PUMP rallies 25% even as Pump.fun and Solana Foundation face class-action heat

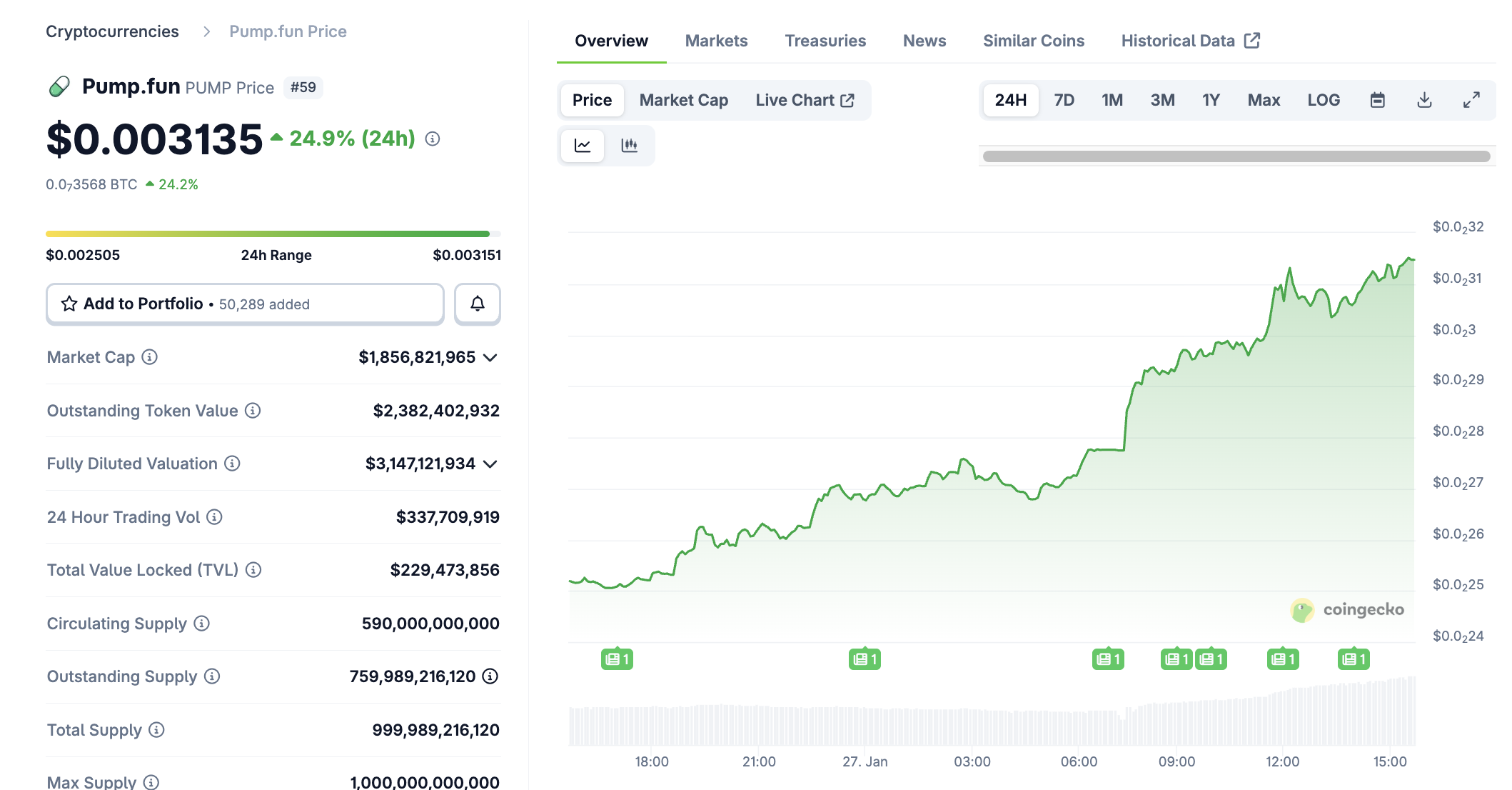

PUMP jumped about 25% overnight while a class action targeted Pump.fun and the Solana Foundation over alleged insider trading and abusive token-launch practices. Traders have also been tracking buybacks and chatter about revenue sharing as the memecoin factory tries to reassure holders.

Pump.fun helped turn Solana into the home base for fast, disposable memecoins. You can mint a token in minutes, watch the bonding curve set the early price, and if it catches on, it moves to bigger liquidity. The setup has brought in plenty of fees, but it’s also left Pump.fun with a growing reputation issue that’s now turning into a legal fight.

Against that backdrop, the platform’s associated PUMP token still posted a sharp relief rally. Market data showed PUMP up roughly 25% overnight, bucking softer price action in Solana’s SOL as headlines around litigation intensified.

The new legal overhang is a class-action complaint that names Pump.fun and the Solana Foundation and alleges insiders benefited from the way launches were structured. The suit adds to a drumbeat of criticism that the memecoin boom has been too friendly to snipers and too punishing for late retail buyers. Observers also say launch activity has cooled as negative coverage and legal uncertainty stack up.

The reputational hit isn’t coming only from the courtroom. A 2025 research report from Solidus Labs argued that most tokens created via Pump.fun and many Raydium pools showed patterns consistent with pump-and-dumps or rug pulls. That kind of statistic is catnip for regulators and a headache for any chain trying to sell itself as “serious” infrastructure.

Solana’s defenders point to fundamentals. Developer activity, transactions and wallet engagement have held up well versus other Layer-1s, suggesting the network’s usage hasn’t collapsed. Still, markets trade narratives, and right now the narrative is risk.

That’s why PUMP’s bid is being watched through a different lens: buybacks and potential tokenholder incentives. Analysts say the token’s longer-term valuation hinges on whether Pump.fun follows through with tighter safeguards, clearer disclosures and a structure that shares revenue rather than socializing losses. If the platform can prove it’s more than a churn engine, the rally might have legs. If not, PUMP may keep trading like a headline ticker.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.