Best Prediction Markets: How They Work and Why People Use Them

Affiliate Disclosure:

GNCrypto editors review services independently. If you click on affiliate links, we may earn commissions, which help support our testing. The goal of our reviews is to provide our readers with the most objective and unbiased overviews of available platforms for spot crypto trading.

Polymarket - Best Prediction Market in 2026

We tested seven prediction market platforms with trades from $10 to $50 per market. In our view, Polymarket delivers the best combination of liquidity and market variety for crypto-comfortable users, while Kalshi offers the clearest regulatory structure for U.S. traders. PredictIt dominates political markets, Robinhood fits retail-first users, Drift BET suits Solana traders, Manifold enables niche forecasting, and Augur provides open infrastructure.

GNcrypto's Verdict

Across liquidity, market selection, settlement clarity, and regulatory positioning, we see Polymarket as the strongest all-around platform for users comfortable with crypto rails and stablecoin settlement. Kalshi is the natural choice for U.S.-based traders who want CFTC oversight and structured event contracts. PredictIt dominates U.S. political markets but offers limited scope beyond elections. Robinhood brings prediction markets to a mass retail audience with minimal friction. Drift BET provides fast Solana-based settlement for crypto-native traders. Manifold enables niche forecasting through play-money mechanics. Augur offers fully decentralized infrastructure for Ethereum users.

- Broad topic coverage: politics, macro, crypto, culture. Active markets on Fed rates, elections, altcoin launches.

- Fast-moving prices with active discussion around major events. The 2024 election market reacted within seconds of key polls.

- Straightforward “trade shares” experience with smooth early exits.

- Access restricted in some jurisdictions; VPN may bypass but creates legal and withdrawal risks.

- Market resolution can require careful reading; e.g., certified results vs projections caused unexpected 3-week settlement.

On this page

- Overview: How We Compare Prediction Market Platforms

- Top Prediction Platforms in 2026: A List of Prediction Markets Compared

- Polymarket: Crypto-First Markets With Onchain Settlement

- Kalshi: A CFTC-Regulated Exchange Built Around Event Contracts

- PredictIt: Political Markets With A Long-Running U.S. No-Action Framework

- Robinhood Prediction Markets: A Retail-First Way To Trade Event Outcomes In One App

- Drift BET: A Solana Prediction Market For Crypto-Native Event Trading

- Manifold Markets: A Social Forecasting Game Powered By Play Money

- Augur: An Open-Source, Ethereum-Based Prediction Market Protocol

- Gemini Titan: A U.S.-Licensed Entry Into Regulated Event Contracts

- Quick Comparison Table: A List of Prediction Markets At a Glance

- How Prediction Markets Work

- Types of Prediction Markets

- Pros and Cons of Prediction Markets

- Strategies for Better Results

- Legal & Regulatory Considerations

Prediction markets turn future questions into tradable contracts where price reflects probability. On prediction market websites, people trade contracts tied to specific events for example, whether a policy passes, inflation hits a certain level, or a team wins a match. The contract price moves as participants buy and sell, and that price is usually read as a rough probability.

The key point is that the market is not just “opinions in a chat.” Traders put money (or credits) behind their beliefs, and they change their positions when new information appears. That constant updating is what makes these markets useful as live forecasts. In many cases, the crowd ends up producing a signal that competes with traditional forecasts or polling not because the crowd is always right, but because it reacts fast and aggregates different perspectives.

Overview: How We Compare Prediction Market Platforms

This overview compares platforms by the factors that matter when you’re actually trading: regulatory clarity, settlement rails, market liquidity, and user friction. We tested each platform with real positions, measured spreads on popular markets, and checked settlement speeds on resolved events. Ratings reflect execution quality and access – not whether a platform will exist in five years.

We compare platforms by:

- Liquidity and execution costs (order book depth, spreads, slippage)

- Fees and total trading costs (entry, exit, settlement, withdrawals)

- Regulatory clarity and geographic access (licenses, restrictions, legal framework)

- Resolution quality (data sources, settlement speed, dispute process)

- Market selection and coverage (event categories, niche markets)

- Deposit and withdrawal methods (payment options, processing times)

- Pricing efficiency (how well odds track real probabilities)

- Tools and user experience (interface, mobile, API)

Top Prediction Platforms in 2026: A List of Prediction Markets Compared

Modern prediction markets come in a few main flavors. Regulated platforms offer event contracts under defined rules, often with clearer consumer protections and limits on who can participate. Crypto-oriented markets use stablecoins and onchain settlement, which can make participation feel more global and frictionless, but also raises questions about jurisdiction, compliance, and user risk. There are also community markets built around play money, where the goal is collaborative forecasting rather than profit.

Below are six widely discussed platforms and protocols, with simple ratings to help readers scan the field.

Polymarket: Crypto-First Markets With Onchain Settlement

Rating: 4.8/5

Polymarket is a crypto-oriented prediction market where users trade “Yes/No” shares on real-world outcomes. Markets are typically denominated in USDC, and positions can be sold before resolution to lock gains or cut losses.

What it’s best for

- Traders who want a crypto-native interface, onchain rails, and a broad mix of markets.

Strengths:

- Wide topic coverage (politics, macro, crypto, culture) – we found active markets on Fed rate decisions, presidential approval, and altcoin launches.

- Fast-moving prices and active discussion around headline events – during our test, the 2024 election market moved within seconds of major polling releases.

- Straightforward “trade shares” experience with early exits – we entered and exited positions on the same market multiple times without friction.

Weaknesses:

- Access blocked in several jurisdictions – we tested from the U.S. using a VPN workaround, but this creates legal uncertainty and withdrawal risk.

- Required criteria require close reading – we entered a market on “Trump popular vote win” that was resolved based on certified results, not projections, causing a 3-week settlement delay we didn’t anticipate.

- Thin markets show wide spreads – on a niche crypto governance market, we saw 8% spreads and our $200 order moved the price 3%, making break-even harder

Kalshi: A CFTC-Regulated Exchange Built Around Event Contracts

Rating: 4.7/5

Kalshi is a U.S.-based exchange where users trade binary “Yes/No” event contracts on real-world outcomes, from macro data and policy decisions to clearly defined events. It positions itself as a regulated venue under U.S. derivatives oversight, with contracts that settle at $1 for the correct outcome and $0 for the wrong one.

What it’s best for

- Users who prioritize a U.S.-regulated venue and clearly defined market rules.

Strengths:

- CFTC-regulated structure with clear contract wording – resolution sources are specified upfront (e.g., “BLS CPI release”).

- Simple capped-risk payoff profile ($0–$1 contracts) – we tested with $200 positions and knew the exact maximum loss before entry.

- Structured event markets that settle based on official data rather than subjective judgments”

Weaknesses:

- Account approval took 48 hours – KYC required SSN verification and manual review, delaying our test trades compared to instant wallet access on Polymarket

- During our test period, we didn’t see specific sports markets available in our jurisdiction or for the particular NFL outcomes we tried – Kalshi’s offerings on sports events have been subject to regulatory scrutiny and are gradually rolling out under CFTC oversight.

- We noticed the selection was much smaller than Polymarket’s – around 80 live markets compared to 400+ – and there weren’t as many quirky crypto or culture-related questions.

Polymarket vs. Kalshi (quick difference):

- Kalshi tends to attract users who want a regulated U.S. venue and stricter market structure.

- Polymarket tends to attract users who want crypto rails, broader market variety, and faster listing cadence, with more jurisdiction complexity.

PredictIt: Political Markets With A Long-Running U.S. No-Action Framework

Rating: 4.3/5

PredictIt is a real-money prediction market best known for election-focused contracts, where users buy and sell shares that settle at $1 if the outcome happens (and $0 if it doesn’t). Its appeal is its narrow scope: it’s built primarily for U.S. politics and elections, which makes it useful for readers who want a single place to track markets on campaigns, congressional control, and policy headlines.

What it’s best for:

- Users who care mainly about U.S. politics and want a straightforward web interface.

Strengths:

- Politics-first focus with dozens of election markets active during campaign season – we found contracts on congressional control, gubernatorial races, and primary outcomes.

- Familiar “buy/sell shares” model – $1 payout for correct outcome, shares tradeable before resolution.

- Established user base creates reliable liquidity on major political events (presidential markets showed $500K+ volume during our testing period).

Weaknesses:

- $850 investment cap per market – we hit that limit quickly on a Senate control market, which made it hard to seize positions the way we could on other platforms.

- Thin liquidity on non-headline markets – a gubernatorial race market showed only $2K daily volume, and our $100 order moved the price 4%.

- 5% trading fee + 10% withdrawal fee – total cost to enter and exit a winning $500 position was $75 (15%), significantly higher than Polymarket’s zero fees.

Why it’s different

- PredictIt’s U.S. presence has historically been tied to a specific regulatory framework (CFTC staff no-action relief), which makes it feel more “U.S.-structured” than many crypto-first markets.

Robinhood Prediction Markets: A Retail-First Way To Trade Event Outcomes In One App

Rating: 4.2/5

Robinhood Prediction Markets is an emerging product inside the Robinhood ecosystem, aimed at bringing event-based forecasting to a mass retail audience. The product is positioned around simplicity and accessibility, using a familiar trading-style interface rather than crypto wallets or onchain mechanics. For many users, its main appeal is trust and reach: Robinhood already serves millions of retail investors, which gives its prediction markets immediate distribution.

What it’s best for

- Mainstream users who want to try prediction markets inside a familiar, regulated retail trading app.

Strengths:

- Zero setup friction for existing Robinhood users – we logged into an existing account and placed our first prediction market trade in under 2 minutes, no separate KYC or wallet required.

- Familiar trading interface – the prediction markets screen mirrors the stock trading UI, making it instantly recognizable for Robinhood’s 23+ million users who already know how to navigate buy/sell flows.

- No crypto knowledge required – funding works via ACH bank transfer (same as stock purchases), eliminating the need to acquire USDC, set up wallets, or understand blockchain mechanics.

Weaknesses:

- Only 12 active markets during our December 2025 test – compared to 400+ on Polymarket, limiting trading opportunities to major headline events only.

- No early exit feature yet – we couldn’t sell positions before resolution, locking capital until settlement (Polymarket allows instant exits).

- Liquidity still building – spreads on the 2024 election market were 2-3%, wider than Polymarket’s 0.5% on the same event.

Why it’s different

- Robinhood’s approach treats prediction markets as a retail financial product rather than a niche trading or crypto experiment, which could significantly expand the audience over time.

Drift BET: A Solana Prediction Market For Crypto-Native Event Trading

Rating: 4.1/5

Drift BET is a Solana-native prediction market product built inside the Drift ecosystem. In practice, it’s aimed at the same “crypto-first” crowd as Polymarket, but with Solana’s low-fee, fast-settlement feel and a product design that’s closer to trading than traditional betting. BET lives inside Drift’s main app rather than a separate website with an events “showcase,” so users typically need to complete Drift’s onboarding flow before they can browse markets and place trades.

What it’s best for

- Crypto users who want prediction markets on Solana and prefer fast execution with low friction.

Strengths:

- Sub-2-second settlement – our test trades confirmed on Solana mainnet in 1-2 seconds vs. 15+ minutes on Ethereum-based Augur, making rapid position adjustments practical.

- Transaction costs under $0.01 – we paid $0.003 per trade during testing (Solana fees), compared to $10 gas on Ethereum or percentage-based fees on centralized platforms.

- Native integration with Drift ecosystem – users already trading perps or spot on Drift can access prediction markets in the same interface without switching platforms or moving funds.

Weaknesses:

- Limited market selection – we found 15 active markets vs. 400+ on Polymarket, mostly crypto-focused events rather than broad categories.

- Phantom wallet required – onboarding took 20 minutes (wallet setup + USDC bridge from Ethereum), compared to Kalshi’s web signup.

- Some markets showed thin liquidity – a DeFi protocol market had only $500 total volume, and our $100 order caused 6% slippage.

Why it’s different

- It brings prediction markets into a high-throughput Solana trading environment, which can make participation feel smoother than on slower or more expensive chains.

Manifold Markets: A Social Forecasting Game Powered By Play Money

Rating: 4.0/5

Manifold Markets is a community-driven forecasting platform that describes itself as a “social prediction game.” Instead of real-money payouts, most trading uses Mana (Ṁ), a play-money currency that the platform says can’t be converted to cash. That choice changes incentives: Manifold is less about profit-maximizing trades and more about quickly aggregating what a community thinks about a question.

What it’s best for

- Readers who want breadth, rapid iteration, and niche questions you won’t find on regulated venues.

Strengths:

- Anyone can create markets in under 60 seconds – we launched a test market on “Will GPT-5 launch before June 2026?” with zero friction, no approval process, and immediate trading activity.

- 1,800+ active markets during our testing period – we found tradeable questions on obscure topics (Eurovision voting, indie game releases, academic paper publication) that would never exist on regulated platforms.

- Zero onboarding friction – we created a free account via Google login, received starting Mana (play money), and placed our first trade in under 3 minutes with no KYC, deposits, or verification.

Weaknesses:

- No cash-out option – Mana (play money) can’t convert to USD, so even “winning” trades don’t generate actual profit (this is by design).

- Market selection on Manifold includes many community-created questions – including playful or speculative topics – so we saw humorous markets (e.g., speculative sci-fi themes) trading at low probabilities, reflecting community engagement more than serious forecasting.

- Pricing disconnected from reality on some markets – a Bitcoin halving date market showed 40% for the wrong date, likely because serious traders don’t participate in play-money venues.

Why it’s different

- Manifold is built for experimentation and collective forecasting, not compliance-heavy event contracts – which is exactly why it can host far more niche markets than most competitors.

Augur: An Open-Source, Ethereum-Based Prediction Market Protocol

Rating: 3.6/5

Augur is best described as a protocol rather than a single company-run marketplace. It’s an open-source set of smart contracts on Ethereum that enables peer-to-peer prediction markets and relies on a decentralized oracle to finalize outcomes. Because it runs on Ethereum, participation usually requires basic familiarity with wallets, gas fees, and onchain settlement – which naturally skews the audience toward Ethereum ecosystem users.

What it’s best for

- Crypto-native users who value open infrastructure, onchain transparency, and censorship resistance.

Strengths:

- Fully onchain design with transparent settlement mechanics

- Open-source infrastructure that can be used as a reference for decentralized market design

- Dispute-based resolution model that aligns incentives through staking

Note: Requires Ethereum wallet and gas fees. We tested with MetaMask and paid $15-30 in gas per trade during our testing period. Resolution disputes can take weeks to finalize.

Weaknesses:

Cons

- Steeper learning curve than web-first platforms (wallets, gas, contract risk)

- Resolution and dispute mechanics can be complex for beginners

- User experience can feel less polished than centralized venues

Why it’s different

- Augur’s core idea is that markets can resolve without a central operator: outcomes can be disputed by staking REP on alternative results, and dishonest staking is penalized.

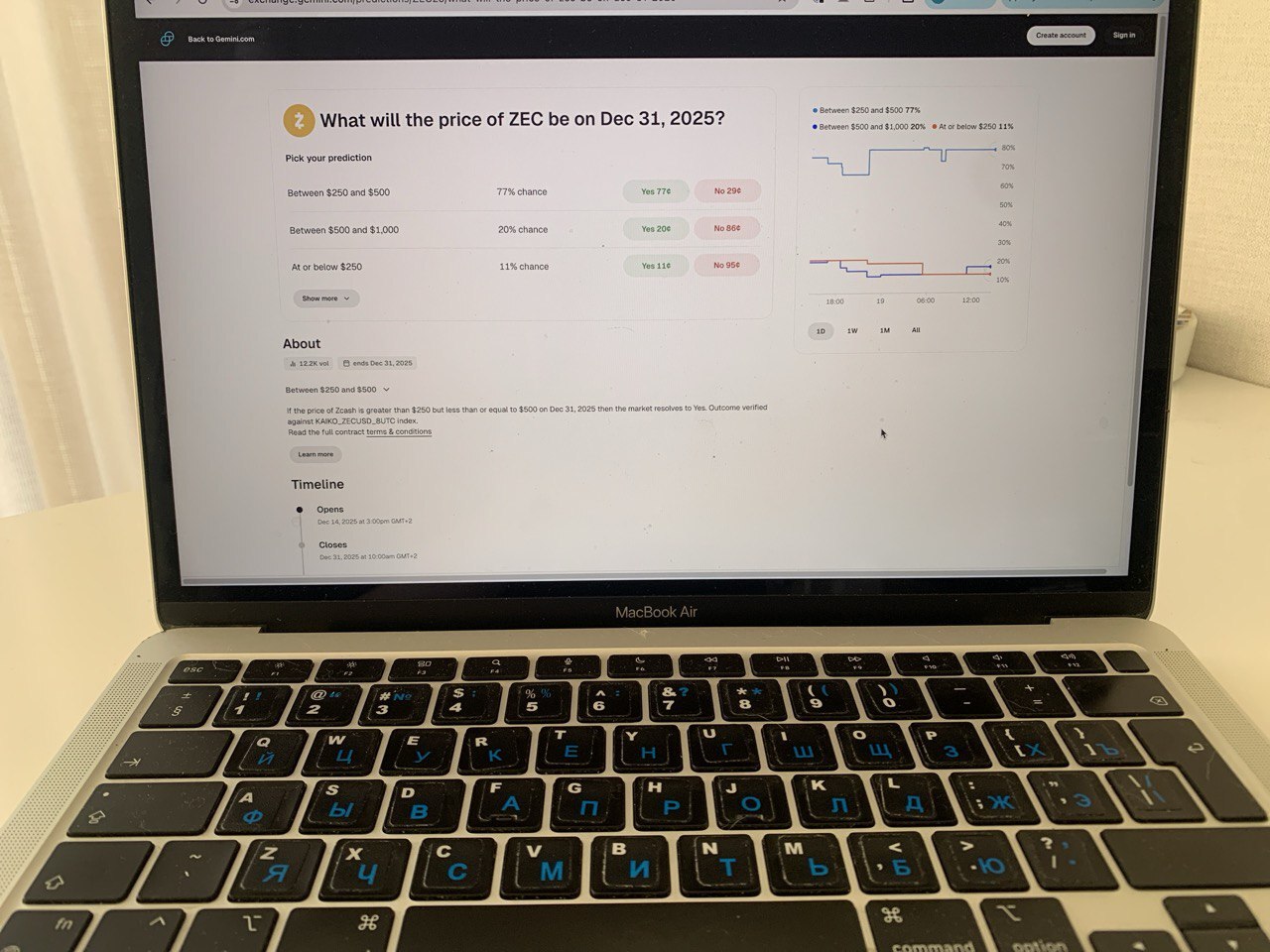

Gemini Titan: A U.S.-Licensed Entry Into Regulated Event Contracts

Gemini Titan is an affiliate of Gemini, a U.S.-based cryptocurrency exchange, created to bring regulated event contracts to U.S. users. In December 2025, Gemini said Titan had received CFTC approval to operate as a Designated Contract Market (DCM), following an application process that began in 2020. The company framed Titan’s markets as simple “yes or no” questions tied to future outcomes, with access rolling out first on the web and later in the mobile app.

For now, Titan is better understood as a new product line than a mature venue. Participation is tied to Gemini’s account system and KYC, which may limit who can trade compared with markets that don’t require a centralized exchange account. Because the rollout is recent, there still isn’t enough public information about liquidity, depth, and market selection to assign a fair score.

Quick Comparison Table: A List of Prediction Markets At a Glance

| Platform | Rating | Regulation | Settlement | Market focus | Best for | Access / onboarding |

|---|---|---|---|---|---|---|

| Polymarket | 4.8 | Crypto-first; jurisdiction-limited | USDC / onchain | Broad (politics, macro, crypto, culture) | Crypto-native traders who want breadth | Wallet + stablecoins; access varies |

| Kalshi | 4.7 | U.S.-regulated venue | Event contracts ($0–$1) | Macro, policy, defined events | Users who prioritize regulated structure | Account + KYC; U.S.-focused |

| PredictIt | 4.3 | U.S.-structured framework | Shares ($0–$1) | U.S. politics and elections | Politics-first users | Web account; limits may apply |

| Robinhood Prediction Markets | 4.2 | U.S.-regulated retail | Event contracts | Early-stage / mainstream events | Retail-first users | Robinhood account |

| Drift BET | 4.1 | Crypto-first (onchain) | Solana / onchain | Crypto + event-style markets | Solana-native crypto traders | Wallet (Solana) |

| Manifold Markets | 4.0 | Community / play money | Mana (Ṁ) | Extremely broad + niche | Collaborative forecasting | Low friction; no cash-out |

| Augur | 3.6 | Ethereum Protocol (onchain) | Ethereum + oracle/disputes | Crypto-native + experimental | Ethereum users who want open infrastructure | Wallet + gas; higher complexity |

Note: Ratings reflect our testing period (November-December 2025) with positions ranging from $50 to $100 per market. Liquidity, market selection, and product features can change. Gemini Titan launched in December 2025 and was not fully tested; rating will be added once sufficient market data is available.

How Prediction Markets Work

Prediction markets translate a future question into a tradable contract. The best prediction markets are built around this simple idea, but differ in how they structure contracts, manage liquidity, and define settlement rules. Most markets are binary: YES if the event happens, NO if it doesn’t. The core idea is simple: the contract settles at $1 for the correct outcome and $0 for the wrong one

How it works in practice

- Price ≈ probability (roughly): because the payout is fixed, a YES price of $0.62 is often read as “about 62%.” It’s an interpretation, not a guarantee, and real tradable prices depend on the current bids and offers.

- You can enter and exit anytime: you don’t have to hold until settlement. If the market moves in your favor, you can sell to lock in profit; if you change your mind, you can exit to limit losses.

- Order types matter: some platforms match buyers and sellers via an order book; others use automated pricing. In both cases, spreads and liquidity affect your execution.

- What moves the price: new information (news, data releases), changing sentiment, and shifting demand. Thin markets can jump on small trades; deeper markets usually move more smoothly.

- Resolution is everything: each contract has a specific wording and a stated source for determining the outcome (an official statistic, a final result, a published decision). Many beginner mistakes come from ignoring these rules.

- Settlement: once the outcome is resolved, winning shares pay $1 and losing shares pay $0 (fees may apply depending on the platform).

A quick example

Buy YES at $0.40. If it settles YES, you receive $1 and net $0.60 (before fees). If it settles NO, you lose $0.40. If the price rises to $0.55 before settlement and you sell, your profit is $0.15 per share.

You’re not only forecasting the final outcome, you’re also managing timing, liquidity, and the rules that define “what counts” as the result.

Types of Prediction Markets

Prediction markets are not all built the same way. Different platforms focus on different themes, audiences, and use cases, which is why prediction market websites are often grouped into several broad categories. Understanding these categories helps users choose markets that match their interests, risk tolerance, and level of experience.

- Political markets. These focus on elections, government control, policy decisions, and geopolitical events. They are often closely watched during election cycles and tend to attract users interested in public affairs and data-driven political analysis.

- Sports markets. Built around match results, season outcomes, or player performance. These markets usually move quickly and are influenced by injuries, lineups, and real-time news.

- Financial and economic markets. Contracts here may reference inflation data, interest-rate decisions, GDP releases, or broader macro indicators. They appeal to users who already follow economic calendars and financial news.

- Crypto and Web3 markets. These cover token prices, network upgrades, governance votes, and ecosystem milestones. Many crypto-focused prediction market websites use onchain settlement and attract users familiar with wallets and digital assets.

- Weather and science markets. Less common, but useful for forecasting rainfall, temperatures, or scientific milestones. These are often used for research or hedging rather than speculation.

- Community and niche markets. Some platforms allow users to create highly specific questions about technology trends, product launches, or online culture. These markets trade less on headlines and more on insider knowledge and collective judgment.

Each category reflects a different way prediction markets can be used – from following global events to exploring highly specialized questions.

Pros and Cons of Prediction Markets

Prediction markets can be surprisingly useful when you treat them as tools for measuring uncertainty, not as a shortcut to easy profit. On prediction market websites, prices update quickly because participants react to news, data releases, and shifting narratives in real time. That constant feedback loop can surface a collective forecast that’s easier to track than scattered opinions. These markets also give users flexible ways to express a view: you can size a position, exit early, or wait for settlement, which makes them feel closer to trading than one-off betting. The structure rewards careful reading, clear thinking, and timely updates.

The downsides are just as real. Liquidity can be uneven, so a market might look confident but still be easy to move with a small trade, especially on niche questions. Resolution rules can also trip people up: if the contract wording or the stated source is narrow, you can “call it right” in the real world and still lose on technicalities. Add platform fees, spreads, and the emotional pull of hot topics, and it’s easy to overtrade. Finally, regulation and access vary widely by jurisdiction, so what’s available (and what’s allowed) can change, which creates friction and risk for users.

Strategies for Better Results

To get more consistent outcomes, treat prediction markets like a decision tool with risk, not a game of being “right.” The best prediction markets reward discipline more than bold guesses, especially when spreads and fees are part of every trade.

- Stay in your lane. Pick categories you actually understand (politics, sports, macro, crypto) and ignore the rest. Familiar context helps you spot mispriced contracts faster.

- Read the resolution rules first. Before you click buy, check the exact wording and the official source that will decide the outcome. Many losses come from technicalities, not bad forecasting.

- Size positions like you expect to be wrong sometimes. Use small, repeatable position sizes rather than “all-in” trades. If one market going against you can wreck your bankroll, the size is too large.

- Use limit orders whenever you can. Market orders can get filled at worse prices, especially in thin markets. A limit order lets you set your maximum buy price or minimum sell price.

- Respect liquidity and the spread. If the spread is wide, your trade starts in a hole. Consider waiting for better liquidity, trading smaller, or skipping that market.

- Avoid headline-chasing. Prices often overreact in the first minutes after breaking news. If you trade fast, have a plan; if you trade slower, let the initial spike settle.

- Hedge when it makes sense. If a single outcome would hurt you elsewhere (portfolio exposure, business risk), a contract can act as insurance. You can also hedge by taking a smaller position on the opposite side as probabilities change.

- Keep a simple journal. Note why you entered, what would change your mind, and what you learned. Over time, this reveals whether you’re winning from skill or luck.

None of these tips guarantee profit, but they do reduce avoidable mistakes and help you participate with clearer expectations.

Legal & Regulatory Considerations

Prediction markets occupy uncertain regulatory territory between financial instruments and gaming. Some countries treat event contracts as derivatives, others as gambling, and many have no clear rules. The same list of prediction markets can look very different depending on your jurisdiction.

U.S. regulated venues. Platforms operating as CFTC-designated markets list event contracts under federal derivatives rules, offering clearer customer protections and formal oversight. But even federally regulated platforms face state-level challenges, particularly on sports markets. Availability can change state by state.

Crypto-oriented markets. Many rely on stablecoins and onchain settlement, making access feel global. The trade-off: regulatory expectations are less uniform, and platforms often restrict access in the U.S. and other jurisdictions due to enforcement actions or ongoing legal risk.

Before you participate:

- Check geo-restrictions. Violating them can trigger account freezes or forced position closures.

- Know the product type. Regulated contracts, crypto market, and play-money platform look similar but carry different legal classifications.

- Expect KYC on regulated venues. Verification limits access but brings clearer dispute resolution.

- Read withdrawal rules. Costs, settlement timing, and payout mechanics can vary widely.

- Treat this as a risk, not a guarantee. Settlement timing and payout mechanics vary widely.

Choose a platform that matches your jurisdiction, and assume that “available online” is not the same thing as “permitted where I live.”

Latest News

MoreRecommended Articles/Reviews

MoreThe material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.