Remitano P2P review 2026: fees, payment methods, escrow safety, and our rating

Remitano is a P2P crypto marketplace where you trade directly with other users using local payment methods. In this review, we explain how it works, what coins and fiat rails to expect, how fees show up in real trades, and what to check to reduce scam risk before you hit “paid”.

Liquidity & Volume

5.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.5

Liquidity & Volume

3.5

Payment Methods

4.5

Liquidity & Volume

4.5

Payment Methods

4.0

Remitano is a peer-to-peer platform where you exchange fiat for crypto with other users, while the platform provides escrow and a dispute framework. In this guide, we focus on practical steps: how to check whether your currency and payment methods have enough offers, where the real costs come from, and how to pick safer counterparties. Based on our methodology, we rate Remitano 3.53/5: a useful option in active local markets, but less predictable when liquidity is thin. P2P always involves counterparty risk; our score reflects observable mechanics, not a guarantee.

GNcrypto’s overall Remitano rating

| Criterion | Score (1–5) |

|---|---|

| Escrow & Trade Safety | 3.8 |

| Liquidity & Order Book Depth | 3.0 |

| Fees & Payment Methods | 3.5 |

| Verification & Account Limits | 3.5 |

| Platform Performance & Reliability | 4.0 |

| User Experience & Trade Flow | 3.8 |

| Customer Support & Dispute Handling | 3.0 |

| Total | 3.53 / 5.00 |

Is Remitano safe and worth using in 2026?

Short answer: Remitano works well for converting local fiat to USDT in active markets, but liquidity is uneven and escrow doesn’t protect against user errors.

Our verdict after testing:

Remitano scored 3.53/5 in our P2P methodology. It’s a useful option when your local market has enough active advertisers, but less predictable when liquidity is thin.

Use Remitano if:

- Your local currency has active offers with familiar payment methods (bank transfer, local payment apps)

- You want to buy USDT or BTC with local fiat without complex exchange setup

- You’re comfortable following strict P2P safety rules (never pay off-platform, always verify counterparty history)

Skip Remitano if:

- Your currency has thin order books (expect wide spreads and limited trade sizes)

- You need high-volume merchant operations (1% maker fee + competition squeeze margins)

- You want to store crypto long-term (custodial platform, withdraw after each trade)

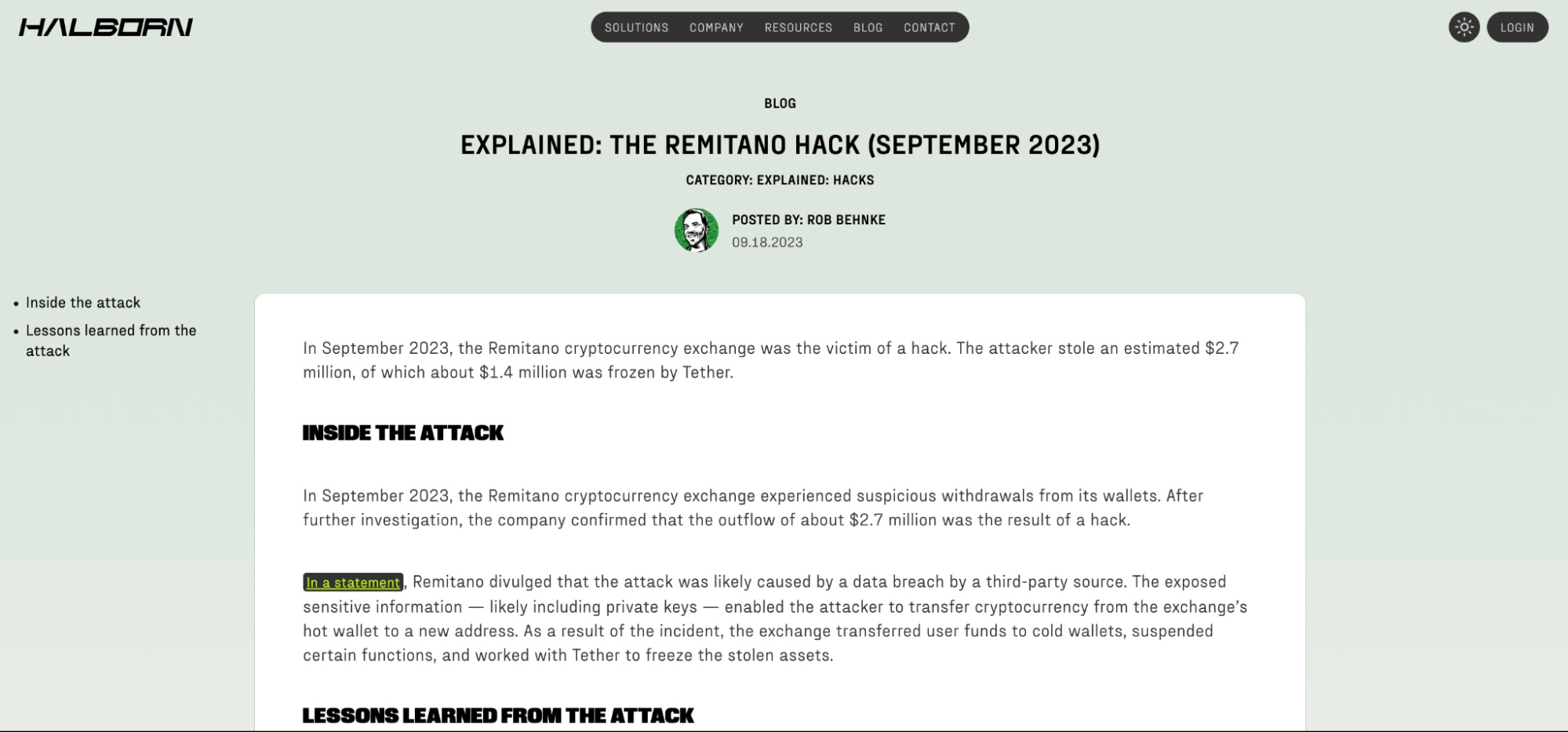

Key safety reminder: Remitano had a hot wallet incident in September 2023 (~$2.7M). Treat P2P platforms as “use for the transaction, not for storage.”

How it compares:

- vs. Binance P2P: Lower liquidity, but works in more regions

- vs. Paxful: Similar escrow model, but fewer payment methods in some markets

- vs. LocalBitcoins (shut down): Remitano is one of the remaining P2P options

Full breakdown below.

Overview of Remitano P2P trading

In our view, Remitano is best understood as a peer-to-peer marketplace where you buy or sell crypto directly with other users, while the platform provides the rules, interface, and the escrow layer that makes the deal possible.

If you are new to P2P, think of it like this: you are not placing an order into a global exchange book. You are choosing a specific person’s offer with a specific price, limits, and payment method. That is why the experience can feel very different country by country.

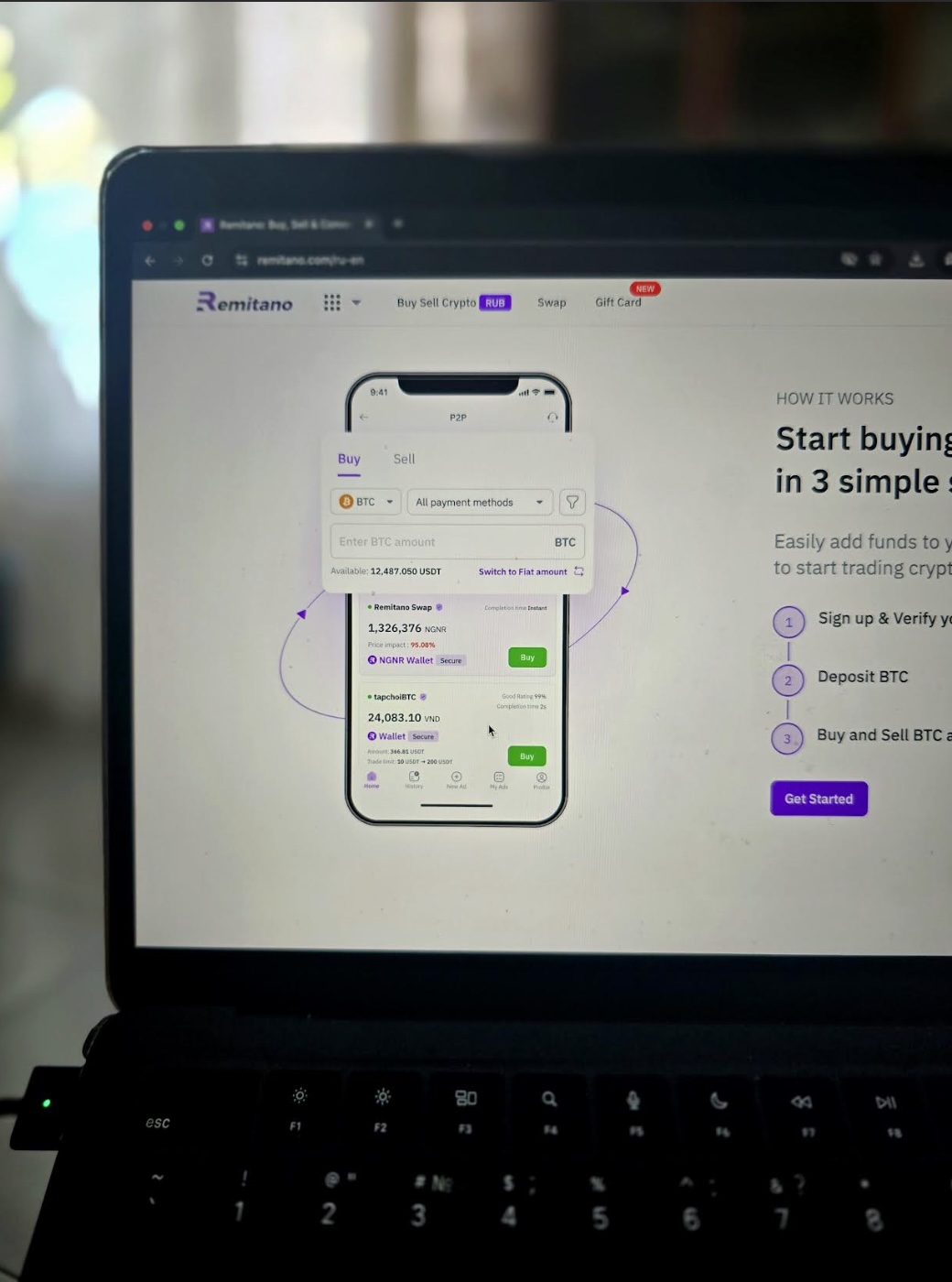

Your first trade usually follows this flow:

- You browse offers for the coin you want, usually USDT.

- You open a trade with a seller or buyer.

- You pay in fiat using the agreed method.

- You receive crypto once the trade is completed.

This is why many Remitano reviews focus on practical questions like “Are there enough offers in my region?” rather than advanced trading tools.

Who we think fits best: beginners who want a straightforward way to convert local money into stablecoins, and users who prefer local bank transfers or regional payment apps.

Who may be disappointed: anyone expecting the same depth and pricing consistency as a top centralized exchange in every currency, or anyone planning to operate as a high volume advertiser from day one.

Assets, fiat currencies, and payments

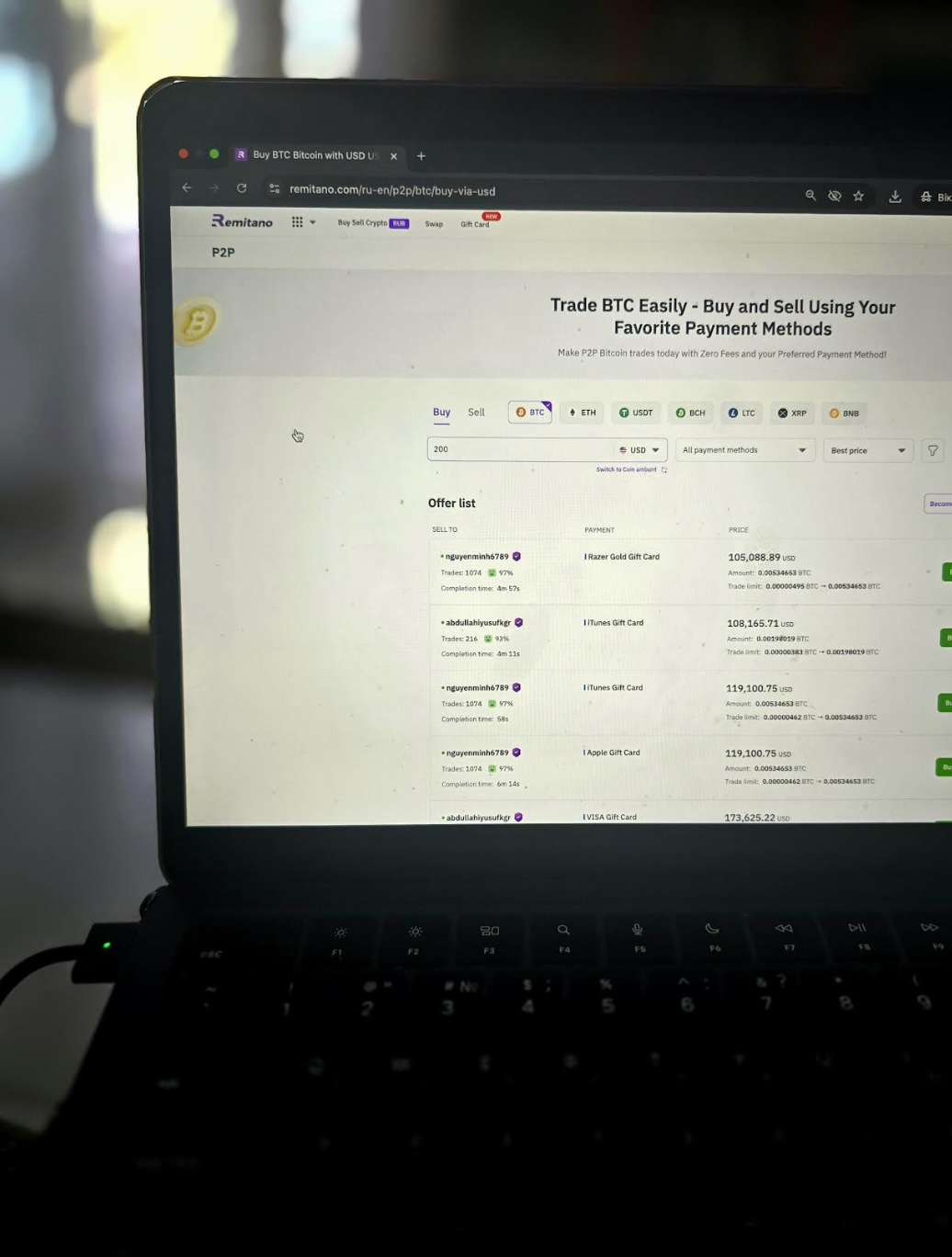

Most beginners care less about “How many coins exist?” and more about “Can I reliably buy USDT in my currency at a fair rate?”. In our view, Remitano works best when your local market has enough active advertisers for your preferred payment method.

What you will typically see on P2P is a stablecoin first flow. USDT is often the most traded option, with BTC and ETH appearing depending on region and demand. Availability can change fast, so we would treat any asset list as a starting point, not a guarantee.

A quick way we would check whether Remitano fits your region:

- Open P2P and select your fiat currency.

- Filter by your exact payment method.

- Compare the best offers to a reliable spot price and note the spread.

If you only see a handful of offers, expect wider spreads and less flexibility on trade size.

Fees are where many newcomers get surprised in a Remitano review. In our testing flow, we treat the platform fee as role-based: Remitano states P2P takers pay a 0% platform fee, while makers (ad creators) pay a 1% fee that is typically reflected in the ad price.

Your real cost also includes bank or payment app charges, FX conversion, and the spread between offers.

Finally, check limits before you commit. Each offer has a minimum and maximum, and higher volumes may require identity verification depending on your region and the payment rails you use.

Escrow protection and user ratings

Escrow is the feature that makes P2P trading safer than sending money to a stranger and hoping for the best. In simple terms, the crypto is reserved for the trade while you complete the fiat payment, and it should only be released when the trade conditions are met.

That said, escrow does not protect you from every mistake. Most losses in P2P come from user errors: paying the wrong person, using the wrong reference, agreeing to move the conversation off platform, or releasing crypto before fiat is truly received.

First trade checklist we follow on Remitano p2p:

- Pick a counterparty with a strong completion rate and meaningful trade history.

- Read the offer terms before doing anything, especially bank name, required memo, and time limits.

- Pay only to the account details shown inside the trade, not to “new” details sent in chat.

- Mark payment as sent and keep proof, such as a receipt or bank confirmation.

- Stay in the in-trade chat until the crypto is released.

- If you are selling, confirm the money arrived in your account before you release crypto.

- Treat “I paid” screenshots as a signal to double check, not as final proof.

- Avoid third party payments and any request to move the deal to Telegram or WhatsApp.

User ratings matter because they are your first filter for risk. Red flags include pressure to hurry, requests to switch to Telegram or WhatsApp, unusual payment narratives, and attempts to cancel after you have already paid.

If something goes wrong, use the dispute process. Open it inside the trade, provide clear evidence, and keep communication on platform so the support team can review the full context.

Pros and cons

We think Remitano is easiest to like when your goal is simple: convert local money into crypto (usually USDT) and back, using payment methods that actually work in your country.

Strengths:

- Taker-friendly P2P pricing: if you simply pick an existing offer, you usually avoid an extra platform fee. In practice, your cost is mostly the spread in the offer plus any bank or payment app charges.

- Local payment methods when the market is active: in regions with many advertisers, you can usually find familiar rails like bank transfer or popular local payment apps without needing a complicated exchange setup.

- Beginner guardrails: escrow, in-trade chat, and user ratings create a cleaner paper trail than “send money and hope,” which matters on a first P2P trade.

Weaknesses:

- Merchant economics can be tight: if you plan to post ads and run volume, the advertiser fee plus competition can squeeze margins fast.

- Liquidity is uneven by country and fiat: some currencies have plenty of offers, others have thin books and wider spreads, which makes “fair pricing” harder.

- When a trade gets stuck, time matters: disputes can solve problems, but your funds may stay locked while support reviews evidence.

How Remitano compares to other P2P platforms

vs. Binance P2P:

- Binance: Higher liquidity, more payment methods, zero fees for both taker and maker

- Remitano: 1% maker fee, lower liquidity, but available in more restricted regions

vs. Paxful:

- Similar escrow model and P2P flow

- Paxful: More payment methods (gift cards, online wallets)

- Remitano: Simpler interface, fewer scam vectors

vs. LocalBitcoins (shut down 2023):

- Remitano is one of the remaining P2P options after LocalBitcoins closure

- Similar user base migrated to Remitano, Paxful, and Binance P2P

Trustworthiness check

We think trust is earned through clear disclosures, how a company responds to incidents, and how predictable the rules feel over time. With Remitano, there are a few public signals worth knowing before you decide to keep a meaningful balance on the platform.

- Mid September 2023 hot wallet incident (reports around $2.7M): multiple reports described suspicious or unauthorized withdrawals, and some USDT was reportedly frozen by Tether. Practical takeaway: don’t store long term funds on a custodial platform, and withdraw after your trade is complete.

- Security narratives and recovery efforts were public: according to post-incident industry write-ups and monitoring reports, Remitano said it tightened controls and moved funds after the event. Our takeaway is simple: treat P2P platforms like “use for the transaction, not for storage,” and enable strong account security (2FA, anti-phishing checks).

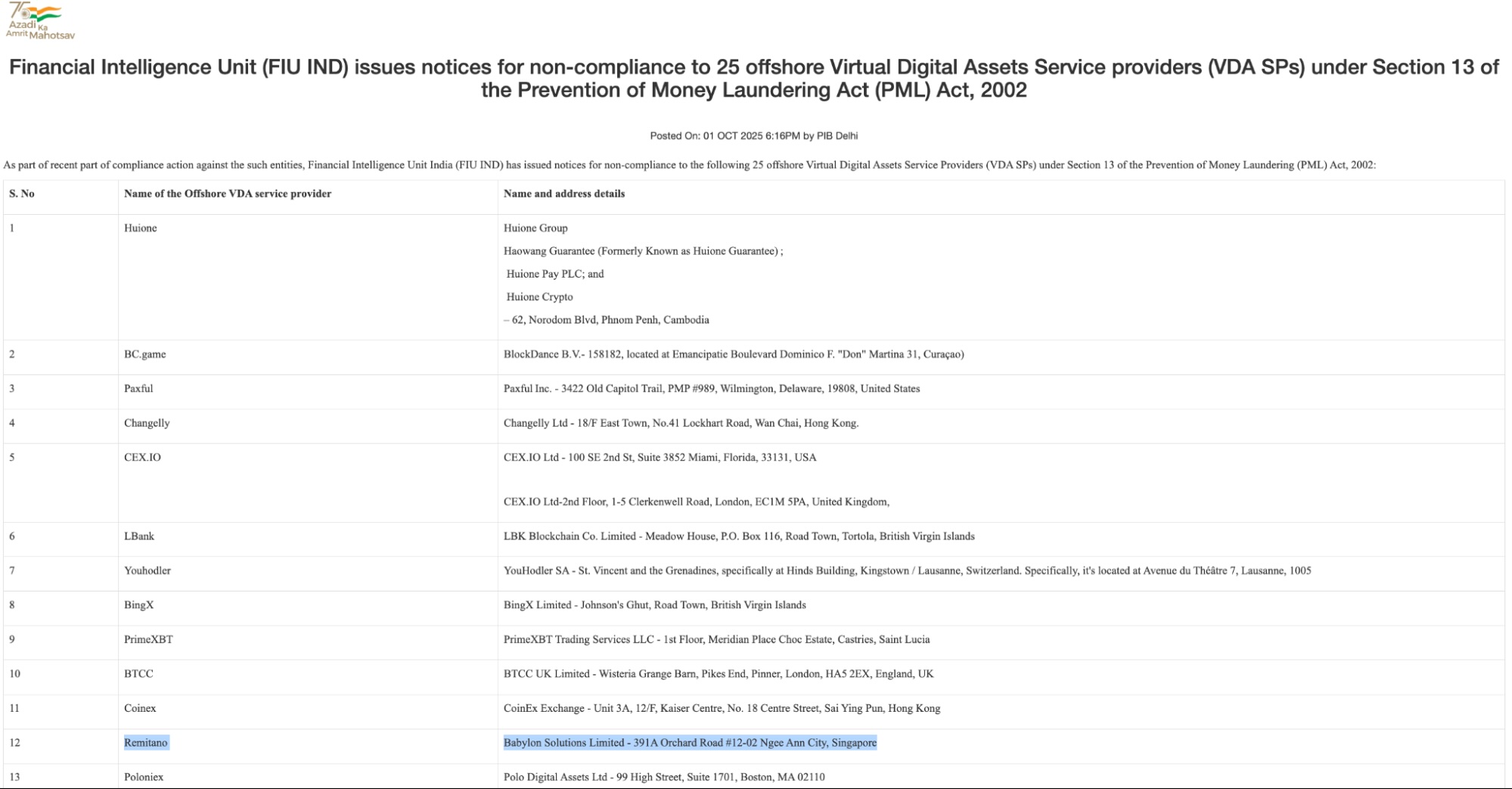

- Jurisdiction and availability can shape your experience: Remitano is commonly listed as operated by Babylon Solutions Limited (Seychelles), which can affect who is served, which payment methods are supported, and what verification is required in your region. We would check this before funding the account.

- User feedback is mixed and sometimes based on small samples: review sites can show negative experiences around support or withdrawals, but the data is not always large enough to treat as statistics. We use it as a list of risks to test: start small, pick counterparties with strong history, and keep evidence inside the trade chat.

Methodology and why you can trust this review

We rate P2P crypto trading platforms using a weighted seven category model and convert the results into a 1.0 to 5.0 score shown as a weighted average. Our focus is practical: can you find real offers in your region, understand the true cost of a trade, and complete the deal safely when money moves between strangers.

We combine public sources such as fee disclosures, help center articles, trading rules, and supported payment methods with hands-on testing using real funds. In our testing flow, we create an account, review verification requirements, browse order books for major coins, and execute small P2P trades as both buyer and seller to observe escrow behavior, release timing, and the support path when a trade gets stuck.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.