Bitget vs Binance Review 2026: Which Exchange is Better?

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Bitget vs Binance

Binance (4.4/5) is a top-option for seasoned traders who seek access to a wide variety of coins. Bitget (4.3/5) serves as a more friendly alternative for newbie traders.

The Bottom Line

We really deep dived into the nuts and bolts of Binance and Bitget, creating accounts, doing the KYC, and trading real bucks. Our verdict is in: Binance is a crypto behemoth for a reason. It delivers the better pure spot-trading experience thanks to an unparalleled asset selection and a host of trading data. But Bitget isn’t an outsider either. It works well for beginners who want a friendly interface, safety, and low fees – especially if you’re buying your first BTC and learning the basics.

- Binance: almost every second trader uses it: ≈ 41% share of global spot trading volume (data for 2025)

- Binance: Our trading experience shows that slippage is minimal (we tested the BTC/USDT pair)

- Bitget: Low effective trading costs for retail users like you and I

- Bitget: Clean, user-friendly pro/spot interface and strong mobile apps for newbies

- Binance: Subject to increased regulatory scrutiny and verdicts, including in the U.S.

- Binance: Does not provide a full third-party audited solvency report (big deal)

- Bitget: Significantly smaller spot liquidity, meaning your options will be limited

- Bitget: Has a narrower global regulatory footprint and is not available to U.S. users

On this page

We have tested both platforms with a real $200 spot trading experience. Binance vs Bitget: Which one is best? Here’s an honest deep dive.

The difference between the two platforms is tangible. Binance is a straight up winner when it comes to choice, offering over 500 coins for trading. Meanwhile, Bitget provides an easier interface and strong transparency tools. Choose Binance if you want to form a thorough portfolio. Go for Bitget if your goal is to just trade major pairs seamlessly.

Binance and Bitget Overview

| Category | Binance | Bitget | Winner |

|---|---|---|---|

| Overall GNcrypto rating | 4.4 | 4.3 | Binance (overall) |

| Daily spot turnover (approx.) | ≈$31B | ≈$1.4–$1.9B | Binance |

| Tradable assets (spot) | 500+ coins | 200+ | Binance |

| Liquidity & volume rating | 5/5 | 4/5 | Binance |

| Fees & total cost rating | 5/5 | 4/5 | Binance |

| Asset selection rating | 5/5 | 4/5 | Binance |

| Tools & order controls | 5/5 | 5/5 | Draw |

| Fiat access & minimum trade size | 4/5 | 5/5 | Binance |

| Reliability & transparency rating | 4/5 | 4/5 | Draw |

Even at a glance, choosing between Binance or Bitget is a pretty easy task. Here are their stories:

- Binance, launched in 2017 by Changpeng Zhao (CZ), has grown from a fast-moving upstart into the world’s dominant crypto trading ecosystem. Now, it commands over 40% of global spot volume. It is known for its deep liquidity, rapid product rollout, and powerful matching engine. The platform embraces a “build everything” philosophy, offering spot, margin, futures, staking, copy trading, APIs. In 2023, it faced some major regulatory challenges, with CZ’s subsequent conviction (he was pardoned in 2025).

- Bitget, founded in 2018, has grown from a mid-tier trading venue into a global exchange serving tens of millions of users. It operates from a Seychelles base with expanding VASP registrations across Europe. The exchange positions itself as a retail-friendly platform focused on low effective costs, broad asset coverage, and a clean Pro/Spot interface. In 2025, it reported no major security or regulatory incidents.

Fees Comparison

Like you, we are looking to trade as cheaply as possible. Here’s what we found out when comparing Bitget vs Binance fees.

A lot depends on who trades and how. If you’re a regular spot trader with small-to-medium trades, both exchanges charge 0.1% base, so effective cost often boils down to liquidity and whether you trade the exchanges’ native coins BNB and BGB. Binance offers a slight edge due to a 25% discount via BNB vs ~20% for Bitget via BGB.

Our Verdict: Neither exchange is the clear winner, but Binance still has a small advantage.

Key Features and Trading Experience Compared

To give you a comprehensive overview of Binance vs Bitget, we stepped into the daily trader’s shoes. Here’s what we think.

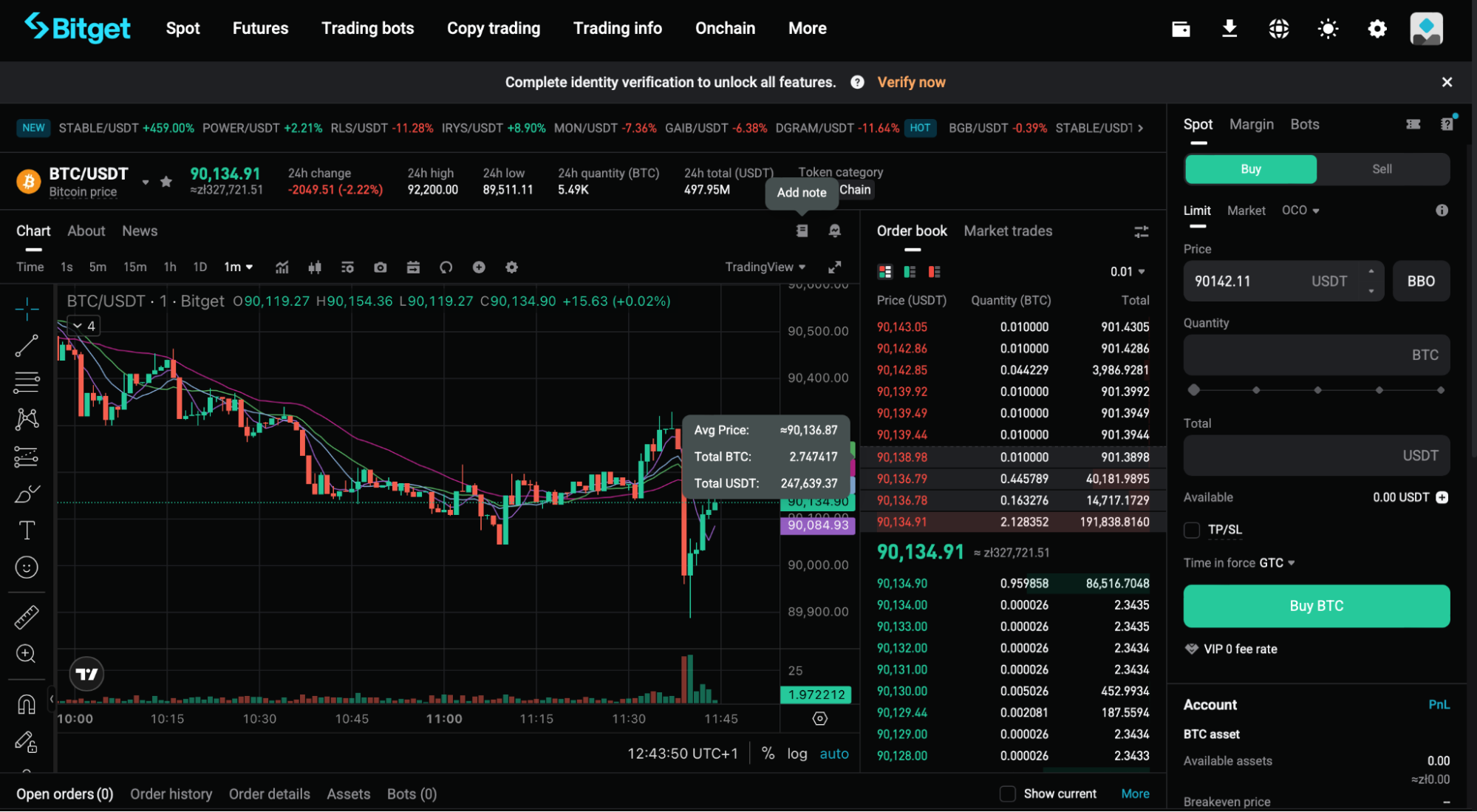

Comparing Bitget vs Binance Interface

Bitget offers a TradingView-based interface that is considerably easier to navigate than Binance’s. The purchase button is placed on the right, making it easier to quickly buy the coin you need. The font is appealing and easy-to-read.

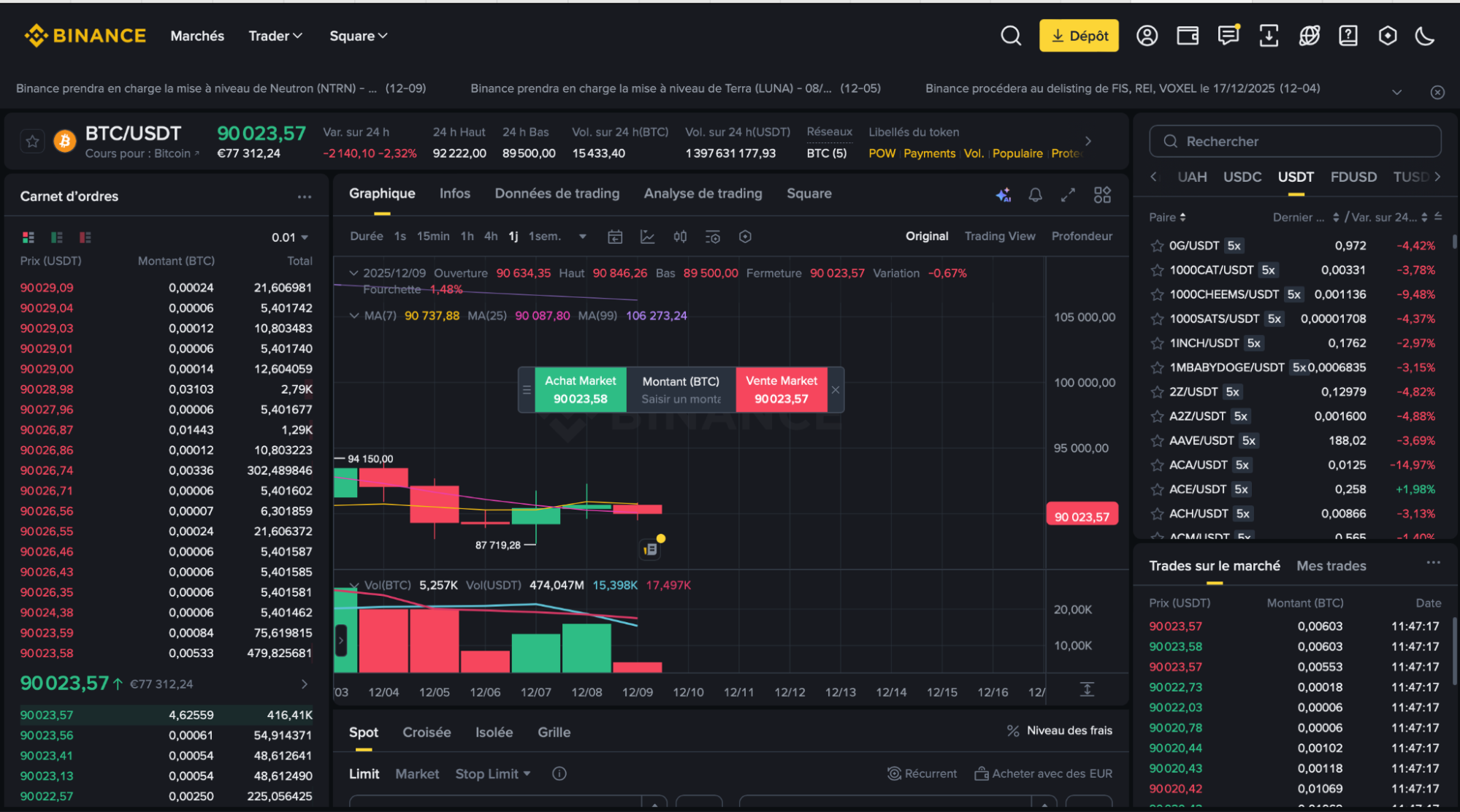

Binance feels slightly messier and less intuitive. It caters to pros and contains a lot of information that is virtually irrelevant to a newcomer. The buy button is located much lower so you need to scroll the screen to actually get what you want.

Our Verdict: Bitget is easier for a newbie trader to navigate so if you’re new to the game, that could be your perfect choice. Meanwhile, Binance offers more data that’s relevant to seasoned traders so if you really want to paint the whole picture and examine data in detail, Binance is “your man.”

Here’s how Binance vs Bitget trading options differ

Binance and Bitget both offer users a wide variety of trading options – though not to the same extent.

Binance supports 500+ cryptocurrencies / virtual tokens on its spot market. As well as stablecoins and multiple tokens across different blockchains and token standards (not just one chain), so users have flexibility across ecosystems.

Bitget does not have such an impressive trading portfolio, offering only several hundred coins. Still, it’s a solid assortment, especially for newbie traders.

Our Verdict: Binance is better for variety, but Bitget has solid options too.

Verdict: Which Platform Is Better

Wrapping up the Binance vs Bitget comparison, here are the takeaways for you:

If you’re a beginner or first-time buyer

Choose: Bitget

Bitget is easier to understand and navigate so if you’re looking for a more intuitive UX and a good assortment of coins, that’s the place to be. You can use a special referral code at this link to get better terms and additional bonuses.

If you’re an active, fee-sensitive spot trader

Choose: Both

Both platforms offer good terms for traders, depending on their goals. So, in a Binance vs Bitget standoff, we recommend that you first define your ultimate goal and then choose accordingly.

If you mainly want a curated list of majors

Choose: Binance

Choose Binance if your primary goal is trading a curated set of major coins with the best liquidity and execution quality. Use our code JO19WNBM on the Binance platform to unlock additional bonuses.

If you want maximum asset variety and global reach

Choose: Binance

Go for Binance 100%. Bitget isn’t available in major markets like the U.S.

Security, Regulation, and Transparency

When comparing Binance vs Bitget, some of the biggest differences show up in how each platform approaches regulation, transparency, and overall user protection.

Binance operates on a global scale with a complex regulatory footprint. Since the major U.S. DOJ and CFTC actions in 2023–2024, the exchange has significantly expanded its compliance programs, strengthened monitoring systems, and improved disclosure practices. Even with these upgrades, Binance still works across a patchwork of international regulations, and ongoing scrutiny from authorities – especially in the EU and U.S. – introduces a degree of jurisdictional uncertainty.

Bitget has taken a more stable regulatory path. It maintains multiple VASP registrations across European jurisdictions and continues expanding compliance coverage. Unlike Binance, Bitget has not faced major regulatory enforcement actions in the 2024–2025 window, giving it a cleaner profile in terms of legal track record. However, it does not operate in the U.S., which limits its regulatory exposure but also its geographic reach. Bitget publishes regular Proof-of-Reserves snapshots with clear overcollateralization figures for major assets. Users can verify their balances via a Merkle-tree audit system, and the exchange provides visibility into on-chain wallets.

How We Tested Binance vs Bitget

To compare exchanges, we use our very own GNcrypto methodology, ensuring consistency at every step.

GNcrypto employs a standardized rating framework with 7 major categories: liquidity & volume, fees & total cost, asset selection & trading pairs, execution quality, tools & order controls, fiat access & minimum trade size, reliability & transparency.

Scores are normalized into a 1.0–5.0 star rating in 0.1-point steps, and then rolled into an overall rating (4.4 for Binance, 4.3 for Bitget). For both exchanges we looked at public data: fee schedules, supported pairs/asset lists, status pages, proof-of-reserves and security documentation, regulatory filings. And then we evaluated it against our first-hand testing, which included: opening accounts, completing KYC, funding balances and placing spot trades.

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.