US futures slip as Amazon’s $200B AI plan rattles market

US stock futures fell after Amazon sank 11% on plans to spend $200 billion this year on AI infrastructure; Nasdaq 100 futures -0.4%, S&P 500 -0.2% early Wednesday.

Amazon’s plan to spend $200 billion this year on artificial-intelligence infrastructure pressured markets. The stock fell 11% in late trading after the announcement. Nasdaq 100 futures dropped 0.4% and were on track for the index’s worst week since April. S&P 500 futures slipped 0.3%, while Dow futures were little changed.

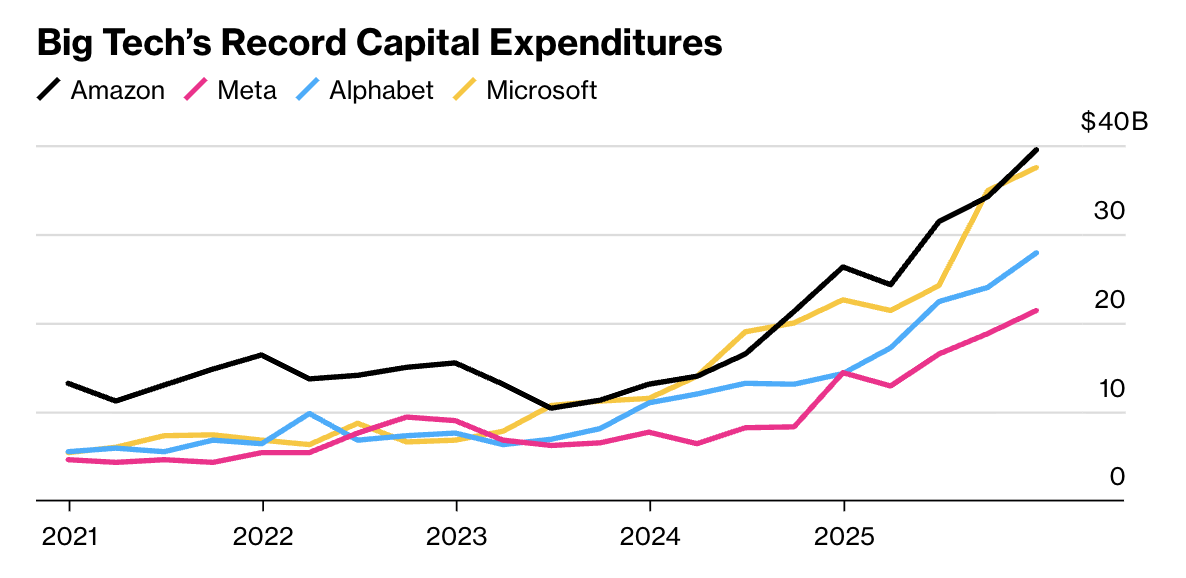

Amazon plans to direct the money to data centers, specialized chips and other equipment to support AI services. The size and timing of the program drew scrutiny as large technology companies step up capital spending on AI.

Laurent Lamagnere, deputy chief executive at AlphaValue in Paris, described “an interesting paradox: markets are betting that AI will disrupt industries, yet investors are spooked by the massive capex.” In his view, many investors had not realized how costly implementation would be.

In Europe, stocks eased about 0.3% by 8:30 a.m. in London. Stellantis flagged roughly €22 billion in charges tied to a strategic overhaul, and the shares fell. Societe Generale started a €1.46 billion buyback after fourth-quarter profit beat expectations.

In Asia, equities also declined. The MSCI Asia Pacific Index slipped 0.1%, and a broader measure of emerging-market stocks fell 0.5%. The dollar was steady. The Japanese yen firmed 0.1% to 156.83 per dollar.

US Treasuries weakened at the front end, pushing the two-year yield about two basis points higher. The 10-year yield rose one basis point to 4.19%.

Gold and silver firmed late in the week. In cryptocurrencies, Bitcoin rebounded about 3% after an earlier slide to the lowest level since October 2024.

Investors are assessing heavy AI budgets across the largest US platforms as they race to secure data-center capacity, chips and power. New model launches from developers such as Anthropic are being tracked to gauge possible effects on demand for software and services.

After months of gains led by technology shares, US stock futures pointed lower again, leaving the Nasdaq 100 on course for its toughest week since April.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.