Crypto and metals on Dec. 30: BTC near $87K as gold and silver rebound

On Dec. 30, crypto markets looked hesitant: Bitcoin slipped below $87K at one point, while Ether stayed under $3K. With demand softer, NFT tokens and Layer2 names took the biggest hit, with average daily declines above 4–5%. For contrast, we also checked precious metals: gold, silver, and platinum were bouncing after a sharp pullback.

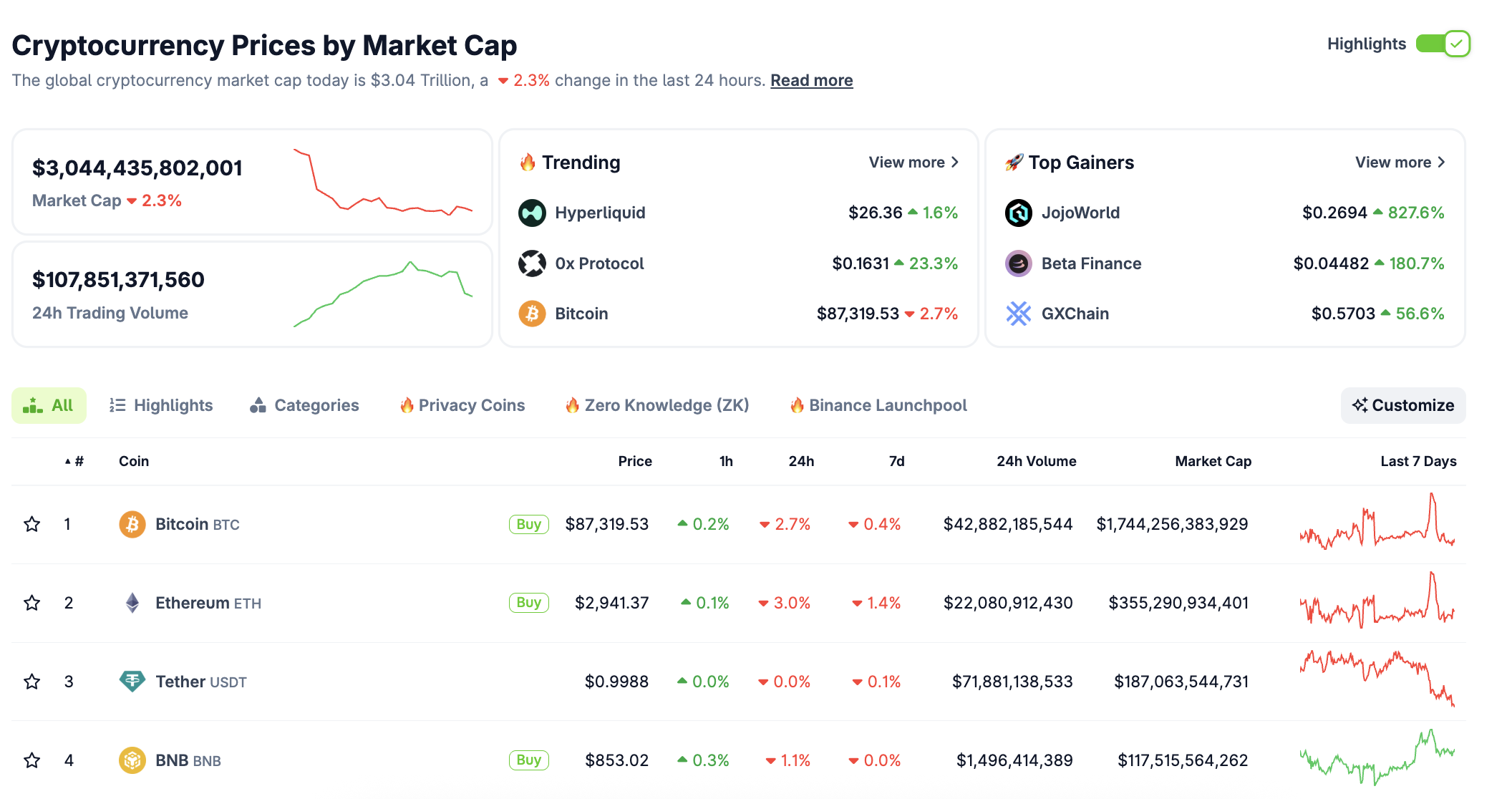

Bitcoin is trading around $87,200 and, once again, shows how much it sets the tone for the whole market. CoinGecko puts total crypto market cap near $3.04T with roughly $109B in 24-hour volume. In the U.S. spot Bitcoin ETF segment, net outflows of $19.3M were recorded on the prior trading day.

BTC dominance sits around 57.3%. With dominance that high, it’s harder for altcoins to stage their own rally without help from Bitcoin’s trend. You can track the dominance mix on CoinGecko.

Ethereum is trading just under the psychological $3,000 level, hovering near $2,940. For a lot of traders, that round number works like a mood line: above it, taking risk feels easier; below it, profit-taking and stablecoin parking show up faster. ETH dominance near 11.7% suggests liquidity is still in the ecosystem, but it’s being deployed selectively.

NFTs were the weakest pocket on the day. According to SoSoValue, the sector’s market cap fell 5.33%: Pudgy Penguins (PENGU) dropped 6.57% and Audiera (BEAT) slid 14.92%. APENFT (NFT) was the outlier, up 0.54%. Moves like this often reflect headline-driven, emotional trading more than fundamentals, and the wide dispersion inside one category makes that pretty clear.

Layer2 tokens were also under pressure, with SoSoValue showing the sector down 4.10%. Merlin Chain (MERL) stood out on the downside, falling 12.19%. On days like this, markets usually compress risk appetite: thinner-liquidity names get sold first, and only then do traders start trimming larger caps if weakness drags on.

Precious metals had a choppy session but finished with a rebound. Reuters reports spot gold rising to about $4,378 an ounce, silver to $74.85, and platinum to $2,174.9. The common explanation is straightforward: year-end trading and thinner volumes can amplify swings, especially after sharp selloffs.

Garrett Jin, an analyst at “1011 Insider Whale,” posted on X that the current tape matches expectations. In his view, the short squeeze in precious metals has run its course, and capital is starting to rotate back toward crypto.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.