Polymarket CEO Shayne Coplan: the king of blockchain predictions

Shayne Coplan might not be the crypto’s household name, but his project, Polymarket, is a real game changer.

Who Shayne Coplan is

Shayne Coplan is the founder and CEO of Polymarket. He is the creator of a blockchain-based prediction market platform that has become one of the most visible experiments in turning collective belief into measurable probabilities.

Yet, he’s not exactly your average crypto figure. Unlike many others, he belongs to a generation of Web3 entrepreneurs focused less on hype and more on the technicalities of it all.

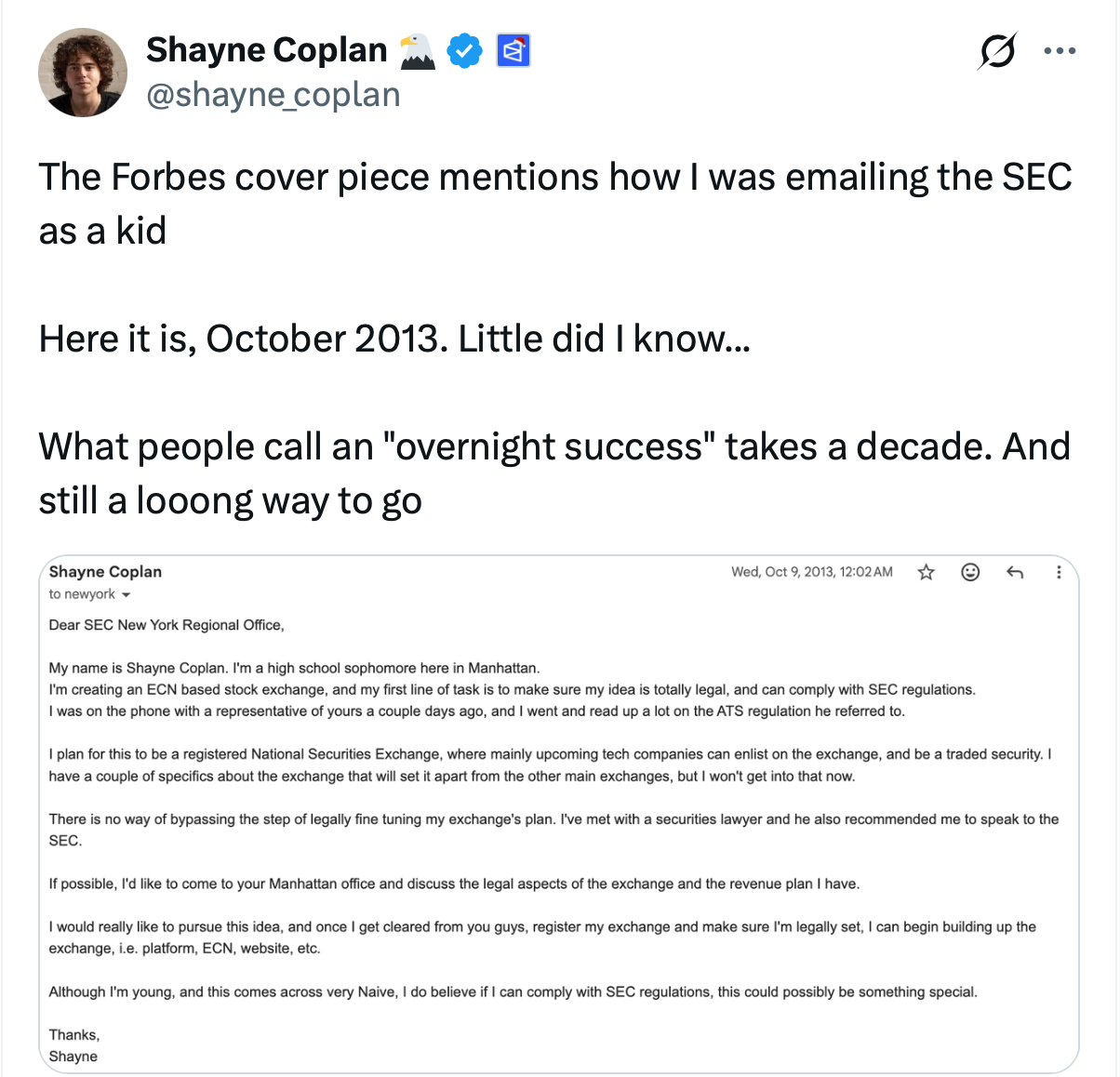

Born into a Jewish family in NYC, Coplan studied computer science at New York University before dropping out to pursue his interests in cryptocurrencies and prediction markets. He demonstrated his entrepreneurial skills early on.

At the age of 15, he reached out to the U.S. Securities and Exchange Commission (SEC), saying that he was “creating a ECN based stock exchange” and thus making sure that it would comply with the SEC regulations already at that stage.

Just a year later, at 16, he participated in the Initial Coin Offering (ICO) of Ethereum, the then little-known project-turned-crypto-behemoth. At the time, ETH was sold for just $0.3–$0.4 apiece.

Despite having a prolific start and some failures, which almost forced him to sell off his belongings to pay rent for his Manhattan flat, Coplan does not position himself as a commentator or influencer. He prefers to focus on building systems that challenge how information is produced and evaluated. This approach earned the community’s respect, shaping Shayne Coplan Polymarket public image and his role as a builder operating at the intersection of crypto, data, and real-world events.

Creating Polymarket

Polymarket CEO Shayne Coplan didn’t give birth to his blockchain baby out of the blue.

His inspiration came from economist Friedrich Hayek’s theories on decentralized information systems and George Mason University professor Robin Hanson’s work on Futarchy.

It was also powered by his belief that markets often outperform polls and expert forecasts when it comes to predicting outcomes. Traditional prediction tools, he has argued, tend to reward confidence or visibility rather than accuracy. Markets, by contrast, create incentives to be right.

At the peak of the coronavirus pandemic in 2020, he finally launched Polymarket, which began as a relatively small project within the crypto ecosystem, built on blockchain infrastructure to allow transparent settlement and open participation.

Early development focused on usability, liquidity, and speed, key challenges for any market-based system tied to real-world events. As well as clearly defined questions with verifiable outcomes.

It’s the most accurate thing we have as mankind right now, until someone else creates some sort of a super crystal ball,

– he said when commenting on Polymarket’s predictive performance.

Coplan has explained that the goal was never to build a gambling product, but rather a forecasting engine powered by incentives.

You make money if you’re right. You lose money if you’re wrong,

– he stressed.

That distinction shaped how Polymarket was designed and how it positioned itself publicly, especially as interest in prediction markets began to resurface in the Web3 space.

Growth of Polymarket

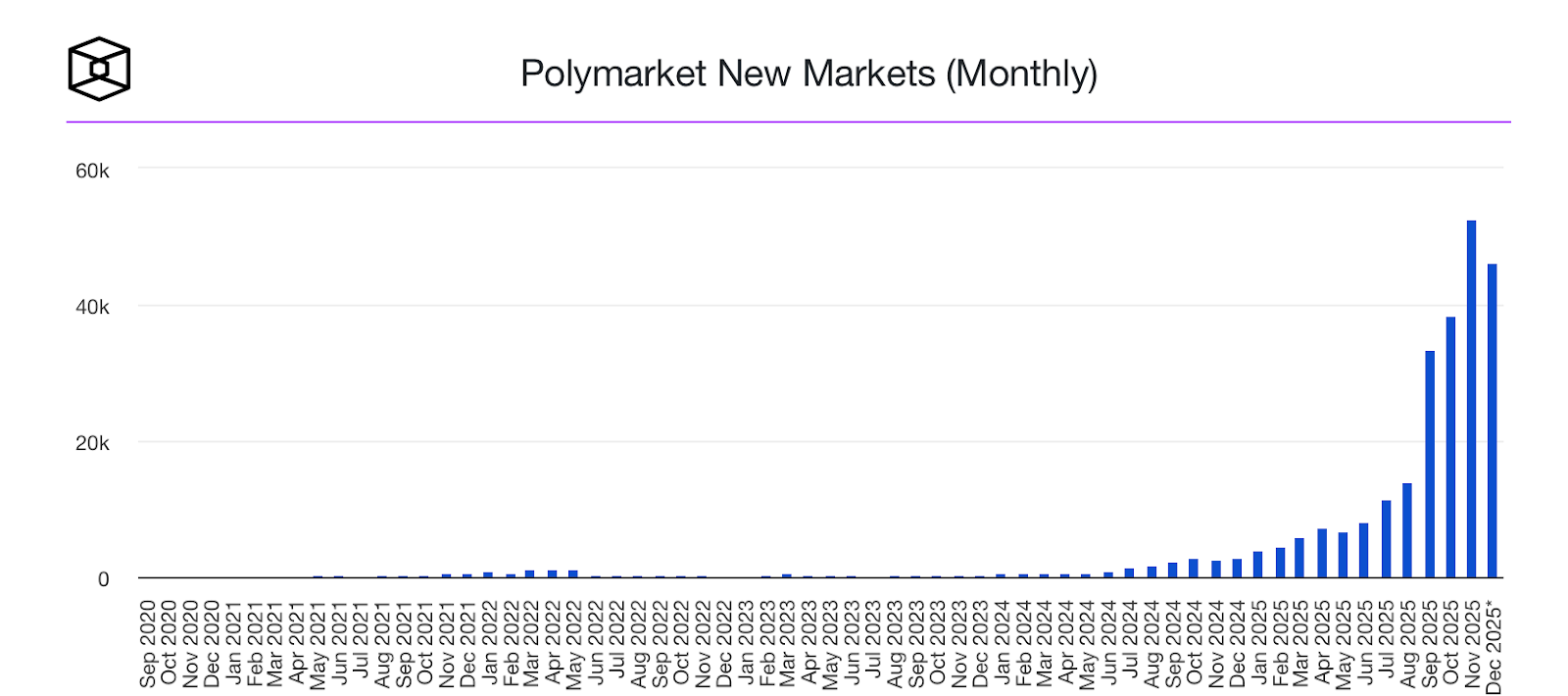

Predictions spike when there’s something to predict. That’s exactly what happened to Polymarket, the growth of which closely followed major political and economic events worldwide.

This is all too clear when you look at the Polymarket’s growth chart over the years. At first, Polymarket enjoyed a minuscule user base, with some noticeable activity in early 2022, reflecting the audience’s response to the start of Russia’s full-scale war on Ukraine.

But the real growth is observable from 2024 and onward. All thanks to the U.S. presidential election, where then–Vice President Kamala Harris faced now-President Donald Trump.

This event proved to be a turning point for Polymarket. On election day alone, Nov. 5, 2024, the volume of “who will be the next president” bets hit $1.8 billion, with users placing more than $3 billion overall. Already in December 2024, Polymarket hit a record 314.5K active traders with $9B trading. Meanwhile, in 2025, data from Dune Analytics shows that open contract volume on the prediction market Polymarket has risen steadily throughout the year, recently reaching an annual high of around $326 million. That figure represents a 170% increase from the start of the year, when open interest stood at roughly $120 million.

It is therefore no wonder that Polymarket began appearing more frequently in media coverage (alongside estimations of Shayne Coplan net worth and questions like is Polymarket legit), often cited as a real-time indicator of how participants assessed the likelihood of specific outcomes.

Coplan has described this evolution as organic rather than engineered.

Public attention & industry scrutiny

Shayne Coplan Wikipedia page doesn’t offer much life detail. But it is safe to say that Polymarket’s ascension attracted a lot of attention from the general public and the regulators too, and not just due to occasional accusations of whale interference.

This especially holds for the U.S. presidential election in 2024, which was marred by a major Polymarket controversy. A week after Trump’s victory, FBI agents searched Coplan’s flat and seized electronic devices as they suspected that the platform had unlawfully allowed Americans onto its platform after the Commodity Futures Trading Commission (CFTC) previous fine and ban.

Coplan insisted that this was “Biden’s revenge”, noting that the project was non-partisan. Still, he never framed scrutiny as antagonistic and avoided inflammatory rhetoric, instead emphasizing dialogue and long-term thinking. Instead, he often described it as a sign that prediction markets are being taken seriously, saying that he’s building infrastructure and infrastructure takes time to understand – and time to regulate properly.

He also noted that new products are bound to be met with a certain degree of skepticism while also emphasizing that if people are paying attention, it means the tool matters.

Thanks to this approach, Polymarket managed to remain part of mainstream discussions about forecasting and information, not a fringe experiment with dubious reputation.

Net worth & professional influence

Polymarket CEO Shayne Coplan’s net worth is not publicly disclosed, and that’s nothing unusual for the industry.

Nonetheless, it is clear that the man who once bought ETH at $0.3-0.4, now traded at just above $3K, and is in charge of a company that’s growing by the day, is more than financially solvent.

However, focusing solely on financial metrics misses the broader scope of his influence.

Coplan’s professional impact lies in reintroducing prediction markets as a serious analytical tool for the digital age. His hard work, belief in burgeoning technology, and the desire to combine the complex with the mundane, like real-world forecasting, helped push Web3 beyond speculation and toward practical applications in information discovery – all in line with his core belief that markets are essentially stories people tell with capital.

Today, Polymarket is frequently referenced alongside traditional forecasting tools, not as a replacement but as a complementary signal. That positioning reflects Coplan’s broader vision: a future where decentralized systems help surface insight rather than noise.

And yes, Coplan dreams big. In his recent interview with Anderson Cooper’s 60 Minutes, he confirmed that Polymarket is eyeing 1 billion users in the next five years.

Until that happens, the “job is not done,” Coplan concluded.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.