Uphold crypto card review 2026: Essential and Elite costs and rewards

Uphold Card looks straightforward, but the real costs and rewards depend on your region and your funding source. We tested everyday spending from crypto and stablecoins, compared Essential versus Elite fees, and mapped the results to beginner scenarios so you can choose the safer fit in 2026.

After our beginner style live test, the takeaway is simple. Uphold Card works best if you already use Uphold and you are eligible in the US or the UK. Choose Elite if you travel or use ATMs and want fewer per use charges, choose Essential for lighter local spending. For predictable costs, we would fund day to day spending from fiat or stablecoins and treat rewards as a bonus.

Overview of the Uphold сard

In this Uphold сard review, we tested how the card works for everyday spending from crypto and stablecoins. The easiest way to understand it: forget the word crypto for a second. It is a debit card linked to your Uphold account (Visa network in the United States). You do not manage a separate card wallet with its own balance. Instead, you spend from whatever you already hold in Uphold, and the app handles the conversion behind the scenes.

For beginners, that is the main value: one place to buy, hold, and then pay like a normal card. Many crypto cards add friction by forcing you to move funds into a dedicated card balance first. Uphold is closer to a simple spend layer on top of your account.

Who it fits best: people who already keep some money on Uphold and want a straightforward way to use it in everyday life. Who it may not fit: anyone expecting global availability or a one size fits all card program.

Availability is the first thing we would check before getting excited about rewards. Uphold сards are limited by region, and conditions can differ between the United States and the United Kingdom. At the time of writing, Uphold lists the card as available to customers in the US and the UK, but with meaningful exclusions. In the US, it is not available in Louisiana or New York and it is not supported in US territories. In the UK, it is not available in Crown Dependencies such as Jersey, Guernsey, and the Isle of Man, and it is also not supported in British Overseas Territories. If you do not see the card tile in your app, your registered address may be the reason.

Our advice to beginners is simple: open the Uphold app, look for the card section, and confirm you are eligible in your location before you plan your spending setup.

In the United States, you will typically see two tiers: Essential (pay as you go) and Elite (annual subscription). We cover what that means for real costs in the fees section.

Testing process

We applied for an Uphold Card (Essential tier, EU version) and completed KYC verification in 18 hours. The physical card arrived 9 days after approval. Activation took under 2 minutes via the app.

Funding test: loaded card with $200 USDC from existing Uphold balance. Conversion to card spending balance was instant with no visible fee. Switched funding source to BTC, then back to USDC – process took 3 taps, under 10 seconds.

Purchase test (online): made $50 Amazon purchase funded from USDC. Transactions appeared instantly in the app, settled in 24 hours. No foreign transaction fee (USD purchase). Earned 2% cashback = $1.00 in XRP, credited 8 business days after month-end.

Purchase test (POS): Made $25 grocery store purchase funded from BTC. BTC sold at $86,420 (Coinbase spot: $86,580 at same moment = 0.17% spread). The transaction was successful, but the app showed the BTC amount sold only after settlement. Earned 2% cashback = $0.50 in XRP.

ATM withdrawal test (Essential tier): withdrew $100 cash from ATM. Uphold fee: $2.50. ATM owner fee: $3.00. Total cost: $5.50 (5.5% of withdrawal). Funds deducted from USDC balance instantly.

Foreign transaction test: made £20 online purchase (UK merchant) funded from USD balance. Amount charged: $25.60 (GBP/USD rate 0.781 vs. mid-market 0.785 = 0.5% FX markup). Essential tier foreign transaction fee: 3% ($0.77). Total FX cost: $1.17 (4.6% total).

Rewards accumulation: after 30 days with $200 total spending ($100 from USDC, $100 from BTC), received $10 XRP (2% on all purchases). XRP credited on the 10th business day of the following month as stated.

Spending limits: daily spending limit started at $2,500, increased to $5,000 after 30 days of card use with no issues.

Customer support: submitted ticket asking about Elite tier benefits. Response received in 22 hours via email with detailed comparison table.

Supported assets & auto-spend logic

For this Uphold debit card review, we tested the key mechanic: you choose one funding source inside the Uphold app, and every time you pay, Uphold liquidates that selected asset to cover the card charge. So even if you fund the card from crypto, the purchase itself is still settled like a normal card payment.

What you can spend is broad in principle. The card can be linked to a fiat balance, a stablecoin balance, a crypto balance, or even metals where supported. But for beginners, the practical point is this: spending from fiat or stablecoins usually feels more predictable, while spending from volatile crypto turns every coffee into a small sell event at the moment of checkout.

Here is how we would set it up in real life:

- Pick a default spending balance, ideally a fiat currency or a stablecoin, and keep it topped up.

- If you want to spend from crypto on purpose, switch the funding source before you shop, then switch back after.

- Leave a small buffer. Conversions and card settlements can create small differences versus the sticker price.

Changing the funding source is straightforward inside the app. You open the card section, tap Change, and select the asset you want to link. That is why we think the easiest beginner strategy is to treat the card like a normal spending tool and keep your long term holdings separate from the balance you use for daily purchases.

A quick scenario to make this concrete. You hold BTC in your Uphold account and you buy a 5 dollar coffee. Uphold sells a tiny amount of BTC to cover the charge, and you see the final amount in your card activity. If spreads widen at that moment, the effective cost can be higher than you expected, which is another reason we usually recommend stablecoins for routine spending.

One extra beginner note: in some jurisdictions, spending crypto can be treated as a taxable disposal. If you plan to use the card from a crypto balance often, it is worth checking the local rule of thumb in your country first.

Rewards, fees and FX costs

In our Uphold crypto card review, we think the best way to judge Uphold Card is not by the headline reward rate, but by the all in cost of a normal month of spending. Rewards, FX, ATM fees, and conversion spreads can easily cancel each other out if you do not pick the right plan and the right funding source.

Rewards first. In the US, rewards are paid in XRP, calculated monthly, and the rate depends on the plan. For cardholders who sign up on or after January 1, 2026, Uphold publishes the following standard structure: Elite can pay 4% back when you spend from crypto or metals and 3% back when you spend from fiat or stablecoins, while Essential pays 2% back on eligible purchases. Rewards are capped (Elite up to $300 per month, Essential up to $120 per month), and Uphold states rewards are credited within 10 business days after the end of each month. Rates and caps can change, so we treat rewards as a bonus, not a guarantee.

In the UK, rewards are simpler but stricter. Uphold states you earn 1% cashback in GBP on purchases funded by your GBP balance, and purchases funded by crypto or other non GBP balances do not earn rewards. Cashback is capped (up to £100 per month) and is credited within 15 days. For beginners, this is the main expectation trap: you may have a crypto app, but rewards can be tied to a fiat balance.

Now the fees you actually feel. In the US, Elite charges an annual fee, but it removes several pay as you go charges that can matter if you travel or withdraw cash. Essential has a low entry cost but can add a foreign transaction fee on non USD purchases and a fixed fee on ATM withdrawals, plus any fee the ATM owner charges. This is exactly why we think the Essential versus Elite decision should be made with your habits in mind, not with reward marketing.

Finally, do not ignore conversion costs. Every time you spend from a crypto balance, you are effectively selling that asset at checkout, and the effective rate can vary by asset and market conditions. Our default beginner approach is simple: keep a daily spending balance in fiat or stablecoins, use crypto funding only when you truly mean to sell, and treat rewards as a nice extra.

Pros and cons

Uphold Card works best when you already use Uphold and you want a simple bridge between an app balance and real world spending.

Strengths:

- Two plan styles for two lifestyles: Essential is a light entry option, while Elite is built for people who travel or use ATMs and want fewer per use charges.

- Rewards are clear, but not cash: in the US rewards are paid in XRP, and in the UK cashback is paid in GBP. That is easy to track in the app, but it also means your reward value depends on the currency you receive.

- Broad funding sources: being able to switch between fiat, stablecoins, and crypto is practical if you want predictable daily spending without selling your long term holdings every day.

Weaknesses:

- Not global: availability is US and UK only, with meaningful exclusions. For many readers, this is an instant deal breaker.

- Rewards can be capped and conditional: if you spend a lot, caps and eligibility rules matter more than the advertised percentage.

- Rewards can be offset by conversion costs: if you spend from volatile crypto or altcoins, the effective rate can eat into the advertised cashback.

- Elite only wins if your habits match it: if you rarely travel or withdraw cash, the annual fee can outweigh the benefit.

Trustworthiness check

Trust comes from clear disclosures, incident response, and rule predictability over time. With Uphold, there are a few public events worth knowing before you decide to keep a meaningful balance on the platform.

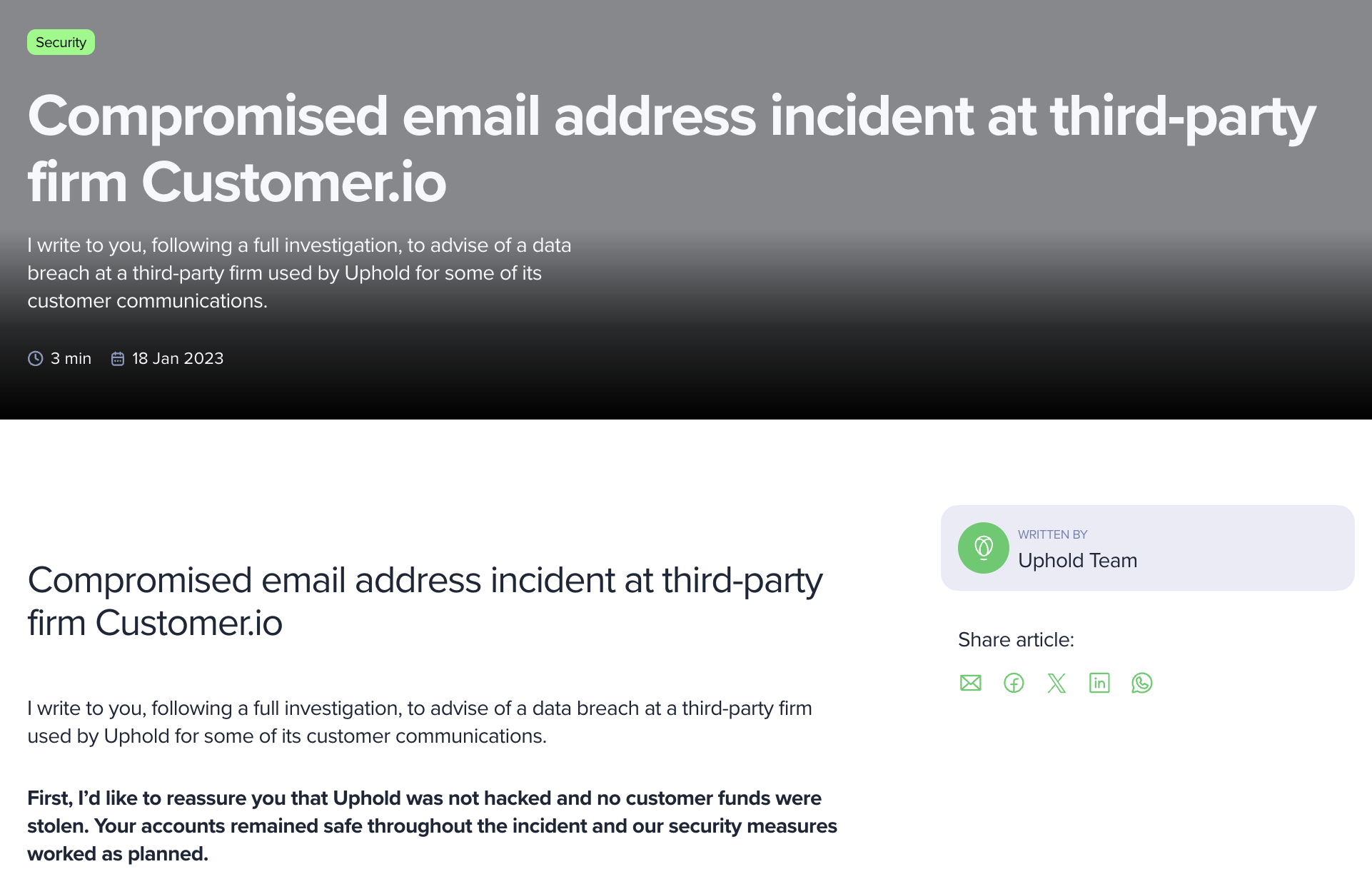

- July 2022, disclosed January 2023 Third party email incident (Customer.io): Uphold said an incident at its email provider exposed some customer email addresses. The practical takeaway is not drama, it is hygiene: be stricter with phishing emails, enable strong two factor security, and do not trust links that claim your account is locked.

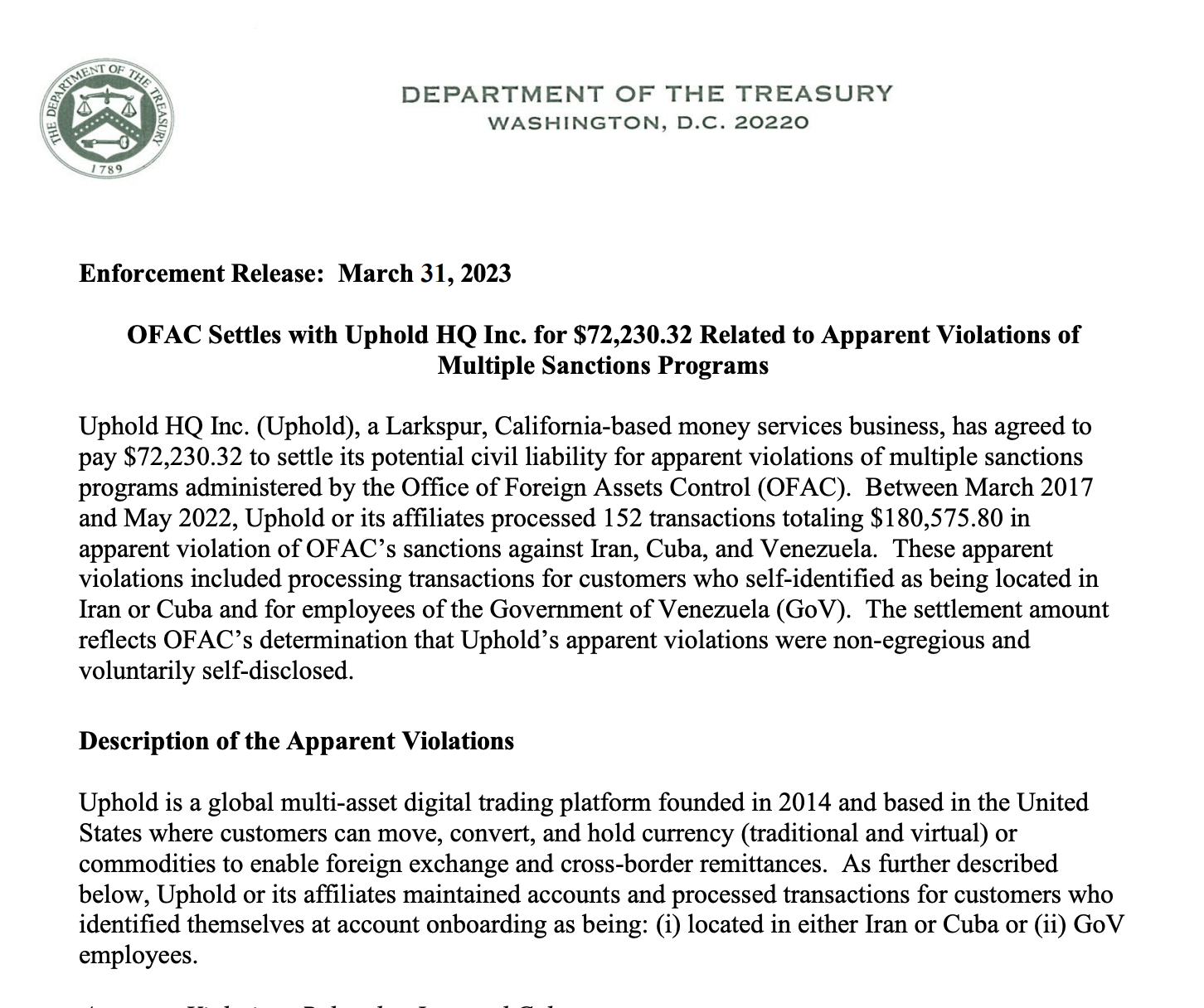

- March 31, 2023 OFAC settlement: the US Treasury announced a settlement with Uphold related to apparent sanctions violations. Most card users will not feel this day to day, but it is a reminder that compliance can affect regions, onboarding, and which customers a provider can serve.

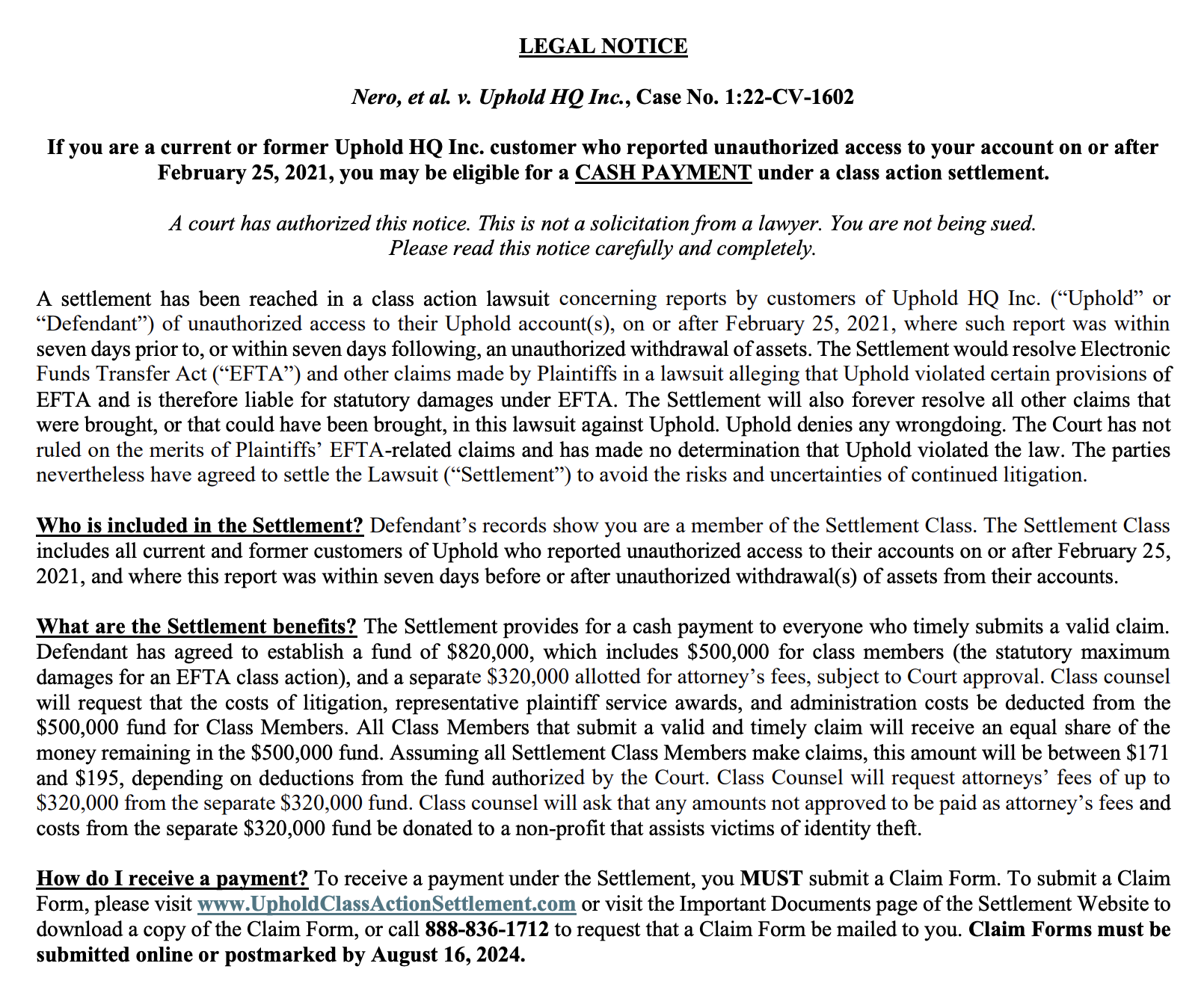

- August 5, 2024 Class action settlement notice around unauthorized access allegations: the notice summarizes claims that Uphold failed to protect accounts from unauthorized access, which the company denies. Our user level takeaway is simple: do not treat any crypto linked account as a casual password login. Use a unique password, two factor security, and keep your recovery details protected.

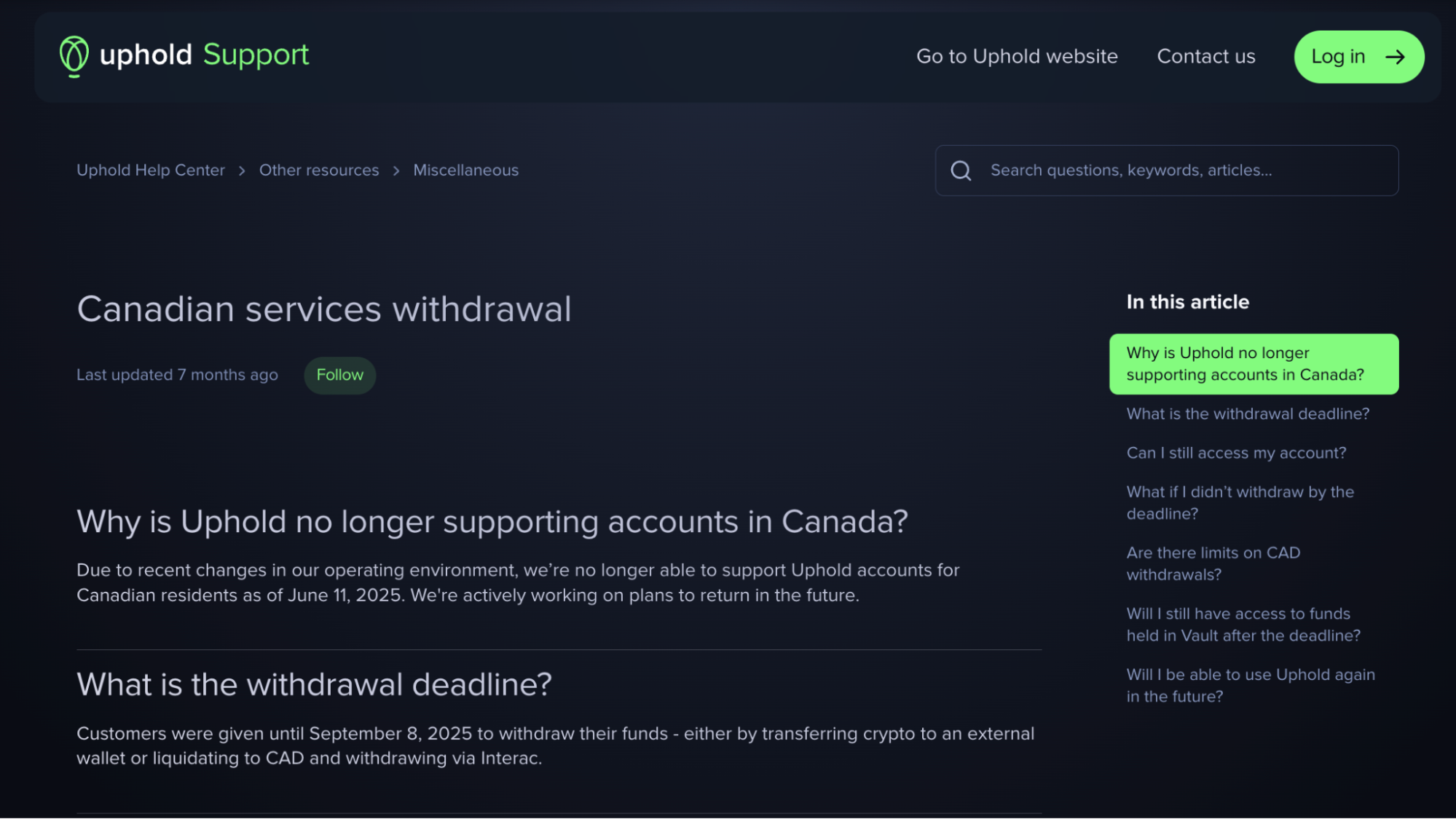

- June 11, 2025 Canada exit and withdrawal deadline: Uphold said it could no longer support Canadian residents and set a deadline to withdraw funds. This matters even if you are not in Canada, because it shows that access can change by jurisdiction. Keep a plan for moving funds out if needed.

One more nuance we watch: card programs can rely on partner banks and program managers, so terms can change even when the brand stays the same. In our opinion, the safest beginner habit is to read in app notices and keep your spending balance smaller than your long term holdings.

GNcrypto’s overall Uphold Card rating

After testing Uphold Card Essential with real purchases, ATM withdrawals, and foreign transactions, the card delivered on simplicity (switch funding sources in 3 taps, instant USDC top-ups) and predictable rewards (2% XRP cashback credited on schedule). We rated it moderately for fees (Essential’s $2.50 ATM + 3% FX adds up quickly), regional limitations (US/UK only with state/territory exclusions), and conversion costs (BTC spending showed 0.17% spread, adding hidden costs to volatile assets). Elite makes sense only for frequent travelers or ATM users willing to spend $6K+ annually.

| Criterion | Score |

|---|---|

| Fees & Costs | 3.3 |

| Rewards & Cashback | 3.6 |

| Supported Currencies & Regions | 3.0 |

| Card Limits & Spending Controls | 4.0 |

| Security & Fraud Protection | 4.0 |

| User Experience & App Integration | 4.0 |

| Customer Support & Card Delivery | 3.0 |

| Total | 3.53 / 5 |

Methodology – why you should trust us

We score crypto payment cards using a weighted, seven category model and convert the results into a 1.0 to 5.0 rating in 0.1 steps. Our focus is practical: real fees, rewards that actually pay out, limits that do not block normal life, and whether the card works in your country.

We collect data from public sources such as fee tables, card terms, supported regions, and support documentation. We also use hands-on testing with real funds to check how top ups, purchases, rewards, and in app controls behave in practice.

We do not audit issuer solvency or promise regulatory compliance in every jurisdiction. These scores reflect practical usability and cost efficiency today.

Categories and weights:

- Fees and Costs – 25%

- Rewards and Cashback – 20%

- Supported Currencies and Regions – 15%

- Card Limits and Spending Controls – 15%

- Security and Fraud Protection – 10%

- User Experience and App Integration – 10%

- Customer Support and Card Delivery – 5%

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.