CZ pushes back on claims Binance worsened liquidation selloff

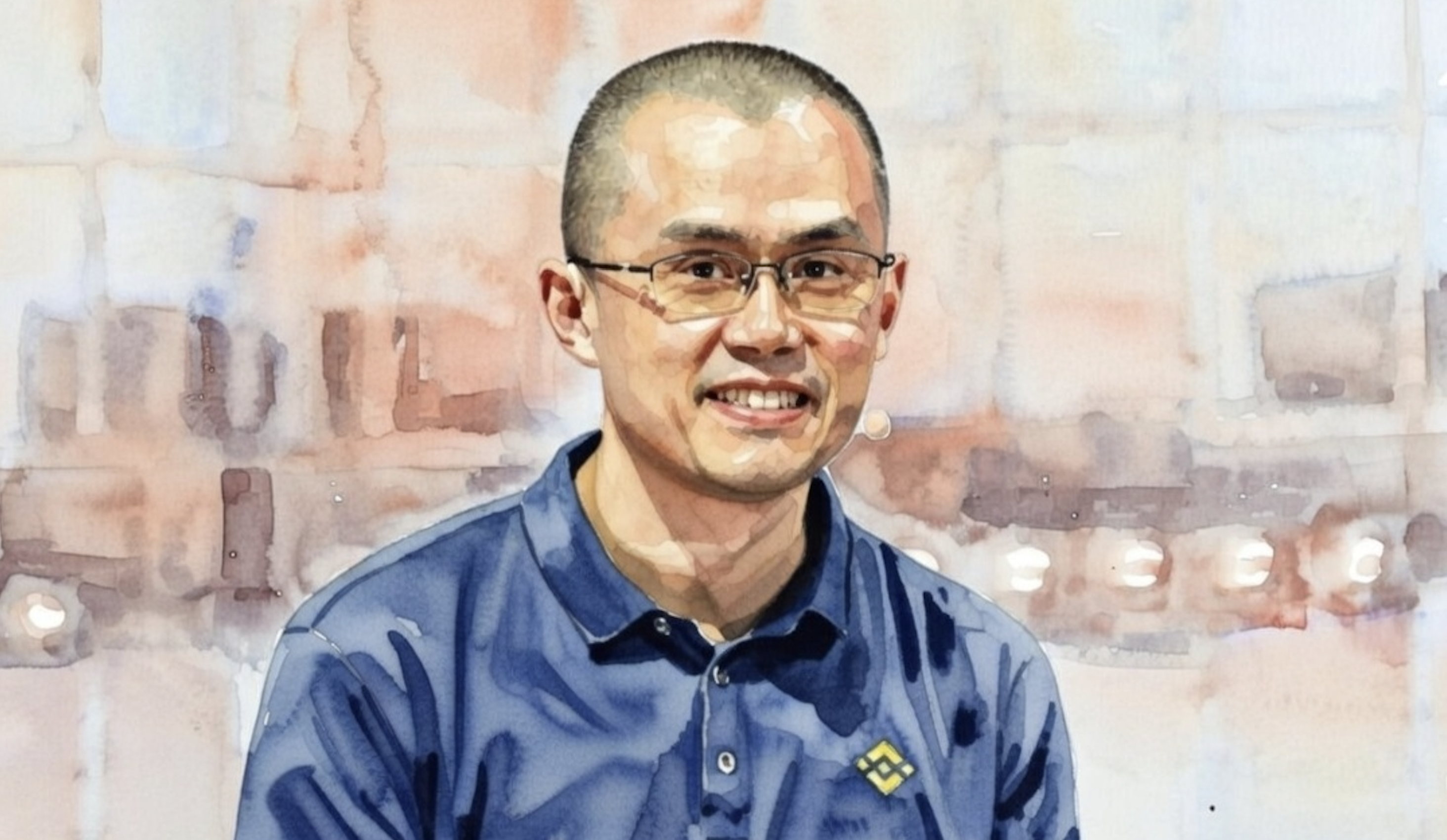

Changpeng Zhao said allegations that Binance helped cause last October 2025 record crypto liquidation event are “far-fetched,” pushing back on criticism that technical issues and price discrepancies on the platform amplified forced selling during the sell-off.

Zhao addressed the dispute during a live Q&A on the exchange’s social channels, where he said Binance was not a key driver of the market-wide wipeout on Oct. 10, when roughly $19 billion in leveraged positions were liquidated across crypto markets.

The renewed scrutiny centers on how liquidations cascade when order books thin out and price feeds diverge across venues. Traders who were stopped out have argued that platform disruptions and mismatched prices on Binance during the volatility window contributed to margin triggers firing more aggressively, turning a fast move into a broader liquidation spiral.

Binance has acknowledged that some systems briefly experienced glitches during the Oct. 10 volatility period and said certain assets saw de-pegging tied to sharp price moves. In an exchange support statement published shortly after the event, Binance said it completed compensation for users affected by those de-pegging issues within 24 hours and described the episode as a short disruption linked to market conditions.

СZ said Binance later offered customers and businesses around $600 million in compensation related to the incident, but he rejected the broader claim that the exchange should reimburse all losses tied to the market crash itself. He described a remaining group of critics as seeking compensation beyond issues directly attributable to platform problems.

The episode remains a flashpoint because it combined three pressure points that tend to collide in leveraged crypto drawdowns: exchange uptime under peak traffic, the behavior of internal pricing and collateral systems during rapid repricing, and the speed at which liquidation engines can accelerate market impact once thresholds are breached.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.