The Trump family’s wealth is increasingly tied to crypto

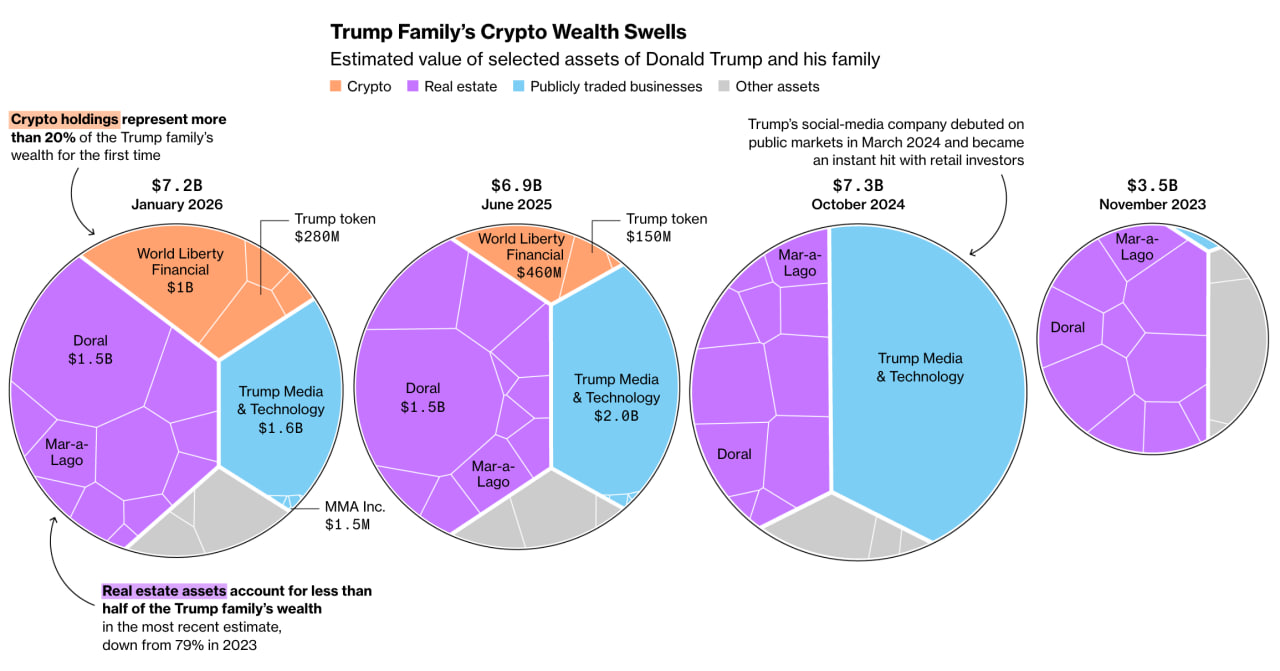

Crypto has become one of the largest sources of wealth for Donald Trump’s family. According to Bloomberg estimates, digital assets added roughly $1.4 billion to the family’s capital over the past year, for the first time accounting for nearly one-fifth of its $6.8 billion total net worth.

The family’s pivot toward crypto accelerated after Trump returned to the White House. By his January 2025 inauguration, his assets already included a social-media company, a crypto platform, and a personal memecoin – a marked shift from the previous focus on real estate and brand licensing.

Over the past year, the family’s investment scope has broadened into AI, prediction markets, defense ventures, and rare-earth magnets. But the most consequential changes came from crypto.

Among the most significant holdings:

- World Liberty Financial, a joint crypto venture by Trump and his sons. Token sales in 2025 generated around $390 million for the family, and a later deal with Alt5 Sigma added more than $500 million. The family also holds founder tokens worth an estimated $3.8 billion, though these are excluded from net-worth calculations due to lockups.

- USD1 stablecoin, launched by World Liberty. Its circulating volume has surpassed $3 billion, and the business is valued at more than $300 million.

- Trump Coin, a memecoin created days before the inauguration. Despite a pullback from its January peak, the family’s holdings and revenue are valued at about $280 million.

- American Bitcoin Corp., a mining project founded by Eric and Donald Trump Jr. in partnership with Hut 8. Eric’s stake is valued at roughly $114 million, even after the stock fell 82% from its September high.

The expansion of the crypto portfolio has been paired with public appearances by Trump Jr. and Eric Trump at conferences in Singapore, Dubai, and Las Vegas. They have said that banks severing ties with the Trump Organization was a turning point that pushed the family toward digital assets.

The rise in crypto wealth contrasts with the decline of Trump Media & Technology Group, whose shares dropped 66% over the past year. Even so, the company has continued announcing new initiatives – from prediction markets to plans for a nuclear fusion reactor.

The administration denies any conflict of interest. A White House spokesperson said the family “has never engaged and will never engage” in such situations.

As crypto becomes more central to the family’s portfolio, the Trumps are also expanding traditional ventures. One recent example is a tokenized hotel complex in the Maldives, reflecting their strategy of combining real estate with digital-asset infrastructure.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.