$905M in crypto tokens set to unlock from November 10 to 16

The week of November 10–16 will be one of the biggest for token unlocks in recent months, with projects releasing nearly $905 million worth of assets into circulation. Leading the list are Aptos, Starknet, and Sei.

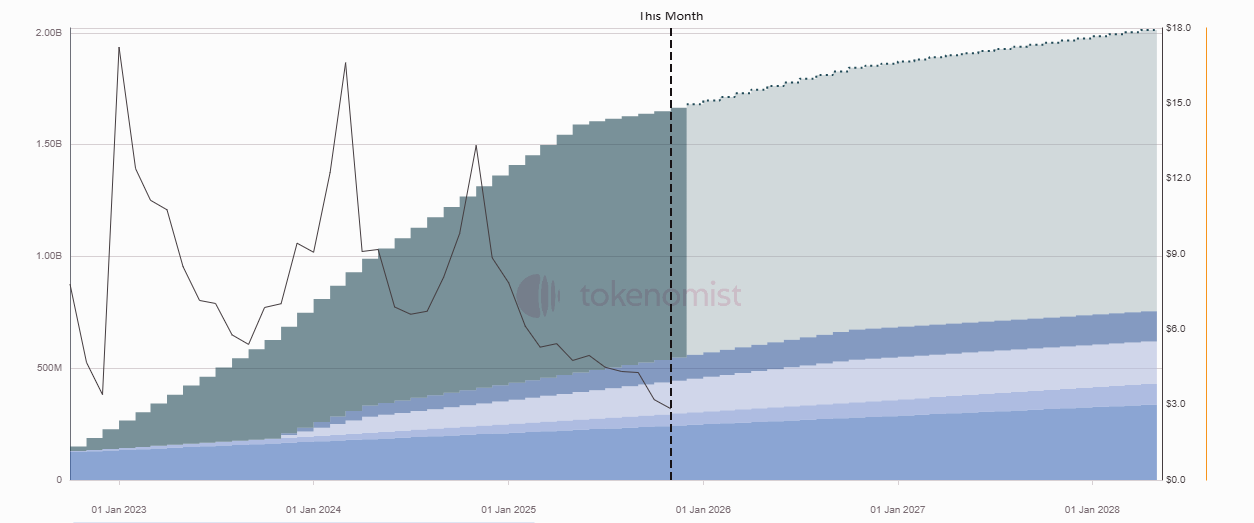

Most of the unlocked assets come from Layer-1 and DeFi projects now entering the final phase of their early vesting schedules.

Major unlocks of the week:

- Aptos (APT) – $32.1 million

- Starknet (STRK) – $14.2 million

- Sei (SEI) – $8.8 million

- Linea (LINEA) – $32 million

- Resolv (RESOLV) – $776,000

- Cyber (CYBER) – $763,000

By category, about 45% of unlocked tokens will go to teams and early investors, 30% to ecosystem incentives, 15% to treasuries, and 10% to community programs.

Aptos – $32 million unlock and historical price reaction

On November 11, Aptos (APT) will release 11.3 million tokens worth roughly $32 million, or 0.69% of the total supply. The tokens will be distributed among the team, investors, community, and the Aptos Foundation.

Historically, Aptos unlocks have often led to short-term corrections – 11 of the last 13 triggered price declines. In September, however, the market reacted more neutrally, with APT trading sideways.

If the trend continues, investors may see mild downside or price consolidation.

Starknet and Sei – unlocks for teams and early investors

Two major unlocks are scheduled for November 15:

- Starknet (STRK) will release 127 million tokens, split between early contributors ($7.46 million) and investors ($6.77 million), totaling about $14.2 million.

- Sei (SEI) will unlock 55 million tokens worth $8.8 million, all allocated to the project team.

For Starknet, the event may serve as a test of resilience: from November 2024 to March 2025, STRK fell from $0.60 to $0.10, with no unlocks during that time triggering a recovery. Sei has also shown no positive momentum since July 2025.

Weekly breakdown by category

Across all projects, the largest unlocks fall into the following categories:

- Layer-1 ecosystems: Aptos, Sei, Linea, Starknet

- DeFi and infrastructure: Resolv, Cyber, Peaq

- GameFi: Move, Copi, Nyan

Of the total $905 million, more than $250 million (27%) comes from Layer-1 networks – reflecting the final phase of early vesting programs that began in late 2023 and early 2024.

The autumn surge in unlocks is tied to the one-year vesting cycle of tokens launched during the 2024 bull market. As these projects move into full circulation, the increased supply could create short-term selling pressure.

However, unlocks don’t always trigger sell-offs – especially when the released tokens are allocated to ecosystem funds or staking programs rather than retail holders.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.