Spot bitcoin ETFs post third straight day of outflows as investors pull nearly $400 million

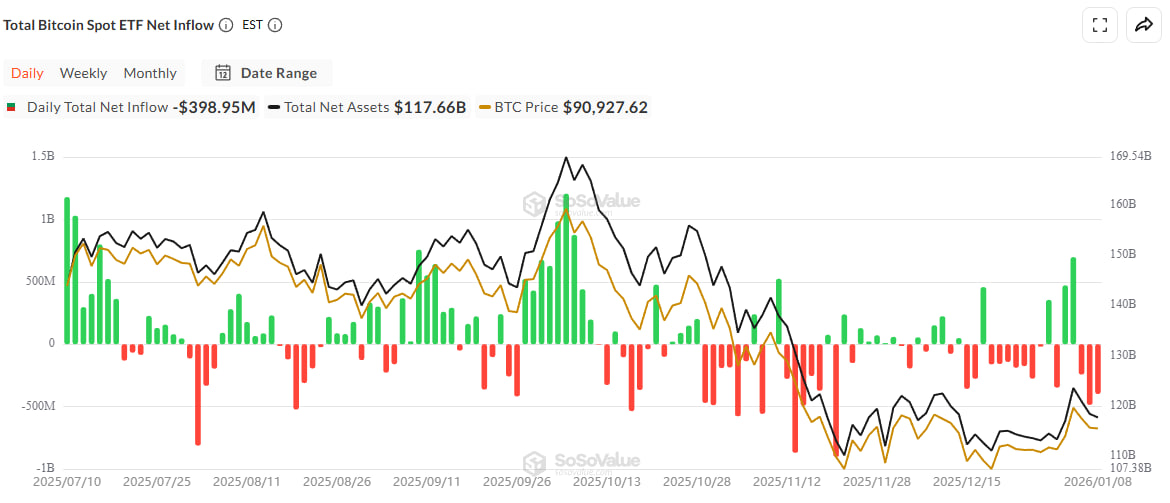

U.S. spot bitcoin ETFs logged another day of outflows, extending their negative streak to three sessions. According to SoSoValue, investors withdrew $398.95 million — another heavy wave of selling after the early-2026 rally.

The largest funds made up most of the outflows: BlackRock’s IBIT lost $193.34 million, Fidelity’s FBTC shed $120.5 million, and products from Ark & 21Shares and Grayscale also finished the day in the red.

Across three days, roughly $1.12 billion has exited bitcoin ETFs — almost the same amount investors added in the first two days of the year. The early wave of optimism has given way to caution, and flows now reflect broad position adjustments.

The outflows do not signal weakening institutional demand; they stem from technical factors — portfolio rebalancing, profit-taking after the January surge, and a short pause as the market consolidates.

The market remains in a steady consolidation phase: bitcoin is holding slightly above $90,000, and institutional buyers continue to provide a base layer of demand.

The same pattern appears in Ethereum products. Spot ether ETFs saw $159.17 million in outflows. BlackRock’s ETHA lost $107.6 million, while Grayscale’s ETHE shed $31.7 million. The parallel moves in BTC and ETH reflect a shared institutional strategy of trimming risk after a strong start to the year.

Some segments, however, saw renewed inflows. Spot XRP ETFs returned to positive territory with $8.72 million — after a $40 million outflow the previous day, their first negative session since launch. SOL ETFs also brought in $13.64 million, extending their streak of positive flows to eight days.

Despite the outflows, bitcoin’s price remains stable: it rose 0.26% over the past 24 hours to $90,660 after briefly dipping below $90,000. Ethereum slipped 0.54% to $3,104.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.