Bitstamp Crypto Exchange Review 2026: The Good, the Bad and the Fees

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Bitstamp

Bitstamp is a great choice for those valuing strong regulatory focus, reliability, and smooth trading experience. But it’s not all glossy and smooth, and we’re here to explain why.

GNcrypto's Verdict

Bitstamp is an established centralized exchange with a strong regulatory focus, serving traders primarily in Europe and other non-U.S. markets. We used a real account to test the exchange’s nuts and bolts. It’s great for traders who value reliability and deep liquidity on major spot pairs like BTC/USD. The real pitfalls are the high cost and narrow trading options.

- Strong regulation and long operating history. Bitstamp has been on the market since 2011 and operates under EU regulatory framework, which works for EU-based customers

- Has strong liquidity on major pairs. This applies to BTC/USD, BTC/EUR, ETH/USD, and ETH/EUR pairs that are great for simple traders

- User-friendly interface. The platform is clean, straightforward, and focused on core spot trading rather than an overwhelming feature set, catering to beginners and conservative traders alike.

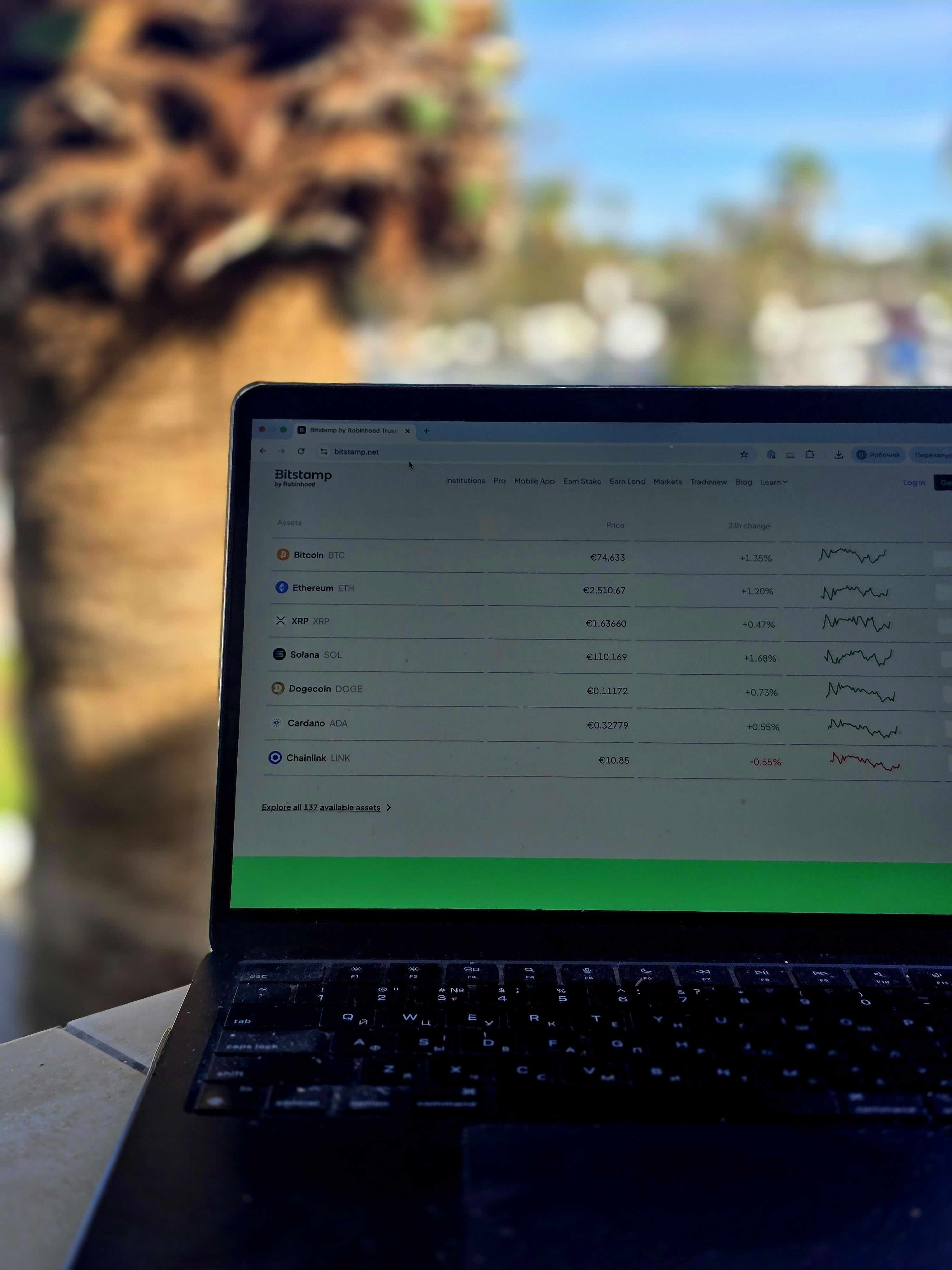

- Limited asset selection. The exchange has a conservative list of major cryptocurrencies and supports far fewer coins than large global exchanges, offering just 100–106 cryptocurrencies for spot trading, with roughly ~220+ trading pairs available.

- Only basic trading tools. The platform is built for straightforward spot trading and lacks advanced features such as futures, options, grid bots, or complex order types.

- Higher fees limit. Not great for high-frequency or short-term trading strategies: the higher fees limit the traders’ ability to save money

On this page

GNcrypto’s finance team tested Bitget with a spot trade to assess costs, market quality, and usability. We explored what makes the exchange attractive to the user, how easy it is to create an account, and how affordable it is.

What Bitstamp Does Well

Our Bitstamp cryptocurrency exchange review has proved that the exchange is pretty solid in several areas. Let’s look at them one-by-one:

- Its regulatory credibility and long track record. It resembles a traditional financial institution, with a focus on compliance, transparency, and operational stability, which is especially valuable to European users adhering to the EU regulatory framework.

- It’s solid for conservative conservative spot traders thanks to liquidity on major fiat pairs. Markets like BTC/USD, BTC/EUR, and ETH/EUR are typically deep and orderly, resulting in reliable execution and low slippage for standard trade sizes.

- Bitstamp’s user-friendly tools and strong fiat rails are a major plus. The platform offers a clean interface focused on core spot trading, which makes Bitstamp especially appealing to users who want an easy, no-frills way to move between fiat and crypto without navigating an overly complex trading environment. Its fiat on-ramps are among the best in the industry, especially for European users, with reliable SEPA transfers and smooth bank withdrawals.

- Reliable customer support. The exchange offers multiple ways for traders to reach out and ask questions or report issues. It offers direct access to human support agents via ticketing and, in some regions, phone support.

Where Bitstamp Falls Short

Still, our Bitstamp exchange review also shows that Bitstamp suffers from major drawbacks too. Let’s go over them:

1. Bitstamp falls short most clearly on cost competitiveness and active-trading appeal. Mainly because trading fees are generally higher than those on newer global exchanges, especially for users who don’t trade at very high monthly volumes. This is bad news for frequent traders or anyone sensitive to fees.

2. Then there’s a limited asset variety. Bitstamp maintains a conservative listing policy, meaning that traders interested in altcoins, newer projects, or emerging market trends don’t have much to benefit from.

3. It also offers few advanced trading features. The platform is built for straightforward spot transactions and long-term holding, not for complex strategies. There are no derivatives, futures, or advanced automation tools that pro traders would appreciate.

4. Bitstamp’s interface is clean and professional but it can also feel less intuitive for first-time crypto users compared to more beginner-focused platforms. The exchange assumes a basic understanding of spot trading, order types, and fiat transfers, offering fewer guided prompts or in-app tutorials.

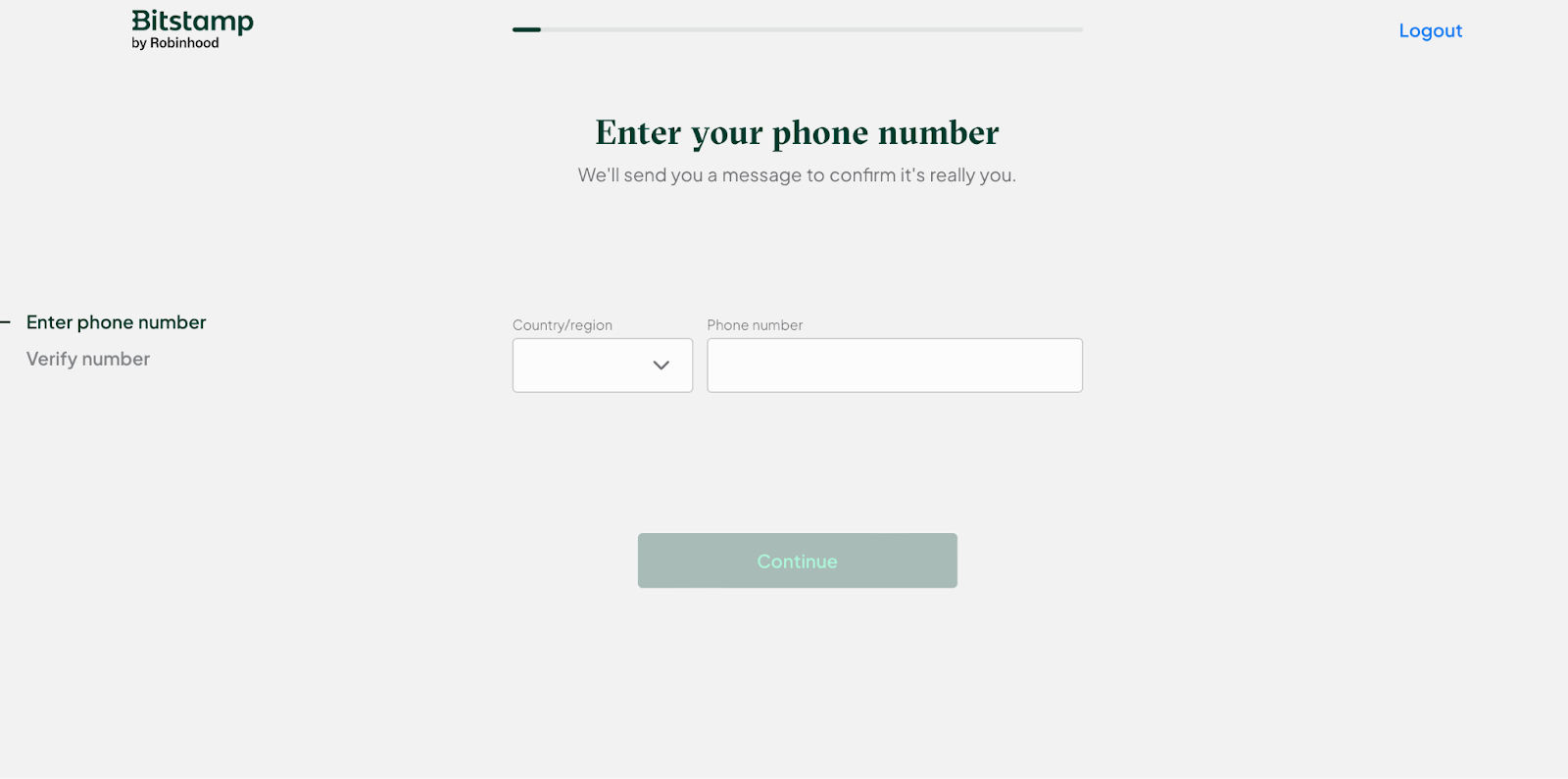

5. Tricky registration. Our experience showed that despite a pleasing interface and multiple attempts, there was trouble receiving a confirmation SMS.

Pros and Cons of Using Bitstamp

For this Bitstamp exchange review, we drew up a list of key pros and cons. Let’s deep-dive:

Strengths:

- Strong execution quality on major fiat pairs (BTC/USD, BTC/EUR, ETH/USD, ETH/EUR), with stable depth and low slippage for retail and mid-size orders

- Transparent spot fees (0.1% maker / 0.1% taker), with volume-based discounts for active traders

- Excellent fiat on/off ramps, especially SEPA bank transfers; deposits and withdrawals are reliable and clearly priced

- Clean, user-friendly interface focused on core spot trading without unnecessary complexity

- High reliability and trust profile, supported by long operating history, strong security practices, and consistent customer support

Weaknesses:

- Limited asset selection compared to large global exchanges

- Higher effective costs for frequent traders: fees only become more competitive at higher volume tiers

- Few advanced trading tools with no derivatives, futures, or automation features for strategy-driven users

- Card purchases and instant buys are expensive, making them less suitable for regular trading compared to order-book execution

Trustworthiness Check

In the crypto-verse, trust is everything. We reviewed Bitstamp’s history of regulatory compliance and safety. Here’s what we found out:

- No major enforcement actions in 2024–2025: We did not find public records of significant lawsuits, regulatory penalties, or enforcement actions against Bitstamp in the U.S. or EU during this period. This contrasts with several larger global exchanges that have faced ongoing legal disputes.

- Regulatory standing: Bitstamp operates under a compliance-first model, with registrations and licensing across multiple European jurisdictions. It is widely regarded as one of the more regulation-aligned centralized exchanges, particularly for fiat-based spot trading.

- Security and operational record: Bitstamp has maintained a long operational history without major recent security breaches affecting customer funds. The exchange continues to emphasize cold storage, account-level protections, and transparent operational practices.

- Transparency and disclosures: Bitstamp approach centers on steady compliance, clear fee disclosures, and reliable customer communication, rather than rapid product expansion.

Our verdict: Bitstamp’s trust profile is proven by the absence of any major scandals and its policy of adhering to industry regulatory frameworks.

Fees & Costs

We used a real deposit to write this Bitstamp review. And here’s what we found out.

Bitstamp uses a straightforward maker–taker fee model for spot trading. The base maker fee is 0.1% and the taker fee is also 0.1%. Discounts are available at higher monthly trading volumes, catering foremost to truly competitive mainly for active or high-volume traders. However, compared to newer exchanges, Bitstamp’s fees remain less aggressive at lower volume tiers.

The minimum spot order size is around $5, which also makes it accessible to small trades and first-time users.

Fiat-related costs depend on the funding method. Bank transfers are generally inexpensive or free, especially for SEPA users. Meanwhile, card purchases and instant buys carry noticeably higher fees, making them better suited for convenience rather than regular trading.

Our verdict: Bitstamp’s fees are clear and predictable, but they are best suited to fiat-heavy or higher-volume spot traders, rather than cost-sensitive or high-frequency users.

GNcrypto’s Overall Bitstamp Rating

| Criteria | Rating (out of 5) |

|---|---|

| Liquidity & Volume | 4 |

| Fees & Total Cost to Trade | 4 |

| Asset Selection & Trading Pairs | 3 |

| Execution Quality / Market Quality | 5 |

| Tools & Order Controls | 4 |

| Fiat Access & Minimum Trade Size | 5 |

| Reliability & Transparency | 5 |

Methodology – Why You Should Trust Us

We use a weighted, category-based model, collect standardized data from each platform (open data + hands-on testing), and convert that into a 1.0–5.0 star score in 0.1 increments.

Our focus is spot trading quality: real fees, minimum trade size, crypto availability, market quality, and the user-facing experience.

How We Collect Data

– Public sources: fee schedules, supported asset/pair lists, proof‑of‑reserves or reserve disclosures, and system status pages.

– First-hand testing: we place test spot trades, observe effective fees (fee + spread), measure slippage/spreads on majors, and evaluate UI speed and order controls.

We do not rate solvency or make guarantees about financial stability. These ratings reflect user experience, access, and trading quality – not a balance‑sheet audit.

Categories & Weights

– Liquidity & Volume – 25%

– Fees & Total Cost to Trade – 25%

– Asset Selection & Trading Pairs – 15%

– Execution Quality (Market Quality) – 10%

– Tools & Order Controls – 10%

– Fiat Access & Minimum Trade Size – 5%

– Reliability & Transparency – 10%

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.