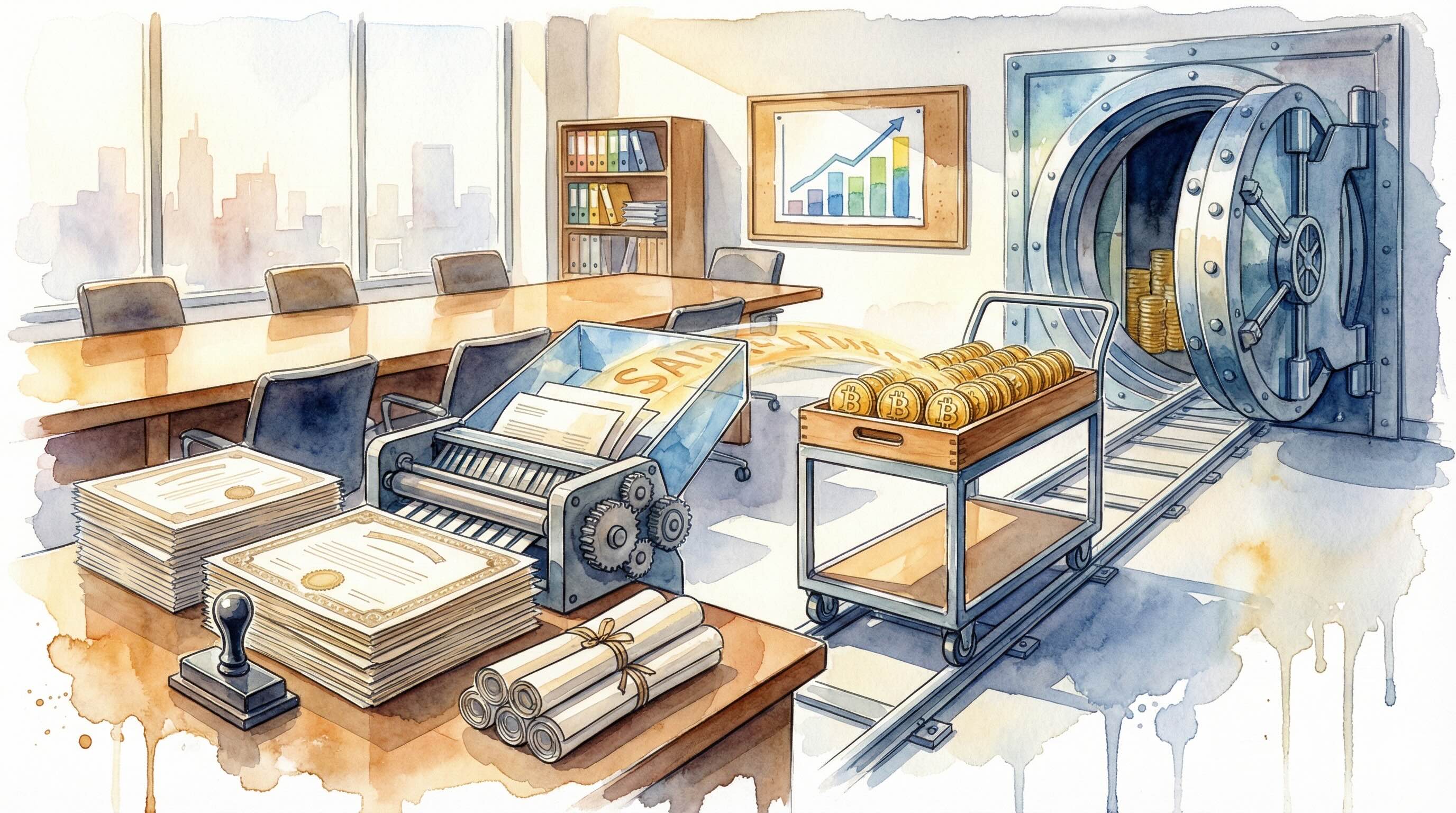

Strategy shifts to preferred stock to fund Bitcoin buys

Strategy CEO Phong Le plans to fund Bitcoin purchases with preferred shares after Stretch (STRC) closed at par, reducing reliance on common stock.

Strategy will lean more on sales of its Stretch preferred stock to fund Bitcoin purchases after Stretch (STRC) closed at its $100 par value on Wednesday, a level the company uses as a floor for new offerings, according to CEO Phong Le.

“We will start to transition from equity capital to preferred capital,” CEO Phong Le said Wednesday. Strategy plans to reduce issuance of common shares and rely on preferred proceeds to expand its Bitcoin holdings. Le expects Stretch to be an important financing tool this year for investors who want steady income and less exposure to common stock volatility.

Stretch is a perpetual preferred launched in July with an annual dividend of more than 11%. It is the company’s fourth perpetual preferred offering used to finance Bitcoin acquisitions. Le noted the program will “take some seasoning” and marketing to gain broader acceptance, and added, “throughout the course of this year, we expect Stretch to be a big product for us.”

STRC ended Wednesday at par for the first time since mid-January. Earlier this month the preferred slipped below $94 as Bitcoin fell under $60,000. Le called the return to par the “story of the day.” With Stretch back at $100-the minimum price the company has set for new sales-Strategy may restart offerings to fund additional Bitcoin purchases.

Strategy is not pursuing acquisitions of other digital asset treasuries. “I think in any new market, whether it be electric cars or AI or SaaS software, you want to focus on your core product,” Le added. “I think it would be a distraction to go buy, at a discount to net asset value, another digital asset treasury company.”

The company has used both common equity offerings and fixed-income-like instruments to build its Bitcoin position. The latest plan emphasizes preferred capital while limiting new common stock.

As we reported earlier, on February 5, 2026, CEO Phong Le told investors during the fourth-quarter results webinar that Bitcoin would need to fall to about $8,000 and remain there for five to six years before Strategy faced meaningful pressure servicing its convertible debt.

He said that at roughly a 90% drop from recent levels, the company’s Bitcoin reserve would be about equal to its net debt. In that scenario, Strategy would be unable to repay convertibles with its Bitcoin and would consider restructuring or raising capital through equity or additional debt.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.