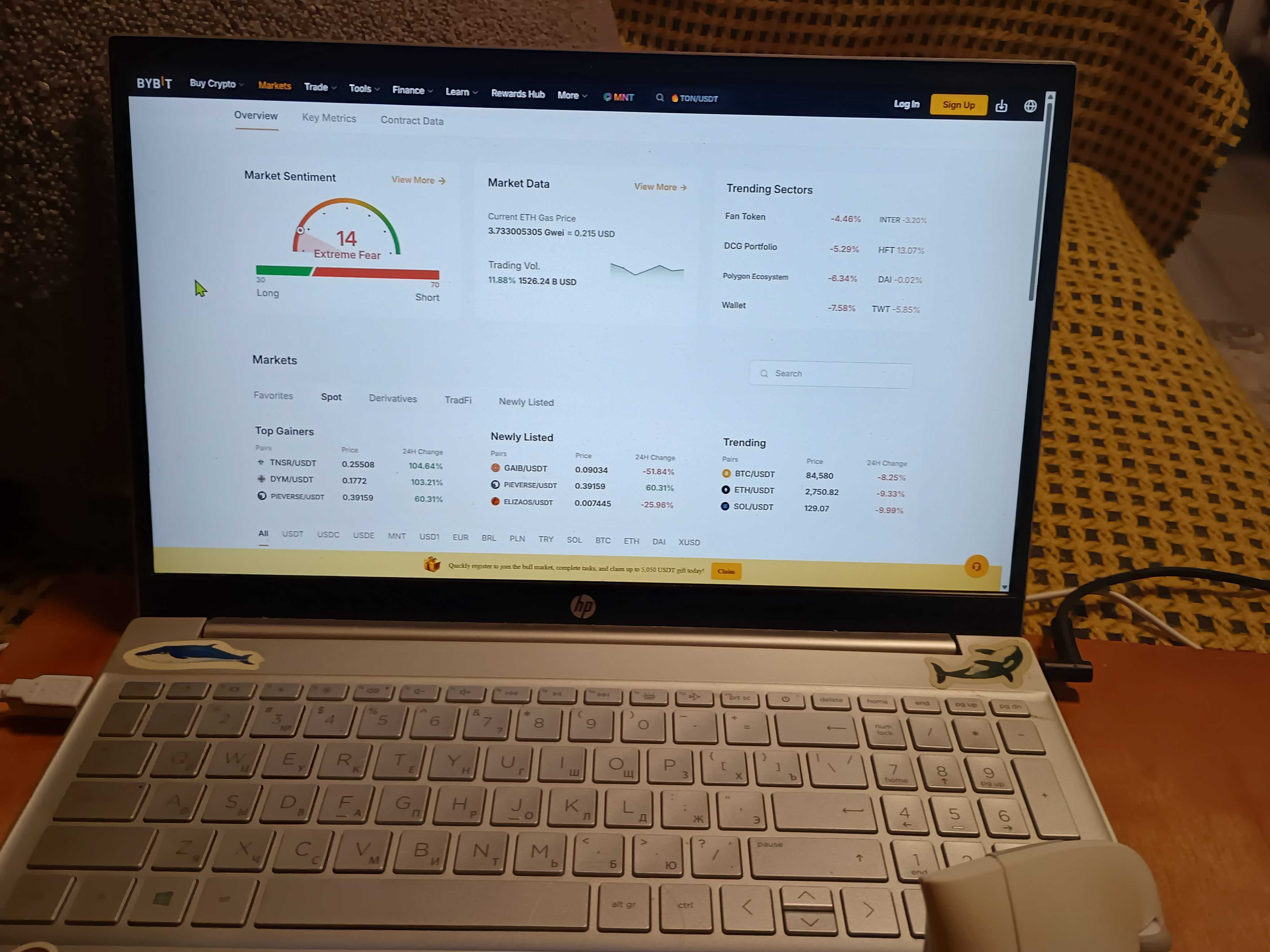

- Bybit was founded in 2018 by Ben Zhou and has evolved from a niche derivatives platform into a comprehensive crypto powerhouse. Headquartered in Dubai, it serves over 70 million users. It is known for its “technological fortress” philosophy, prioritizing uptime and matching engine speed. Despite a security incident in Feb 2025 (fully restored), it retains a strong reputation for solvency and performance, though it has exited strict jurisdictions like Canada and the UK.

- MEXC, also founded in 2018, positions itself as the “Crypto Gem” exchange. Known for its rapid listing speed, it operates globally (170+ countries) and pushes volumes of over $3 billion daily. While Bybit emphasizes regulatory compliance in certain regions, MEXC operates under a lighter regulatory framework in many jurisdictions, often allowing spot trading without mandatory KYC in many regions. However, it faces questions regarding regulatory oversight and recent controversies regarding listing fees.

Supported Cryptos, Volume, Trading Markets

Our team analyzed “Bybit vs MEXC” from the perspective of a daily trader.

MEXC offers a TradingView-based interface that is responsive and familiar. During our tests, the mobile app remained stable even under load. The standout feature is the low barrier to entry – spot trading is accessible in many regions without the friction of heavy identity verification. However, the sheer number of features can feel cluttered. Our MEXC review walks through platform structure, fee tiers, and advanced trading features.

Bybit takes a different approach with its Unified Trading Account (UTA). This system is a game-changer for pros, allowing cross-asset margin. Bybit’s order execution is arguably the best in the industry, with our mystery shopper test confirming instant fills and negligible slippage on majors. The interface is denser and steeper for beginners but offers more power for automated strategies (Grid Bots, Copy Trading). Read our Bybit review for the complete breakdown of what works and what doesn’t.

Our Verdict: Bybit wins on technology and professional tools (UTA); MEXC wins on accessibility and ease of onboarding.

Supported Assets and Market Access

When looking at MEXC or Bybit for portfolio building, the philosophy is quality vs. quantity.

MEXC is the undisputed king of volume listings. With 2,000+ cryptocurrencies and ~2,400 trading pairs, it lists assets that Bybit would never touch. If you want to trade a token that launched yesterday, it’s likely on MEXC. We gave it a 5/5 for Asset Support.

Bybit is more curated. With roughly 496 assets, it focuses on “High Market Quality.” It prioritizes depth – ensuring that you can buy $100,000 of ETH without moving the price – rather than listing every micro-cap coin.

Our Verdict: MEXC wins for variety; Bybit wins for market depth on top-tier assets.

Fees and Pricing

Every trader wants to save money. In the battle of MEXC fees vs Bybit, the numbers are distinct.

MEXC is extremely aggressive. Their standard spot rates are 0.00% (Maker) and 0.05% (Taker). This is effectively half the price (or less) of the industry standard. Holding their MX token grants further discounts.

Bybit charges a standard 0.10% for both Maker and Taker orders. While competitive with Binance, it is twice as expensive as MEXC for takers. However, Bybit’s VIP program is robust for institutional volume, and “Post-Only” orders can reduce costs for market makers.

Our Verdict: MEXC is cheaper for the average retail trader. Bybit requires high volume to match MEXC’s low base rates.

Summary

If you are an active “Gem Hunter”

Choose: MEXC

With over 2,000 listed assets, MEXC is often the first centralized exchange to list meme coins and low-cap projects. If your strategy involves finding the “next big thing” before it hits major tier-1 platforms, MEXC is your playground.

If you are a Professional or Algo Trader

Choose: Bybit

Bybit’s Unified Trading Account (UTA) allows you to use spot assets as collateral for derivatives seamlessly. Combined with world-class execution speeds and deep market liquidity, in the Bybit vs MEXC comparison it stands as the superior engine for high-volume strategies.

If you are Fee-Sensitive

Choose: MEXC

MEXC currently offers a 0.00% maker fee and a very low 0.05% taker fee. For high-frequency traders who don’t qualify for VIP tiers elsewhere, these base rates are significantly cheaper than Bybit’s standard 0.10%.

If you need a User-Friendly Experience

Choose: Bybit

While both interfaces are complex, Bybit’s “technological fortress” approach ensures fewer glitches during high volatility. However, beginners should be aware that Bybit has strict regional bans (no US/UK/Canada).

How We Tested Bybit vs MEXC

We evaluated both exchanges using the same GNcrypto methodology, which is why a Bybit vs Mexc comparison is consistent. GNcrypto employs a standardized rating framework with 7 major categories: liquidity & volume, fees & total cost, asset selection & trading pairs, execution quality, tools & order controls, fiat access & minimum trade size, reliability & transparency.

Scores are normalized into a 1.0–5.0 star rating in 0.1-point steps, and then rolled into an overall rating (3.6 for MEXC, 4.2 for Bybit). For both exchanges we looked at public data: fee schedules, supported pairs/asset lists, status pages, proof-of-reserves and security documentation, regulatory filings. And then we evaluated it against our first-hand testing, which included: opening accounts, completing KYC, funding balances and placing spot trades.

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.