Strategy funds $90M bitcoin buy with stock sales

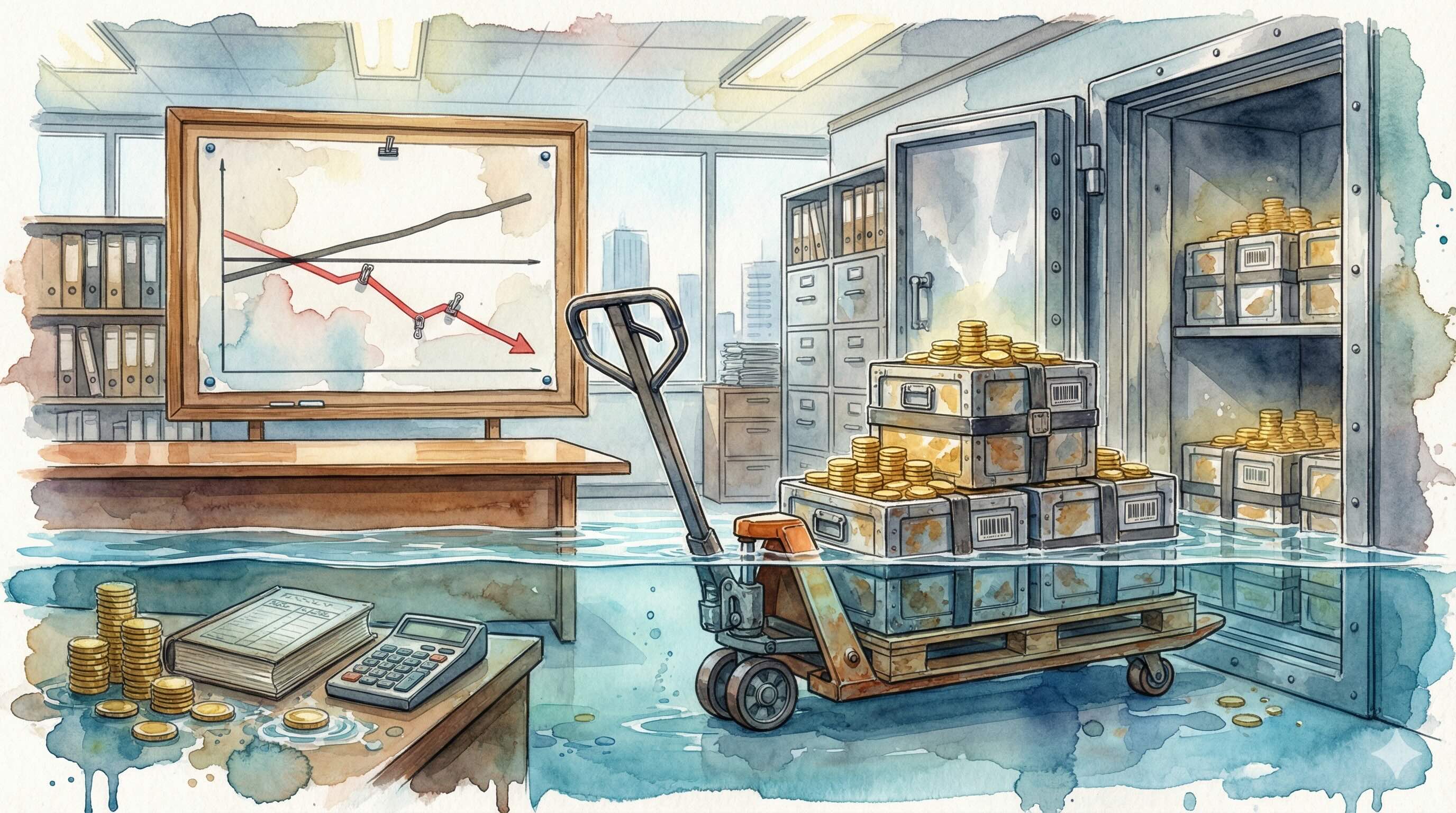

Strategy bought 1,142 BTC for about $90 million at an average $78,815 between Feb. 2 and Feb. 28, funded through at-the-market stock sales, an SEC filing shows; its bitcoin holdings remain below cost.

Strategy acquired 1,142 bitcoin for about $90 million at an average price of $78,815 per coin between Feb. 2 and Feb. 8, according to a Monday filing with the Securities and Exchange Commission. The company’s bitcoin holdings remain below their aggregate cost basis following recent price declines.

The purchases were financed with proceeds from at-the-market sales of its Class A common stock. Last week, Strategy sold 616,715 MSTR shares for approximately $89.5 million under that program, and it retains capacity to issue additional shares as needed.

Co-founder and executive chairman Michael Saylor hinted at the buying over the weekend by updating the company’s bitcoin acquisition tracker and posting, “Orange Dots Matter.”

The latest disclosure follows an update last Monday that Strategy had acquired an additional 855 bitcoin for roughly $75 million at an average price of $87,974 per coin. Despite continued accumulation, the overall position in bitcoin remains below total purchase cost at current market levels, resulting in unrealized losses.

Strategy reported a fourth-quarter loss on Wednesday tied to the decline in bitcoin prices, which reduced the reported value of its digital asset holdings on the balance sheet. On the earnings call, CEO Phong Le outlined an extreme downside in which a 90% drop in bitcoin to $8,000 would bring the company’s reserve in line with net debt.

Le put it this way:

“In the extreme downside, if we were to have a 90% decline in bitcoin price, and the price was $8,000, that is the point at which our bitcoin reserve equals our net debt, and we will not be able to then pay off our convertibles using our bitcoin reserve, and we’d either look at restructuring, issuing additional equity, issuing additional debt.”

Analysts at TD Cowen, Lance Vitanza and Jonnathan Navarrete, wrote Friday that Strategy has strengthened its standing as a corporate bitcoin holder and is positioned to participate in a potential recovery. On Monday, Bernstein analysts noted that while Strategy has used leverage to buy bitcoin, it has structured liabilities conservatively with long-dated perpetual preferred equity, cash reserves to cover dividends, and no major debt maturities until 2028.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.