Binance vs Bybit: Which is on Top?

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Binance vs Bybit

Binance (4.4/5) is a top-option for seasoned traders who seek access to a wide variety of coins. Bybit (4.3/5) is good for traders looking for an easy-to-use interface.

The Bottom Line

We ran real trades on both platforms, Bybit and Binance, and here’s what we found. Binance wins for spot trading: deeper order books, faster fills on majors, and access to everything from BTC to obscure altcoins. Bybit offers a cleaner interface and strong derivatives tools, but smaller liquidity and limited availability (no U.S. access) make it a secondary choice for most users.

- Binance: Lists 500+ cryptocurrencies, giving traders access to majors, mid-caps, and deep altcoin catalogs

- Binance: Our trading experience shows that slippage is minimal, we tested the BTC/USDT pair

- Bybit: We found the interface easier to navigate – buy/sell buttons are prominent, TradingView charts load quickly, and the layout doesn’t overwhelm beginners

- Bybit: Offers a solid derivatives ecosystem like futures, options, leveraged products for those looking to use more trading options. Use our secret code QZBDZMK to claim the benefit.

- Binance: Subject to increased regulatory scrutiny and verdicts, including in the U.S.

- Binance: Does not provide a full third-party audited solvency report

- Bybit: Its spot markets generally have smaller order book depth and lower overall liquidity

- Bybit: Not available in the U.S., limits global reach.

On this page

We have tested both platforms with a real $200 spot trading experience. Binance vs Bybit: Which one is best? Here’s an honest deep dive.

Binance wins on sheer asset choice, offering more than 500 coins. Bybit counters with a more streamlined interface and strong transparency tools. Pick Binance to build a deep, diverse portfolio. Go with Bybit for fast execution on majors without the complexity.

Binance vs Bybit: Snapshot Summary

| Category | Binance | Bybit | Winner |

|---|---|---|---|

| Overall GNcrypto rating | 4.4 | 4.3 | Binance |

| Daily spot turnover (approx.) | ≈$31B | ≈$3.5B | Binance |

| Tradable assets (spot) | 500+ coins | ~500 | Binance |

| Liquidity & volume rating | 5/5 | 5 / 5 | Binance |

| Fees & total cost rating | 5/5 | 5/5 | Draw |

| Asset selection rating | 5/5 | 4/5 | Binance |

| Tools & order controls | 5/5 | 5/5 | Draw |

| Fiat access & minimum trade size | 4/5 | 3 / 5 | Binance |

| Reliability & transparency rating | 4/5 | 4/5 | Draw |

To understand Binance vs Bybit standoff better, we deep-dived into their stories. Here’s what we found out.

Binance: Founded in 2017, Binance is the largest global crypto exchange. It is famous for its broad service offering: spot, margin, futures, staking, Copy Trading, APIs, and a massive ecosystem of tokens and services. Its global footprint, deep liquidity and large user base make it a top platform for both retail and professional traders.

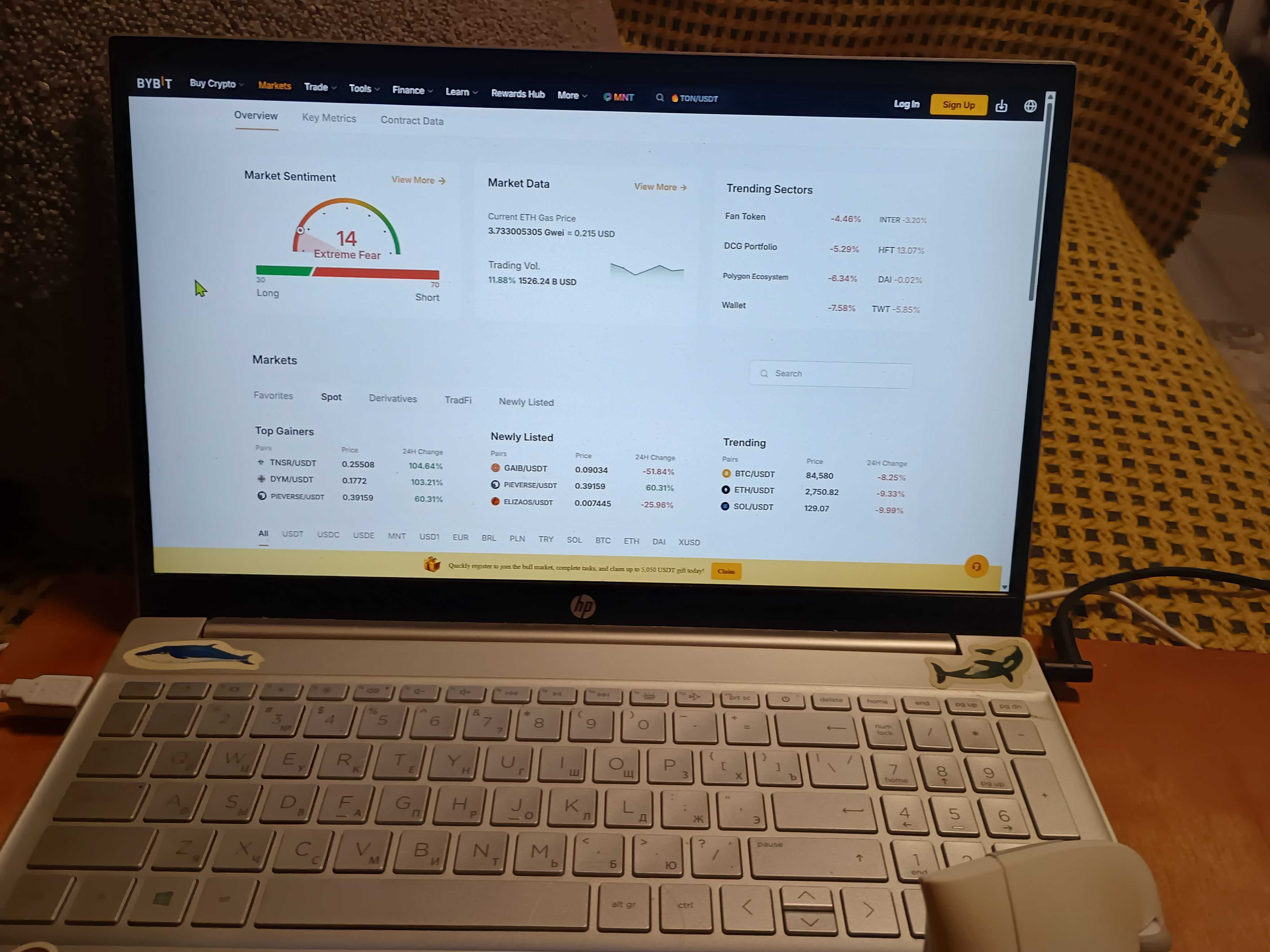

Bybit: Founded in 2018 by Ben Zhou, Bybit is headquartered in Dubai. Since its launch it has rapidly expanded to become one of the world’s top crypto exchanges, often ranked as the second-largest by trading volume. Bybit serves tens of millions of users globally and is known for a clean, user-friendly interface, strong derivatives offering, and a simpler experience compared with the mega-platform ecosystem of Binance.

Trading Tools, Platform Products, and Fees Compared

To deep dive into Binance vs Bybit comparison, we set up an account with real money. Here’s our take.

Interface friendliness

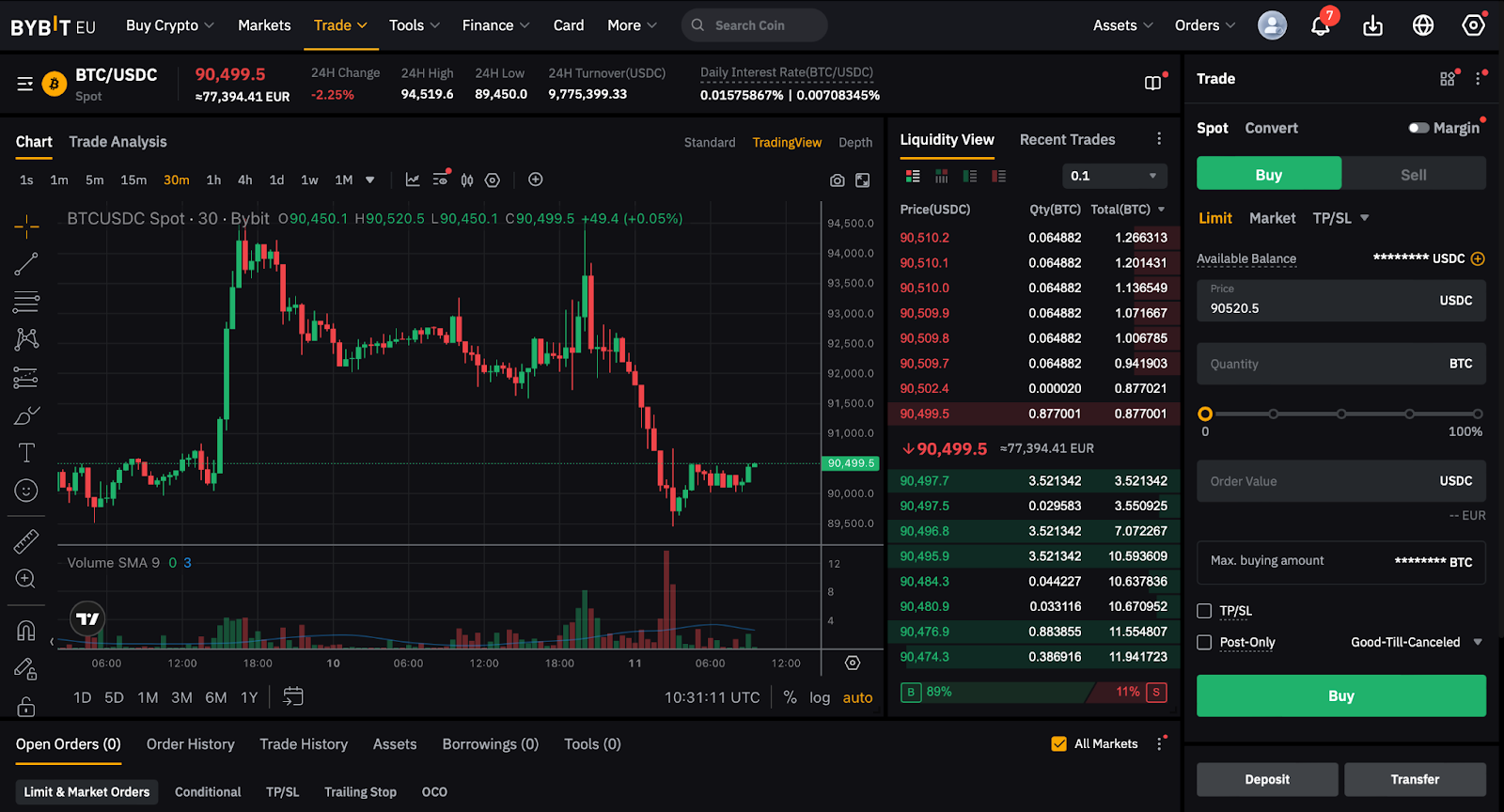

Bybit’s TradingView-based interface is much more intuitive than Binance’s. The purchase button is placed on the right, making it easier to quickly buy the coin you need. The font is eye-pleasing and accessible.

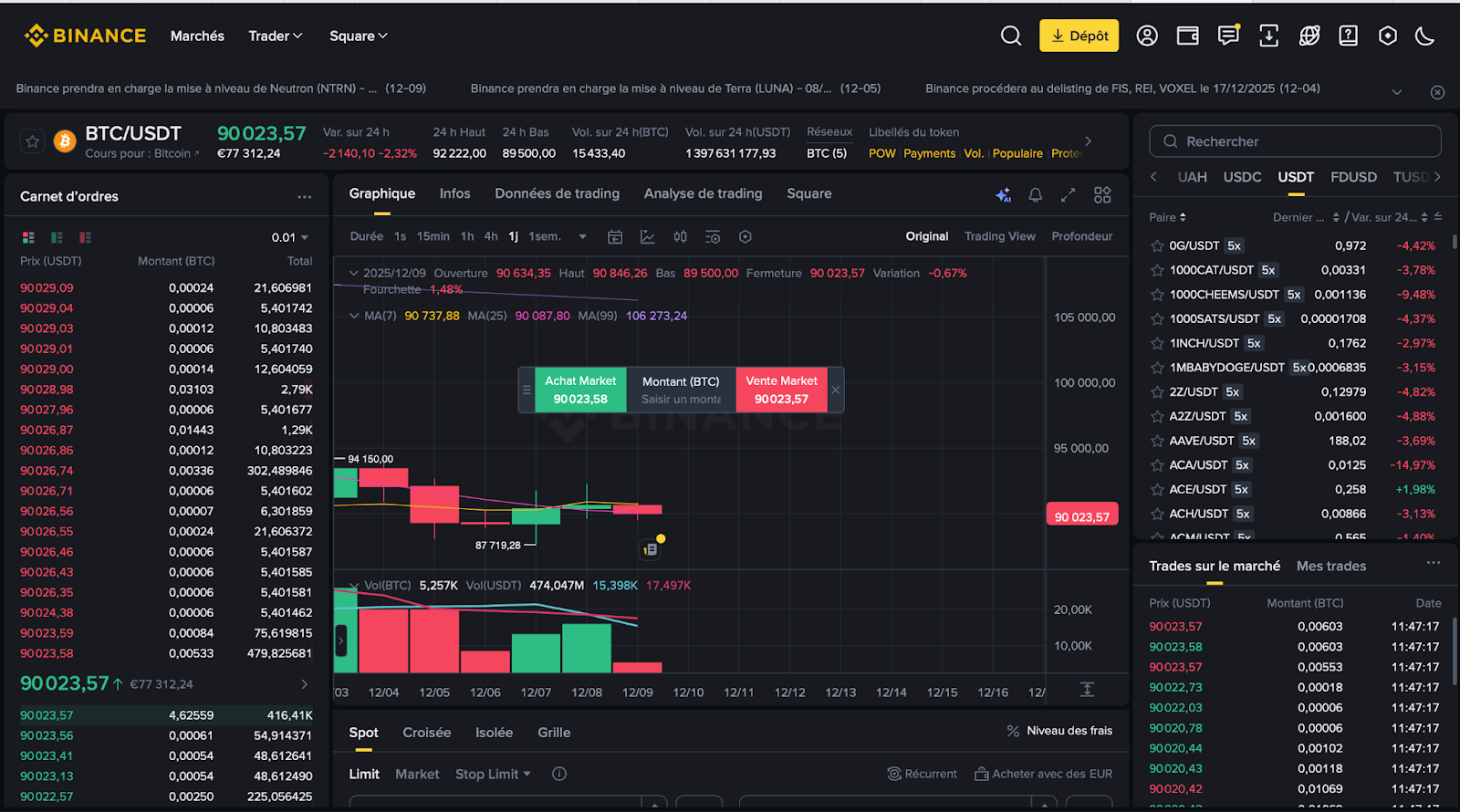

Binance feels slightly messier and less intuitive. It caters primarily to advanced users, offering a lot of information at once. The buy button is located much lower so you need to scroll the screen to actually get what you want.

Our Verdict: Bybit wins here – easier for quick trades, buy button prominent, less clutter. Go for Binance if you’re looking for a wider assortment of trading options and room for trade maneuver.

Supported assets and market access

For our Binance and Bybit comparison, we tested both interfaces with real trades to see how they actually handle.

Binance supports a very broad selection of cryptocurrencies and trading pairs, making it ideal for those wanting access to both major and niche coins. It is basically a go-to place for traders willing to build broad portfolios. Meanwhile, Bybit lists hundreds of cryptocurrencies – majors plus many altcoins – but the catalog is narrower. We tested ETH/USDT and SOL/USDT on Bybit – both had decent depth for retail trades, but spreads widened noticeably compared to Binance during off-peak hours.

Our Verdict: Binance takes this one. 500+ coins vs Bybit’s limited catalog makes the choice obvious if you want variety.

Fees and Pricing

Like you, we want to save every single penny while trading. Here’s what we found out when comparing.

A lot depends on who trades and how. If you’re a regular spot trader with small-to-medium trades, both exchanges charge 0.1% base, so effective cost often boils down to liquidity and whether you trade the exchanges’ native coins.

To that end, Binance offers fee discounts: volume-based tiers and paying with BNB, which can significantly lower your effective costs. If you pay with BNB, you’ll typically reduce fees by ~25%, bringing the effective spot fee down to around 0.075% at base tier and even lower with higher volume.

Meanwhile Bybit’s fee structure generally stays flat at the 0.10% level for standard users, but it can decrease with higher VIP tiers and trading volume (down to around 0.0625% maker and 0.075% taker for top VIP levels).

Our Verdict: Both charge 0.1% base, but Binance’s BNB discount (down to 0.075%) gives it a slight edge.

Security, Regulation, and Transparency

Binance operates everywhere, which means regulators everywhere watch it closely. The company paid massive fines to the DOJ and CFTC in 2023–2024 and overhauled its KYC and compliance systems. That cleaned up some problems, but the exchange still operates in a patchwork of different rules depending on where you live. If you’re in the U.S. or EU, expect tighter restrictions and ongoing legal uncertainty.

Bybit keeps a lower profile. No major legal battles, no billion-dollar settlements. The exchange is based in Dubai and blocks U.S. users entirely, which keeps American regulators off its back but also limits who can use it. Bybit’s been picking up licenses in smaller markets, though it’s nowhere near Binance’s global footprint.

On transparency, Bybit publishes Proof-of-Reserves using Merkle-tree audits – you can verify your funds are actually there. They also show reserve ratios and wallet addresses publicly, which is more than most exchanges do.

Choosing Between Binance and Bybit: Final Take

If you’re a beginner or first-time buyer

Choose: Bybit

Bybit is easier to understand and navigate so if you’re looking for a more intuitive UX and a good assortment of coins, that’s a solid option.

If you’re an active, fee-sensitive spot trader

Choose: Both

Both platforms offer good terms for traders, depending on their goals. So, in a Binance vs Bybit standoff, we recommend that you first define your ultimate goal and then choose accordingly.

If you mainly want a curated list of majors

Choose: Binance

Go here if you want the deepest liquidity and tightest spreads on major pairs.

If you want maximum asset variety and global reach

Choose: Binance

Go for Binance 100%. Bybit isn’t available in major markets like the U.S., making it impossible for local traders to take advantage of the exchange’s benefits.

How We Tested Binance vs Bybit

To compare exchanges, we use our very own GNcrypto methodology, ensuring consistency at every step. GNcrypto employs a standardized rating framework with 7 major categories: liquidity & volume, fees & total cost, asset selection & trading pairs, execution quality, tools & order controls, fiat access & minimum trade size, reliability & transparency.

Scores are normalized into a 1.0–5.0 star rating in 0.1-point steps, and then rolled into an overall rating (4.4 for Binance, 4.2 for Bybit). For both exchanges we looked at public data: fee schedules, supported pairs/asset lists, status pages, proof-of-reserves and security documentation, regulatory filings. And then we evaluated it against our first-hand testing, which included: opening accounts, completing KYC, funding balances and placing spot trades.

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.