What Wall Street is Reading: Top Investing Books for 2025

Using this research, GNcrypto has identified nine must-read books on investing and trading. As 2025 approaches, these selections could be invaluable for anyone looking to refine their strategies and take advantage of new opportunities in the cryptocurrency market.

Liar’s Poker by Michael Lewis

Michael Lewis, a renowned American author and financial journalist, is best known for his non-fiction books that unpack complex financial systems and human behavior.

First published in 1989, Liar’s Poker is a semi-autobiographical account of Lewis’s time as a bond trader at Salomon Brothers, one of Wall Street’s most influential investment banks in the 1980s. Through vivid personal anecdotes and sharp observations, Lewis exposes the greed and recklessness often driving financial decisions.

I am a little biased because I started my career at Citigroup, which is formerly Salomon Brothers. I also recommend 'Panic!' by Michael Lewis, and I generally like all the 'Market Wizards' series, which are helpful in knowing what fits your trading style and what doesn't,Tian Zeng, Nirvana Capital.

Cover of Liar’s Poker by Michael Lewis. Source: labirint.ru

Flash Boys: A Wall Street Revolt

Published in 2014, Flash Boys: A Wall Street Revolt explores the rise of high-frequency trading (HFT) on U.S. financial markets.

Lewis reveals how technological advancements enabled traders to generate massive profits at the expense of ordinary investors by exploiting millisecond-level advantages. Understanding these mechanisms is crucial to avoid being on the losing end.

The book chronicles the efforts of a group of Wall Street insiders who uncovered these practices and sought to reform the financial system.

In addition to explaining how HFT works, Flash Boys addresses ethical questions surrounding the rapid technological changes in finance. Lewis underscores the importance of transparency and fairness in preserving equal opportunities for all market participants.

Similarly, today we're experiencing the confluence of cryptography, blockchain technology, and distributed systems, which are meaningfully challenging preconceived notions of not just the financial industry but what constitutes money,Michael Sonnenshein, former Grayscale Investments CEO.

Michael Lewis, author of Liar’s Poker and Flash Boys: A Wall Street Revolt. Source: Britannica

The Most Important Thing by Howard Marks

First published in 2011, The Most Important Thing presents Marks’s investment philosophy, emphasizing core concepts such as second-level thinking, understanding market cycles, and the importance of risk management.

The book offers readers valuable insights into value investing, the psychological dynamics that drive market behavior, and strategies for achieving sustained investment success over the long term.

Second-level thinking is all about finding value that others don't appreciate yet. It's risk/reward times the coefficient of likelihood for being right,Mark Stearns, Goldman Sachs.

Howard Marks, author of The Most Important Thing. Source: Bloomberg

Active Portfolio Management by Richard C. Grinold and Ronald N. Kahn

Originally published in 1994, Active Portfolio Management serves as a comprehensive resource on quantitative investment strategies designed to achieve high returns while effectively managing risk. The book delves into critical topics such as the fundamental law of active management, the complexities of forecasting, and the nuances of portfolio construction.

It's pretty technical, but a must-read for any quant,Robert Lam, Man Group's Man Numeric

Cover of Active Portfolio Management. Source: Amazon.com

Lords of Finance: The Bankers Who Broke the World by Liaquat Ahamed

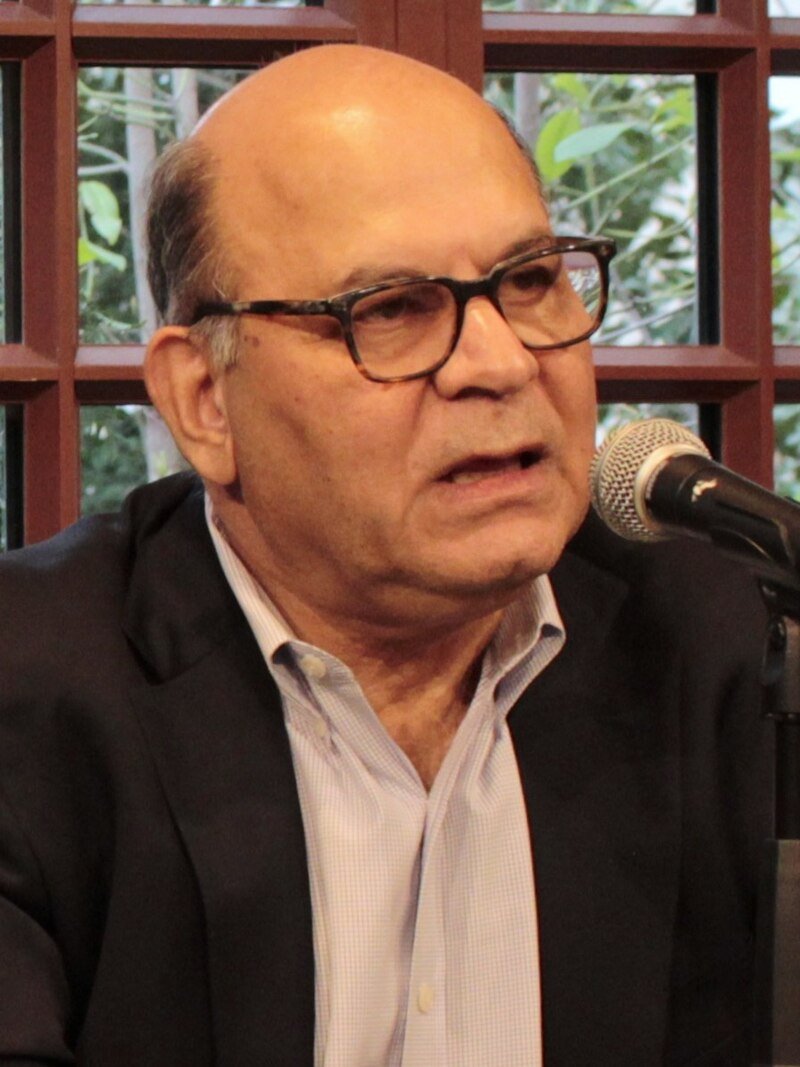

Liaquat Ahamed, an investment manager and acclaimed author, is widely recognized for his deep insights into economic history and global finance.

Published in 2009, Lords of Finance examines the events leading up to the Great Depression, centering on four influential central bankers who shaped the economic policies of the world's leading economies: Benjamin Strong Jr. (U.S.), Montagu Norman (U.K.), Émile Moreau (France), and Hjalmar Schacht (Germany).

Ahamed explores how their decisions—particularly those concerning the gold standard—impacted the global economy and contributed to the financial collapse of the 1930s.

The book sheds light on the complexities of international finance, the far-reaching effects of monetary policy, and the critical role of strong leadership in maintaining economic stability. It underscores how central bankers’ decisions can profoundly influence the trajectory of the global economy.

It's a great book about monetary policy in the Depression era that has major implications for how monetary policy and currencies have evolved,Phil Salinger, former Bridgewater Associates.

Liaquat Ahamed, author of Lords of Finance: The Bankers Who Broke the World. Source: Wikipedia

Beating the Street by Peter Lynch

Peter Lynch, a legendary American investor and former manager of Fidelity’s Magellan Fund, delivered an average annual return of 29% between 1977 and 1990, cementing his reputation as one of the most successful fund managers in history.

First published in 1993, Beating the Street offers Lynch’s investment strategies and insights, teaching individual investors how to outperform the market. He highlights the importance of thorough research, understanding the fundamentals of businesses, and focusing on industries you’re familiar with.

The book provides practical lessons on selecting stocks, managing portfolios, and building a long-term investment strategy. Lynch’s clear and approachable writing makes complex financial concepts accessible to readers at all levels, from beginners to experienced investors.

Being a Fidelity person, I had to pick a Peter Lynch book. Beating the Street has been one of my favorites, such a classic. It's about how Peter ran Magellan day-to-day. And so I've just found it to be an excellent guide to investment processes for new fund managers,Jennifer Fo Cardillo, Fidelity.

Peter Lynch, author of Beating the Street. Source: Fortune

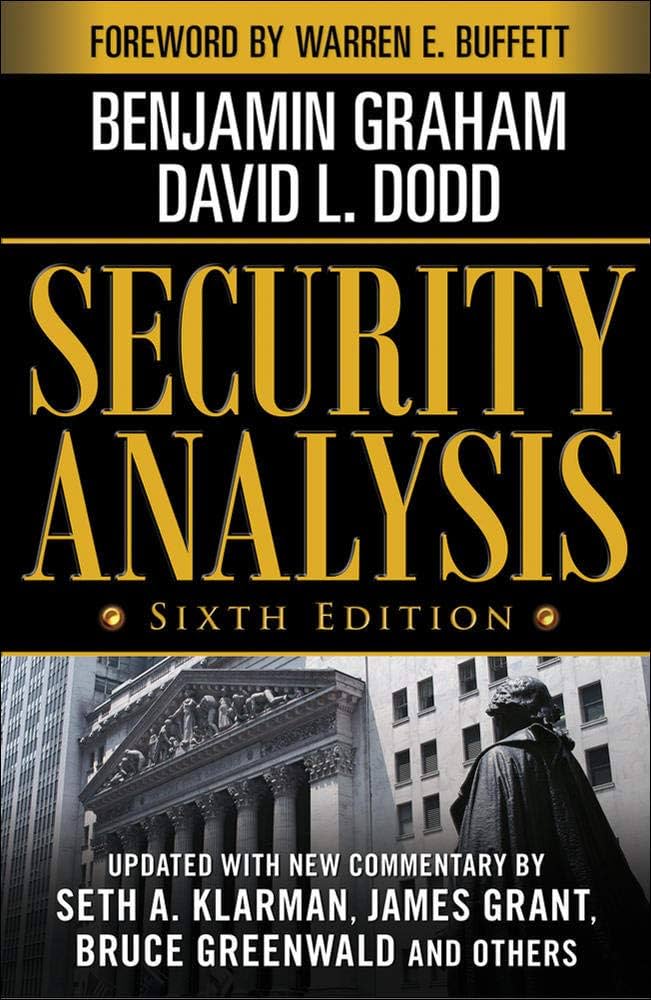

Security Analysis by Benjamin Graham and David L. Dodd

Much has been said about 'Margin of Safety' over the years, but in my opinion nothing quite compares to the original "Security Analysis" by Benjamin Graham and David L. Dodd. They epitomized the concept through their careful approach, still relevant to this day,Paul Kamenski, Man Group's Man Numeric.

Cover of Security Analysis by Benjamin Graham and David L. Dodd. Source: Amazon.com

Contrarian Investment Strategy: The Psychology of Stock Market Success by David Dreman

David Dreman, a renowned investor and author, is widely recognized as a pioneer of contrarian investment strategies, which challenge traditional market norms.

Compared with what has now often become fairly complex and evolved, his works as an early adopter of the approach were simple, intuitive, and persuasive, establishing clear roots for what it means to use a systematic approach,Paul Kamenski, Man Group's Man Numeric.

David Dreman, author of Contrarian Investment Strategy: The Psychology of Stock Market Success. Source: theglobeandmail.com

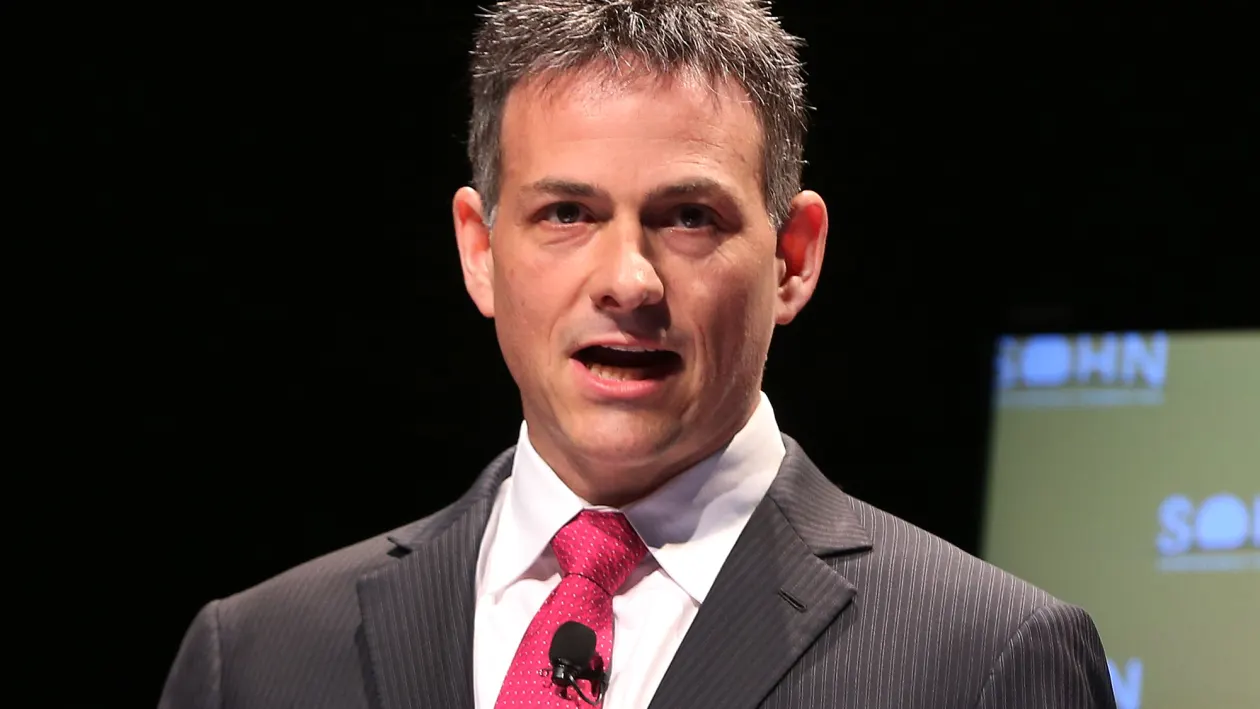

Fooling Some of the People All of the Time by David Einhorn

It is an interesting read, and I enjoy how David Einhorn seems so relentless when he believes in something,Tanaka Maswoswe, Carlyle Group.

David Einhorn, author of Fooling Some of the People All of the Time. Source: CNBC

Let this curated list help you achieve new financial milestones in 2025!

When it comes to the top investing books that Wall Street is reading in 2025, some notable titles stand out. 'The Tech Investor's Handbook' by John Roberts has become a staple, offering insights into the booming tech sector and smart strategies for navigating it. Another must-read is 'Green Investing: Profiting from the Sustainable Revolution' by Emma Thompson, which addresses the growing trend in sustainable and responsible investing. 'Cryptocurrency Mastery: From Blockchain to Altcoins' by Alexa Smith provides a deep dive into the ever-evolving world of digital currencies. Also making waves is 'Behavioral Finance: Understanding the Mind of the Market' by Robert Caldwell, a book that examines the psychological factors shaping market trends. These books, packed with valuable information and innovative strategies, are at the top of Wall Street's reading list in 2025.