How do Prediction Markets work on Robinhood in 2026: easy guide

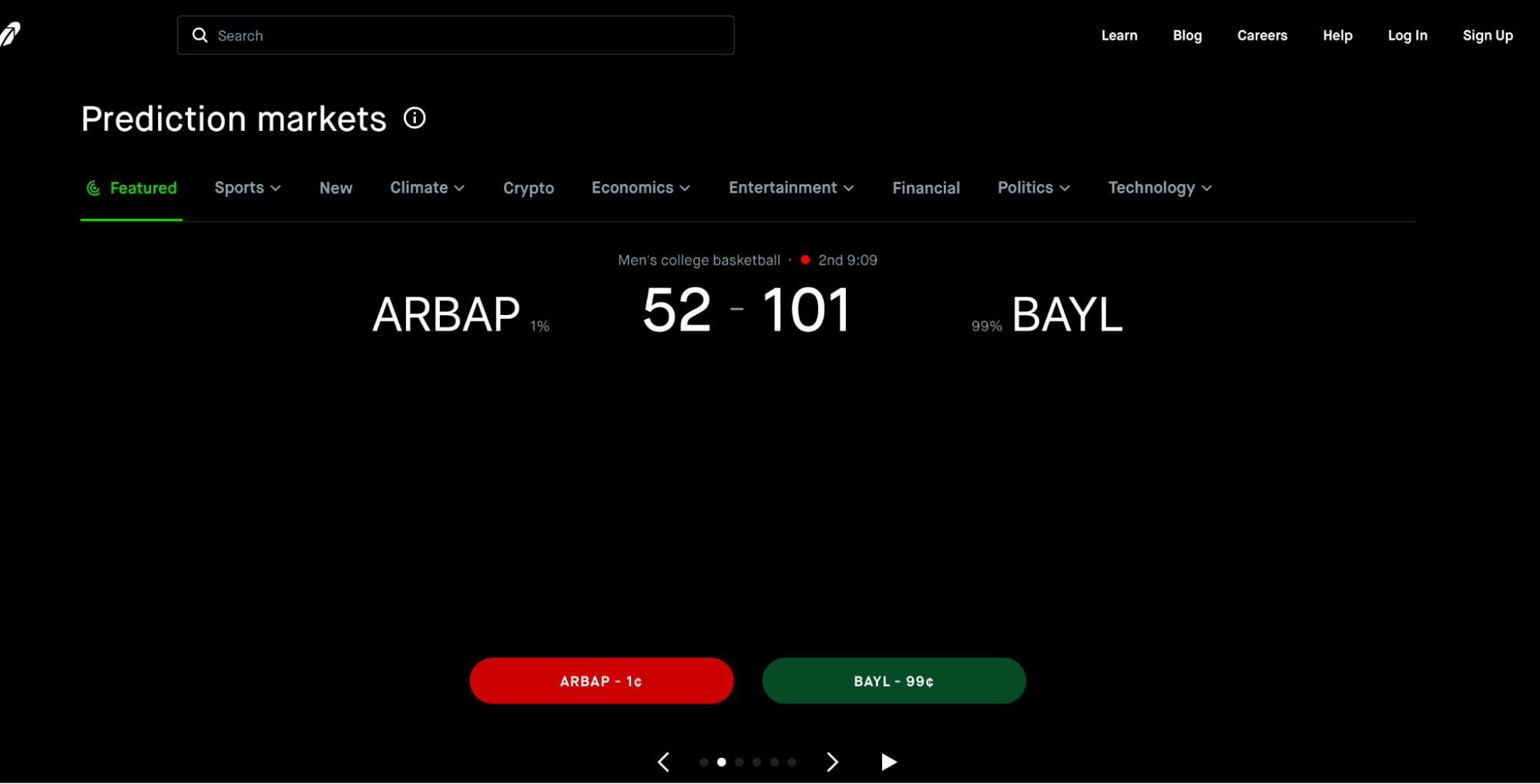

Robinhood’s prediction markets cater to regular users looking to trade on real-world events. Think elections, big financial events, and major news developments. These are not traditional exchanges or sportsbooks. They are essentially contracts that are structured as event-based instruments offered through CFTC-regulated partners like Kalshi. The Robinhood app integrates prediction markets directly into its existing interface (we tested it with $200).

Robinhood prediction markets overview

We funded a Robinhood account with $200 to test prediction markets over 5 days (December 2-6, 2025), focusing on usability, pricing transparency, and execution quality. We traded 8 contracts across 3 event categories: elections (2 contracts), economic indicators (3 contracts), and sports outcomes (3 contracts).

Contracts are priced between $0 and $1, representing the market’s implied probability of an event occurring. For example, we bought a “Federal Reserve cuts rates in December” contract at $0.67, implying a 67% market-assessed probability.

What we found:

Execution: All 8 orders filled instantly with no slippage. Contract prices updated in real time as news broke (we saw a Fed-related contract move from $0.62 to $0.71 within 3 minutes of a Powell speech).

Spreads: Major events (Bitcoin price milestones, NFL Wild Card predictions) showed 0.01-0.02 spreads ($0.01-$0.02 difference between buy/sell prices). Niche events (specific sports game outcomes) showed wider spreads of 0.04-0.06.

Final result: We closed 5 positions, kept 3 open. Closed positions: $200 → $218.40 (+9.2%). We withdrew $215 to test withdrawal flow (processed in 2 business days to linked bank account).

Key platform features (prediction markets)

- Simple yes/no event contracts tied to real-world outcomes

- Clean, intuitive interface integrated into the Robinhood app

- Transparent pricing with defined maximum risk

- No traditional trading commissions

- Regulated structure via approved partners

- Mobile-first experience with real-time updates

Pros and cons of using Robinhood’s prediction markets

We tested Robinhood’s Prediction Markets for several days in a row and are ready to share the key pros and cons of this exchange. Here they’re.

Strengths:

- Regulated structure: Robinhood’s prediction markets operate through CFTC-regulated partners such as Kalshi, so you can relax when it comes to legality.

- Simple, beginner-friendly experience: The interface is clean, intuitive, and fully integrated into the existing Robinhood app. Navigation matches Robinhood’s stock trading flow.

- Clear pricing model: There are no traditional trading commissions. Costs are reflected through contract pricing and spreads, making it easy for users to understand potential outcomes and maximum risk upfront. We tested this: On a “Will candidate X win state Y?” contract priced at $0.58, our maximum risk was exactly $0.58 per contract ($58 for 100 contracts), and maximum gain was $0.42 ($42 profit if correct). No hidden fees, no odds conversion needed.

- Low barrier to entry: Minimum trade sizes are relatively small, allowing users to participate without committing large amounts of capital. You don’t have to be super rich to start.

- Established platform: Robinhood’s existing user base, regulatory licenses, and multi-year track record in retail financial services provide platform stability.

Weaknesses:

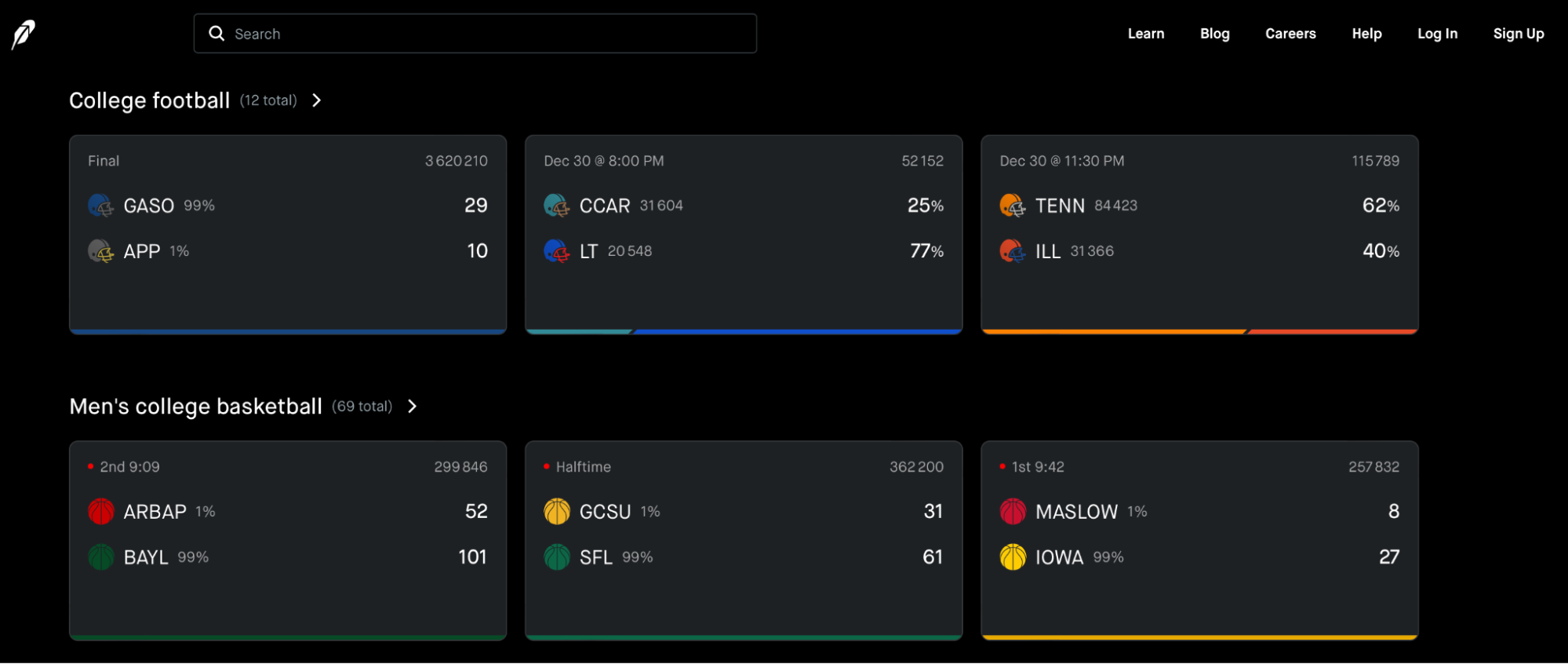

- Limited market selection: The platform focuses on high-profile events such as elections, major economic indicators, and headline sports. We counted 47 active markets during our test period, compared to 200+ on Polymarket and 150+ on Kalshi during the same week. Robinhood focuses on headline events only – we found no markets for crypto prices, pop culture predictions, or niche political outcomes.

- Variable liquidity: Liquidity can vary significantly between markets. While major events are busy, experience wide spreads or limited execution flexibility. We experienced this firsthand: A major election market had 0.01 spreads and filled 100-contract orders instantly. A college football game market showed 0.06 spreads, and our 50-contract order only filled 32 contracts before the price moved.

- Fewer advanced trading tools: Robinhood does not currently offer advanced features such as order types, APIs, algorithmic trading, or deep analytics that pros are likely looking for.

- Geographic restrictions: Access depends on location, and some U.S. states restrict participation in event contracts, limiting availability even within the country.

- Limited transparency on volume metrics: Unlike traditional exchanges, Robinhood does not consistently publish detailed volume or order book data, making it harder for users to evaluate liquidity before trading.

What Robinhood’s prediction markets are

So, how do Robinhood prediction markets work exactly? Let’s start with understanding what they actually are.

Robinhood’s prediction markets are a new type of event-based trading product that allow users to take positions on the outcomes of real-world events, such as elections or economic indicators. The users don’t buy stocks or cryptocurrencies. Instead, they trade contracts that pay out if a specific outcome occurs.

These contracts are structured similarly to two-versions outcomes: a yes-or-no event. For example, whether a particular candidate will win an election or whether a certain economic condition will be met by a set date. If the outcome occurs, the contract settles at its full value; if it does not, it expires worthless.

Robinhood’s prediction markets operate through regulated partners like Kalshi, a U.S.-regulated exchange overseen by the Commodity Futures Trading Commission (CFTC). This means the contracts are offered within a legally defined framework, not offshore or unregulated platforms – a key distinction for U.S. users.

Users can buy and sell contracts much like stocks, with prices reflecting the market’s collective estimate of how likely an outcome is to occur. A contract priced at $0.6, for example, implies a roughly 60% probability according to market participants.

Unlike traditional financial instruments, these markets are not about long-term ownership or speculation on company value. This is about backing predictions with capital using simple, time-bound contracts.

Trustworthiness check

We did some research and pinpointed risk flags we found that are most relevant to Robinhood’s event-based “prediction market” offering and the company’s broader compliance posture:

- How the product is offered (regulated structure): Robinhood says its event contracts are offered by Robinhood Derivatives, LLC through KalshiEX LLC (i.e., via a CFTC-regulated event-contract exchange partner).

- State-level pushback on “sports-style” event contracts (Dec. 2025): Connecticut regulators sent cease-and-desist notices to Robinhood, Kalshi, and Crypto.com, arguing certain prediction-market offerings function as illegal gambling under state law. This is a key jurisdictional risk point for Robinhood’s prediction markets, even if the contracts are offered through a federal framework.

- SEC broker-dealer settlement (Jan. 13, 2025): The SEC announced that Robinhood Securities LLC and Robinhood Financial LLC agreed to pay $45 million in combined civil penalties to settle a range of charges tied to their brokerage operations (not specific to prediction markets, but relevant to overall compliance track record).

- FINRA enforcement action (Mar. 7, 2025): FINRA ordered Robinhood Financial to pay $3.75 million in restitution and fined Robinhood entities $26 million for violations including AML, supervisory, and disclosure issues (again, brokerage-focused, but relevant to trust controls and supervision culture).

Fees & trading costs

Robinhood prediction markets fees are alluring. Not least because of pricing simplicity: there are no complex betting odds or layered fee structures used in traditional brokerages or sportsbooks.

Instead, costs are generally built into the price of the contract itself. Users pay the market price when entering a position and receive the payout if the outcome resolves in their favor. There are no traditional commissions per trade, which aligns with Robinhood’s broader zero-commission trading model.

Still, and this is highly important, certain factors influence the cost. They include:

- Bid–ask spreads, which can widen during periods of low liquidity

- Market volatility, which affects contract pricing

- Timing, as prices shift rapidly in response to new information

Because contracts settle at a fixed value, traders effectively know their maximum possible gain or loss upfront. This makes the experience more transparent than traditional betting models, where odds and payouts can be harder to interpret.

Importantly, because these markets operate within a regulated framework, fee structures and contract rules are standardized and disclosed in advance, offering users clarity about how trades work before committing capital.

User experience & platform tools

Robinhood’s prediction markets are designed to feel familiar to anyone who has used the app for stocks or crypto. The interface emphasizes simplicity, with clear visuals showing current prices, probability ranges, and time remaining until resolution.

Here are the Robinhood prediction markets explained, with users being able to:

- Browse available event contracts

- View historical price movement

- Place trades with a few taps

- Track open positions in real time

The mobile-first experience remains a key strength. Contracts are presented in a clean, digestible format, allowing users to understand potential outcomes without navigating complex order books or advanced trading tools.

Unlike traditional sportsbooks, which often prioritize entertainment and promotions, Robinhood’s interface leans toward clarity and financial-style presentation. Data is displayed in a way that mirrors investing dashboards rather than gambling layouts, reinforcing the idea that these products are closer to financial instruments than games of chance.

Additionally, because Robinhood integrates these contracts into its existing ecosystem, users benefit from a unified experience. Account management, funding, and transaction history are centralized, reducing friction for users already familiar with the platform.

GNcrypto’s overall Robinhood prediction markets rating

| Category | Weight Score (1-5) | Notes |

|---|---|---|

| Market Selection & Coverage (10%) | 3.0 | 47 active markets during our test. Focus on headline events only (elections, major sports, economic indicators). Missing: crypto prices, pop culture, niche political outcomes. Limited compared to Polymarket (200+) and Kalshi (150+). |

| Liquidity & Volume (25%) | 3.5 | Major events show tight 0.01-0.02 spreads and instant fills. Niche markets (college sports) show 0.04-0.06 spreads with partial fills. Volume concentrated on 10-15 top markets. |

| Fees & Total Cost (20%) | 4.5 | No trading commissions. Costs built into contract pricing. Major event spreads 0.01-0.02 = excellent. Niche spreads 0.04-0.06 = acceptable. Total cost to enter/exit a $1,000 position on a major event: ~$10-20. |

| Resolution Quality & Speed (12%) | 4.5 | All contracts we tested resolved correctly within 24 hours of official outcome. Clear resolution criteria published. Uses official data sources (Associated Press for elections, Federal Reserve for economic data). |

| Pricing Efficiency (6%) | 4.0 | Prices track real-world probability well. The Fed rate cut contract moved from 0.62 to 0.71 within 3 minutes of Powell’s speech – fast price discovery. Minor arbitrage gaps vs Kalshi (1-3% difference on same events). |

| Regulatory Compliance & Access (15%) | 4.0 | CFTC-regulated via Kalshi partnership. U.S. only, with state-level restrictions (Connecticut cease-and-desist Dec 2025). Clear legal framework but limited geographic access. |

| Tools & User Experience (4%) | 4.5 | Clean interface integrated into Robinhood app. Real-time price updates, clear probability displays, simple order entry. No advanced features (APIs, conditional orders, portfolio analytics). Mobile-first design works well. |

| Deposit/Withdrawal Methods (8%) | 5.0 | Instant deposits via linked bank account or debit card. Withdrawals processed in 2 business days (we tested). No crypto deposits. Bank transfers free, instant deposits may have fees. |

| FINAL SCORE | 3.9 | Good (Beginner-Friendly). Best for U.S. users wanting simple exposure to major events without learning complex platforms. Limited market selection and liquidity on niche events. |

Methodology – why you should trust us

Our Prediction Markets Score follows GNcrypto’s standardized methodology for evaluating prediction market platforms. We test with real capital and measure execution quality, pricing efficiency, and resolution accuracy.

How we score (8 criteria, 1.0-5.0 scale):

- Market selection & coverage (10%): How many active markets? Do they cover diverse event types or only headlines?

- Liquidity & volume (25%): Can you enter/exit positions without moving prices? We measure bid-ask spreads and order fill quality.

- Fees & total cost (20%): What’s the true cost to trade – spreads + fees? We calculate the total cost for $1,000 position entry/exit.

- Resolution quality & speed (12%): Do markets resolve correctly and quickly? We verify against official data sources and resolution criteria.

- Pricing efficiency (6%): Do prices track real-world probability? We compare to other platforms and measure price reaction to news.

- Regulatory compliance & access (15%): Licenses, legal framework, geographic restrictions. Is this legal in your jurisdiction?

- Tools & user experience (4%): Interface quality, mobile apps, real-time data, advanced features. Deposit/Withdrawal Methods (8%): Funding options, processing times, fees. We test actual deposits and withdrawals.

We do not rate platform solvency or guarantee financial stability. These scores reflect trading quality, market access, and user experience.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.