Zcash developer team says it collectively resigned

Electric Coin Company (ECC) CEO Josh Swihart says the developers who have long worked on Zcash are leaving the current structure as a group and are preparing to launch a new company.

Swihart frames the move as a governance fight, not a technical split.

The immediate trigger was a dispute with the board of the Bootstrap Project. Bootstrap is a nonprofit that oversees ECC and was built to act as a “parent” organization in support of Zcash’s mission.

Swihart argues that a group of board members he refers to as ZCAM (Zaki Manian, Christina Garman, Alan Fairless, Michelle Lai) has, in recent weeks, moved away from the project’s original goals. He says the team decided it could not keep working under those conditions while staying aligned with professional ethics and sound engineering practice.

In a post on X, Swihart describes what happened using the term “constructive discharge.” In plain terms, he claims the working conditions were changed in a way that effectively pushed people out, even without a direct termination notice.

Swihart’s main point is that Zcash the network and the protocol are “not affected.” In his telling, the team is changing the legal wrapper, not the codebase. He says the new company will keep the same people and the same goal: building private digital money.

What Bootstrap is and why it matters

Bootstrap did not appear out of thin air. In 2020, ECC’s owners approved transferring the company to the Bootstrap Project, a nonprofit set up under the U.S. 501(c)(3) framework. The idea at the time was to hardwire the mission and reduce dependence on purely commercial incentives. Later, Zcash formalized developer funding through a dev fund mechanism, where part of block rewards goes to multiple organizations, including Bootstrap as ECC’s “parent.”

In that light, this dispute looks like a fight over who sets direction: the engineers who ship the work, or a governing body with formal oversight powers.

In crypto, governance blowups like this often end in one of three ways.

- A governance reset and a new “constitution.” Arbitrum ran into this in spring 2023. Its first major foundation proposal (AIP-1) sparked backlash, was reworked, and went back to a fresh vote. After that, the project tried to get clearer about how the DAO treasury gets used.

- A fork and a split community. The classic example is Steem in 2020, after the Steemit Inc. deal. Some participants treated it like a hostile governance takeover and launched Hive as a separate fork. The chain can survive, but trust and resources get divided.

- A reputational hit, reversals, and leadership changes. DeFi has seen plenty of these moments. In 2020, SushiSwap’s creator, known as Chef Nomi, sold a large share of tokens, triggered “exit scam” accusations, then publicly apologized and returned funds. Even when money comes back, the damage can linger and force internal reforms.

How the ECC dispute could affect Zcash (ZEC)

If Swihart is right that this is not a technical break, then in the short run most users will not notice a difference. Wallets still work. Transactions still settle. The chain keeps running.

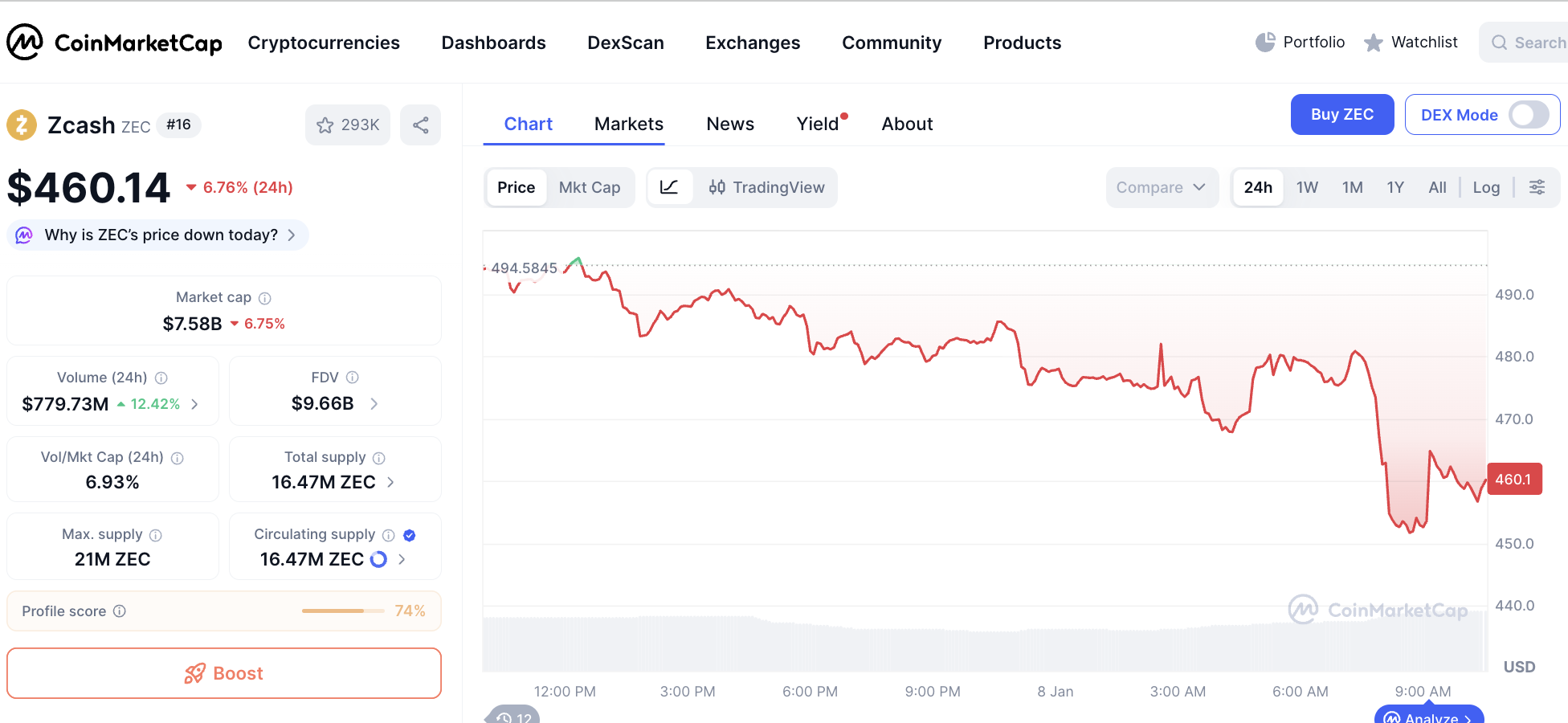

Markets, though, already reacted. CoinMarketCap’s chart shows a sharp jump in volatility after Swihart’s post. Over the last 24 hours, ZEC is down a little over 7% and trades around $457.

One reason for the nervous move is the risk of two competing centers of influence, each claiming legitimacy. That usually spills into everything else. Funding gets questioned. Partnerships slow down. Roadmaps turn into politics.

So far, there are few concrete details on how the new ECC entity would be structured, or how it would coordinate with the existing governance setup. Still, the public nature of the conflict is a reminder that crypto projects often break along social lines first. The code is rarely the first thing to fail.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.