Why MYX is up today: key reasons explained

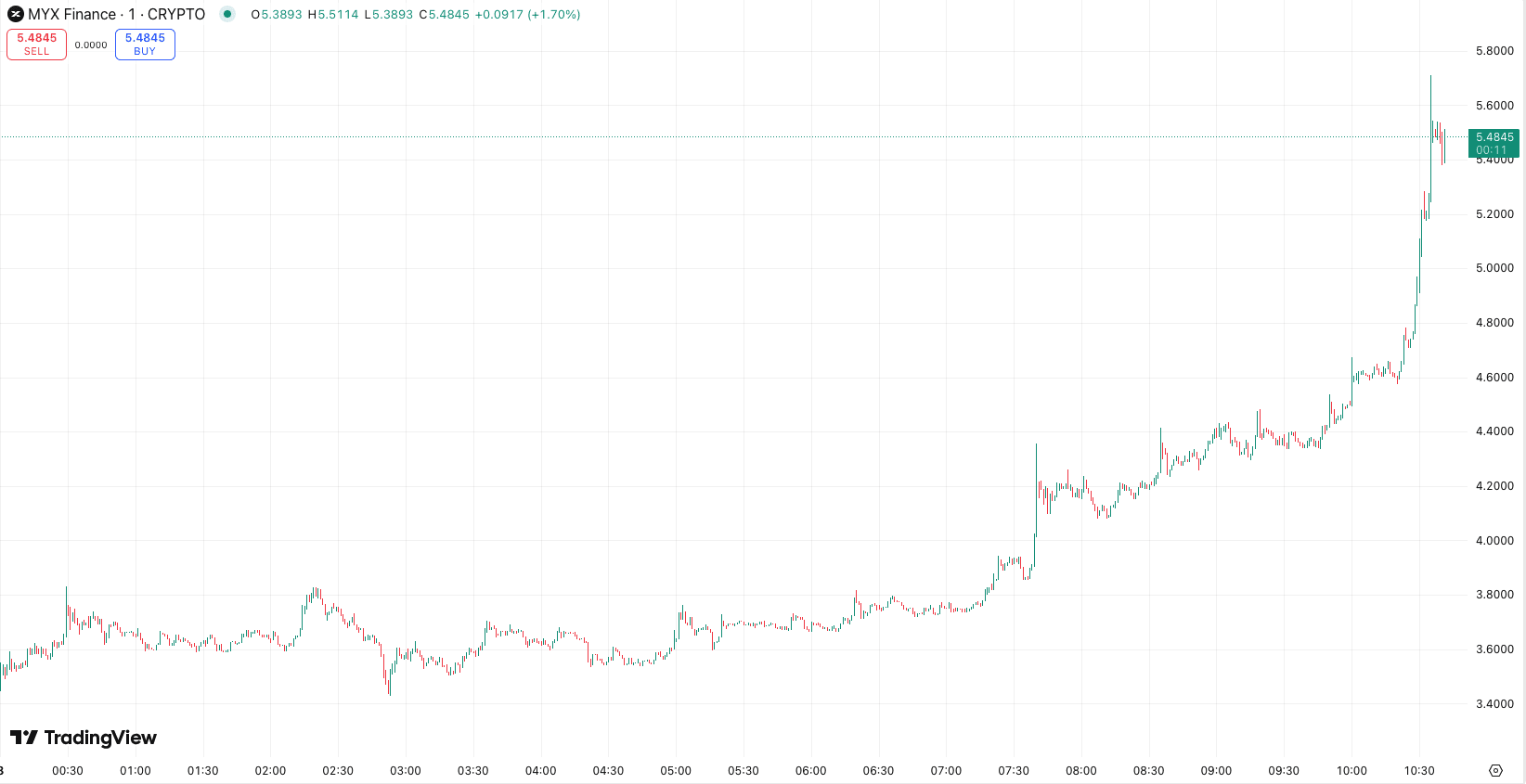

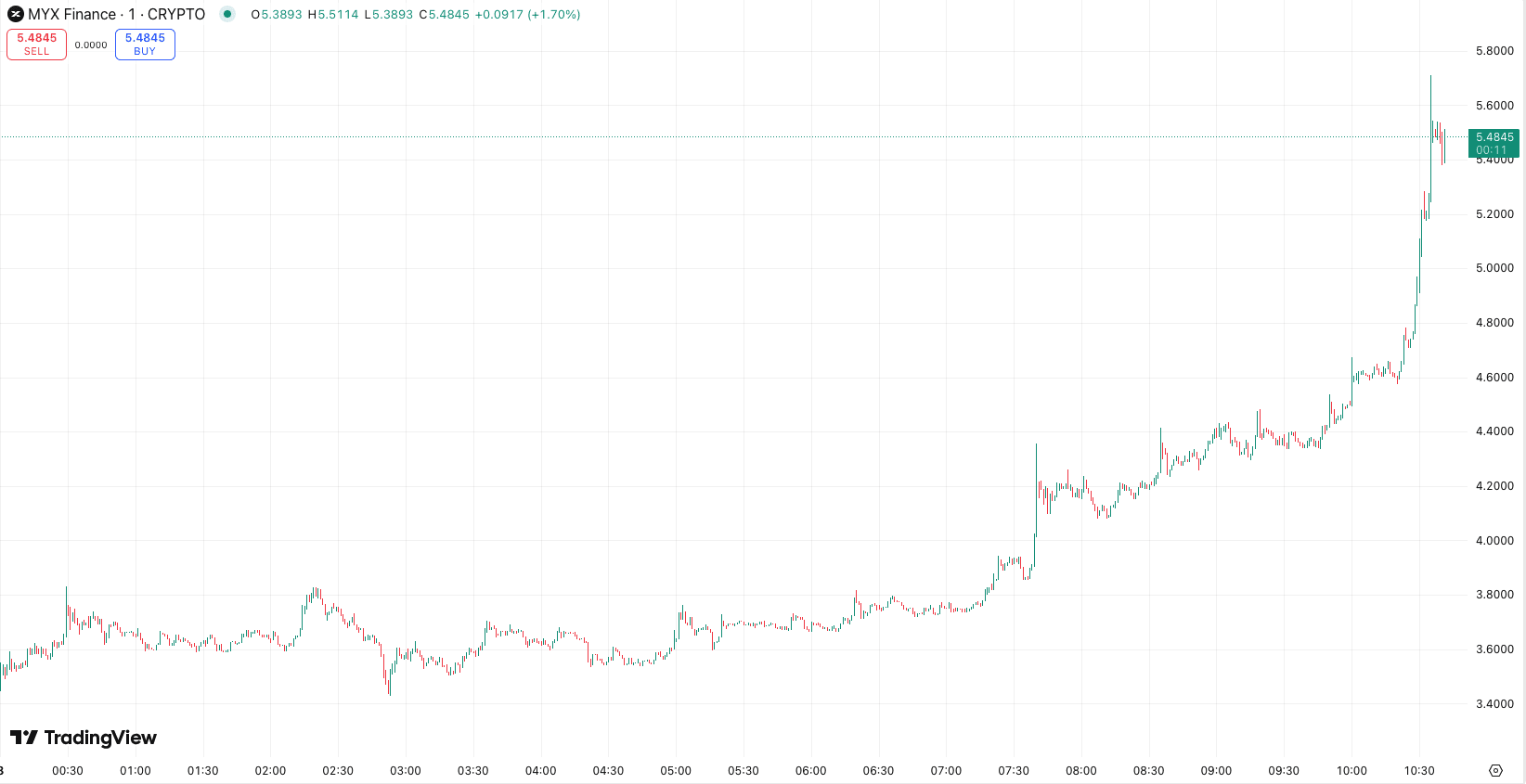

MYX Finance’s native token MYX surged dramatically today, setting a new all-time high of $5.5.

In the last 24 hours, MYX Finance (MYX) gained around 250%, with current trading prices ranging from $3.56 to $4.4. Over the last week, MYX gained more than 272%. It is in the top 100 largest cryptocurrencies with a market cap of over $850 million.

So, why is MYX up today?

Launched in February 2025, MYX now has over $32 million in total value locked (TVL) across its smart contracts.

So, why is MYX up today?

Key points

- New listings and high trading volumes

- Whales may be behind MYX short squeeze rally

- Insider trading concerns

MYX price reaches a new high after a strong daily jump. Source: TradingView

Trading volume increases

On September 5, the derivatives exchange MYX Finance announced the listing of World Liberty Financial (WLFI) with 50x leverage and 0.05% fees. This listing could largely contribute to the price increase by attracting WLFI traders, which has been among the trending coins this month. More frequent trading increases demand for MYX tokens, which are used for transaction fees and platform governance.

Launched in February 2025, MYX now has over $32 million in total value locked (TVL) across its smart contracts.

Forced short squeezes and whale activities

Another factor behind the MYX rally is forced short squeezes. Over $14 million in short positions were liquidated in a single day, according to CoinGlass. Some observers believe large holders, including groups active on the Whales app, may have pushed prices higher to trigger these liquidations, creating temporary demand that could fade once shorts are cleared.

Concerns over insider trading

As MYX continues to trade with high volatility, some analysts have highlighted insider trading concerns. On-chain data shows activity from wallets linked to early investors or project accounts ahead of the recent rally. While there is no confirmation of coordinated action, the timing has drawn attention from market participants who are monitoring whether insider activity may have influenced trading patterns.

Recommended