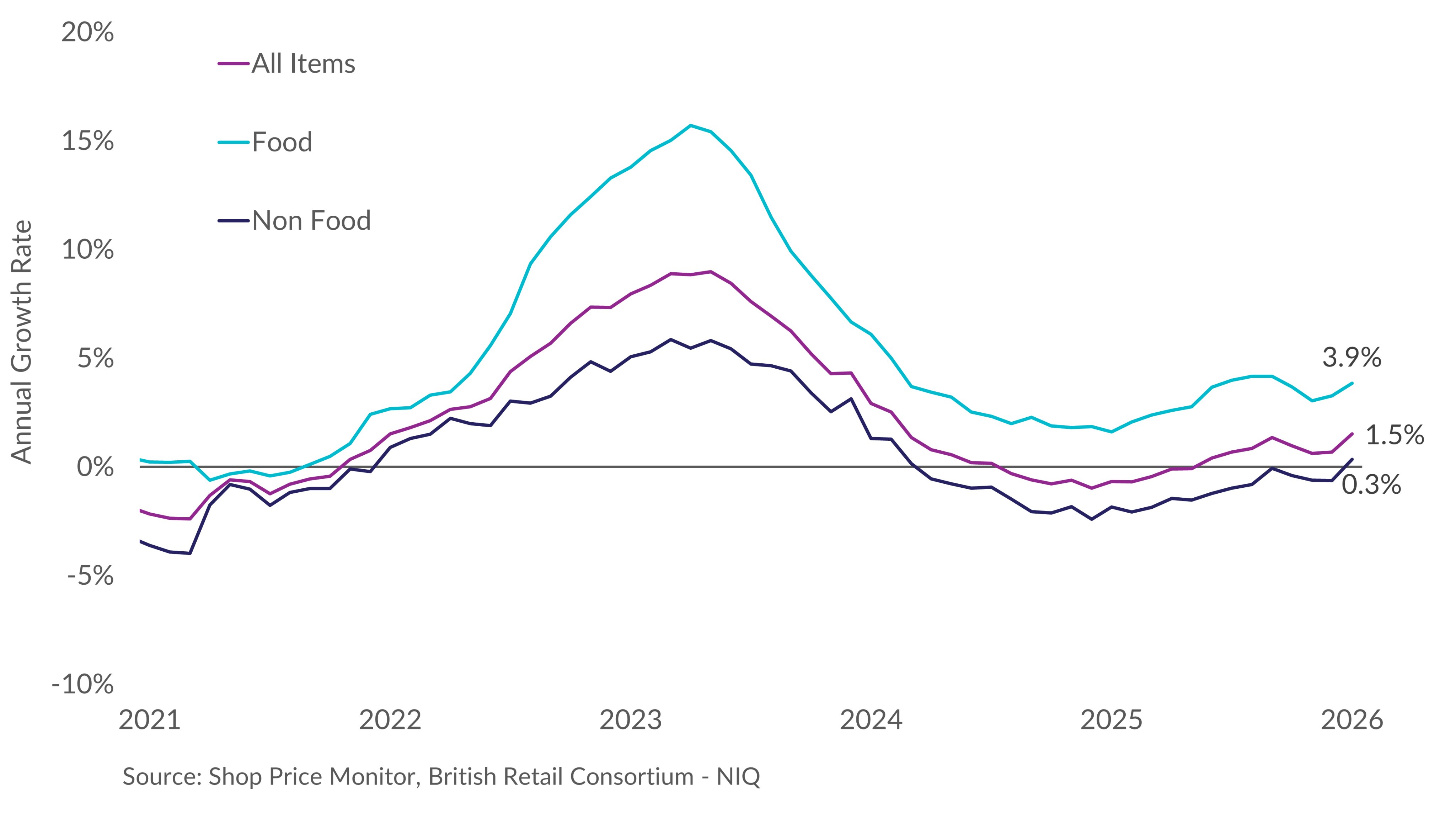

UK shop price inflation jumps to 1.5% in January as food costs climb

UK shop price inflation rose to 1.5% year over year in January, up from 0.7% in December, according to the British Retail Consortium. Food inflation accelerated to 3.9% as higher business costs continued to feed through to shelves.

UK shop price inflation rose to 1.5% year over year in January, up from 0.7% in December, according to the British Retail Consortium.

Food inflation quickened to 3.9% from 3.3%. Non-food prices increased 0.3% after recent declines, the first positive reading since early 2024. Price growth was strongest in meat, fish and fruit, reflecting tighter supply and firmer demand. Furniture, flooring, and health and beauty also saw faster increases.

The BRC index offers an early read on retail prices ahead of official inflation figures due February 18. Headline consumer price inflation, which includes services, stood at 3.4% in December, up from 3.2% in November and above the Eurozone rate of 1.9%.

The Bank of England estimates inflation peaked at 3.8% last year and projects a decline to around 3% in the first quarter of 2026, approaching its 2% target.

BRC pointed to high business energy costs and last year’s rise in National Insurance as factors pushing up shop prices. Employers’ National Insurance contributions and the National Living Wage were increased in April 2024.

“Any suggestion that inflation has peaked is simply not borne out by these figures,” noted Helen Dickinson, chief executive of the BRC. “Shop price inflation jumped this month due to high business energy costs and the hike to National Insurance continuing to feed through to prices.”

Food accounts for a larger share of spending in lower-income households, so faster food inflation raises pressure on those budgets.

In November, Chancellor Rachel Reeves announced measures intended to ease living costs, including cutting energy bills and freezing rail fares.

Mike Watkins, head of retailer and business insight at NIQ, which compiles the data with the BRC, observed: “Shoppers are always cautious about spending in January and this will not be helped by the continuation of inflation.”

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.