Is Kalshi Safe In 2026? Legality, Regulation, And Beginner Risks

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Kalshi

Kalshi operates as a CFTC-regulated Designated Contract Market, placing it under federal derivatives oversight with required compliance procedures, fund segregation rules, and market surveillance. For users asking whether Kalshi is safe, this regulatory framework provides clearer protections than offshore prediction platforms but comes with access restrictions and state-level compliance variations.

GNcrypto's Verdict

In our testing, we opened an account with full KYC verification (passport + address proof), deposited $200 via bank transfer, and placed positions on political and economic event markets. Account security relies on standard 2FA and email verification, while funds are held under segregated custody rules typical of CFTC-regulated venues. The main risks aren’t technical security breaches but rather resolution disputes, liquidity gaps on niche markets, and evolving regulatory boundaries around certain event categories (sports, elections).

For beginners, Kalshi is safer than unregulated prediction sites in terms of fund protection and legal clarity, but carries risks specific to prediction markets: resolution rules that can surprise new users, thin liquidity outside major events, and state-by-state access uncertainty as regulators continue testing the boundaries of event contracts.

- Federally regulated and legally structured event trading in the U.S

- Transparent settlement and clearly defined contract terms

- Simple, intuitive interface built around probability-based trading

- Geographic and state-level access restrictions

- Limited liquidity in smaller or niche markets

On this page

Kalshi is a federally regulated event-trading exchange, but many users still ask one thing first – is Kalshi safe? In this guide, we break down how Kalshi works, what regulation means in practice, and what beginners should know about access, protections, and key risks.

What Kalshi Is

A common question readers ask is “is Kalshi betting legit?” – and the answer depends on how you define “betting.” Kalshi is a federally regulated event-trading exchange where users trade contracts tied to real-world outcomes – not sportsbook odds. You’re buying and selling event contracts that represent a specific outcome, such as whether a reported number exceeds a certain threshold, and each contract settles based on a verified resolution source.

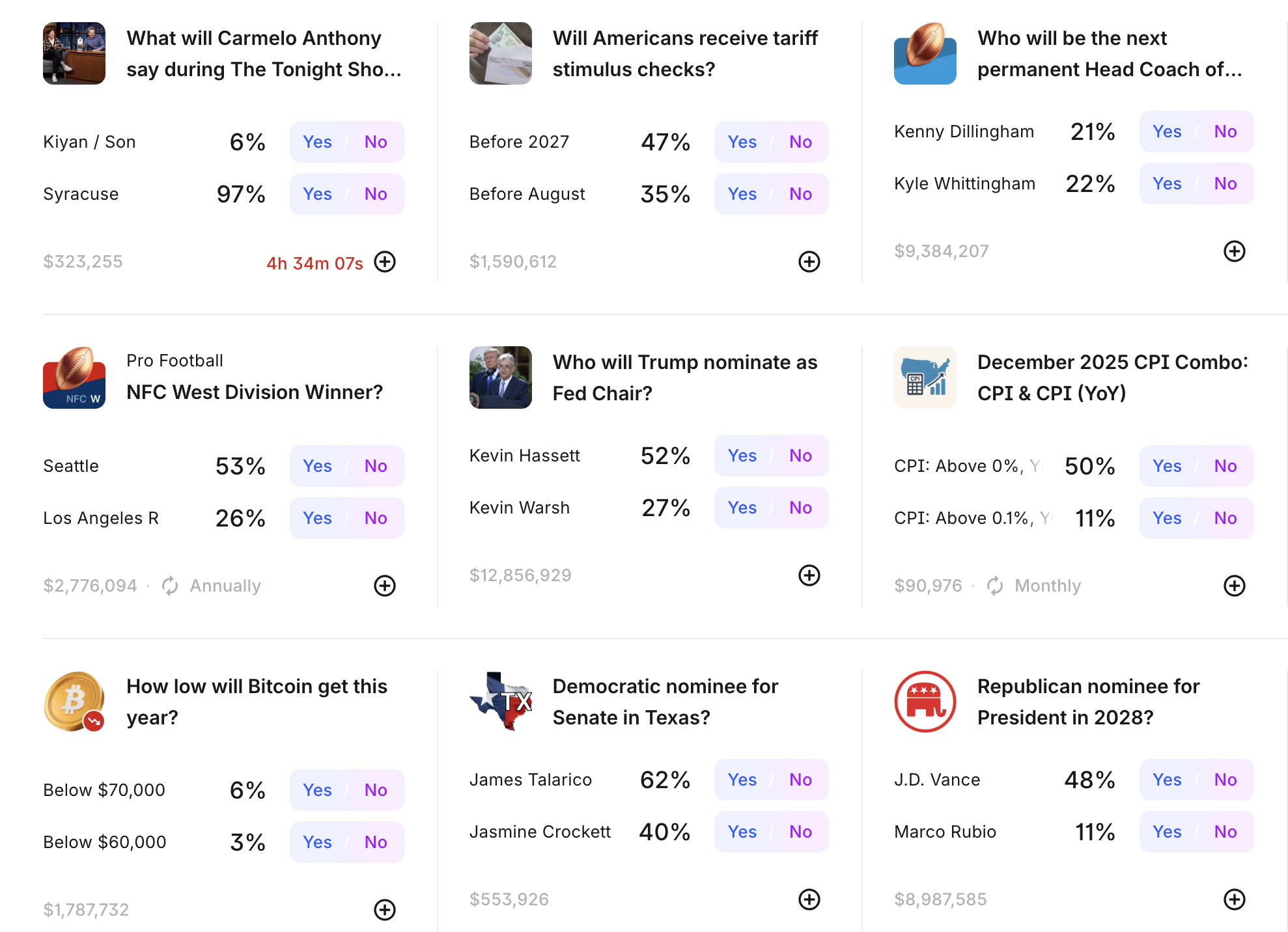

Every market comes with clearly defined terms: what determines the final outcome, where the official data is sourced, and when settlement occurs. Kalshi typically lists markets across categories like politics, the economy, major news, and other key events. Contracts are intentionally simple – you enter at a price reflecting implied probability, trade out before settlement if you choose, or hold until the outcome is finalized.

Is Kalshi Legit and Regulated?

For most users, the real question isn’t whether Kalshi looks professional but whether it can be trusted from a legal and regulatory standpoint. Kalshi operates as a CFTC-regulated Designated Contract Market, placing it under the direct oversight of the U.S. Commodity Futures Trading Commission. In practice, this means the exchange must comply with federal standards for market integrity, surveillance, reporting, and risk management – the same framework governing other regulated financial markets.

For users, that translates to strict compliance procedures. Kalshi requires identity verification and AML checks, operates under formal rulebooks, and structures its markets around clearly defined outcomes and resolution sources. The platform also notes that customer funds are held separately from company operating funds – which directly addresses the “is Kalshi trustworthy?” question many new users have – with additional oversight tied to its regulatory obligations.

Regulation, however, doesn’t remove every limitation. While Kalshi’s license is federal, access and available products can still vary due to state-level restrictions or ongoing legal reviews of certain market categories. Unlike offshore prediction platforms that operate without direct supervision, Kalshi trades flexibility for clear legal structure, tighter oversight, and a framework built to function within – not outside – the U.S. regulatory system.

Is Kalshi Safe to Use?

Account Security: Kalshi offers standard 2FA (Google Authenticator, Authy) and email verification. In our testing, we enabled 2FA during initial signup, which took about 90 seconds. The platform doesn’t support hardware keys (YubiKey) or biometric authentication like some crypto exchanges, but the 2FA + email flow worked without issues across multiple logins.

The bigger risk isn’t Kalshi’s security – it’s user behavior. We tested password reset: it required email confirmation but no additional identity verification beyond that. If your email is compromised, an attacker could potentially reset your Kalshi password. Use a unique strong password, enable 2FA, and secure your email account with its own 2FA.

Fund Protection: Kalshi operates under CFTC segregated funds rules, meaning customer deposits sit separately from Kalshi’s operating capital. In our test, we deposited $500 via ACH (took 3 business days), placed $350 across three event markets, and withdrew $200 after one market settled. The withdrawal was processed in 2 business days back to our bank account – no manual approval delays or surprise holds.

This regulatory structure reduces custody risk compared to offshore platforms where your funds sit in an unaudited company account. But “segregated” doesn’t mean “insured.” If Kalshi faces operational failure, legal disputes, or regulatory shutdown, fund recovery would go through bankruptcy or regulatory receivership – not FDIC protection. And unlike SIPC coverage for stocks, there’s no equivalent insurance for event contracts.

Our approach: keep only active trading capital on the platform ($200-500), withdraw winnings regularly, and don’t treat Kalshi like a savings account. Every contract is a high-variance position, not a bank deposit.

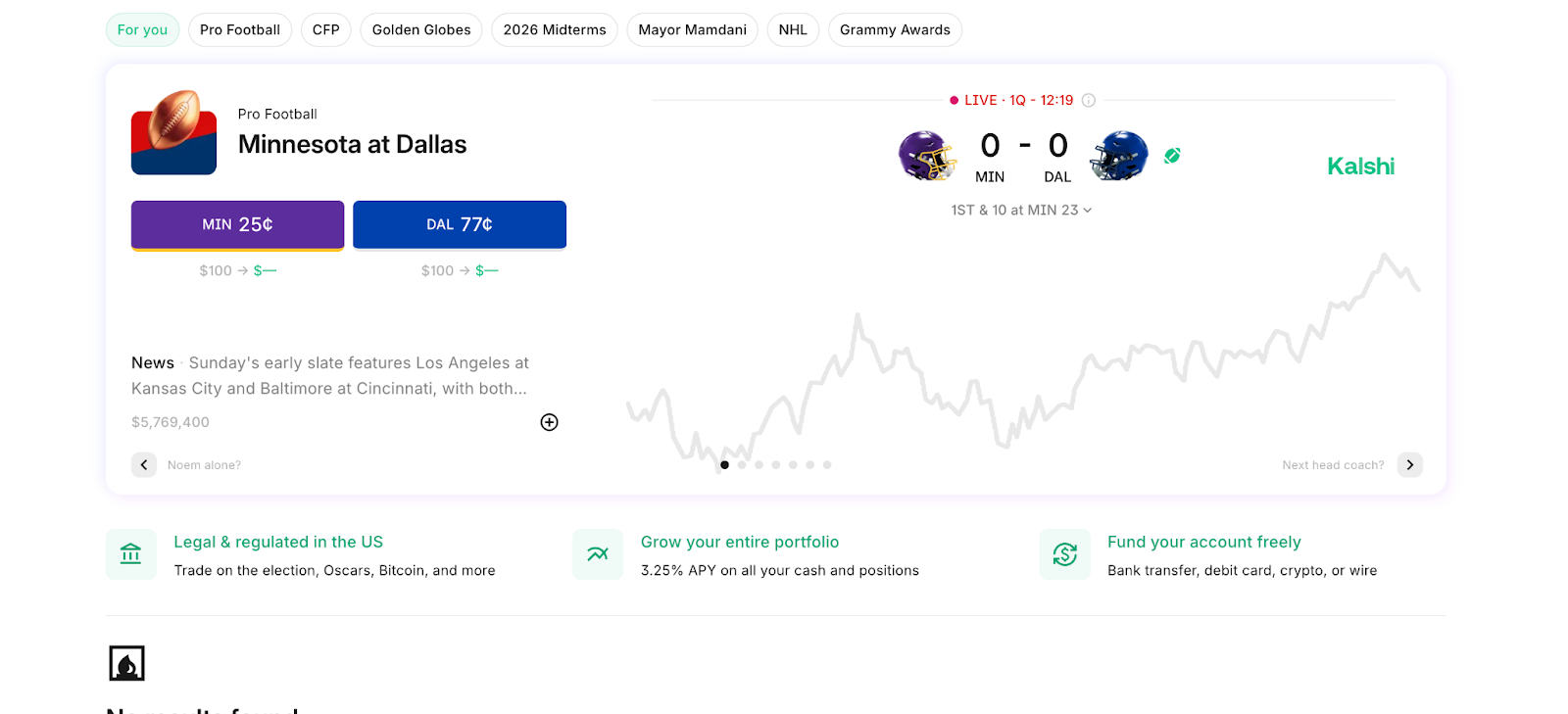

Market Selection & Coverage

Kalshi organizes its markets across categories such as Politics, Sports, Culture, Crypto, Climate, and Economics, along with additional verticals like Companies, Financials, Tech and Science, Health, and World. The catalog is built around precisely defined event contracts, favoring outcomes that can be resolved clearly with verifiable terms and reliable data sources.

In terms of breadth, the platform offers a balance between mainstream and niche topics. Major markets focus on high-visibility events like elections, macroeconomic releases, and major sports, while others explore longer-tail questions in culture and technology – from entertainment outcomes to trends in AI and science. It’s not just a politics-focused exchange.

New markets appear regularly because many listings follow repeatable series templates – for example, monthly jobs reports, weekly jobless claims, or daily weather-style events. The total number of active markets fluctuates as contracts expire and new ones are added, but Kalshi has said it can host over 700 live markets at once and continues to expand the pace at which new listings go live.

Liquidity & Volume

Kalshi operates a central limit order book, making liquidity visible through the depth chart and bid-ask spread. In its most active markets-major political events, key economic releases, and headline sports – the books are deeper and spread tighter, allowing users to enter or exit positions with minimal slippage when using limit orders. In niche or low-volume markets, liquidity drops quickly, spreads widen, and market orders can become costly, so execution quality depends heavily on what and when you trade.

Trading activity has surged sharply in 2025. According to Reuters, Kalshi’s weekly trading volumes have exceeded $1 billion, marking a more than 1,000% increase from 2024. A company spokesperson confirmed that the platform cleared over $1 billion in a single week in early October 2025, up from roughly $300 million in total annual volume the year before. Independent trackers that compile on-platform data estimate Kalshi’s cumulative traded volume in the tens of billions, reflecting how headline-driven markets now attract the majority of liquidity while quieter categories remain thinner.

Pros and Cons of Using Kalshi

In this Kalshi review, we focus on the fundamentals of prediction markets: market coverage, order book liquidity, total trading costs (fees plus spread), resolution reliability, and overall usability.

Kalshi is structured around event contracts that trade as probabilities and settle at $1 or $0 based on clearly defined outcomes. This design makes it a practical tool for hedging news-driven risk or expressing views without using leverage. Liquidity is typically strongest in high-profile markets such as major political events and key macroeconomic releases, while niche questions can be more difficult to trade efficiently.

Strengths:

- Clear contract terms with defined resolution sources – every market we tested specified the exact data source (e.g., ‘BLS CPI release,’ ‘AP election call’) and settlement timing upfront, eliminating ambiguity common on offshore platforms.

- Сentral limit order book with visible depth – we placed limit orders on the December 2025 Fed rate decision market and could see $50K+ in resting bids/asks, allowing precise entry prices without slippage (market orders on thin markets showed 2-5% worse fills).

- Simple, capped contracts with fixed payouts that make position sizing straightforward.

- CFTC oversight means formal dispute process – if you disagree with a resolution, there’s a structured appeals process tied to regulatory obligations, unlike offshore platforms where admin decisions are final.

- Liquidity is strongest in flagship markets, supporting smooth execution during major news cycles.

Weaknesses:

- KYC took up to 24–48 hours in our case – passport and proof of address required, followed by manual review before trading. This contrasts with Polymarket’s near-instant wallet-based access.

- ACH funding adds 3-day delays – our $200 deposit cleared in 3 business days, meaning we couldn’t react to breaking news as quickly as on stablecoin platforms where deposits are instant.

- Niche markets showed wide spreads – a tech IPO timing market had only $2K volume with 8% bid-ask spread, making our $100 order cost $8 in execution vs. 0.5% spreads on headline political markets

- No leverage or margin trading, which restricts some trading strategies.

- Funding options are traditional compared to crypto platforms, which may frustrate users who prefer on-chain transfers.

Trustworthiness Check

Here are the legal cases and compliance items we found for Kalshi.

- Nov. 4, 2020: The CFTC issued an order designating KalshiEX LLC as a Designated Contract Market (DCM), placing the exchange under federal derivatives-market oversight.

- Aug. 29, 2024: The CFTC registered Kalshi Klear LLC as a Derivatives Clearing Organization (DCO), enabling clearing for fully collateralized positions.

- Oct. 2, 2024: A federal court in Washington, D.C. ruled in Kalshi’s favor in its challenge tied to political-event contracts, after the CFTC had previously moved to block that product category; the matter continued through appeals.

- Jan. 17, 2025: The CFTC approved a modification to Kalshi’s DCM designation to permit intermediated futures trading.

- Nov. 25, 2025: A federal judge in Nevada ruled Kalshi could be subject to Nevada gaming rules for sports-related event contracts, reversing earlier temporary relief; Kalshi indicated it would appeal.

- Dec. 9, 2025: The Massachusetts attorney general asked a state court to block Kalshi from offering sports-prediction markets to Massachusetts residents, arguing they amount to unlicensed gambling; Kalshi argued federal CFTC oversight applies.

GNcrypto’s Overall Kalshi Rating

| Criteria | Rating (out of 5) |

|---|---|

| Liquidity & Volume | 4 |

| Fees & Total Cost | 5 |

| Regulatory Compliance & Access | 5 |

| Resolution Quality & Speed | 5 |

| Market Selection & Coverage | 4 |

| Deposit/Withdrawal Methods | 4 |

| Pricing Efficiency | 4 |

| Tools & User Experience | 4 |

How We Score Platforms

We rate prediction market platforms from 1.0 to 5.0 using our standardized, weighted model based on eight criteria. The score is designed to reflect what matters when you are actually trading events, not what looks good on a marketing page.

To do that, we use two inputs. First, we review public information such as fees, market rules, settlement criteria, access restrictions, and platform reliability updates. Second, we test the platform directly by placing real trades and measuring the things that affect results, including spreads, slippage, and total cost to enter and exit positions.

These ratings are not solvency reviews. Our team does not audit balance sheets and does not make financial guarantees.

Our Weighting System

Liquidity & Volume — 25%

Fees & Total Cost — 20%

Regulatory Compliance & Access — 15%

Resolution Quality & Speed — 12%

Market Selection & Coverage — 10%

Pricing Efficiency — 6%

Deposit/Withdrawal Methods — 8%

Tools & User Experience — 4%

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.