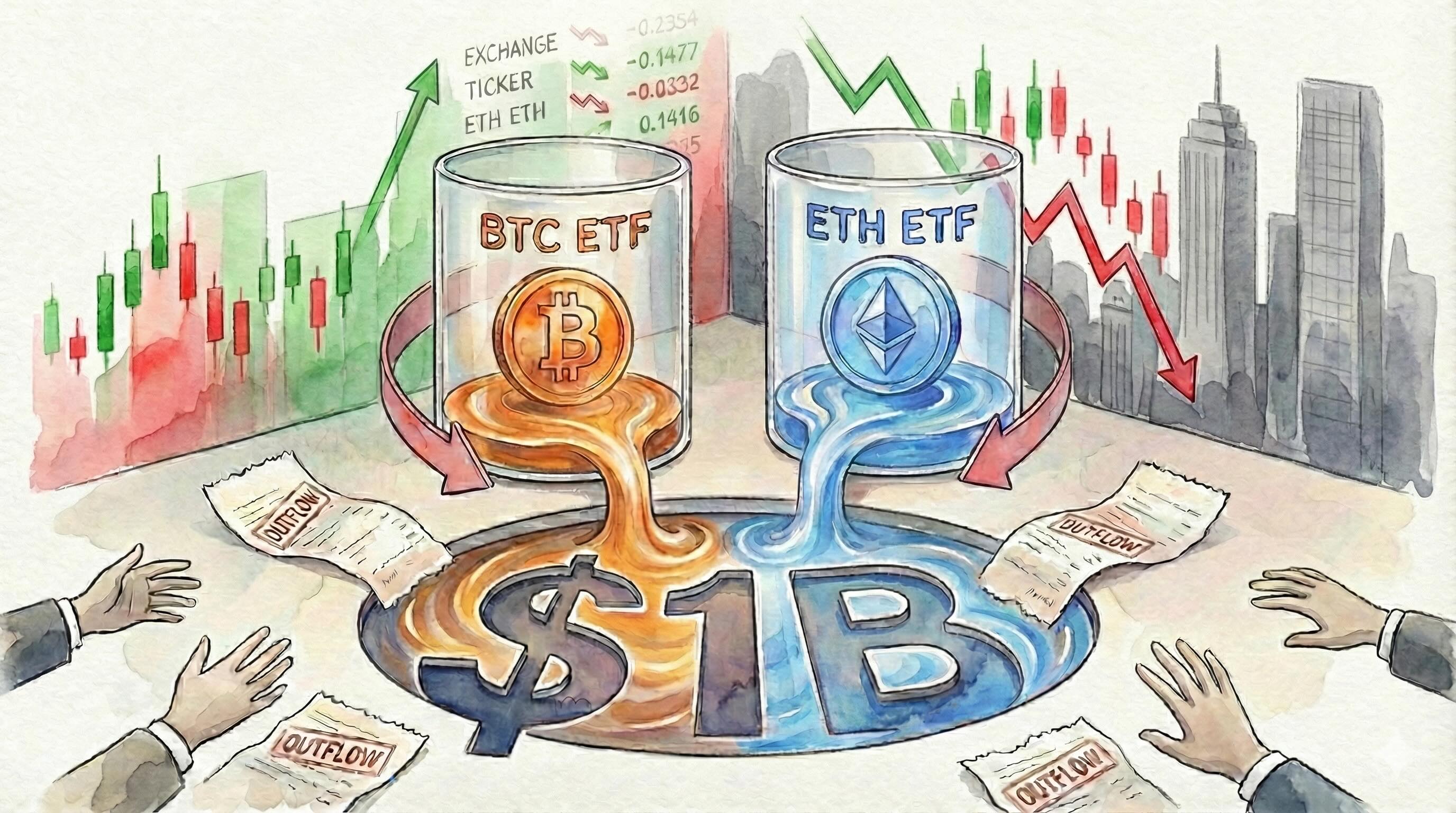

U.S. bitcoin and ether ETFs together post almost $1B outflows

U.S. spot bitcoin ETFs posted $708.7M in net outflows Wednesday, the largest in two months, led by $356.6M from BlackRock’s IBIT and $287.7M from Fidelity’s FBTC; ether funds recorded $286.9M outflows.

U.S. spot bitcoin and ether exchange-traded funds saw net redemptions Wednesday, with bitcoin funds losing $708.7 million and ether products down $286.9 million, based on SoSoValue data. The bitcoin figure was the biggest single-day outflow in two months.

BlackRock’s iShares Bitcoin Trust (IBIT) accounted for $356.6 million of the bitcoin withdrawals, and Fidelity’s Wise Origin Bitcoin Fund (FBTC) had $287.7 million. In total, six bitcoin ETFs posted redemptions.

Ether ETFs recorded a combined $286.9 million in net outflows across five funds. BlackRock’s iShares Ethereum Trust (ETHA) led with $250.3 million in redemptions. Three other ether funds also reported net outflows, while Grayscale’s Ethereum Mini Trust drew $10 million in inflows. Daily flow data for 21Shares’ ether fund was not available.

Flows diverged in other categories. Spot XRP ETFs saw $7.16 million in net inflows Wednesday, and Solana funds added $2.92 million.

The shift in flows came as bitcoin briefly dipped toward $87,000 before rebounding to around $90,000 later in the session. Ether traded near $3,000. As we covered previously, risk appetite improved after signs President Donald Trump was backing away from escalating Greenland-linked tariff threats, and US stocks and major cryptocurrencies rebounded.

The Crypto Fear & Greed Index read 20, categorized as Extreme Fear. Garrett Jin said the week’s weakness was tied more to a global bond sell-off than geopolitics and noted separate volatility in Japan’s bond market. Japanese institutions later announced stabilizing purchases, and US Treasury Secretary Scott Bessent met Japan’s finance minister.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.