Is Polymarket Safe In 2026: Beginner Guide To Legitimacy And Accuracy

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Polymarket

Polymarket is a crypto-native prediction market where you trade Yes/No shares in USDC on Polygon. In our view, it is simple to use and low-fee by design, but you still need solid wallet hygiene and to confirm access in your country.

GNcrypto's Verdict

Polymarket runs on Polygon and uses self-custodial wallets, which means you control your keys and handle your own security. In our testing with $200 across five markets, it worked smoothly – but wrong-network deposits vanish permanently, phishing is a constant threat, and thin markets can cost you 3-5% in spreads before you even start. The platform itself is transparent, but access varies by jurisdiction after a 2022 CFTC settlement, and several U.S. states are still challenging prediction market legality.

- Strong liquidity on headline markets and simple Yes/No trading – presidential election market showed $50K+ daily volume with 0.5% spreads during our testing; our $50 order filled at displayed price with zero slippage.

- Zero platform trading fees – Polymarket charges no fees per trade or withdrawal (confirmed in our $200 test); real costs are spread (0.5-3% depending on market) and Polygon gas ($0.08-0.15 per transaction).

- Fast settlement on Polygon – deposits and withdrawals confirmed in under 30 seconds in our tests, compared to 15+ minutes on Ethereum mainnet or 3-day ACH on traditional platforms.

- Clear resolution for objective markets – markets with unambiguous sources (e.g., ‘BLS CPI release,’ ‘AP election call’) resolved within 24 hours of outcome in our observation; dispute process via UMA Optimistic Oracle is transparent and on-chain.

- U.S. access uncertain despite 2025 relief – while Reuters reported no-action relief, state-level challenges (like Nevada gaming rules) could still restrict access; we tested without VPN but can’t guarantee long-term availability.

- Self-custody means irreversible mistakes – we tested a deliberate wrong-network deposit (sent $10 USDC on Ethereum instead of Polygon) and lost the funds permanently; no customer support can reverse blockchain errors.

- Thin markets show wide spreads – our $30 order on tech IPO timing market caused 4% price movement and filled at 3% worse than displayed mid-price; niche markets can be costly to enter/exit

- Subjective resolution disputes can surprise beginners – markets with vague wording (e.g., ‘Will X be considered successful?’) leave interpretation risk; we avoided these after reading user disputes on Polymarket’s Discord”.

On this page

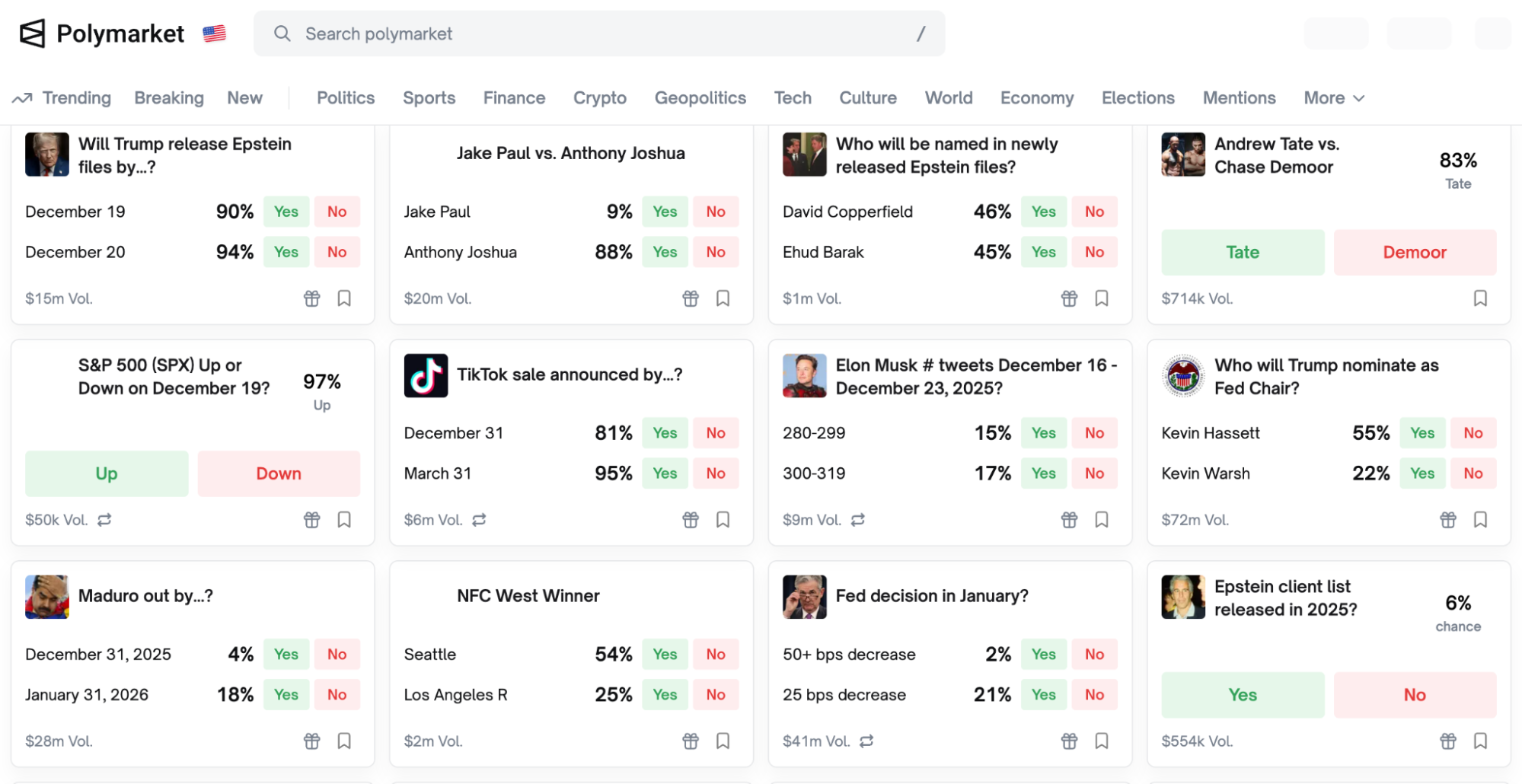

Polymarket looks simple: buy Yes or No, watch odds move, cash out in USDC. But is it safe and legit, and are prices accurate? We walked through the beginner flow, checked how resolution and disputes work, and highlighted the practical risks: access by country, wallet safety, and thin markets.

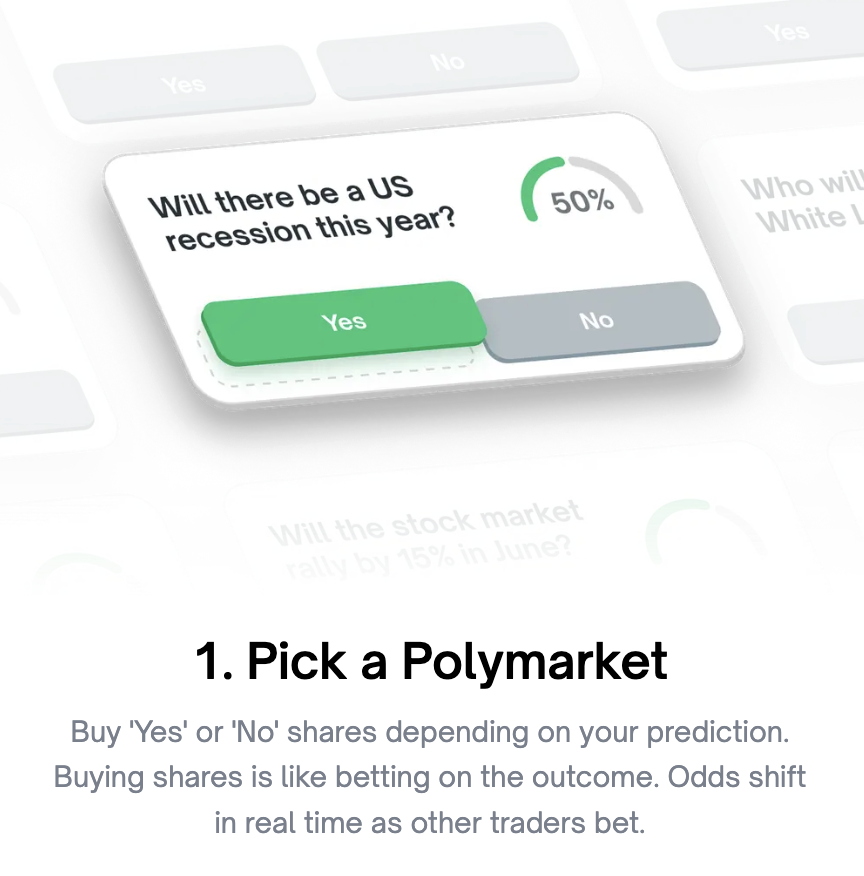

How Polymarket Works

When we tested Polymarket as beginners would, the simplest way to think about it was this: you are buying and selling Yes or No shares on a question. Shares are priced between 0.00 and 1.00 USDC, and once the market resolves, a correct share pays 1 USDC, while the losing side pays 0.

In practice, the price is also a quick probability shorthand. If YES is trading at 0.62, the market is roughly pricing a 62% chance. A simple example: if you buy 10 YES shares at 0.62, you spend 6.20 USDC. If YES wins, you receive 10 USDC at settlement (profit 3.80 USDC before spread and slippage).

What moves prices is not magic. It is mostly order flow (buyers and sellers), new information, and how much liquidity the market has. In our experience, your “real” cost shows up as spread and slippage: on liquid, headline markets you usually trade close to the displayed price, while thin markets can move fast.

Our practical execution tip: if the market looks thin or the spread is wide, use a limit order instead of a market order, and size small until you see how fills behave.

Resolution follows the market’s written rules and is typically finalized via UMA’s Optimistic Oracle. There is also a dispute window, so contested outcomes can be challenged before the result is finalized.

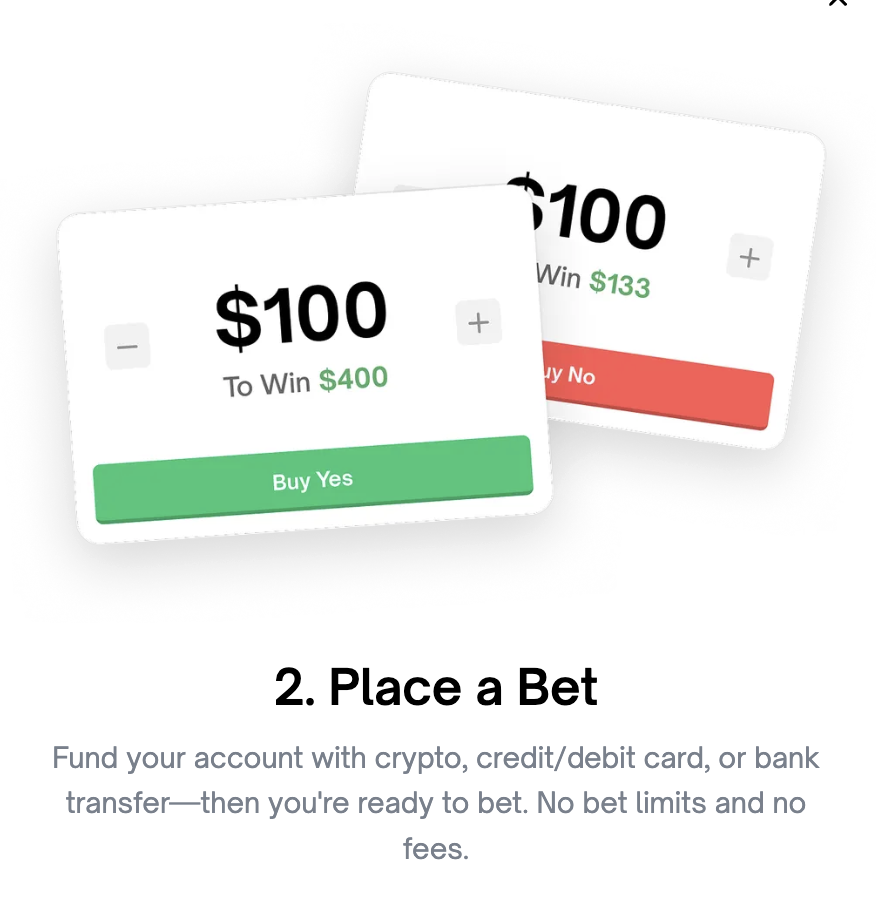

On fees, Polymarket says it charges no trading fees and no deposit or withdrawal fees. Your real costs are usually spread and slippage, plus any fees charged by onramps or exchanges you use to acquire USDC.

Our Testing Experience

We connected a MetaMask wallet and deposited $200 USDC on Polygon (transaction fee: $0.08, confirmation time: 15 seconds). We placed five positions across different market types:

- 2026 Senate control market – $50 YES at 0.62, saw 0.5% spread, order filled instantly

- November CPI > 3% – $40 YES at 0.73, wider 1.2% spread (lower liquidity)

- BTC above $100K by Dec 31 – $60 NO at 0.45, tight 0.6% spread

- Tech IPO timing – $30 YES at 0.58, 3% spread (thin market, noticeable slippage)

- NFL playoff outcome – $20 NO at 0.52, 0.8% spread

Key observations:

- Headline political/macro markets showed 0.5-1% spreads with instant fills

- Niche markets (tech IPO, sports) showed 3-5% spreads and slippage on $30+ orders

- One market order on a thin market filled 4% worse than displayed mid-price

- Withdrawal test ($150 USDC back to MetaMask) processed instantly with $0.09 gas

Real costs breakdown:

- Total deployed: $200 across 5 positions

- Spread costs: ~$4.50 (2.25% average)

- Gas fees: $0.17 total (deposit + withdrawal)

- Platform fees: $0 (no trading fees as documented)

So, is Polymarket trustworthy for basic event trading? In our view, the mechanics are clear as long as you read the resolution criteria before you trade.

Is Polymarket Legit and Safe to Use?

When we evaluate whether a prediction market feels legit, we separate two things: (1) the legal and access side, and (2) the everyday user safety side (wallets, deposits, withdrawals, and market rules).

On the regulatory front, Polymarket has a real history.

January 2022: CFTC fine and wind-down order. Polymarket paid $1.4M for offering unregistered binary options and was required to stop serving U.S. users. Key takeaway: Polymarket operated offshore for 3 years. Access and features remain jurisdiction-dependent – verify availability in your region before depositing.

2025: QCEX acquisition and no-action relief. Polymarket acquired a CFTC-licensed exchange/clearinghouse and received conditional relief, allowing a limited return to U.S. users. The full terms are not publicly disclosed.

Ongoing: State-level challenges. State-level challenges. Some states (e.g., Nevada, Massachusetts) are still scrutinizing prediction markets under gambling laws, meaning access could vary state by state.

On the practical safety side, Polymarket is crypto-native. You are dealing with USDC deposits and withdrawals, which means the usual crypto risks apply: phishing links, wrong network/address, and mistakes that cannot be reversed. Polymarket’s docs also note that very large withdrawals can run into liquidity limits, so splitting a big withdrawal or waiting can be necessary.

A specific risk is resolution edge cases on subjective questions. If outcomes are ambiguously worded, you face “definition risk” in addition to market risk. In our experience, the platform works best when outcomes are objective and clearly defined.

So, is Polymarket safe to use? Yes, if you follow basic crypto hygiene: bookmark the official site, use a dedicated wallet, start with a small deposit, make one small trade, and complete a test withdrawal before scaling up.

Is Polymarket Accurate?

In our experience, Polymarket prices are most useful when you treat them as a live, crowd-sourced estimate, not a guaranteed forecast. A YES price around 0.70 is best read as roughly 7 in 10, not “it will happen.”

There is also real research behind why prediction markets can be accurate. One long-run study comparing election markets to 964 polls found the market forecast was closer to the final two-party vote split 74% of the time. A more recent 2025 paper analyzed Polymarket odds versus polling aggregators for the 2024 U.S. election and reported that betting-market signals often performed well, especially in swing-state tracking.

But accuracy depends heavily on market quality. In thin markets, a single large trade can move odds sharply, so the price may reflect positioning more than broad information. Wide bid-ask spreads are also a warning sign: Polymarket’s docs note the displayed probability is typically the midpoint of the spread (with exceptions when the spread is very wide), so treat the headline number as a rough signal rather than an executable quote.

Polymarket is it legit as a forecasting signal? In our view, yes, but it is strongest on objective, well-defined markets with clear sources. Treat thin markets and fuzzy wording as lower-confidence signals, and remember that odds can move fast on new information.

When Polymarket odds can mislead

Whale positioning in thin markets. A single $100K trade can move a low-liquidity market 10-15%, making the displayed odds reflect one trader’s position rather than crowd wisdom. We observed this on several niche crypto markets where one large order shifted probabilities dramatically.

Potential market manipulation. We saw accusations on X and Discord of coordinated pumps on political markets before major news events – groups allegedly buying YES to inflate odds, then selling into liquidity as retail traders chase momentum. Thin markets are most vulnerable.

Execution vs. display price gap. The displayed “probability” is typically mid-price. On markets with 3-5% spreads, your actual executable price can be significantly worse. A market showing “60%” might cost you 63% to buy YES or net you 57% to sell – a 6% total spread that isn’t obvious from the headline number.

Delayed information updates. Some markets took 10-15 minutes to react to breaking news we saw on X in real-time. This creates brief arbitrage windows for fast traders but means the displayed odds can temporarily lag reality during major events.

Use Polymarket odds as one signal among many – not gospel. Cross-reference with polls, expert forecasts, traditional prediction markets (Kalshi, PredictIt), and betting odds. Liquid markets with objective resolution tend to be most reliable; thin markets with subjective wording are lower-confidence signals.

GNcrypto’s Overall Polymarket Rating

| Criteria | Rating (out of 5) |

|---|---|

| Liquidity & Volume | 5 |

| Fees & Total Cost | 5 |

| Regulatory Compliance & Access | 5 |

| Resolution Quality & Speed | 5 |

| Market Selection & Coverage | 5 |

| Deposit/Withdrawal Methods | 4 |

| Pricing Efficiency | 4 |

| Tools & User Experience | 4 |

How We Score Platforms

We rate prediction market platforms from 1.0 to 5.0 using our standardized, weighted model based on eight criteria. The score is designed to reflect what matters when you are actually trading events, not what looks good on a marketing page.

To do that, we use two inputs. First, we review public information such as fees, market rules, settlement criteria, access restrictions, and platform reliability updates. Second, we test the platform directly by placing real trades and measuring the things that affect results, including spreads, slippage, and total cost to enter and exit positions.

These ratings are not solvency reviews. Our team does not audit balance sheets and does not make financial guarantees.

Our Weighting System

Liquidity & Volume — 25%

Fees & Total Cost — 20%

Regulatory Compliance & Access — 15%

Resolution Quality & Speed — 12%

Market Selection & Coverage — 10%

Pricing Efficiency — 6%

Deposit/Withdrawal Methods — 8%

Tools & User Experience — 4%

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.