Rabby Wallet crypto wallet review 2026: what it does well and where it costs

Rabby is a DeFi focused wallet for Ethereum and EVM networks that tries to make approvals and signatures safer. In this review, we tested the beginner path from dApp connection to swaps and stuck transactions, and explained who it fits, where fees can add up, and what habits reduce risk before you click Sign.

We approached Rabby Wallet the way a DeFi curious beginner would: connect to a dApp, face your first approval and swap prompts, and then deal with the realities of signing and pending transactions. Rabby is an Ethereum and EVM focused wallet, and it is built around one idea that comes up again and again in this review: the most dangerous moment is the moment you click Sign.

The practical upside, in our experience, is that Rabby adds guardrails around smart contract interactions, so approvals and signatures feel harder to rush through. The practical downside is that this DeFi first design can feel heavier than a simple store and send wallet, and frequent in wallet swapping can add costs on top of network gas.

After testing Rabby Wallet with real transactions across Ethereum, Arbitrum, and Polygon, the wallet delivered strong signing safety (approval warnings caught unlimited allowances, recovery took 90 seconds) and clean multi-chain switching. We rated it highly for DeFi integration and security controls but noted that Rabby Swap’s 0.25% fee adds cost for frequent swappers, recovery relies entirely on seed phrase (no cloud backup), and support documentation assumes DeFi familiarity rather than guiding beginners step-by-step.

GNcrypto’s overall Rabby Wallet rating

| Criterion | Score |

|---|---|

| Security & Key Management | 4.5 |

| Supported Assets & Networks | 4.0 |

| Transaction Costs & Speed | 4.0 |

| User Experience & Interface | 4.0 |

| DeFi & dApp Integration | 4.5 |

| Recovery & Backup Systems | 3.5 |

| Customer Support & Documentation | 3.5 |

| Total | 4.10 / 5.00 |

Testing process

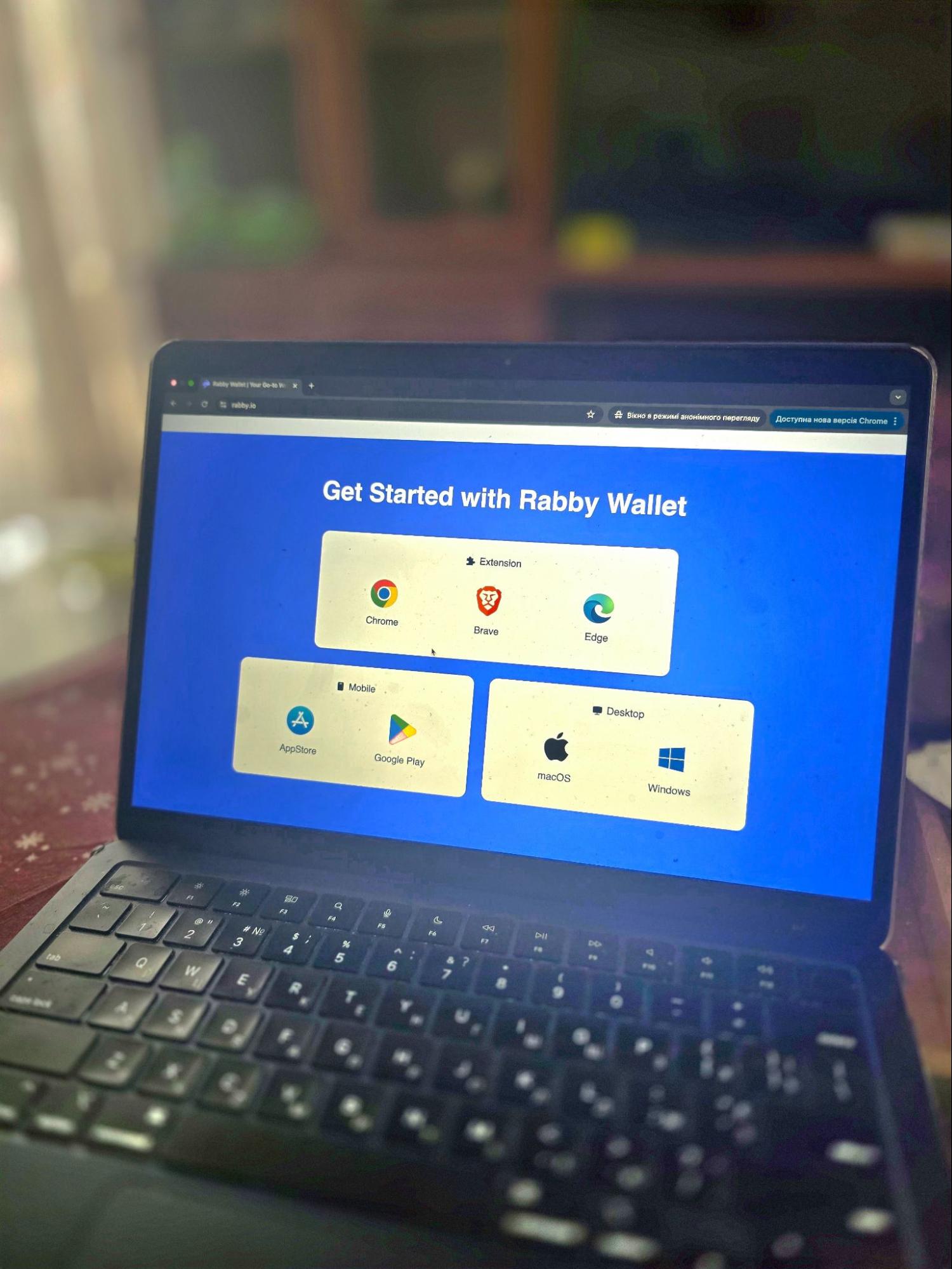

We installed the Rabby Wallet app (Android) and created a new wallet in under 3 minutes. Setup included generating a 12-word seed phrase and setting a password – no additional verification steps.

Transaction tests: sent $15 USDT from Rabby to an external address on Ethereum mainnet. Gas fee quoted: $1.85 (Normal speed), actual confirmation: 2 minutes. Sent $10 ETH on Arbitrum: gas $0.08, confirmation: 12 seconds.

Swap test: swapped $50 USDC for ETH using Rabby Swap on Ethereum mainnet. The swap routed through 1inch aggregator, showing 0.25% Rabby service fee ($0.125) + $1.20 network gas. Total cost: $1.325 (2.65% of swap amount). For comparison, swapping directly on Uniswap would cost only network gas ($1.20), making Rabby Swap’s 0.25% fee an added convenience cost.

dApp connection: connected Rabby to Uniswap. Approval prompt showed clear warning about unlimited token allowance with option to set custom limit. We set a $100 USDC spend limit instead of unlimited. Swap executed in 8 seconds after approval.

Recovery test: we backed up the 12-word seed phrase, then restored the wallet on a second device (laptop). Recovery took 90 seconds: opened extension, selected “Import wallet,” entered seed phrase, and all balances appeared immediately without additional verification.

Network switching: Tested switching between Ethereum, Arbitrum, and Polygon. Network change happened instantly without requiring manual RPC configuration.

What Rabby Wallet is

Rabby Wallet is best understood as a power user Ethereum and EVM wallet built for DeFi, not just a place to store coins. It is primarily a browser extension that connects to dApps, signs smart contract transactions, and helps you manage activity across EVM chains. While the extension is the main entry point for most users, Rabby also ships desktop and mobile clients for the same EVM first workflow. If you are looking for a Rabby Wallet security review, the most important context is that Rabby is designed for people who interact with contracts often, where one wrong signature can be expensive.

In our testing, Rabby feels different from simpler hot wallets because it constantly tries to make the signing moment clearer. Instead of treating every approval as a tiny pop up you click through, the wallet pushes you to slow down and understand what the transaction is doing. For beginners, that is valuable because most early losses happen after a rushed approval, a blind swap, or a bridge you did not fully understand.

We walked through the typical beginner DeFi loop without turning it into a tutorial. We connected Rabby to a dApp, reviewed a common approve and swap flow, watched how pending transactions are shown, and checked the general transaction flow end to end. We also tested basic multi network use on a few EVM chains to see whether the wallet keeps the experience consistent.

The main value we see is simple: Rabby tries to help you make a better decision before you sign, rather than leaving you to discover the consequences after the transaction is final. If your crypto activity is mostly on Ethereum and Layer 2 networks, that focus can be a real advantage.

Security model

Rabby is a self custody wallet, which means you control the private keys and the wallet is not a bank that can reverse mistakes. Once a transaction is confirmed on-chain, it is final, so the real security question for beginners is not only where keys live, but also how safely you approve and sign smart contract actions.

What we like about Rabby is its risk before sign mindset. In practice, DeFi losses often come from three patterns: an unlimited token approval you forgot about, a signature request that looks harmless but can act like an approval (for example, permit style, gasless permissions), or a swap and bridge flow where the route is not what you assumed. Rabby tries to slow you down at the exact moment when it matters, by surfacing warnings and making approvals feel like a decision instead of a click.

Avoid unlimited token allowances – set a specific spend limit for each action. After using a new dApp, revoke old approvals to prevent forgotten permissions from draining funds later. If you see an unfamiliar message signature, stop, close the tab, and verify the domain before trying again through an official link. When transactions get stuck, use Rabby’s speed-up or cancel tools instead of spamming new transactions.

If you want an extra layer, Rabby supports hardware wallets, which lets you keep the signing key off the browser while still using DeFi. For most users, that is the safest way to use a Rabby Wallet crypto wallet review style setup without turning your extension into a long term vault.

Who Rabby Wallet is for

We think Rabby Wallet is a strong match for users who live inside the Ethereum and EVM world and interact with dApps regularly. If your routine includes swaps, bridges, staking dashboards, or NFT mints on Layer 2 networks, Rabby is built for that pace. The wallet is also a good fit if you want more control over what you sign, because it treats approvals and contract interactions as the main event rather than an afterthought.

At the same time, Rabby is not the most comfortable choice for every beginner. If your goal is to buy and hold a small amount of crypto and only send it once in a while, a simpler wallet may feel less intimidating. Rabby also is not a one wallet for everything option if you rely heavily on non EVM ecosystems like Bitcoin first storage or Solana based apps. In those cases, you may end up running Rabby as your DeFi wallet and keeping a separate wallet for your other chains.

A quick self check can help you decide in ten minutes. If you make only one or two transactions per month and you dislike pop ups and warnings, Rabby may feel like too much. If you have ever approved a token spend and later wondered why funds disappeared, Rabby is worth trying because it is designed to make those moments harder to ignore.

Our recommendation is practical: use Rabby as an EVM work wallet for active on chain use, keep long term holdings in a more cold style setup, and treat Rabby Wallet reviews as guidance for matching the tool to your habits, not a promise that mistakes will never happen.

Pros and cons

In our experience, Rabby Wallet is at its best when you are actively using DeFi and want more guardrails around what you sign. It feels less like a simple “store and send” wallet and more like a daily work tool for EVM apps. The upside is fewer blind clicks. The downside is that the DeFi focus adds complexity and some costs if you rely on wallet features.

Strengths:

- If you sign transactions daily, Rabby can reduce common mistakes by pushing you to slow down at approvals and signatures, instead of treating them like background pop ups.

- If you often get stuck pending transactions, the built in speed up and cancel tools are a practical fix that many beginners end up needing sooner than they expect.

- If you want DeFi but do not want your key sitting in a browser alone, Rabby pairs well with hardware wallets, so the signing key can stay off the extension.

- If you live across multiple EVM networks, Rabby is designed for that routine, so network switching feels like part of the workflow, not a constant obstacle.

Weaknesses:

- If your goal is only to hold and occasionally send, the warnings and DeFi style interface can feel heavy compared with simpler wallets.

- If you swap frequently inside the wallet, Rabby Swap charges a 0.25% fee on top of network gas that can add up over time.

- If you need Bitcoin first or Solana first ecosystems, you will likely end up using a second wallet alongside Rabby.

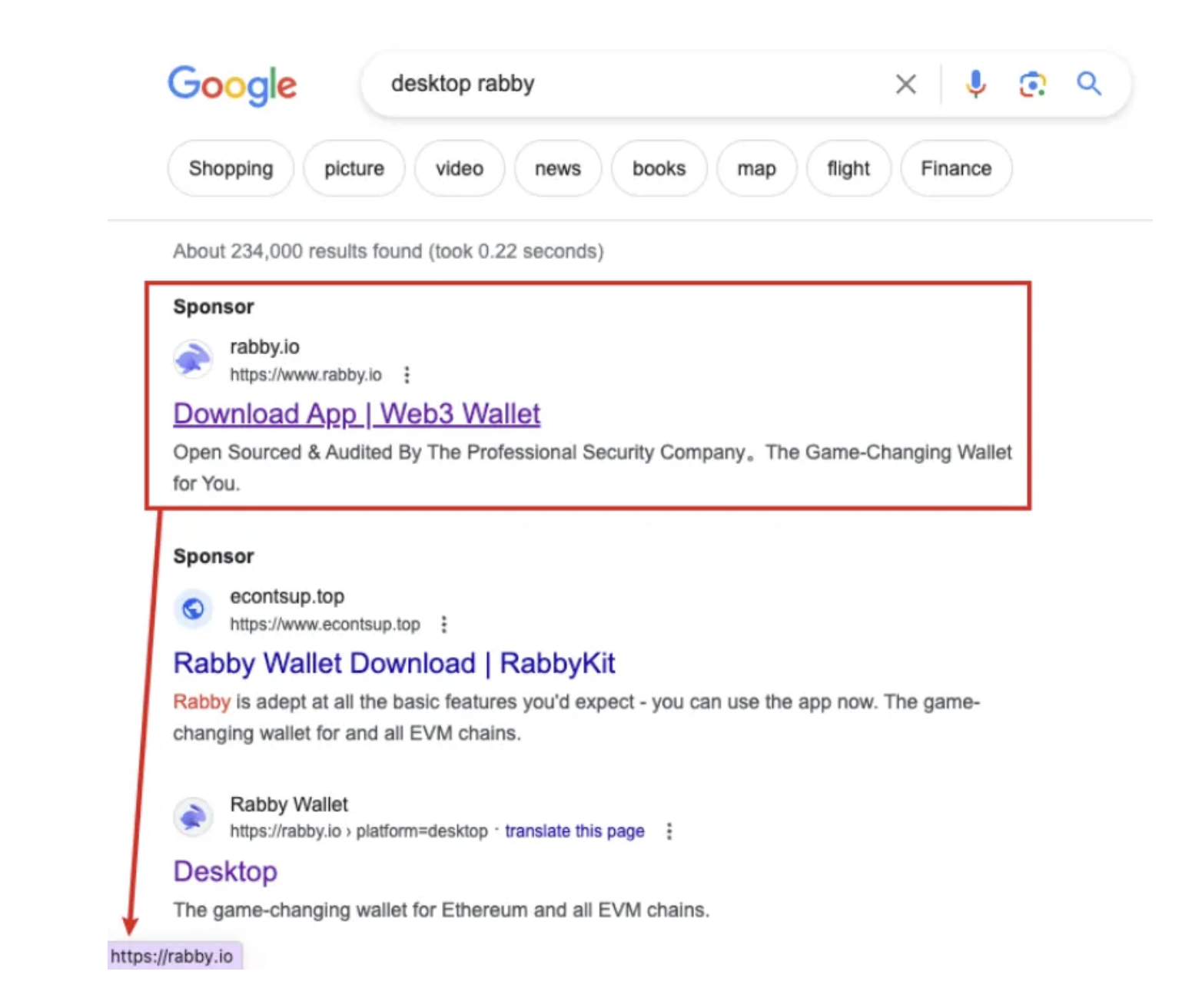

- If you install from random links, extension wallets are a bigger phishing target, so using only official download sources is non-negotiable.

Fee comparison

Rabby swap: 0.25% service fee + network gas. $50 swap = $0.125 Rabby fee + ~$1.20 gas = $1.325 total.

MetaMask swap: 0.875% service fee + network gas. $50 swap = $0.44 MetaMask fee + ~$1.20 gas = $1.64 total.

Coinbase Wallet swap: up to 1% fee + network gas. $50 swap = $0.50 fee + ~$1.20 gas = $1.70 total.

Direct Uniswap interface: 0.25% interface fee + network gas. $50 swap = $0.125 Uniswap fee + ~$1.20 gas = $1.325 total.

Rabby Swap’s 0.25% fee is the lowest among major wallet swaps, but connecting directly to Uniswap through Rabby eliminates the wallet fee entirely. The convenience trade-off: Rabby Swap aggregates multiple DEXs (1inch, 0x) and may find better rates, potentially offsetting the 0.25% fee on larger swaps.

Trustworthiness check

We think trustworthiness for a hot wallet is less about marketing claims and more about what the project shows publicly when things get messy: transparency, audits, and how it handles real world threats like phishing.

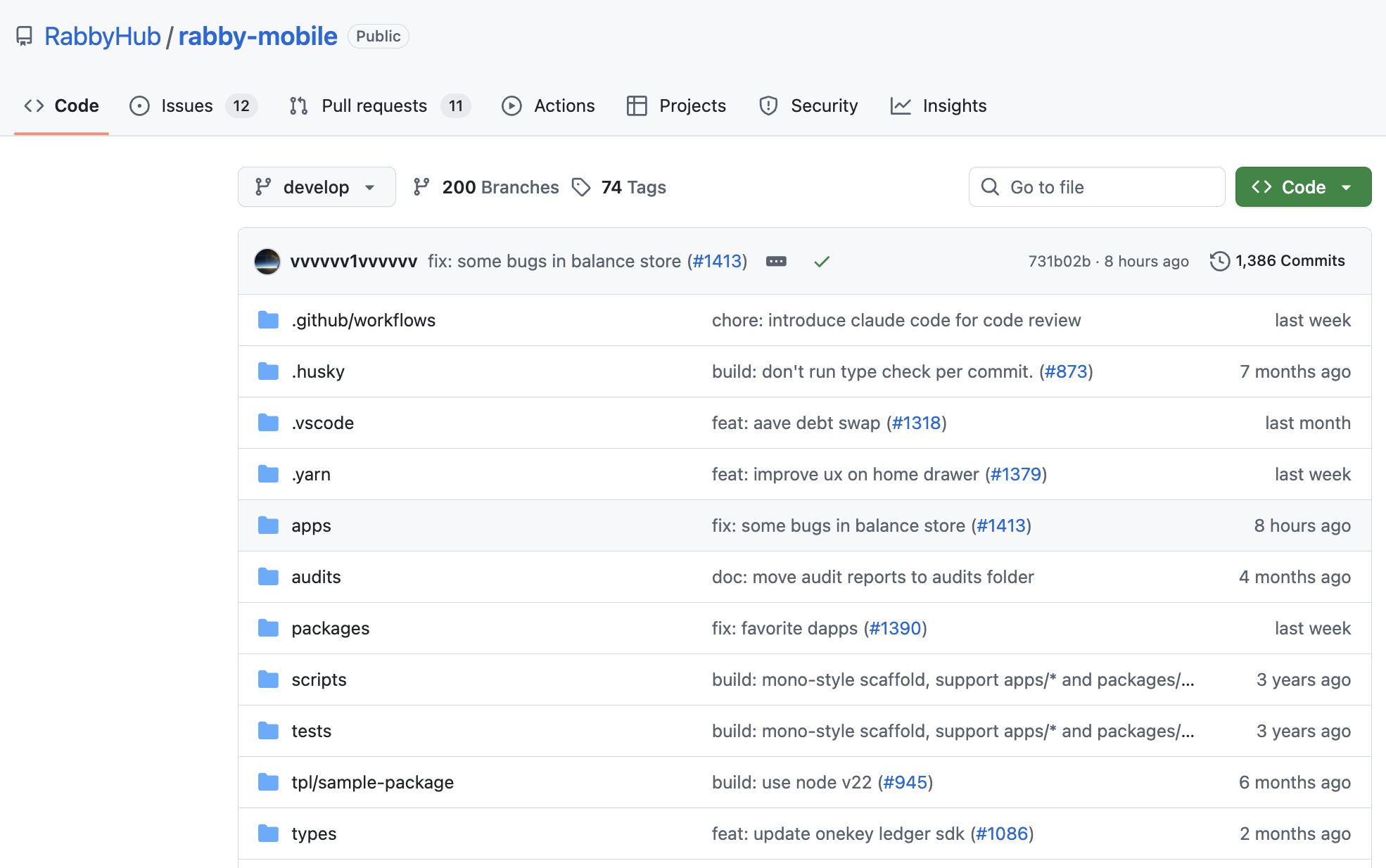

- Open source (ongoing): Rabby publishes its core wallet code on GitHub, which is a meaningful transparency signal compared with closed source wallets. Open code is not a guarantee, but it makes independent review and community scrutiny possible.

- Independent audits (2024–2025): Rabby has publicly shared third party security audits, including a Least Authority audit for the wallet extension dated September 2, 2025. Audits reduce risk, but they do not eliminate it, especially as products change over time.

- Oct 11, 2022 – Rabby Swap exploit: Rabby reported an exploit affecting its Swap smart contract and urged users to revoke approvals. The key takeaway is that wallet risk is often concentrated in optional features like swaps and the approvals they require, not only in the core wallet.

- Phishing and fake downloads (recurring): Security researchers have documented campaigns using fake Rabby download pages and search ads. For extension wallets, this is one of the most practical threats: users lose funds not because the official app fails, but because they install a lookalike.

Our takeaway is pragmatic. Rabby looks stronger than average on transparency and security posture, but you still need to treat it as an active DeFi tool, not a vault, and assume that phishing pressure is part of the reality around popular wallets.

How we test hot crypto wallets

We evaluate wallets using our weighted, category-based model across 7 criteria: Security & Key Management, Supported Assets & Networks, Transaction Costs & Speed, User Experience & Interface, DeFi & dApp Integration, Recovery & Backup Systems, and Customer Support & Documentation. Each criterion receives a score from 1.0 to 5.0, weighted by importance. Our testing combines public documentation with hands-on verification: installing the wallet, creating and recovering accounts, executing test transactions, connecting to dApps, testing swaps, and reviewing security prompts.

For full methodology: How We Test Hot Crypto Wallets

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.