Best Binance Alternative 2026: Top Safe and Low Cost Crypto Exchange Picks

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

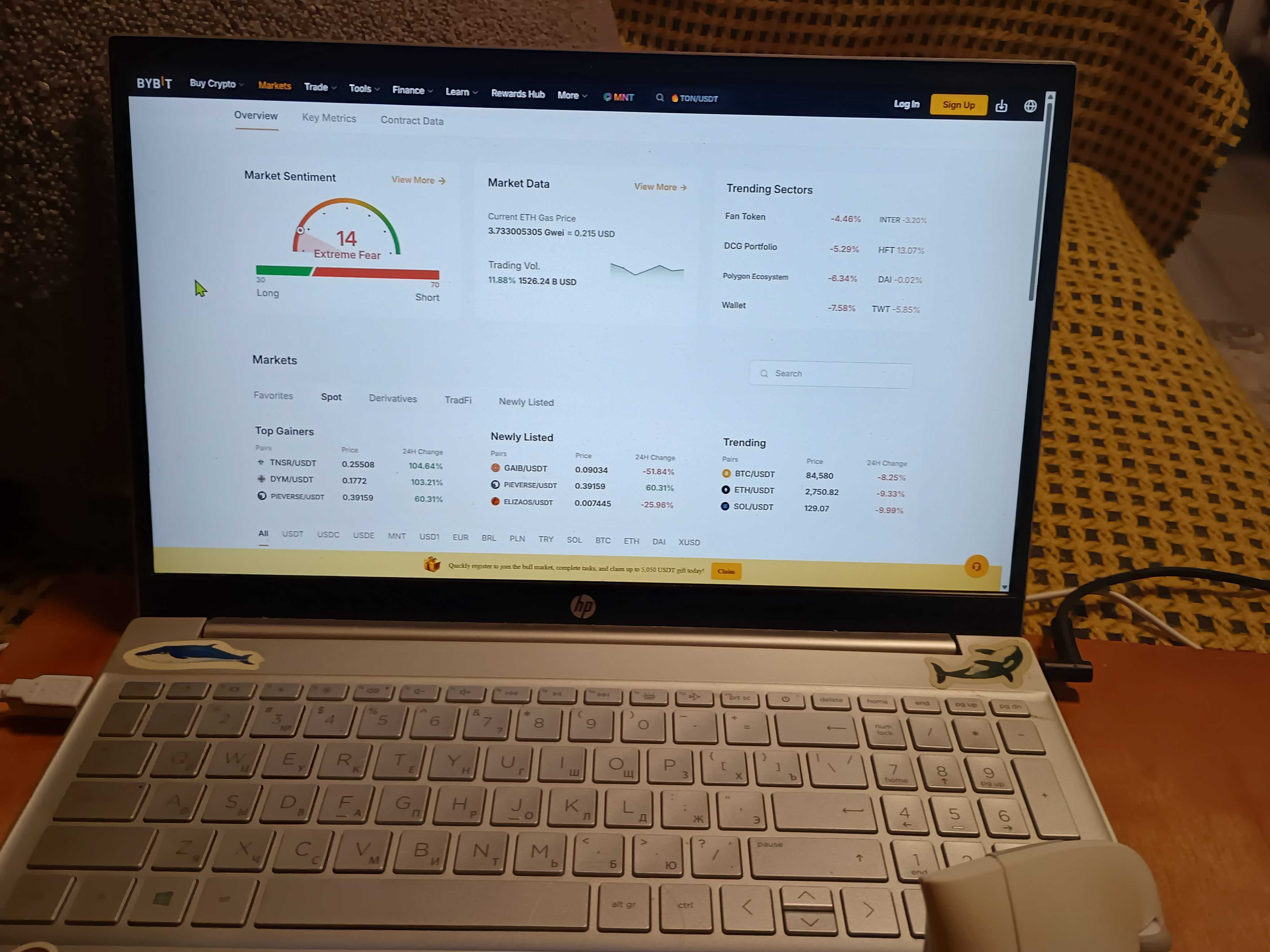

Bybit - Best Binance Alternative

In our head-to-head test of Binance alternatives, Bybit clearly stood out for speed and usability. Its 0.10% fees, instant BTC/ETH fills, and pro tools make it feel closest to Binance. Kraken suits US/EU users prioritizing compliance, Coinbase offers simplicity, OKX handles automation, and KuCoin shines for altcoins. Bybit impressed us most.

GNcrypto's Verdict

During our $200 spot tests, Bybit showed why it’s a serious choice for traders: orders executed instantly, fees stayed at 0.10%. We found OCO orders, grid bots, copy-trading, and charts worked smoothly – essentially a very wide altcoin list. Kraken felt safest for regulatory-conscious users, Coinbase was simple but costlier, OKX handled automation strategies well, and KuCoin offered the widest altcoin selection. From what we saw, Bybit struck the best balance of low fees, liquidity, and advanced features.

- Instant‑feeling fills on BTC/ETH (our $200 tests)

- Low base on‑book costs (0.10% maker / 0.10% taker)

- Full pro toolset (OCO/stop), grid and copy options

- TradingView‑style charts

- Lots of newer listings moving fast (good for altcoin hunters)

- Geo restrictions; availability varies by country

- Fiat ramps can be uneven (P2P or third‑party gateways)

- Self‑published Proof of Reserves; no independent financial audit

- Some users might find the interface overwhelming

On this page

GNcrypto team reviews the best Binance alternatives for 2025. Bybit ranks first for low 0.10%/0.10% spot fees, fast BTC/ETH fills, and a pro toolkit with bots. We also compare Kraken for compliance and fiat rails, Coinbase for simplicity and transparency, OKX for automation, and KuCoin for the altcoin variety.

Top Binance Alternatives: Quick Overview

Our tests point to Bybit as the best overall Binance substitute for everyday spot trading.

- Kraken – best for compliance‑first US/EU onboarding and reliable banking rails.

- Coinbase – best for simplicity and public‑company transparency.

- OKX – best for automation and a terminal‑style workflow (availability and pricing vary by region).

- KuCoin – best for wide altcoin variety and niche pairs.

Pick based on your priorities: fees, liquidity, fiat access, and safety.

Why Traders Look for Binance Alternatives

When people explore Binance alternatives, we usually hear four practical reasons. First, fees and true on‑book costs: some users want the lowest effective rate for small tickets. Second, regional access: fiat rails and features can vary by country. Third, listings: traders may want broader altcoin coverage or specific quote pairs. Fourth, compliance and transparency posture. In our opinion, you should start by ranking your priorities: fees versus access versus safety — then pick the venue that best matches that list.

Kraken

US traders leaving Binance should consider Kraken for its safety-first reputation, solid fiat rails in supported regions, and a beginner-friendly path that scales into Kraken Pro. In our tests, onboarding felt clean and the advanced terminal covered core spot tools without overwhelming new users.

Stronger compliance posture, transparent operations, and good spot tooling (Pro interface, L2 depth, standard order types).

A narrower asset list than some offshore venues, fees that are not always the lowest at small volumes, and regional variance – fiat rails and certain products/features can differ by country or U.S. state.

Cautious beginners and U.S./EU users who value regulatory alignment and a calm, well‑documented onboarding experience.

Strengths:

- Fast account creation and verification

- Easy-to-use and intuitive platform, suitable for beginners and experienced traders

- Strong security, with a 90% score from CER.live

- Standard and Pro versions for advanced and institutional traders

- Access to 562 trading assets across multiple markets

Weaknesses:

- Maintenance downtime and restricted access to funds during upgrades

- Customer support answers sometimes are late

- Users report losing funds on deposits below the minimum requirement

- Baseline fees are higher than those of some competitors

Coinbase

Coinbase works as the public, U.S.-listed option with strong fiat ramps and a very simple interface that scales into Advanced Trade. From what we saw, it fits well as a first stop for buying BTC/ETH, then graduating to pro tools without changing platforms.

Audited financial reporting as a public company, beginner‑friendly onboarding and instant buys, robust infrastructure and brand trust.

Base trading fees are higher than some global rivals, listings are more conservative, and product availability can vary by region.

Cautious first‑time buyers who value brand, clean UX, and transparency more than rock‑bottom fees.

Strengths:

- Top-tier spot liquidity on majors (BTC, ETH) at fair prices for U.S./EU users.

- Clear, beginner-friendly UI and mobile apps.

- Strong fiat access for the U.S. and Europe.

- Advanced Trade mode for those who need order types and charts.

- Large, reputable brand with public reporting.

Weaknesses:

- Retail/low-volume fee is not the cheapest and often higher than competitors’ instant-buy fees.

- Asset selection sits in the mid/high tier, but not at the “thousands of altcoins” level.

- Features remain geo-restricted.

Bybit

Bybit stands out thanks to active liquidity on major pairs, a terminal-style interface, and frequent fee promotions that can lower on-book costs. Testing showed order entry feels quick and the pro toolkit covers advanced orders and automation where available.

Low effective trading costs on the book (especially during promos), deep books on BTC/ETH pairs, rich order types and bot hooks.

Regional restrictions and uneven fiat ramps in certain countries; proof‑of‑reserves and audit practices may not satisfy the most conservative investors.

Active spot traders seeking deep liquidity and consistently low per‑trade costs.

Strengths:

- High Market Quality: We experienced instant fills and tight spreads on majors (BTC/ETH) during our $200 test orders.

- Competitive Costs: Low 0.10% base fees, which can be further reduced via “Post-Only” orders and frequent promotions.

- Power User Terminal: A complete toolkit featuring native OCO orders, Grid Bots, Copy Trading, and TradingView charts.

- Asset Depth: An aggressive listing cadence (496+ coins) that provides early liquidity for altcoin hunters.

Weaknesses:

- Geo-Restrictions: The platform is strictly blocked in major markets, including the U.S., UK, Canada, and France.

- Fiat Friction: Direct bank deposits are limited; funding often relies on P2P markets or pricier third-party gateways.

- Audit Status: While Bybit publishes a self-reported Proof of Reserves, it lacks a fully independent, external financial audit.

- Learning Threshold Complexity: For a newbie who just wants to buy a coin, it might feel cluttered.

OKX

OKX brings terminal-style trading with built-in bots and broad market coverage. When we tested the pro screen, it felt familiar with quick order entry and solid depth on major pairs; however, pricing and product availability vary by region, which matters for small tickets and fiat ramps.

Competitive global spot fees, good liquidity on BTC/ETH books, recurring Proof‑of‑Reserves snapshots, automation tools (grid/DCA) where available.

Entry‑tier fees in the EEA are higher than the global schedule; some products/features are not offered in certain countries.

Users outside higher‑fee regions who place disciplined limit orders and want automation in a pro‑grade interface.

Strengths:

- Low baseline spot fees on the global schedule: 0.08% maker / 0.10% taker; additional discounts via VIP tiers and when paying in OKB.

- High liquidity on top pairs (BTC/USDT, ETH/USDT) and a broad lineup of assets.

- Regular Proof‑of‑Reserves (monthly snapshots; “primary assets” expanded in 2025).

- VARA in the UAE: in 2025 – a pilot for retail derivatives in a regulated environment.

Weaknesses:

- Legal risk (US and parts of the EU). In February 2025, the OKX operator pleaded guilty to AML violations; an external compliance monitor was appointed through 2027.

- Geographic unevenness: Exit from Canada (2023), limited CeFi services in India (2024), local restrictions in the EEA. OKX US rolls out gradually with a reduced product set.

- EEA fees above global baseline: Since 01.10.2025, the Regular spot tier is 0.20% maker / 0.35% taker with no volume discounts; VIP and OKB fee rules differ from the global schedule.

KuCoin

Among alternatives to Binance, we think KuCoin stands out for broad altcoin coverage and over one thousand spot pairs aimed at retail and active traders. In our experience, the interface is familiar for CEX users and the market menu makes it easy to explore mid‑caps and niche tokens.

Very wide listings and pairs, competitive on‑book costs with disciplined limit orders, and a feature‑rich spot terminal.

Regulatory nuances by region and uneven access to certain fiat rails; we suggest a cautious custody approach for larger, longer‑term holdings.

Users who prioritize variety — altcoin hunters and pair‑seekers who want a single account with broad market reach.

Strengths:

- Low trading fees starting at 0.1%

- Over 700 supported assets

- Futures trading with up to 100x leverage

- KCS token bonuses and fee discounts

- Built-in trading bots and mobile apps

Weaknesses:

- No operating license in the United States

- Complex onboarding and verification for new users

- Limited customer support

- Security breach in 2020 (see KuCoin announcement. Since resolved with full reimbursement)

Final Verdict

The right Binance alternative depends on what you value most – fees, regulation, or specific trading tools.

In our testing, Bybit came out ahead: 0.10% fees beat most rivals, BTC/ETH liquidity is consistently deep, and all test trades filled instantly. Its terminal supports advanced orders and automation without unnecessary clutter.

Kraken fits US/EU traders who want regulatory clarity and reliable fiat access. Coinbase is best for beginners who prefer simplicity, even with higher fees. OKX appeals to automation-heavy strategies, though availability varies by region. KuCoin stands out for altcoin depth.

Whatever you choose, start with a small test – deposit, trade, withdraw. It’s the quickest way to confirm real fees, execution quality, and local availability before committing more funds.

Top Binance alternatives – quick comparison

| Exchange | Standout | Entry spot fees | Assets (approx) | Fiat access | PoR / transparency | Best for |

|---|---|---|---|---|---|---|

| Kraken | Security-first, clean UX, strong compliance | Pro tiers competitive; instant buy costs extra | 500+ curated | Strong in US/EU (bank rails, SEPA) | Regular PoR info, detailed security docs | Cautious beginners; users who want regulated onboarding |

| Coinbase | Public US-listed, simple start to Advanced Trade | Higher base tiers than fee-first rivals | ~475, conservative listings | Very strong where supported | Audited financials (public company) | First-time buyers who value brand and transparency |

| Bybit | Deep books on majors, pro toolkit, fee promos | ~0.10% maker / 0.10% taker base | ~500 with many pairs | Varies by country; uneven in places | PoR hub with self-published snapshots | Active spot traders chasing low effective costs |

| OKX | Terminal-style UI, grid/DCA bots | Global ~0.08% / 0.10%; EEA 0.20% / 0.35% | Hundreds, broad lineup | Good globally; varies by region | Monthly PoR snapshots | Users outside higher-fee regions using disciplined limit orders |

| KuCoin | Very wide altcoin and pair coverage | ~0.10% maker / 0.10% taker; KCS discounts | 1,000+ coins and 1,000+ pairs | Uneven by region; some methods limited | Merkle-tree PoR available | Altcoin hunters wanting maximum variety from one account |

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.