Tarek Mansour net worth: from macro trader to CEO of Kalshi

How Tarek Mansour, CEO of Kalshi, built a regulated event-trading platform and helped bring prediction markets into the U.S. financial system.

Who Tarek Mansour is

Tarek Mansour, Kalshi co-founder and CEO, leads a regulated platform that lets traders buy and sell contracts based on real-asset events, positioning Kalshi at the forefront of the U.S. prediction-trading market. Public profiles confirm Tarek Mansour nationality is American, though he was born in Egypt and raised in the U.S., a background that shaped his global perspective on markets and regulation. An MIT-educated engineer, Mansour developed an early interest in prediction markets and market design, viewing them as tools for aggregating information rather than mere speculation.

Under his leadership, Kalshi has gained recognition for its transparency, efficiency, and forward-thinking design, attracting both retail and institutional users. Beyond his executive role, Mansour regularly appears in interviews and public discussions about prediction markets, regulation, and financial infrastructure, positioning himself as a key voice in the evolution of event-based trading and the broader U.S. financial system.

Career foundations

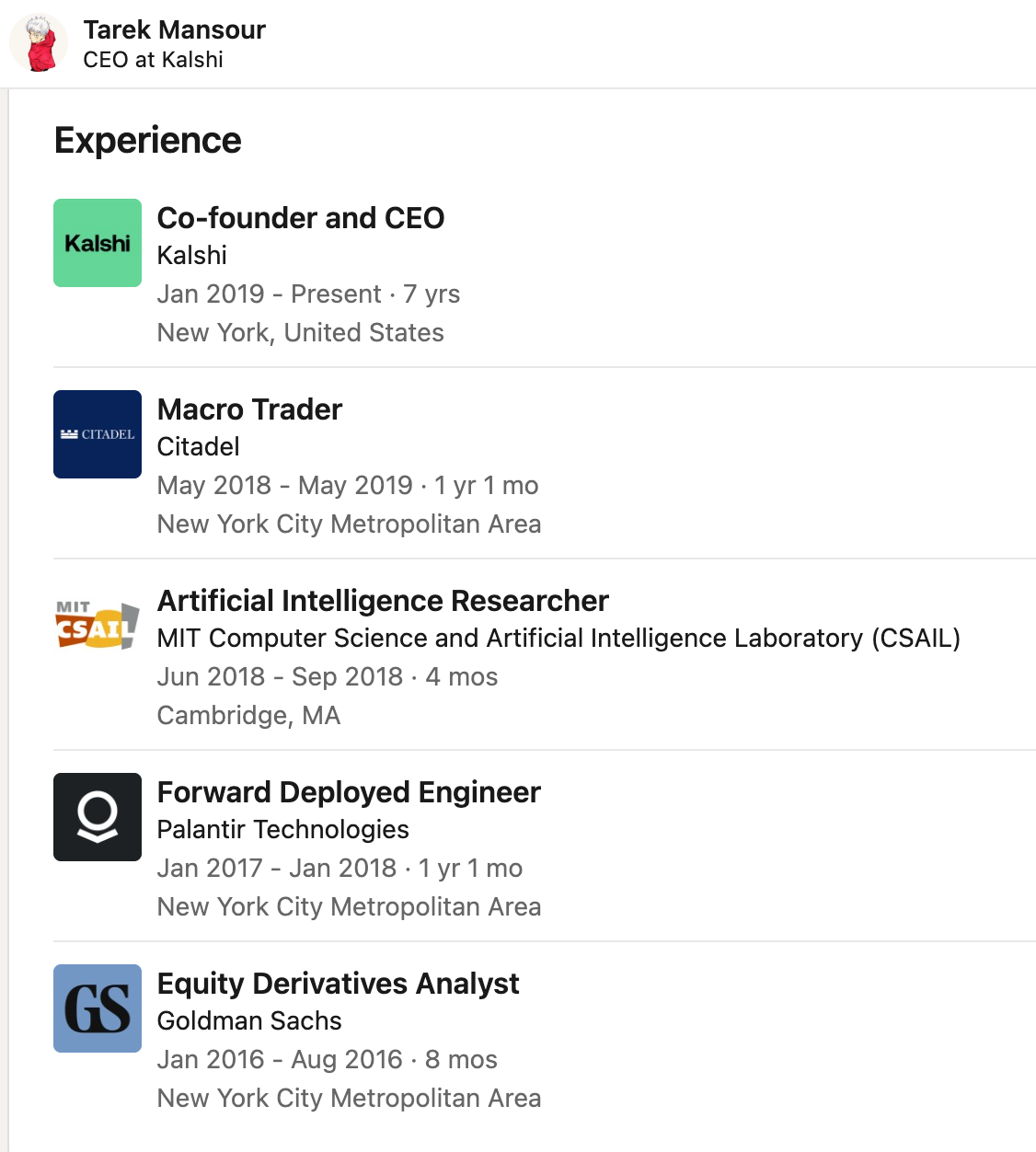

Tarek Mansour’s early career laid the groundwork for his future as an innovator in event‑driven trading and blockchain‑enabled markets. Before founding his own platform, he gained extensive experience at the intersection of finance and technology, building expertise in market analysis, trading strategies, and applied engineering through roles at Goldman Sachs and Citadel, and later applying that insight to financial technology. These roles gave him firsthand exposure to how macro events move markets and how technology shapes trading infrastructure – lessons he would later put to the test in a prolonged battle with the Commodity Futures Trading Commission, working to secure approval for Kalshi and prove that prediction markets could operate legally and transparently within the U.S. financial system.

There are no publicly verified figures for Tarek Mansour net worth. He appeared on Forbes Under 30 in finance, and Kalshi’s rapid valuation growth – backed by prominent investors – suggests significant founder equity value even if precise personal wealth figures are private.

Key early roles and achievements include:

- Equity derivatives analyst at Goldman Sachs – worked on structured credit and equity products, developing a deep understanding of institutional risk management and market dynamics.

- Forward deployed engineer at Palantir Technologies – designed and implemented data-driven solutions for complex, real-world problems, bridging technical systems with actionable insights.

- Artificial intelligence researcher at MIT CSAIL – contributed to cutting-edge AI projects, gaining exposure to advanced computational techniques and their applications in finance.

- Global macro trader at Citadel – executed trades across multiple asset classes, honing his ability to anticipate market reactions to macroeconomic events.

Founding Kalshi

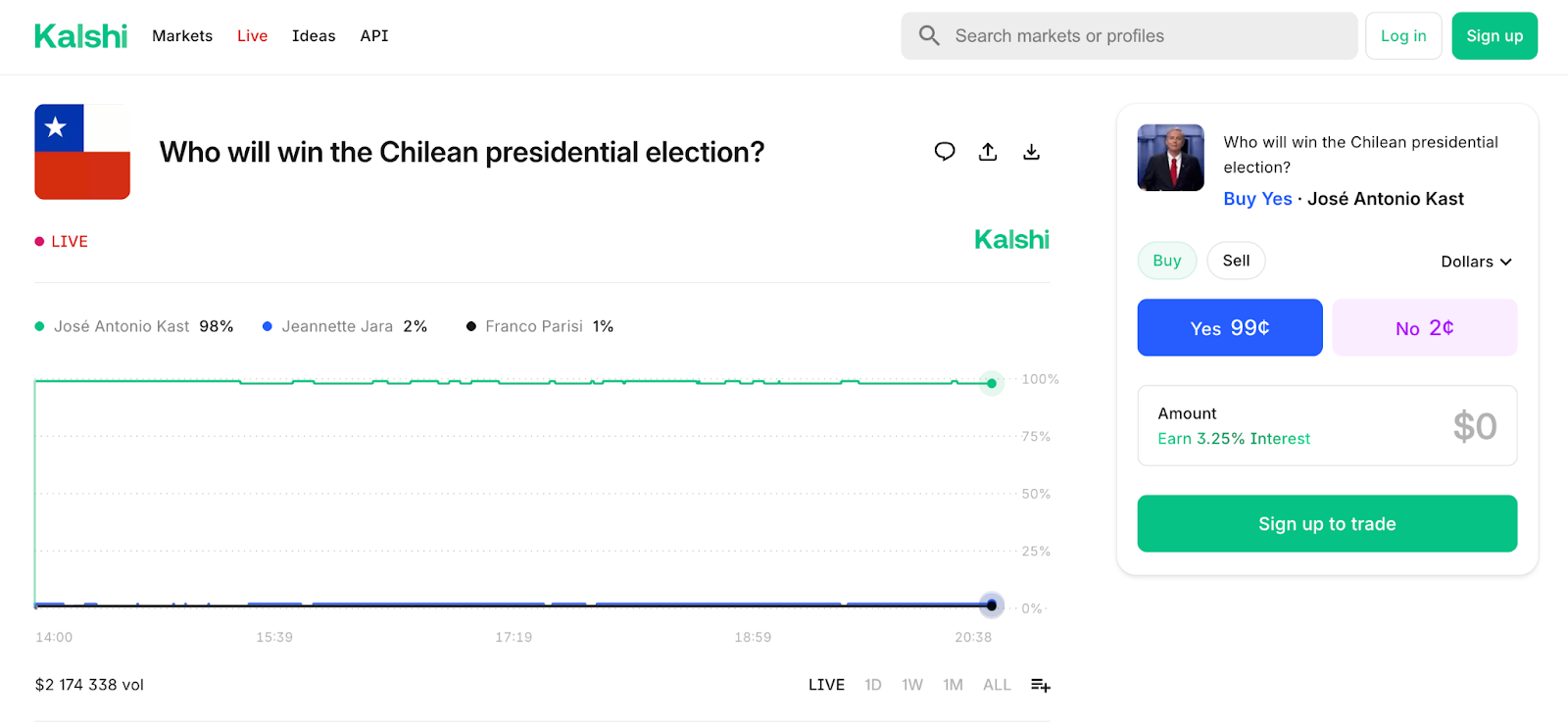

Kalshi is a regulated event-trading platform that allows people to buy and sell contracts based on the outcomes of real-world events. These events can range from economic indicators and election results to other measurable occurrences, creating a new type of financial market where users can speculate, hedge, or gain insights into future outcomes. Unlike traditional prediction markets, Kalshi operates under federal regulation, ensuring transparency, legality, and protection for its participants.

Tarek Mansour founded Kalshi after recognizing a gap in the market: there was no compliant, accessible platform for trading on real-world events. Drawing from his experience as a macro trader and derivatives analyst, he envisioned a system where measurable events could become tradeable assets while operating fully within U.S. regulatory frameworks. The founding process involved designing the core mechanics of event contracts, planning the business model, and prioritizing legal compliance.

Mansour engaged closely with regulatory experts to secure approval from the Commodity Futures Trading Commission (CFTC), while simultaneously overseeing the technical architecture with his engineering team to ensure scalability, security — a point covered in our is Kalshi safe review — and user accessibility. Through this combination of market insight, regulatory strategy, and hands-on execution, Mansour successfully launched Kalshi, establishing one of the first federally regulated marketplaces for event-based trading in the United States.

Leadership at Kalshi

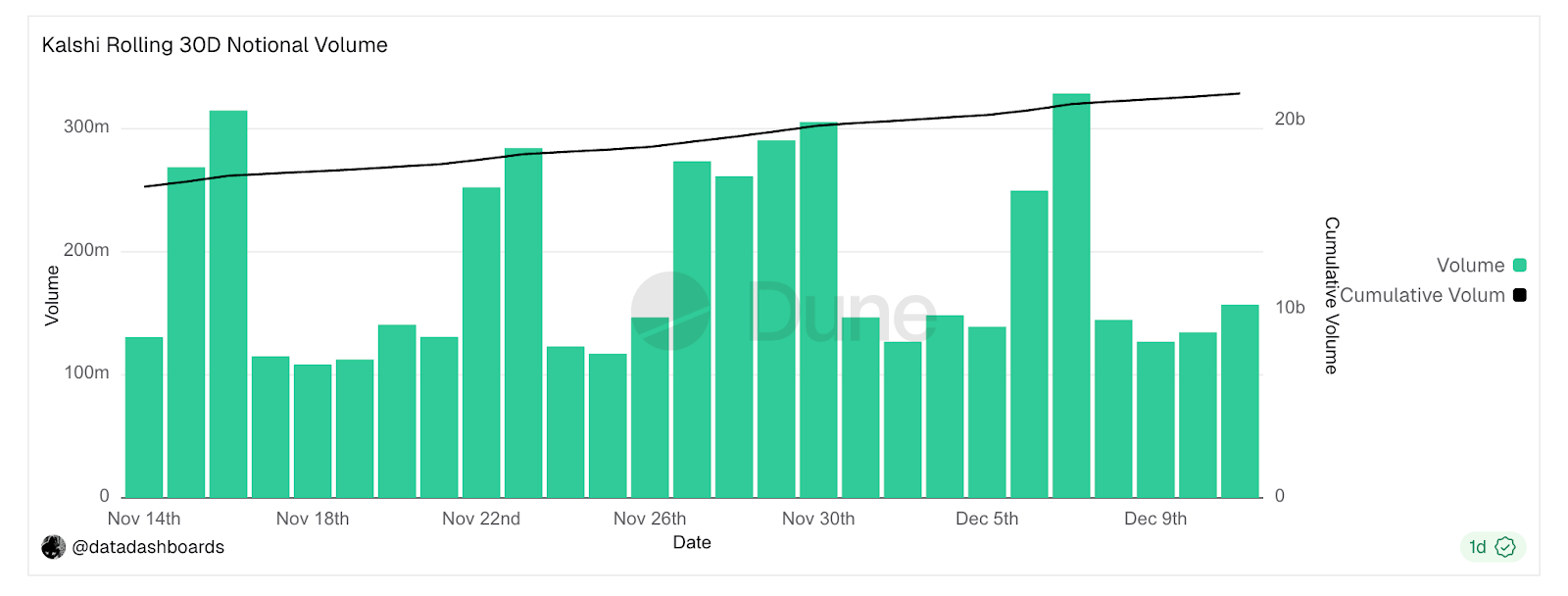

As CEO of Kalshi, Tarek Mansour oversees all aspects of the platform’s operations, from product development to regulatory compliance. His leadership style combines hands-on involvement with a clear strategic vision, emphasizing innovation, transparency, and market integrity. Mansour’s decisions shaped Kalshi’s rapid growth and established it as one of the first CFTC-regulated event-trading marketplaces in the U.S.

Reflecting on the platform’s regulatory approach, he noted: “Our approach has always been… legal and regulate first, always do it within the bounds and expand the bounds,” underscoring his commitment to building prediction markets that operate fully within the U.S. financial system while pushing the boundaries of innovation.

For readers curious about Tarek Mansour age, he is in his early 30s, which underscores how much he has achieved at a relatively young stage in his career. Under his guidance, Kalshi has expanded its range of event contracts, attracted institutional and retail traders, and operates within federal regulatory frameworks while maintaining a user-focused approach to market design.

Industry impact & vision

As Kalshi CEO, Tarek Mansour envisions a future where event trading becomes a mainstream financial tool, offering individuals and institutions a way to hedge, speculate, and gain insights from measurable real-world events. He believes that innovation in market design, combined with strict regulatory compliance, can transform prediction markets into trusted, transparent venues for trading outcomes.

Mansour emphasizes that regulated platforms like Kalshi help legitimize these markets, ensuring that growth is sustainable while providing users with clear rules, fair access, and reliable pricing.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.