Tangem card reviews 2026: how the hardware wallet works and how to spend crypto

We tested Tangem and compared it with other crypto cards, scoring fees, limits, security, and real world usability. This review explains who it fits in 2026, what setup steps to expect, and the main pitfalls to avoid before you commit.

Tangem is a card shaped hardware wallet aimed at beginners who want self custody without living by a seed phrase. In our testing and comparisons, it stood out for its tap to sign NFC flow and the optional Tangem Pay layer, which lets you spend USDC (a dollar pegged stablecoin) on Polygon through a virtual Visa card added to Apple Pay or Google Pay. The trade off: no cashback today, USD settlement that can add FX costs abroad, and extra steps if your funds sit on other chains.

What makes Tangem Card different

Tangem is easy to misunderstand because it is not a classic crypto debit card you top up from an exchange. In this Tangem card review, we tested it first as a hardware wallet in the shape of a bank card. You keep your crypto in self custody, and you approve actions by tapping the card to your phone via NFC. No screen, no cables, no laptop routine.

For beginners, the biggest difference is the default mindset: seedless by default. Instead of relying on a 12 to 24 word phrase that you must store perfectly, Tangem is designed around a more physical habit. You can link multiple cards as backups (many users start with a 2 to 3 card set) and store them separately. If you know you will not manage a seed phrase well, this approach can feel more realistic.

There is also a second product layer called Tangem Pay. We think this is where people get confused, so we would simplify it like this: Tangem Wallet is your key, Tangem Pay is a separate payment account that can connect spending to card rails. In practice, it means you can use the same app for storage and payments, but they are not the same thing.

If you want a quick mental model: your phone is the interface, the Tangem card is the key. That is the core idea that makes Tangem different.

Testing process

We ordered a Tangem 3-card family pack for $139.80 (includes shipping). Cards arrived in 8 days via standard international delivery. Each card came in sealed packaging with a quick-start guide.

Setup test: downloaded Tangem app (iOS), scanned primary card via NFC, created wallet in under 3 minutes. Set 8-character alphanumeric access code. Linked two backup cards by tapping each one and confirming in app – total backup setup: 5 minutes.

Funding test (wallet layer): sent $200 USDC on Polygon from external wallet to Tangem wallet address. Funds appeared in the app within 45 seconds (2 block confirmations). No Tangem fees for receiving.

Tangem Pay setup: enabled Tangem Pay in app, completed KYC verification (passport photo + selfie) – approved in 4 hours. Added virtual Visa card to Apple Pay in under 1 minute.

Tangem Pay funding: transferred $100 USDC from Tangem wallet to Tangem Pay balance. Internal transfer was instant with no visible fee, but required one NFC tap for authorization.

Purchase test (online): made a $25 Amazon purchase using Tangem Pay card via Apple Pay. Transactions appeared instantly in the app, settled in USD. No foreign transaction fee (USD purchase). Zero cashback earned.

Purchase test (POS): made €20 grocery purchase using Tangem Pay via Apple Pay. Amount charged: $21.40 (EUR/USD mid-market rate 0.935 vs. charged rate 0.934 = 0.1% FX markup). Total FX cost is minimal compared to traditional cards.

Cross-chain test: attempted to fund Tangem Pay with USDT on Tron (held in Tangem wallet). The process required swapping USDT→USDC via in-app exchange, then bridging to Polygon. Total time: 8 minutes. Total cost: $2.80 (swap fee $1.20 + bridge gas $1.60).

ATM withdrawal test: ATM withdrawals not supported by Tangem Pay. Feature unavailable in app.

Backup recovery test: removed app from phone, reinstalled on second device (iPad). Scanned primary card, entered access code, wallet and all balances restored in under 2 minutes. No seed phrase needed.

Spending limits: Tangem Pay started at $500 daily spending limit, increased to $2,000 after 7 days of verified use.

Customer support: submitted ticket asking about supported countries for Tangem Pay. Response received in 18 hours via email with a list of available regions.

How crypto spending works

For this Tangem card wallet review, we tested the practical question: how do you go from crypto to a real purchase without messing up the steps? With Tangem Pay, the checkout experience can feel like a normal card payment, but the balance you spend is funded in crypto.

Here is the beginner friendly flow, the way we would explain it:

- Set up Tangem Wallet in the app (this is the self custody layer).

- Enable Tangem Pay (this is the payments layer) and complete KYC verification.

- Fund your Tangem Pay balance with USDC on Polygon.

- Add the virtual card to Apple Pay or Google Pay.

- Pay anywhere Visa is accepted (online or in-store). For contactless, add it to Apple Pay or Google Pay.

The main thing to understand is the funding format: you are not spending random coins from your wallet. You are spending USDC on a specific network, and the card charge is processed in USD.

What can trip beginners up:

- If your funds are on a different chain (for example USDT on Tron), you will likely need an extra swap or bridge step before you can spend.

- Give yourself a buffer for costs around funding and conversion. Even if the card product markets itself as a low fee, you can still pay network fees when moving USDC and FX costs when you spend in a currency other than USD.

- At the moment, ATM withdrawals are not supported, so treat this as a tap to pay setup first.

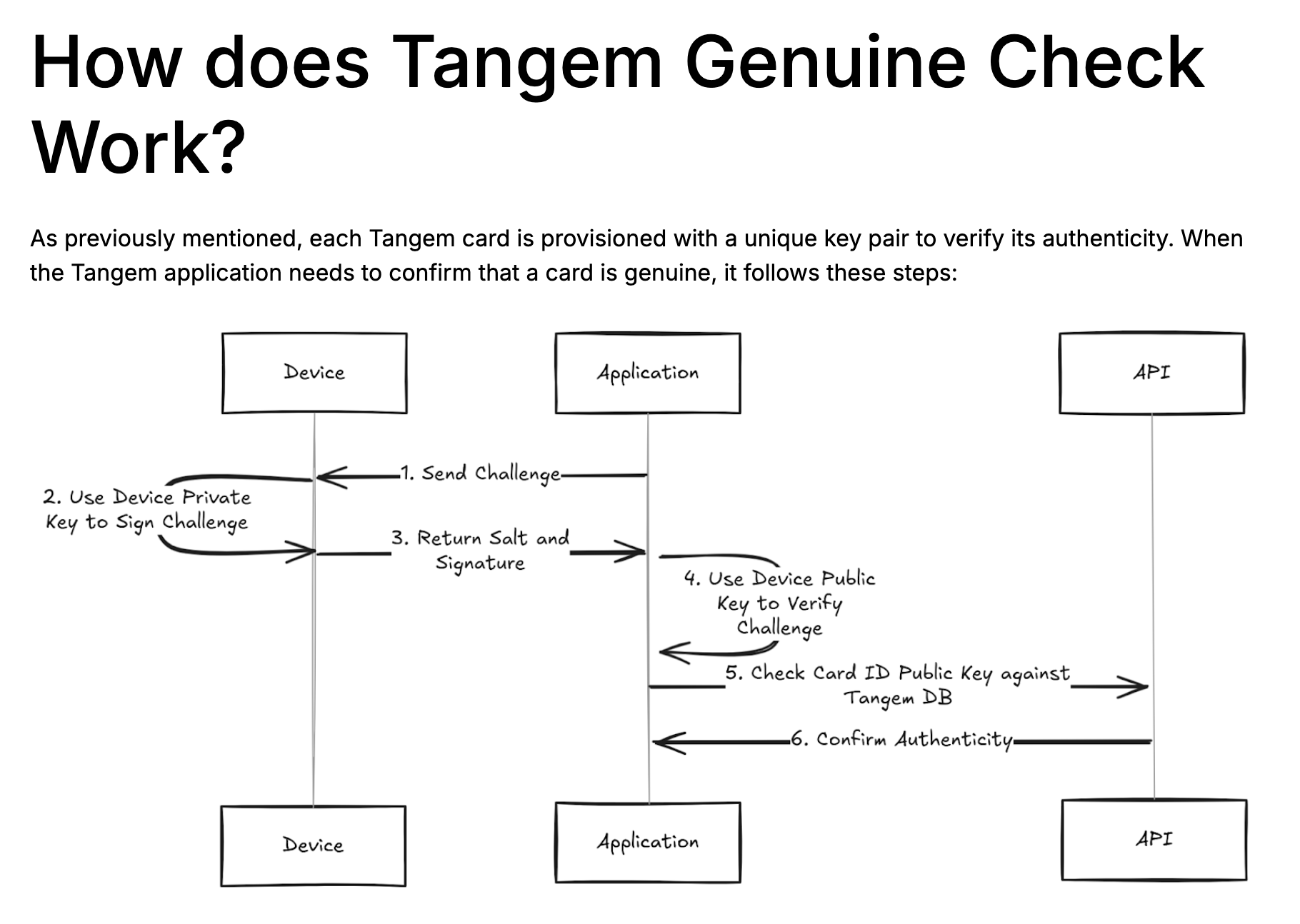

Security model & key management

The same beginner worries show up again and again Tangem card reviews: can someone drain my wallet if they steal my phone, scan my card, or if I simply lose access? In our opinion, Tangem’s security is less about “advanced crypto theory” and more about how you set it up in real life.

In practice, transactions require a physical tap with the card while the phone acts as the control panel. That is why we think most everyday failures come from weak access codes and sloppy backups, rather than sophisticated NFC-based attacks.

What we would do as a beginner (simple, actionable rules):

- Use a strong access code. Avoid short PIN style codes. A long, unique code is one of the biggest safety upgrades you can make.

- Create real backups and separate them. If you keep your backup card in the same bag as your main card, you do not really have a backup.

- Treat the card like a key, not like a bank card. Do not lend it, do not leave it unattended, and do not store it where someone can quietly grab it.

- If you enable any seed phrase options, protect them like cash. Write it down offline, never store it in screenshots, notes, or emails.

Common scenarios are where Tangem either feels reassuring or stressful, depending on how you prepared. If you lose your phone, the situation is usually not fatal as long as you still control your Tangem card or cards. You can install the app on a new device and keep going, because your crypto is not stored “inside” the phone.

If you lose one card, that is when the backup setup matters. With a backup card stored separately, a lost primary is mostly an inconvenience: you replace what you lost and move on. Without a backup, the same event can turn into a hard stop.

And if someone finds your card, the risk is not that they can magically read your funds through NFC. The real risk is sloppy access hygiene. In practice, your defense is simple: keep physical control of the card and use a strong access code so a casual thief cannot turn a found card into a spendable wallet.

One more important distinction: Tangem Wallet security is one thing, and Tangem Pay is another. Even if your wallet is self custody, a payments account can still follow card program rules (verification, possible restrictions, and standard compliance). We would keep these two layers separate in your head from day one.

Pros and cons

Tangem can be a surprisingly good fit for beginners, but only if you are choosing it for the right reason.

Strengths:

- A simpler self custody habit: If seed phrases stress you out, the backup card approach can feel easier to manage in real life. We think it works best when you treat your spare card like a house key and store it in a different place.

- Built for stablecoin spending, not trading: If your goal is to keep value in USDC and pay day to day, Tangem Pay is aligned with that use case. For many beginners, it is less intimidating than “sell crypto first, then spend.”

- Fast start with tap to pay: If you rely on Apple Pay or Google Pay, a virtual card setup can be convenient because you do not have to wait for plastic delivery.

Weaknesses:

- Not a rewards card right now: If cashback is your main reason to use a crypto card, we would not pick Tangem Pay today.

- Extra steps if your funds live elsewhere: Many users will hold USDT on Tron or ETH on mainnet. In that case, you should expect a swap or bridge step before spending, which adds friction and small network costs.

- FX can become the real fee: The card settles in USD, so frequent spending in EUR or other currencies may quietly cost more than you expect.

- Access depends on rollout: Availability can vary by country, so this is not a universal solution yet.

Trustworthiness check

Trust comes from two things: independent scrutiny and how a team reacts when real issues are reported. With Tangem, there is enough public material to form a practical opinion, but it is important to read it like a user, not like a marketer.

August 6, 2018 Independent code audit (Kudelski Security). Tangem commissioned a third party review of the smartcard wallet code. For us, this is a solid baseline signal because it is more credible than a self issued security claim. The nuance is scope: an audit reduces risk, it does not eliminate it.

December 2, 2023 Second audit reported (Riscure). Tangem published results of a firmware and embedded software focused audit. We like to see repeated external reviews over time, especially for products that depend on secure hardware behavior.

May 15, 2025 Ledger Donjon disclosure about an Android genuine check bypass, with a patch already shipped earlier. The practical takeaway is not the exploit details. It is a simple rule: keep the Tangem Android app updated (version 5.18.3 or higher includes the fix) and do not ignore authenticity checks. If you buy a card, we would also avoid random resellers and stick to official sales channels.

December 31, 2024 Tangem disclosure and fix of a log related issue tied to seed phrase mode. Tangem said this was a narrow edge case, but we still take the lesson seriously: if you ever use seed phrase features, treat logs and support attachments as sensitive. Better yet, update your app and avoid sending anything that could expose keys.

September 17, 2025 Ledger Donjon brute force related report versus Tangem response. We are not here to pick sides in a vendor dispute. We turn it into user action: do not use a weak access code. A long, unique code and good physical control of the card will matter more than almost anything else in day to day safety.

Finally, if you plan to use Tangem Pay, remember it is a separate, partner based card program. That is normal for Visa style spending products, but it means the payments layer can have compliance rules that do not apply to a pure self custody wallet.

Our takeaway: Tangem has a visible security trail (audits, disclosures, public responses). For beginners, keep the wallet layer and the Tangem Pay layer mentally separate, because the payment account follows card program compliance rules.

GNcrypto’s overall Tangem card rating

After testing Tangem with a 3-card family pack and Tangem Pay spending layer, the product delivered on self-custody simplicity (seedless backup setup in 5 minutes, wallet recovery in 2 minutes) and low spending costs (0.1% FX markup on €20 purchase). We rated it lower for rewards (zero cashback today), regional availability (Tangem Pay limited rollout), and cross-chain friction (USDT on Tron required a $2.80 swap+bridge to reach Polygon USDC). Strong for custody-focused users, weak for cashback chasers.

| Criterion | Score |

|---|---|

| Fees & Costs | 4.0 |

| Rewards & Cashback | 1.0 |

| Supported Currencies & Regions | 2.0 |

| Card Limits & Spending Controls | 3.5 |

| Security & Fraud Protection | 3.5 |

| User Experience & App Integration | 3.5 |

| Customer Support & Card Delivery | 3.0 |

| Total | 2.88 / 5 |

Methodology – why you should trust us

We score crypto payment cards using a weighted, seven category model and convert the results into a 1.0–5.0 rating in 0.1 steps. Our goal is not to impress you with theory. We focus on what actually affects beginners: total fees, whether the card works in your country, how easy it is to top up and spend, and how much control you get if something goes wrong.

How we collect data

- Public sources: fee schedules, card program terms, supported countries and top up assets, published limits, and documented security features.

- Hands on testing: we load the card with $200, make everyday purchases (including at least one foreign currency test), try an ATM withdrawal if available, check freeze and notification controls, and submit a support request to measure responsiveness.

We do not audit issuer solvency, make guarantees about financial stability, or promise regulatory compliance in every jurisdiction. These scores reflect practical usability and cost efficiency today, based on what we can observe and test.

Categories and weights

- Fees and Costs – 25%

- Rewards and Cashback – 20%

- Supported Currencies and Regions – 15%

- Card Limits and Spending Controls – 15%

- Security and Fraud Protection – 10%

- User Experience and App Integration – 10%

- Customer Support and Card Delivery – 5%

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.