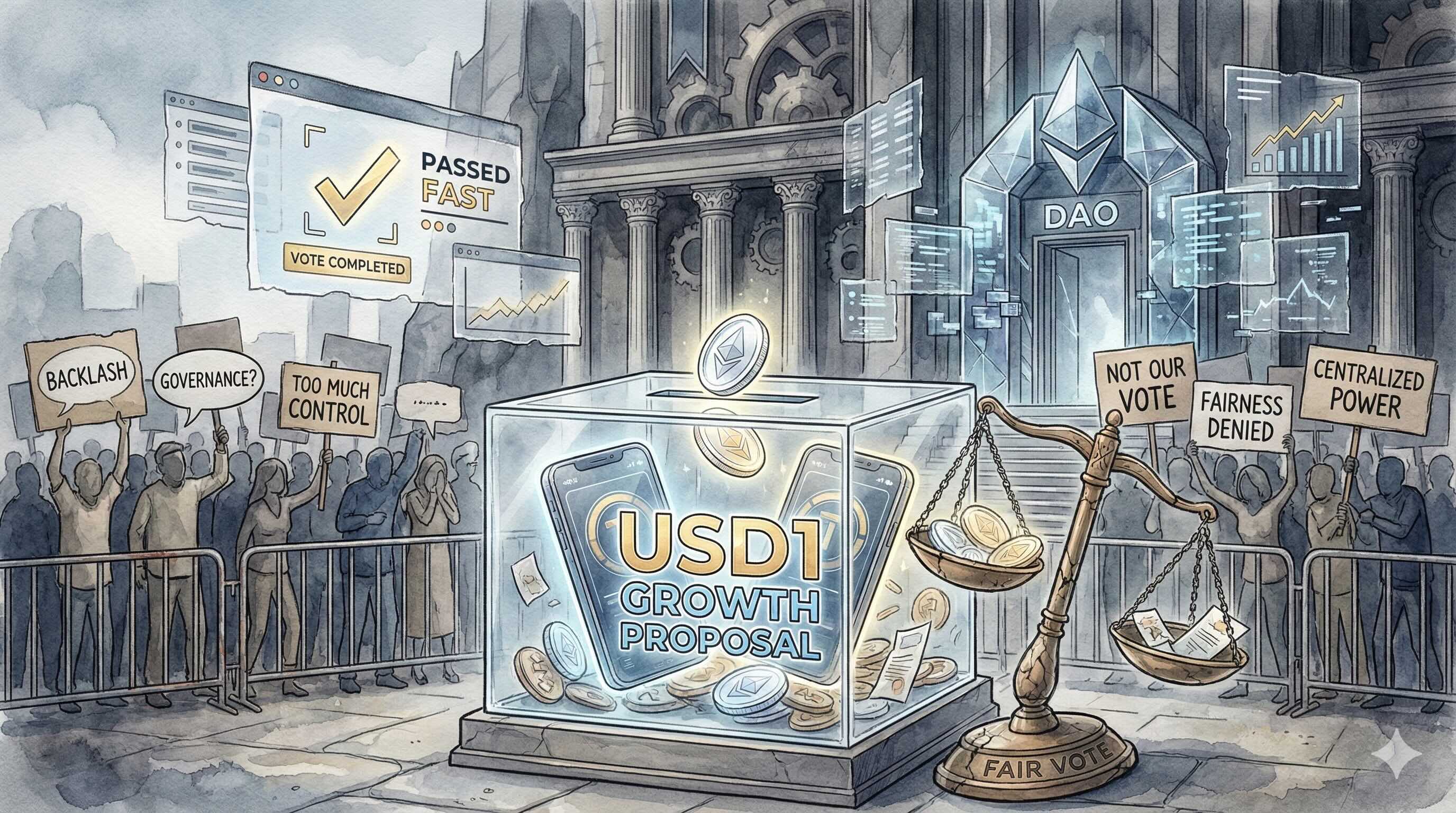

World Liberty Financial faces backlash over USD1 vote

World Liberty Financial approved a USD1 growth plan after an onchain vote dominated by wallets flagged as team-linked or partners, while locked WLFI holders lacked voting access, drawing criticism.

World Liberty Financial approved a proposal to fund growth of its USD1 stablecoin following an onchain governance vote that has drawn criticism from tokenholders. The largest ‘for’ votes came from wallets flagged as team-linked or strategic partner addresses, while many WLFI holders with locked tokens reported they could not vote.

Onchain data reviewed by pseudonymous trader and researcher DeFi^2 indicate that the nine largest wallets in the snapshot held about 59% of total voting power. The single largest wallet accounted for 18.786%. DeFi^2 labeled those top addresses as connected to the team or strategic partners.

Several holders stated they were unable to participate because their WLFI has been locked since the token generation event (TGE). On X, DeFi^2 posted: ‘This is in contrast to the real voters lower in the screenshot, who have all been locked from accessing their WLFI tokens since TGE, and unable to vote on an unlock until the team allows it.’

Community members questioned why governance prioritized a USD1 growth plan while many investors remained locked. In another post, DeFi^2 wrote: ‘WLFI holders are not entitled to ANY protocol revenue at all.’ The project’s Gold Paper states that 75% of net income is allocated to entities linked to the Trump family and 25% to entities associated with the Witkoff family.

A tokenholder who opposed the measure argued it would further dilute investors without clear benefit. The user pointed to a treasury that includes Bitcoin, Ether and Chainlink and argued that WLFI holders have not received direct participation in gains from those assets. ‘World Liberty Financial could easily liquidate their alt assets to support their USD1 incentives instead of diluting investors even more,’ the user wrote.

World Liberty Financial is developing its stablecoin and platform strategy in parallel. Earlier this month, the company applied for a national trust banking charter in the United States to bring issuance, custody and conversion of USD1 under one regulated entity. The application outlines plans to mint and redeem USD1 without third-party providers, enable fee-free conversions between U.S. dollars and USD1, and expand services for institutional clients.

As we covered previously, an address tied to Justin Sun remains blacklisted by World Liberty Financial, leaving his locked WLFI frozen more than three months after a token contract action in September, when he moved roughly $9 million of WLFI, according to Bubblemaps. The firm says the value of his locked WLFI has fallen about $60 million since then.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.