SoFi crypto wallet 2026: a unique deep-dive

GNcrypto analysts tested SoFi wallet to see what it has to offer to regular users like you and I. Here’s what we found out.

What SoFi crypto wallet is

Let’s start our SoFi crypto review with the nuts and bolts.

At its simplest, the SoFi Crypto Wallet is a custodial wallet built into the SoFi ecosystem. Unlike self-custody wallets where you hold the private keys, assets held in the SoFi wallet are under SoFi’s custody. That means SoFi, as the platform, technically controls the keys and manages the on-chain custody of coins on behalf of users.

This model is common among financial service providers that want to make crypto accessible without exposing users to the typical complexities of key management and blockchain mechanics.

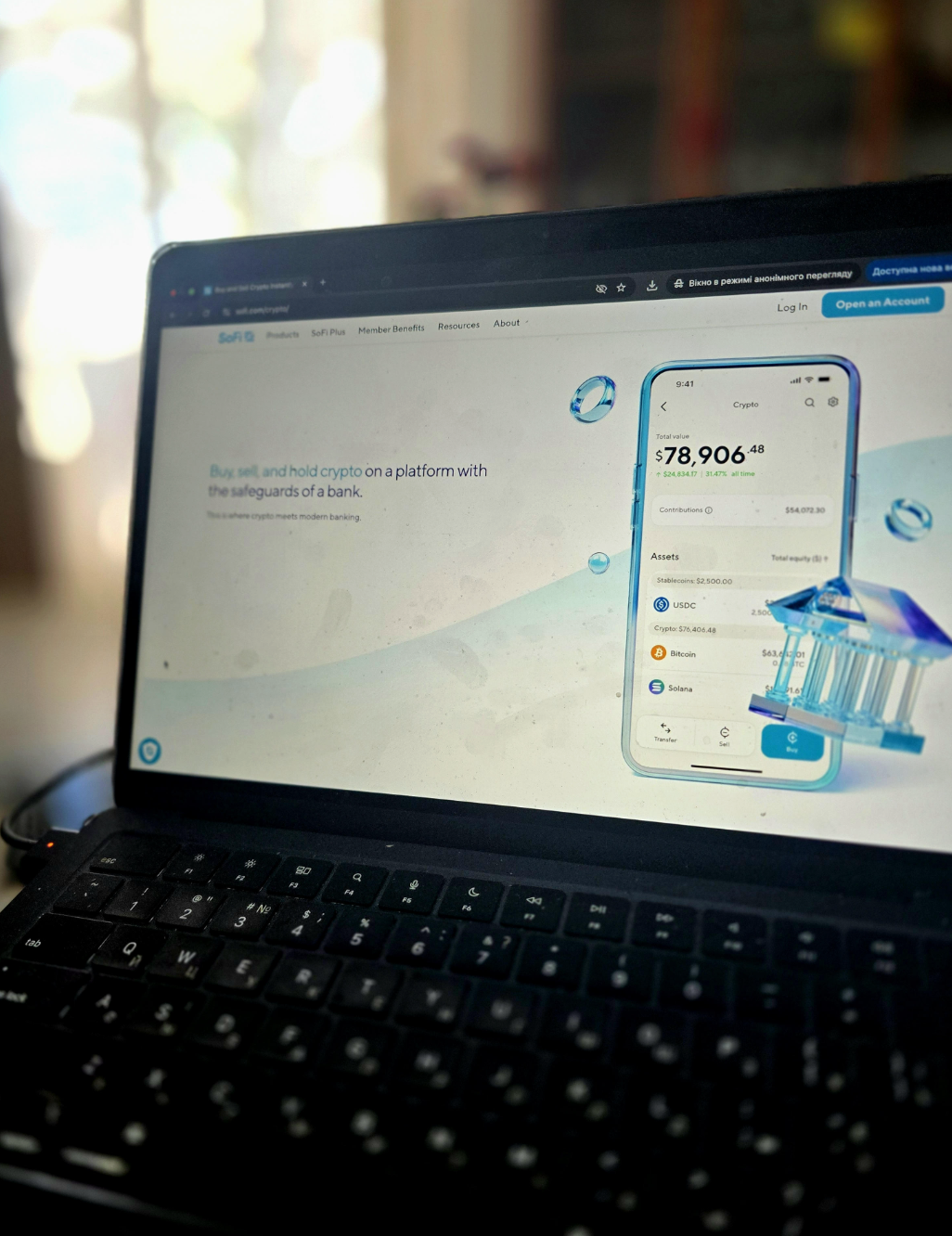

From a user’s perspective, the wallet feels like an extension of the existing SoFi app, a place to view crypto balances, buy and sell coins, and see simple performance charts. The wallet is not designed to be a stand-alone Web3 self-custody tool, nor does it function like a hardware wallet or browser extension wallet.

Importantly, you can hold crypto inside your SoFi account and view it in the SoFi app. Yet, SoFi remains the custodian of your crypto assets.

Overall, the wallet feels seamlessly integrated alongside SoFi’s banking, lending, and investing products. This places SoFi Crypto Wallet in a familiar position for users already comfortable with SoFi’s platform: it’s safe and simple, but not decentralized in the strict Web3 sense.

Testing process

We created a SoFi account and enabled crypto trading in under 5 minutes. Setup required linking a bank account and completing identity verification (Social Security number, driver’s license photo). No seed phrase or private key was provided – custody remained entirely with SoFi.

Buy test: purchased $100 worth of Bitcoin using a linked bank account. Transaction executed instantly at quoted price with 1.25% markup (effective cost: $101.25). BTC appeared in the portfolio immediately, but wasn’t available for withdrawal until the 7-day settlement cleared.

Sell test: sold $50 of Ethereum. Execution was instant, funds credited to SoFi cash balance within seconds. No network confirmation wait, no gas fees visible to users.

Withdrawal test: attempted to withdraw $25 in BTC to an external wallet after a 7-day hold period. Withdrawal required additional identity verification (2-factor authentication via phone). Minimum withdrawal: $10. Withdrawal fee: $2.50 (10% of transfer amount). Processing time: 6 hours before funds appear in the external wallet.

Portfolio integration: crypto holdings displayed alongside stocks and cash in a unified dashboard. Performance charts showed real-time price movements. No option to view on-chain transaction history or wallet addresses.

Recovery test: tested account recovery by logging out and resetting password. Recovery followed standard fintech process: email verification → security questions → new password. All crypto balances remained accessible after recovery. No seed phrase or private key management required.

Customer support: submitted support ticket asking about withdrawal limits. Response received in 26 hours via email with clear explanation of daily/weekly withdrawal caps based on account verification level.

Supported assets and core features

Having tracked the platform across multiple SoFi crypto reviews, we can confirm that its crypto wallet isn’t trying to be a comprehensive blockchain toolbox. Instead, it focuses on the most common crypto assets and basic functions most users care about.

Supported cryptocurrencies

SoFi supports a curated list of major digital assets. As of the latest platform listings, this includes: Bitcoin (BTC), Ethereum (ETH, Litecoin (LTC), Chainlink (LINK), Polygon (MATIC), Solana (SOL), other U.S.-accessible tokens (varies by regulatory eligibility).

This list covers the big names that most retail investors are familiar with, but it does not include the full universe of altcoins available on many centralized exchanges or self-custody wallets. Tokens on smaller chains or niche projects typically aren’t supported.

Buying and selling functionality

Within the wallet interface, SoFi provides instant buy/sell options for supported coins as well as price charts and simple performance metrics and cost and fee summaries before trade execution.

The experience is designed to feel more like stock trading than traditional crypto transactions, which is logical for users who think in terms of “positions” rather than on-chain transfers.

Sending and receiving crypto

This is where we noticed some limitations. SoFi’s wallet allows users to withdraw crypto to external addresses, but only after meeting certain conditions as withdrawal eligibility depends on account status and verification. Accordingly, some accounts require additional identity checks before withdrawals are enabled while withdrawal fees and minimums apply.

You can send crypto out of SoFi, but not as freely or seamlessly as you can with self-custody wallets, where you control keys and gas fees directly.

Portfolio & Integration

One of the strengths of SoFi’s wallet is that it sits alongside your banking suite, investing dashboard, and loan products.

This provides a unified view of your financial life, which appeals to users who prefer everything in one place.

Pros, cons & key limitations

Here’s how SoFi crypto wallet stacks up once you take a step back from the slick interface and look at the practical implications.

Strengths:

- Ease of use for beginners: because the crypto wallet lives inside the SoFi app, there’s no separate setup process. A user who already has a SoFi checking or investment account can buy crypto in a few taps – no browser extensions, no seed phrases to write down, no network settings to configure. For example, a first-time crypto buyer can purchase Bitcoin using the same linked bank account they use for stocks or savings, without learning how wallets or private keys work.

- Unified financial view: crypto holdings appear alongside stocks, ETFs, and cash balances in the same dashboard. A user logging into SoFi can see, in one place, how much they hold in cash, equities, and crypto rather than switching between an exchange app, a wallet app, and a bank app. For users who think in terms of net worth rather than wallet addresses, this unified view is a clear advantage.

- Custodial simplicity: SoFi removes much of the operational risk that trips up new crypto users. There’s no need to store a recovery phrase, no concern about losing access if a phone breaks, and no need to think about gas fees or blockchain confirmations. For example, if a user forgets their password, account recovery follows standard fintech procedures instead of permanent asset loss, a major difference from self-custody wallets.

- Instant buy/sell capability: buying and selling crypto on SoFi feels similar to placing a stock trade. Users see a price quote, confirm the transaction, and the position updates almost instantly in their portfolio. There’s no need to wait for blockchain confirmations or manually manage order routing. For users who primarily want exposure to Bitcoin or Ethereum price movements, this simplicity is appealing.

Weaknesses:

- Custodial model limits control: SoFi holds custody of crypto assets on the user’s behalf. That means users cannot sign transactions themselves or move funds independently of SoFi’s systems. For example, if SoFi temporarily restricts withdrawals due to compliance checks or account review, users must wait – there is no way to bypass the platform and move funds directly using a private key.

- Limited asset support: SoFi supports a relatively small set of major cryptocurrencies. A user interested in newer Layer 1s, DeFi governance tokens, or experimental projects will quickly hit a wall. For instance, someone wanting exposure to emerging ecosystems or niche tokens would need to open a separate exchange account or wallet elsewhere.

- Withdrawal restrictions and fees: while SoFi does allow crypto withdrawals to external wallets, the process is more controlled than with dedicated wallets. Users may need to complete additional verification, meet minimum withdrawal amounts, and pay withdrawal fees. Transfers can also take longer than sending funds directly from a self-custody wallet, where the user controls timing and fees.

- Not designed for Web3 interaction: SoFi Crypto Wallet cannot connect to decentralized. applications, NFT marketplaces, or DeFi protocols. A user cannot use it to stake tokens, swap assets on a DEX, mint NFTs, or interact with smart contracts. In practice, this means SoFi’s wallet functions as a buy-hold-sell account, not a gateway into the broader Web3 ecosystem.

Fee comparison

SoFi Crypto: 1.25% markup on trades. $100 BTC buy = $101.25 effective cost. Withdrawal: ~$2.00–$2.50 minimum fee + network gas. Note: SoFi Plus members currently get a 1% match in stablecoins, potentially cutting the effective buy fee to 0.25%.

Coinbase Wallet (Base App): ~0.5% spread + $2.99 fixed fee on $100 orders. $100 buy = ~$103.50 total. Effective cost is higher than SoFi’s base rate due to the flat fee, making it expensive for smaller “casual” purchases.

Robinhood Crypto: 0.35%–1% dynamic spread based on volatility. $100 buy = ~$100.35–$101. Still the price leader for retail, though it lacks the integrated banking “all-in-one” convenience that SoFi provides to its account holders.

Cash App: dynamic spread ~1.75%–2.5%. $100 BTC buy = ~$101.75–$102.50. High cost, but offers “free” standard withdrawals (within 24h), which can be cheaper than SoFi’s $2.50 minimum for small-time stackers.

Verdict: SoFi’s 1.25% fee is competitive if you are a “Plus” member earning the 1% match. However, the $2.50 withdrawal floor remains a barrier for micro-investors: a $25 transfer carries a 10% penalty, while a $250 move costs only 1%.

Trustworthiness check

Trust is a central issue for any crypto wallet – but it becomes even more important when the wallet is fully custodial and embedded inside a traditional financial platform. Here’s how SoFi Crypto Wallet stacks up from a trust and risk perspective.

Regulatory history and restart

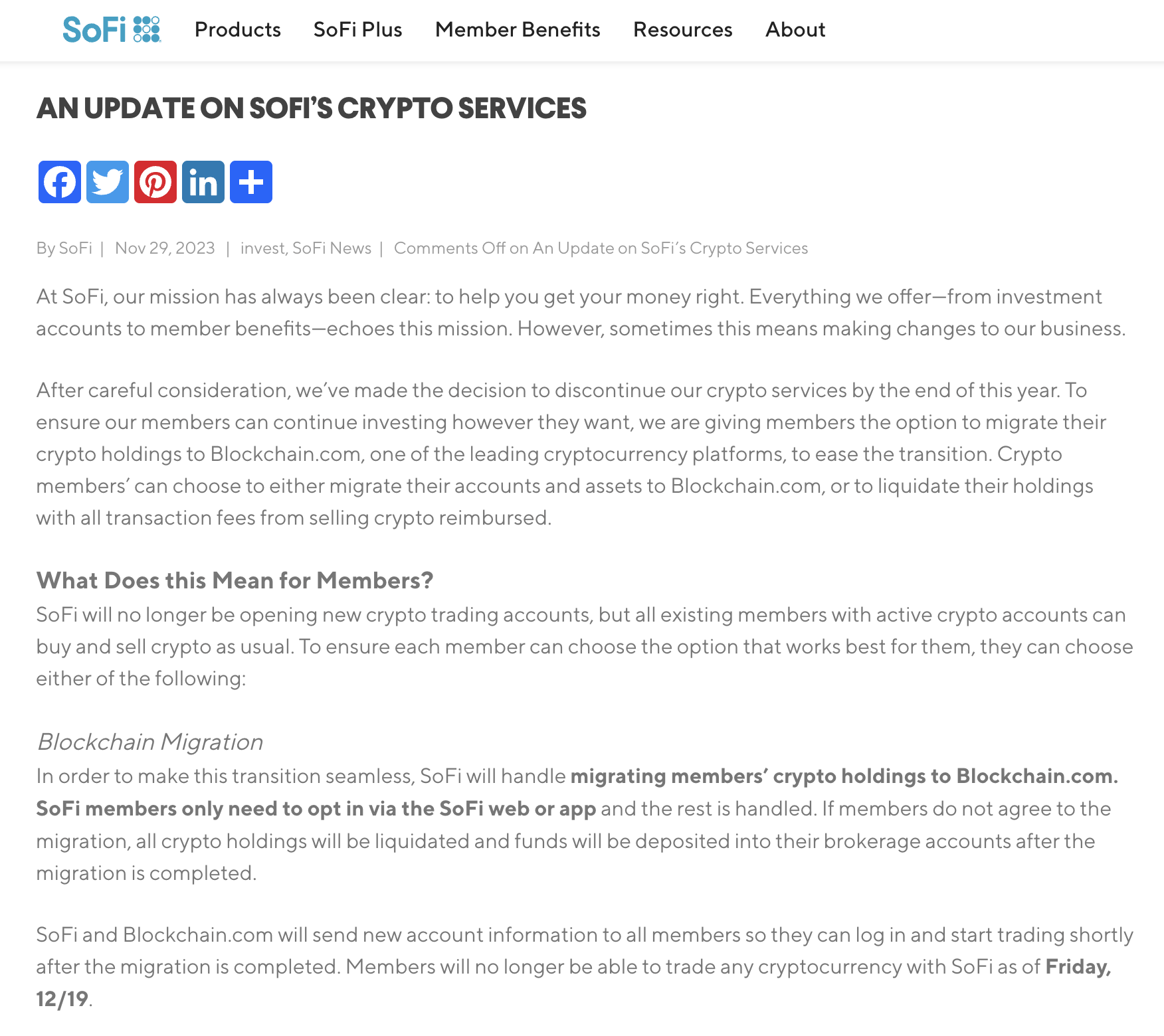

SoFi originally launched cryptocurrency trading in 2019 through a partnership with Coinbase. In late 2023, the company discontinued all crypto services as a condition for receiving its national bank charter from the Office of the Comptroller of the Currency (OCC). Customers were required to either liquidate holdings or migrate them to third-party platforms like Blockchain.com.

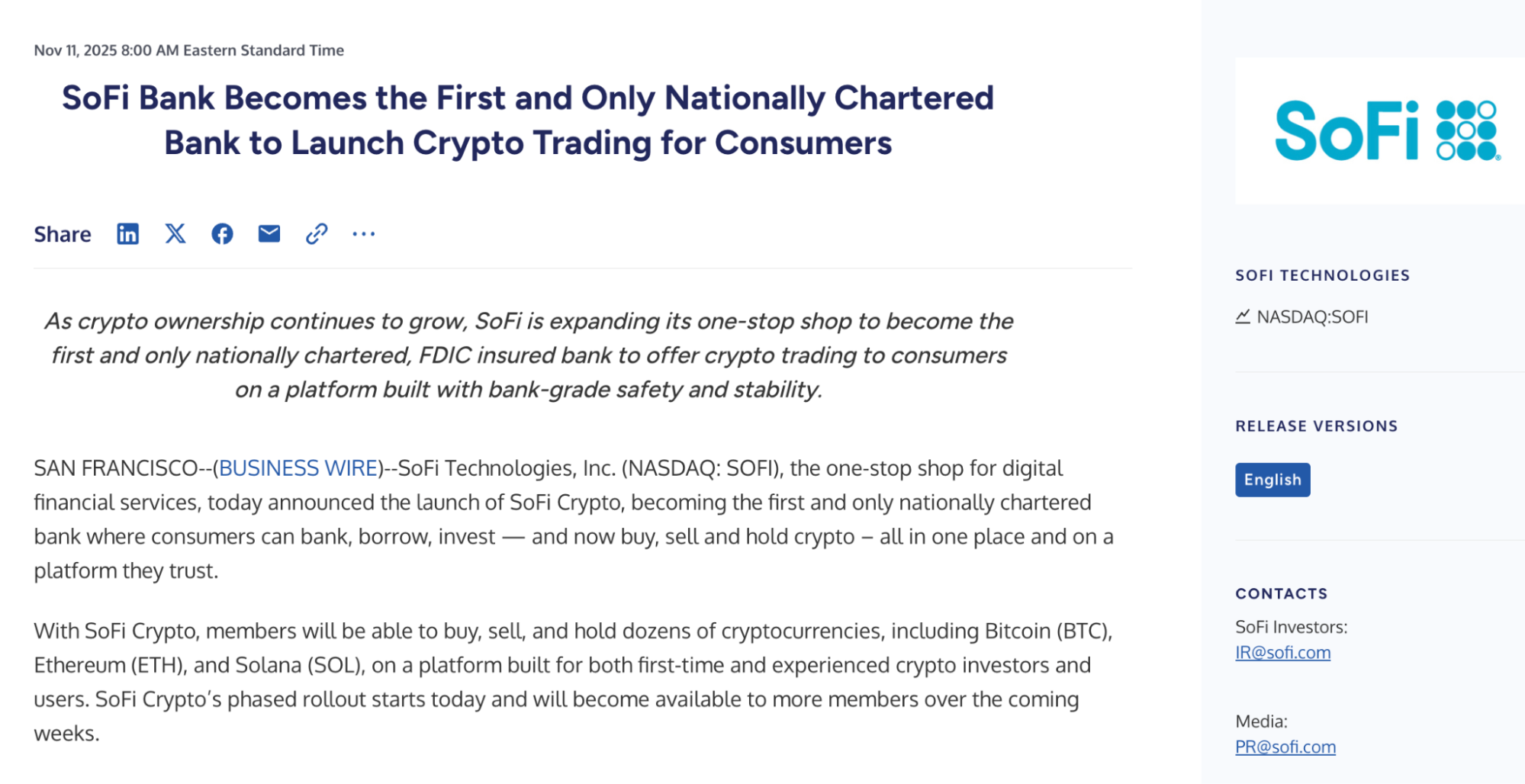

In November 2025, SoFi relaunched crypto trading under changed regulatory guidance, becoming the first nationally chartered U.S. bank to offer retail customers the ability to buy, sell, and hold cryptocurrencies directly within a banking app. The restart followed new OCC guidance issued in May 2025 and broader regulatory shifts under the Trump administration’s crypto-friendly policies.

This history matters because SoFi Crypto is now operating directly through SoFi Bank, N.A., with full regulatory oversight – unlike its previous partnership-based model. The service is designed for compliance with federal banking standards, though crypto assets remain uninsured by FDIC.

Company & custodial model

SoFi Crypto Wallet operates as a fully custodial wallet. Unlike hybrid or self-custody wallets, users do not control private keys at any point. All crypto assets are held and managed on the user’s behalf by SoFi and its custody partners.

SoFi (or its designated custodians) controls the private keys. Users access crypto balances through their SoFi account, not a standalone wallet, and transactions are authorized at the account level rather than via user-held cryptographic keys.

This places SoFi Crypto Wallet firmly in the traditional custodial trust category, closer to a brokerage account than a Web3 wallet.

The trade-off is straightforward: simplicity, reduced user error, no key management burden vs. no direct asset control, full reliance on SoFi as custodian.

Users are trusting SoFi’s operational security, internal controls, and policies in much the same way they trust a bank or brokerage.

Security & fund protection

From a conventional security standpoint, SoFi Crypto Wallet is designed to minimize user-side risk. No private keys or seed phrases for users to lose or expose, strong account-level security including login protections and identity verification, and custody is handled through regulated or institutional-grade crypto custodians.

No widely reported incidents of large-scale user fund losses have been directly attributable to SoFi Crypto Wallet.

However, custodial safety comes with limitations. Users are exposed to platform-level risk, not just personal security risk. Access to funds depends on account standing, verification status, and SoFi policies while withdrawals and transfers can be restricted or delayed under certain conditions.

Unlike self-custody wallets, users cannot independently move assets if the platform restricts access.

Recovery & control trade-offs

Recovery is simple but it comes at the cost of autonomy. Because SoFi controls custody users do not risk permanent loss due to forgotten seed phrases while account recovery follows familiar fintech processes (identity verification, support workflows).

However, users cannot restore funds in another wallet independently, and access is inseparable from the SoFi account. Control can only be limited by compliance, account reviews, or operational changes.

This model prioritizes consumer protection and ease of recovery over decentralization.

Regulatory context

SoFi operates as a U.S.-based, regulated financial services company, which shapes how its crypto wallet is perceived from a trust perspective.

SoFi itself is subject to U.S. regulatory oversight as a financial institution; crypto assets held in the wallet are not insured like bank deposits, and there is no SIPC or FDIC protection for crypto balances.

That said, compared to offshore crypto platforms, SoFi benefits from operating within U.S. compliance frameworks, clearer legal accountability, and established consumer protection norms.

Trust here is legal and institutional rather than cryptographic.

Transparency & reputation

SoFi has a long-standing reputation as a mainstream fintech company serving millions of users across banking, lending, and investing. Its crypto wallet benefits from established corporate governance, public company disclosures and scrutiny, and integration into a broader financial platform with reputational risk.

User sentiment around SoFi Crypto Wallet generally emphasizes ease of use, familiarity for traditional investors, and perceived safety compared to standalone crypto platforms.

Criticism most often focuses on lack of self-custody, limited withdrawals and transfer restrictions, and narrow asset support compared to exchanges.

Notably, concerns tend to be about control and flexibility, not security failures.

Overall trust assessment

SoFi Crypto Wallet is not trustless, and it does not attempt to be. It is explicitly custodial and positioned as a crypto extension of a regulated financial platform.

- If your definition of trust is direct control, self-custody, and independence, SoFi Crypto Wallet will not meet that standard.

- If your definition of trust is institutional accountability, user protection, and operational stability, SoFi performs relatively well.

GNcrypto’s overall SoFi Wallet rating

After testing SoFi Crypto Wallet with real purchases, sales, and withdrawals, the platform delivered exceptional ease of use (5-minute setup, instant buys/sells) and strong account recovery (standard fintech password reset).

We rated it highly for user experience and recoverability but noted that the custodial model eliminates private key control, withdrawals face 7-day ACH holds and $2.50 minimum fees (10% on small transfers), asset selection is limited to ~20 major tokens, and there’s zero Web3 functionality (no dApp connections, no DeFi, no NFTs).

| Criteria | Weight Score (1-5) | Notes |

|---|---|---|

| Security & Key Management (25%) | 4 | SoFi Crypto Wallet is fully custodial by design. Users do not manage private keys, seed phrases, or signing logic themselves; instead, custody is handled by SoFi and its institutional crypto custody partners. From a mainstream safety perspective, this significantly reduces the most common causes of crypto loss – forgotten seed phrases, phishing, and accidental key exposure. For users accustomed to banks and brokerages, this model feels familiar and reassuring. The trade-off: users do not have cryptographic ownership of their assets and cannot independently authorize transactions outside the SoFi platform. Control is account-based rather than key-based. For crypto-native users, this is a meaningful limitation; for traditional investors, it is often a feature rather than a flaw. |

| Supported Assets & Networks (20%) | 3 | SoFi supports a limited but carefully curated list of major cryptocurrencies, including assets such as Bitcoin, Ethereum, and a small selection of other large-cap tokens available to U.S. users. This approach prioritizes regulatory clarity and simplicity over breadth. While sufficient for users seeking exposure to well-known assets, it falls short for anyone interested in smaller altcoins, emerging ecosystems, and tokens used in DeFi or on-chain applications. There is no multi-network management in the Web3 sense. Assets are held within SoFi’s custodial system rather than managed across native blockchains by the user. |

| Transaction Costs & Speed (15%) | 3.5 | Trading speed within SoFi Crypto Wallet is fast and predictable, as transactions are executed through SoFi’s internal systems rather than directly on-chain by the user. Costs are transparent at the point of trade, but users do not have granular control over network fees or transaction routing. Withdrawals to external wallets – where supported – may involve minimum thresholds, processing delays, and additional fees. Compared to self-custody wallets, users trade flexibility for convenience and simplicity. |

| User Experience & Interface (15%) | 4.5 | This is one of SoFi Crypto Wallet’s strongest categories. The interface is clean, intuitive, and tightly integrated with SoFi’s broader banking and investing tools. Crypto holdings appear alongside stocks, ETFs, and cash balances, reinforcing the idea that crypto is just another asset class rather than a separate ecosystem. Buying, selling, and tracking performance feels familiar to anyone who has used a modern investment app. Customization is limited, but for the target audience, clarity and simplicity clearly take priority. |

| DeFi & dApp Integration (10%) | 1.5 | SoFi Crypto Wallet does not support DeFi protocols, dApps, NFT marketplaces, or on-chain interactions. There is no wallet connection functionality, no smart contract approvals, and no Web3 signing. This is an intentional design decision rather than an oversight. SoFi positions crypto as an investment product, not a gateway into decentralized applications. For users interested in Web3, this is a hard stop. For users who only want price exposure, it may not matter at all. |

| Recovery & Backup Systems (10%) | 4.5 | Recovery is straightforward and user-friendly. Because SoFi controls custody: users do not risk permanent loss from forgotten seed phrases account recovery follows familiar fintech processes (identity verification, customer support) This dramatically lowers the risk of catastrophic user error. The downside is dependency: access to funds is inseparable from the SoFi account and subject to its policies and compliance requirements. This model favors consumer protection and recoverability over independence. |

| Customer Support & Educational Resources (5%) | 4.0 | SoFi benefits from a mature customer support infrastructure and extensive educational content aimed at retail investors. While crypto-specific education is relatively high-level, support channels are clear and accessible. Compared to crypto-native wallets, SoFi offers stronger general customer support, but less depth on blockchain mechanics – which aligns with its intended audience. |

| Final score | 3.8 | SoFi Crypto Wallet scores well on security, usability, and recoverability, but intentionally underperforms on decentralization, asset breadth, and Web3 functionality. |

Who SoFi Crypto Wallet fits based on testing

Based on hands-on review of account setup, buying and selling crypto, withdrawals, and day-to-day portfolio management, SoFi Crypto Wallet is clearly built for a mainstream, finance-first audience, not for crypto-native or Web3-focused users.

Best for: users who already use SoFi for banking, investing, or loans and want simple crypto exposure in the same app; beginners who value ease of use, familiar fintech workflows, and not having to manage private keys or seed phrases; long-term, low-frequency investors who primarily want to buy, hold, and occasionally sell major cryptocurrencies; and users who prefer a regulated, U.S.-based platform with clear accountability over navigating self-custody tools.

Skip if: you want true self-custody and direct control over private keys; you actively use DeFi, NFTs, or Web3 applications; you need unrestricted, on-demand withdrawals and on-chain flexibility; you trade a wide range of altcoins beyond major assets; or you are uncomfortable with a fully custodial model where access to funds depends on platform policies and account status.

Bottom line: SoFi Crypto Wallet fits users who see crypto as part of a broader financial portfolio, not as a standalone on-chain ecosystem. It prioritizes simplicity and institutional trust over flexibility and decentralization – and works best for investors who are comfortable with that trade-off.

Methodology – why you should trust us

We use a weighted, category-based model, collect standardized data from each platform (open data + hands-on testing), and convert that into a 1.0–5.0 star score in 0.1 increments.

Our focus: Can you store assets safely, transact efficiently, and access DeFi without exposing your keys to unnecessary risk?

We don’t audit wallet code or guarantee security against all attack vectors. These scores reflect usability, feature completeness, and observable security practices – not absolute protection from exploits.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.