$1.19B in token unlocks: Aptos, Aethir, and Linea

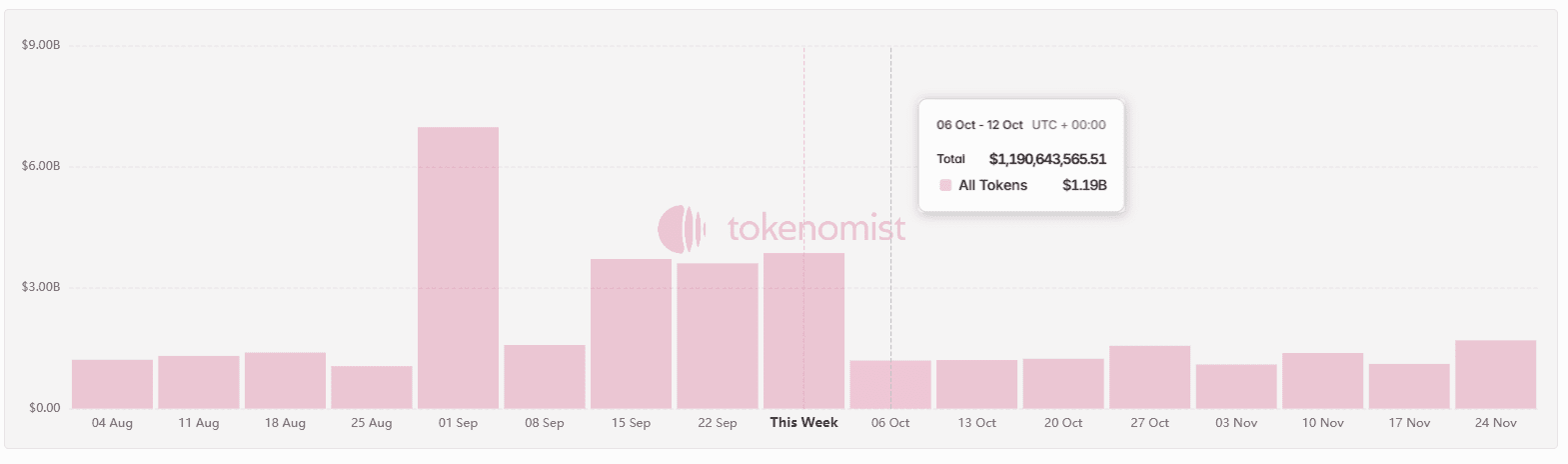

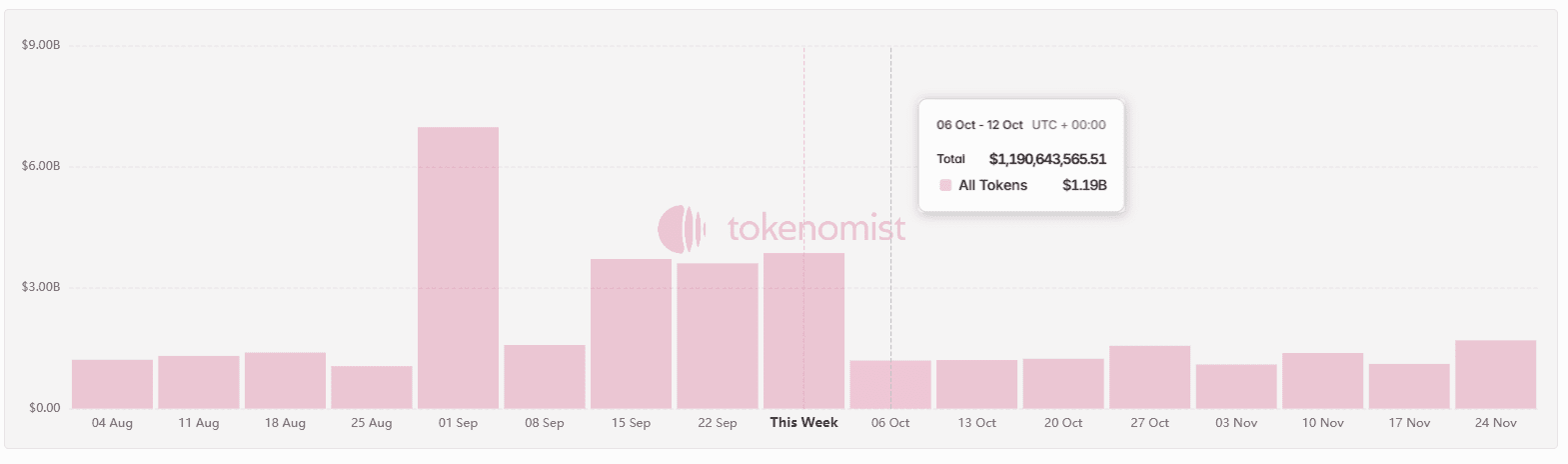

According to Tokenomist, token unlocks totaling $1.19 billion will take place between October 6 and 12 – nearly 3.3 times less than last week.

After last week’s record-breaking $3.86 billion in token unlocks, the market is heading into a calmer period. Between October 6 and 12, the cumulative volume will amount to around $1.19 billion, with the largest events tied to Aptos, Aethir, and Linea.

Axie Infinity (October 9). 652,500 AXS ($1.48M), or 0.25% of circulating supply, will be unlocked. These tokens are designated for staking rewards, meaning the price impact will be limited.

Linea (October 10). 1.08B LINEA ($28.39M) will hit the market, equal to 6.57% of circulating supply. Main recipients are Linea Consortium (Ignition) and long-term alignment, which may imply partial distribution to investors and ecosystem participants.

1inch (October 10). Unlock totals 214,000 1INCH ($57K), or 0.02% of supply. This is not a significant market event.

Optimism (October 10). 4.47M OP ($3.31M), or 0.24% of supply, will be released. Category – Seed Fund, meaning early investors, who may exert selling pressure.

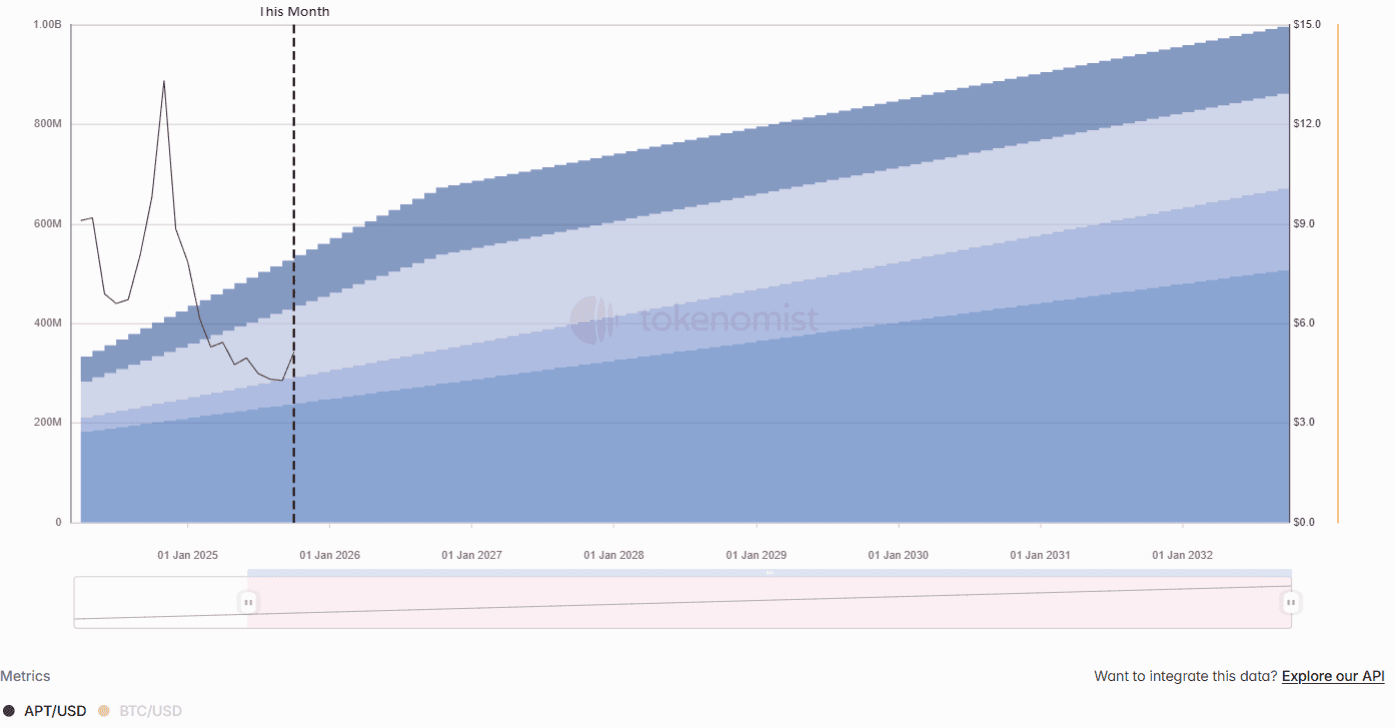

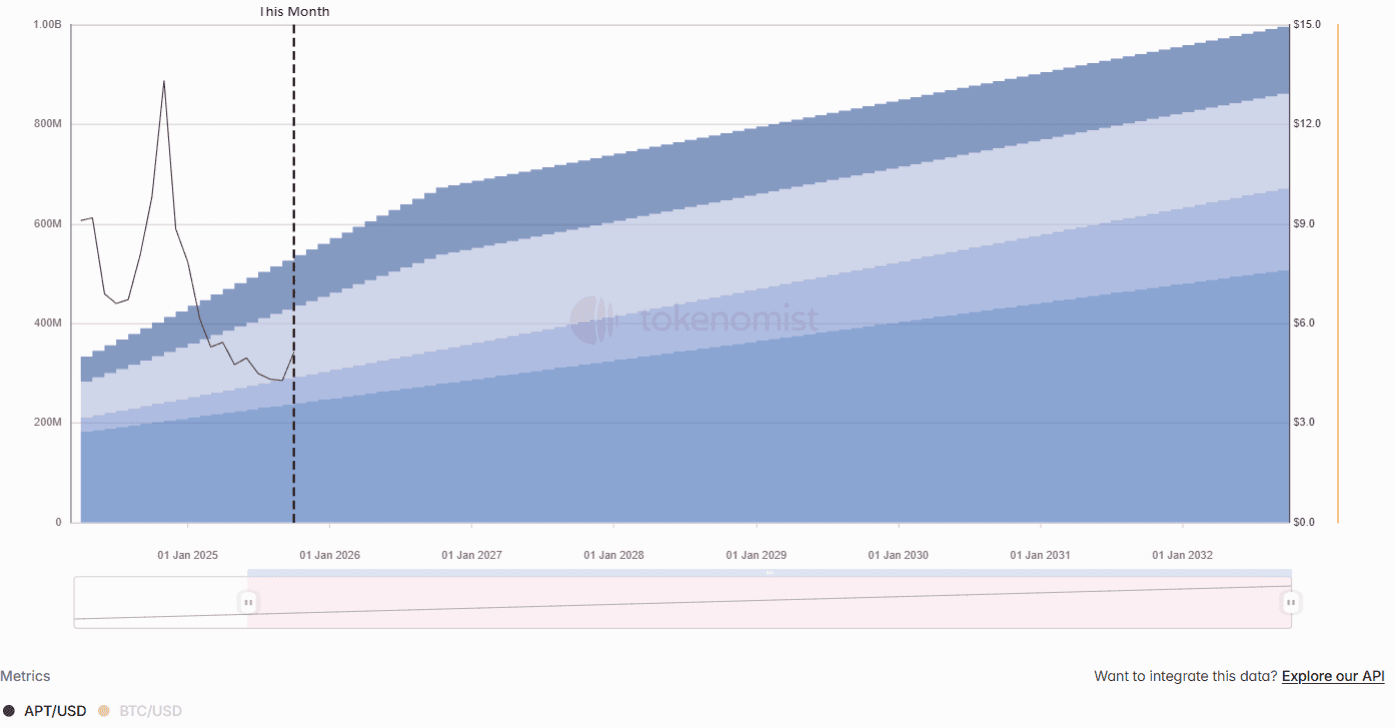

Aptos (October 11). The largest unlock of the week: 11.3M APT ($57.91M), equal to 2.15% of supply. Tokens are distributed among the foundation, investors, team, and community, making this event particularly market-sensitive.

Since November 2024, nearly every APT token unlock has been followed by a price drop. Investors have grown accustomed to treating unlocks as a sell signal, and the “short APT on unlocks” strategy worked almost flawlessly for a long time.

Aethir (October 12). The second most significant event is 1.26B ATH ($64.04M), or 16.08% of supply. The Airdrop category makes this release especially risky: users who received free tokens may rush to sell them on the market.

Chart of total token unlock volumes. Source: tokenomist.ai

Movement (October 9). 50 million MOVE ($5.68M) will be unlocked, equal to 1.85% of circulating supply. Tokens go to the Ecosystem + Community category, increasing the likelihood they will circulate on the market.

Axie Infinity (October 9). 652,500 AXS ($1.48M), or 0.25% of circulating supply, will be unlocked. These tokens are designated for staking rewards, meaning the price impact will be limited.

Linea (October 10). 1.08B LINEA ($28.39M) will hit the market, equal to 6.57% of circulating supply. Main recipients are Linea Consortium (Ignition) and long-term alignment, which may imply partial distribution to investors and ecosystem participants.

1inch (October 10). Unlock totals 214,000 1INCH ($57K), or 0.02% of supply. This is not a significant market event.

Optimism (October 10). 4.47M OP ($3.31M), or 0.24% of supply, will be released. Category – Seed Fund, meaning early investors, who may exert selling pressure.

Aptos (October 11). The largest unlock of the week: 11.3M APT ($57.91M), equal to 2.15% of supply. Tokens are distributed among the foundation, investors, team, and community, making this event particularly market-sensitive.

Since November 2024, nearly every APT token unlock has been followed by a price drop. Investors have grown accustomed to treating unlocks as a sell signal, and the “short APT on unlocks” strategy worked almost flawlessly for a long time.

Correlation of APT unlocks and price. Source: tokenomist.ai

However, in September 2025 this trend broke: despite new tokens entering circulation, Aptos held steady and even showed signs of recovery. This could indicate the beginning of a reversal and the formation of a new upward trend, where unlocks stop being an unequivocal bearish factor.

Aethir (October 12). The second most significant event is 1.26B ATH ($64.04M), or 16.08% of supply. The Airdrop category makes this release especially risky: users who received free tokens may rush to sell them on the market.

Recommended