PrimeXBT alternative guide 2026 for crypto futures traders and beginners

GNcrypto team reviews the best PrimeXBT alternatives for 2026 crypto futures traders. Binance Futures ranks first for deepest liquidity and a 4.57 score. We also compare Bybit for unified margin tools, BitMEX for derivatives native risk mechanics, WhiteBIT for TradingView futures, and NinjaTrader for regulated crypto futures without 8 hour funding.

Fees & Funding

4.5/5

Leverage & Margin

4.5/5

Fees & Funding

4.2/5

Leverage & Margin

4.2/5

Fees & Funding

4.2/5

Leverage & Margin

4.3/5

Fees & Funding

4.4/5

Leverage & Margin

4.2/5

Fees & Funding

4.5/5

Leverage & Margin

4/5

GNcrypto’s verdict: best PrimeXBT alternatives 2026

After testing five futures venues with real leveraged trades (typically $200 balances at 10x-50x on BTC/ETH perps), tracking 8-hour funding cycles, and comparing stop-loss behavior during volatility, here’s our ranking:

Best overall: Binance Futures (4.4/5) Deepest liquidity on majors with tight spreads and predictable fills. Our BTC/ETH orders filled cleanly at retail size even during volatile hours.

Runner-up: Bybit (4.3/5) Best trade-management toolkit for building guardrails – conditional orders, OCO, trailing stops, TWAP helpers. Strong for beginners who want pro-grade controls with demo/testnet practice.

Third place: BitMEX (4.1/5) Derivatives-native risk mechanics with the clearest documentation on fair price marking, liquidation triggers, and ADL. Best when you want to understand what causes what.

Specialized picks:

- WhiteBIT (4.1/5) for TradingView-first traders who want chart execution plus protective orders without pro-terminal complexity.

- NinjaTrader (4.1/5) for regulated exchange-listed crypto futures (no perp funding) with simulator-first learning.

Quick decision framework:

- Want tightest spreads and cleanest fills on majors? → Binance Futures

- Want unified margin + strongest trade-management tools? → Bybit

- Care about liquidation mechanics and engine transparency? → BitMEX

- TradingView workflow + protective orders? → WhiteBIT

- Prefer regulated futures over perpetuals? → NinjaTrader

Full breakdowns below.

What Is PrimeXBT and who is it for?

PrimeXBT is a multi-market trading platform, but for this Primexbt alternatives guide we are focusing on one product: PXTrader 2.0, its dedicated crypto futures interface. This is where you open leveraged, perpetual-style crypto positions with a familiar long/short workflow, instead of doing simple spot buys.

In our experience, PrimeXBT makes the most sense when you look at how the futures mechanics work in real use. PXTrader 2.0 supports cross margin and isolated margin, advertises up to 500x leverage on eligible markets, and prices trades on a maker/taker model with a 0.01% maker fee and tiered taker fees (described as starting from 0.02%, with VIP tiers down to 0.015%). Positions also pay or receive funding every 8 hours, and the product is marketed with 130+ crypto assets. For basic position management, you get practical protection tools like TP/SL and OCO, plus a built-in demo path.

The feature we see beginners care about most is PrimeXBT’s negative balance protection. It does not make leverage “safe,” and you can still get liquidated, but it aims to prevent the worst-case psychological scenario: going below zero after a fast market move.

In our experience, PrimeXBT fits best when you want a low-friction place to build futures habits. If you are still learning the routine, the demo helps you rehearse the full cycle – entry, stop-loss, take-profit, and closing – before you risk real money. If you trade small and trade often, the headline 0.01% maker fee is appealing when you are willing to learn the discipline of limit entries, with fewer impulsive market clicks and more “place a level, wait, then manage the position.” And if you want a simple, repeatable workflow, PXTrader 2.0 stays straightforward: pick an asset, choose cross or isolated margin, size the position and leverage, then manage it without wading through a dense institutional dashboard.

Best PrimeXBT alternatives compared

Three things push beginners and active traders toward alternatives to Primexbt: the temptation to use very high leverage, the slow bleed of 8-hour funding on positions you hold for days, and the difference in execution quality when you trade outside the most liquid names.

Simple math: $200 at 10x becomes a $2,000 position. Once you scale leverage beyond that, small moves can liquidate you before you have time to react. And if you hold a trade across multiple funding periods, funding can quietly become your largest “fee,” even when your entry looks cheap.

The most practical PrimeXBT alternatives for futures trading, based on how each platform behaves when you place orders, manage risk, and trade through volatility:

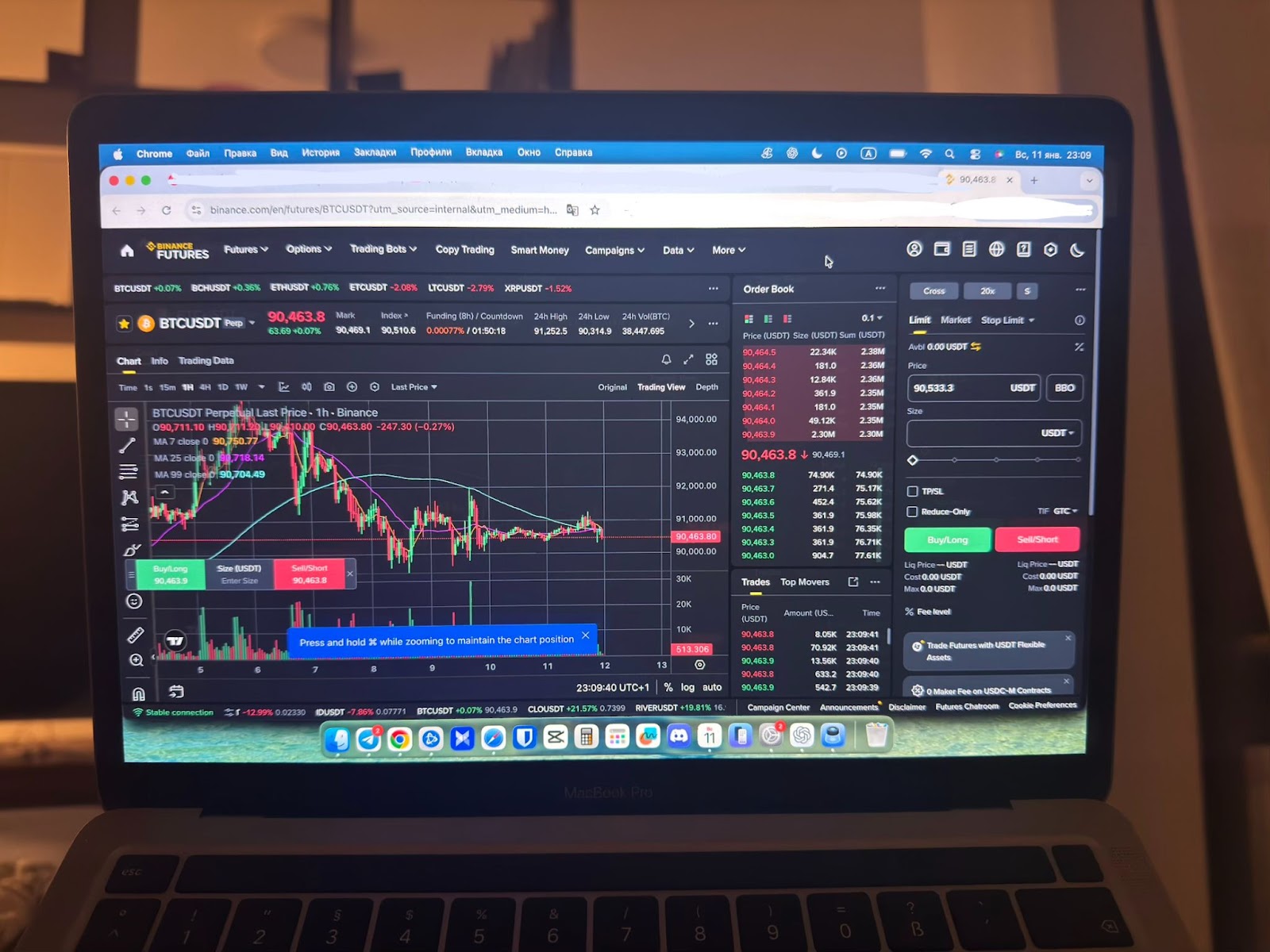

Binance Futures

Overall Score 4.4/5

If you want the deepest, most predictable execution on majors, Binance Futures is the PrimeXBT alternative that usually fixes the “fill and spread” problem immediately. In our testing, BTC and ETH orders filled cleanly at retail size, and the platform felt like the 2026 liquidity baseline with a mature risk setup behind it (mark price, tiered maintenance margin, insurance funds, and ADL backstops). The real learning curve here is not liquidity, but trade discipline: sizing, stop placement, and holding periods where funding becomes a silent cost. Access and fiat rails can still vary by jurisdiction, so the exact experience is not equally global everywhere.

Benefits

Best in class liquidity and contract breadth, with a complete risk and order toolset that helps you trade more like a system.

Limitations

Funding still settles every 8 hours, the interface can feel dense for new users, and access plus fiat rails vary by jurisdiction (Binance global vs Binance.US).

Best for

Active futures traders who want maximum liquidity on majors, broad market coverage, and pro grade execution and risk tooling.

Strengths:

- Deep order books on majors with consistently tight spreads, so retail sized orders usually fill cleanly even in volatile hours.

- Exchange-grade margin model: tiered maintenance margin with clearly documented liquidation rules, where mark price is the trigger reference and insurance plus ADL act as last-resort backstops.

- Flexible margin frameworks for different skill levels: isolated and cross margin by default, with portfolio margin available for advanced risk netting.

- Practical execution controls for scaling in and out: strong conditional and trailing-stop tooling, plus TWAP-style helpers that reduce the need to chase price in fast markets.

- Transparency and account protection signals beginners actually notice: Proof of Reserves with Merkle verification, SAFU described publicly, and passkeys as a modern login option.

- A large education layer (Academy + Futures FAQs) that makes it easier to learn stops, triggers, and margin rules without guessing.

Weaknesses:

- Regional product differences and compliance overhang can affect availability, limits, and fiat rails, so the experience is not equally “global” everywhere.

- Proof of Reserves is recurring and verifiable but still self published, and not all regulators treat it as a full audit standard.

- Even top tier platforms have real world operational risk: Binance has had moments when futures trading was briefly unavailable (reported by Reuters in Aug 2025), which matters if you trade through major volatility.

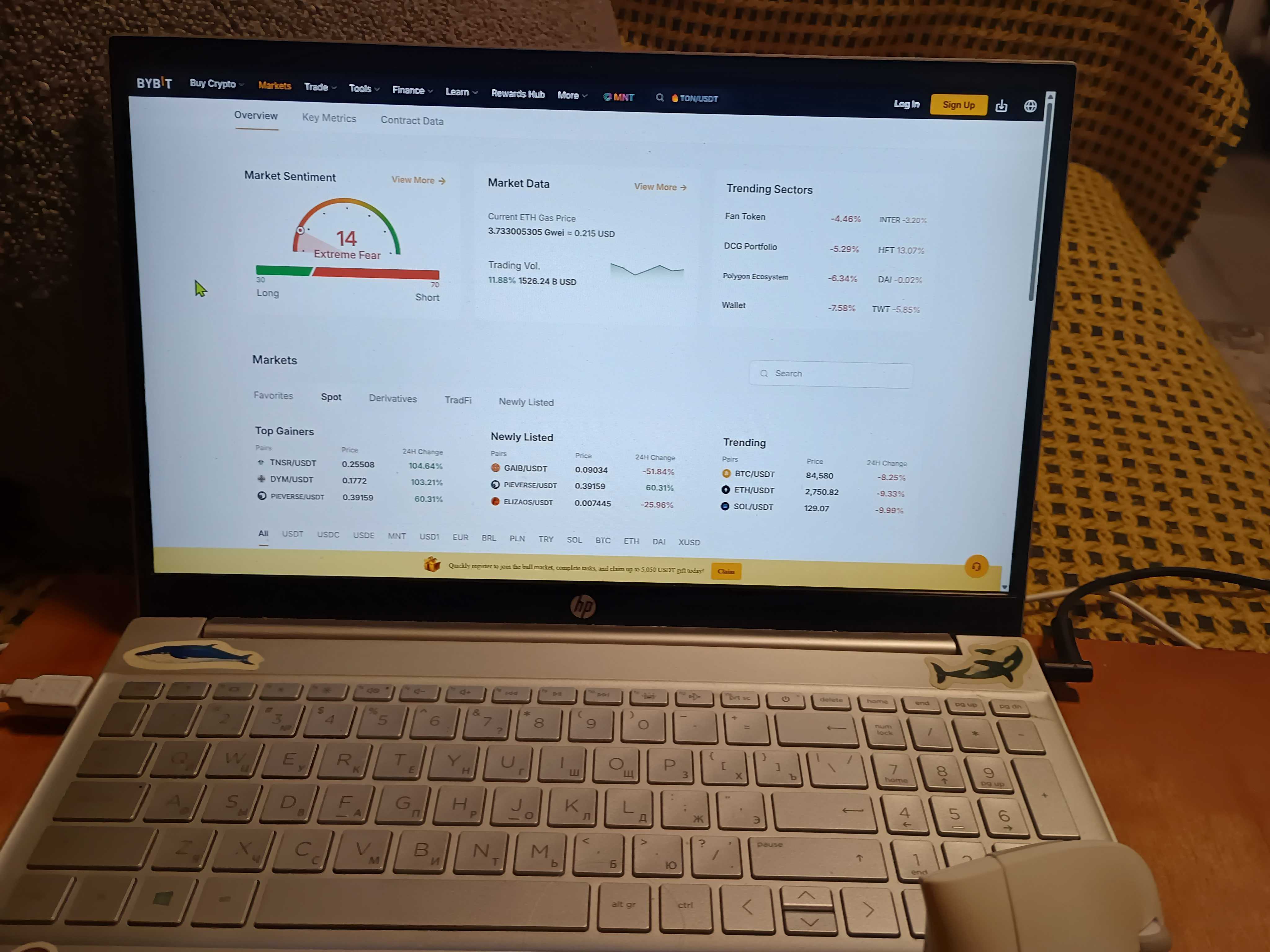

Bybit

Overall Score 4.3/5

Bybit is the PrimeXBT alternative we reach for when the goal is trading with guardrails, not just trading with leverage. In our testing, the execution toolkit is the main edge: conditional entries, OCO flows, trailing stops, and TWAP-style helpers make it easier to build rules into the trade instead of relying on willpower. The Unified Trading Account adds flexibility as you grow, but it can feel like settings overload at first, so we recommend starting with simple and expanding features one by one. On trust, Bybit has visible transparency work (Proof of Reserves materials) and regulatory progress in the UAE, but it is still the venue where many beginners prefer to do their own comfort check before scaling size.

Benefits

Deep derivatives coverage with one of the most complete order and risk toolkits for building disciplined futures habits.

Limitations

Security and regulatory trust is not a “free win” after the 2025 hack, and the Unified Trading Account can feel like settings overload for beginners.

Best for

Beginners who want pro-grade futures tools (and a demo/testnet) without jumping straight into a pure “institutional” interface.

Strengths:

- Guardrail-heavy order workflow: conditional entries, OCO, and trailing stops are easy to wire into a plan, so beginners can predefine exits instead of improvising under stress.

- UTA-style liquidation framework that is explained in plain mechanics: mark price is index-based with a basis component, the liquidation process is laddered where possible, and insurance plus ADL sit behind it for extreme events.

- Unified Trading Account with multiple margin frameworks (isolated, cross, and portfolio margin) that scales from beginner to advanced risk netting as you grow.

- Funding is transparent, and the stress-mode nuance matters: settlement frequency can switch to hourly during extreme spikes, which changes carry costs when markets overheat.

- Practice environments we actually like for learning: Demo Trading and a separate Testnet make it easier to rehearse entries, stops, and exits before trading real money.

- Proof of Reserves materials with third-party work around liabilities verification, plus practical account security features like 2FA, anti-phishing controls, and withdrawal protections.

Weaknesses:

- The February 2025 theft is still a major confidence hit, so we do not treat security posture as “best in class” even if reporting and controls improved afterward.

- Regulatory progress (for example, UAE licensing signals) is meaningful, but it does not fully erase the perception gap versus the most established “baseline” venues.

- The platform is feature-rich, and beginners can get lost in margin modes and settings – which is exactly how people end up overleveraged by accident.

BitMEX

Overall Score 4.1/5

BitMEX is the alternative to PrimeXBT that still feels most “derivatives-native” in how it explains and builds its risk mechanics. In our experience, it is strongest on majors when you care about engine behavior and trigger logic: fair price marking, mark price concepts, liquidation behavior, and ADL are documented in a way that helps you understand what causes what. This is less of a soft onboarding product and more of a pro tool, so the UI and terminology can feel like hard mode for beginners. Liquidity is typically best on majors, while the long tail is not where BitMEX tries to beat the biggest venues.

Benefits

Derivatives-first tooling and documentation that helps you understand triggers, liquidation behavior, and mark price mechanics more precisely.

Limitations

Liquidity and market share tend to be strongest on majors, and the platform feels more “pro tool” than onboarding-friendly for beginners.

Best for

Traders who want futures and perpetuals with exchange-native risk mechanics, plus a broader derivatives toolbox beyond basic perps.

Strengths:

- Broad derivatives lineup for a crypto-native venue: perpetual swaps, futures, options, and pre-launch style products (100+ derivatives products overall).

- Strong risk-engine transparency: Fair Price Marking and mark price concepts are explained clearly, with the goal of reducing wick-driven liquidations and manipulation risk.

- Margin and liquidation mechanics that feel built for serious leverage: leverage can go high (up to 250x where available), with documented partial liquidation behavior and a clearly described ADL framework for extreme scenarios.

- A transparency posture that stands out versus “marketing-only” claims: BitMEX publishes Proof of Reserves and Liabilities data with a stated twice-weekly cadence, plus public datasets and verification tools.

- Practical operational signals for active traders: a public status page with scheduled maintenance and recent uptime history helps set expectations during volatile weeks.

- Good “practice before pain” path: a dedicated Testnet, plus extensive product and API documentation for traders who plan to scale into systematic execution.

Weaknesses:

- Liquidity is typically best on majors, but BitMEX often sits mid-pack on derivatives rankings rather than consistently top-3, so long-tail contracts can be less forgiving on slippage.

- Fees vary by contract; public examples on some USDT perps show ~0.05% maker / 0.05% taker as a baseline, but you still need to check the exact contract you trade.

- The interface and derivatives-first language can feel like “hard mode” for beginners, especially if you are still building basic stop-loss and sizing habits.

WhiteBIT

Overall Score 4.1/5

WhiteBIT is the PrimeXBT alternative we think works best for chart-first beginners who still want real derivatives controls in a cleaner retail flow. Our testing revealed a no-nonsense workflow: perpetual futures, clear protective orders (TP/SL, OCO, stop-market, stop-limit), and leverage that scales by brackets instead of nudging you into “always 100x” behavior. WhiteBIT stands out for TradingView broker integration for futures, which makes execution feel natural when your analysis and alerts already live in TradingView. On majors the experience felt smooth, and for smaller contracts we preferred limit entries to keep slippage predictable.

Benefits

Straightforward perpetual futures with solid protective orders and a TradingView-friendly workflow.

Limitations

Liquidity is deepest on majors; for smaller contracts, stick to limit orders. Documentation covers the key retail mechanics, while ultra-deep engine write-ups are less prominent than on derivatives-first venues.

Best for

Beginners who want a clear futures interface with real risk orders, plus TradingView execution for chart-first trading.

Strengths:

- Perpetual-only futures with funding every 8 hours (00:00, 08:00, 16:00 UTC), which is easy to plan around if you hold positions for 1–7 days.

- Up to 100x leverage with brackets, so the platform nudges you toward more realistic leverage as position size grows.

- A genuinely useful set of risk orders for beginners: TP/SL, OCO, stop-market and stop-limit, plus post-only/IOC-style execution controls.

- Hedge Mode is available (long and short on the same pair), which matters once you start managing positions more actively.

- Strong “trust signals” for a retail-first venue: a published Proof of Reserves audit report (Hacken, Nov 2024 snapshot) plus clearly stated custody/security claims (WhiteBIT states 96% cold storage and an insurance-fund coverage plan up to $30M).

- TradingView broker integration (futures) is a big workflow win if your alerts and levels already live in TradingView.

Weaknesses:

- On secondary pairs, pricing can move faster than you expect; we would still use stop orders and limit entries rather than chasing with market orders.

- The interface has a lot of knobs. If you are brand-new, master one stop type at a time before adding Hedge Mode and OCO into the mix.

NinjaTrader

Overall Score 4.1/5

NinjaTrader is a different category of PrimeXBT alternative: it is a regulated futures brokerage, not an offshore perpetuals venue. In our experience, it fits best if you want exchange-listed crypto futures with a rules-based workflow, where costs are modeled as per-contract commissions and fees rather than perpetual funding cycles. You trade contracts with expiries and learn rollovers, which is a different habit than holding perps for days. The upside for beginners is structure and practice: simulator-first workflows and classic futures trade-management tools make it easier to build disciplined entries and exits before going live.

Benefits

Regulated futures trading with predictable fee mechanics (no perp funding) plus a strong simulator path that lets beginners practice entries and exits without stress.

Limitations

This is not a perp exchange: crypto selection is narrower, and you must learn per-contract commissions/fees and how to manage expirations and rollovers.

Best for

Beginners who want regulated crypto futures (not perpetuals) and prefer practicing in sim before risking real money – especially if they already like “pro” futures platforms.

Strengths:

- Regulated posture (FCM / NFA membership disclosures) is a real trust signal for first-time leveraged traders who worry about offshore venues.

- No 8-hour funding because you trade exchange-listed futures with expirations; costs are easier to model as commissions + exchange/clearing/regulatory fees.

- Crypto futures access is “major-first”: CME Bitcoin futures and micro products, plus smaller “nano” contracts via Coinbase Derivatives for more accessible sizing.

- Practice-first onboarding: free trial / sim trading with live-data style workflows makes it easier to learn stop placement, brackets, and position management before funding.

- Risk tooling that nudges discipline: classic futures order types plus trade management features (like ATM-style workflows) help you predefine stops/targets instead of improvising.

- Margin is rules-based (including intraday margin programs on some products), which often feels more predictable than “pick 100x–500x” leverage sliders.

Weaknesses:

- The platform can feel pro-software-first: beginners may need a few sessions in sim before the interface stops feeling overwhelming.

- If you hold positions longer than a day, you must understand expiry and rolling contracts, which is a different habit than holding perps.

- If your goal is broad altcoin exposure, this is not the best fit — it is mainly a BTC/ETH futures-style menu, not a long-tail perp universe.

Final verdict: best PrimeXBT alternative for you

Which PrimeXBT alternative fits you best? We tested these venues with beginner-style workflows, and the fastest way to decide is to match the platform to your first-month constraint: liquidity, margin model, tooling, or access.

If you want the tightest spreads and the cleanest fills on BTC and ETH

Choose: Binance Futures

In our experience, this is the safest default when execution predictability matters most. Just keep leverage conservative and treat funding as part of the plan on multi-day holds.

If you want a unified margin setup and the strongest trade-management toolkit

Choose: Bybit

We think Bybit is easiest for building guardrails into your routine with conditional orders, OCO flows, trailing stops, and TWAP-style helpers. If you are still learning, start in Demo/Testnet before you scale.

If you care most about derivatives-native mechanics and understanding liquidation triggers

Choose: BitMEX

BitMEX is our pick when you want the rules explained clearly: fair price marking, liquidation behavior, and other engine mechanics are documented in a way that helps you understand what causes what. It is less about hand-holding and more about mechanics.

If TradingView is where you already do analysis every day

Choose: WhiteBIT

If your workflow is charts, alerts, and levels first, the TradingView broker integration can make execution feel much more natural. In our experience, it is a practical middle ground for beginners who want protective orders without a full pro-terminal maze.

If you want a regulated brokerage style experience instead of perpetuals

Choose: NinjaTrader

We would choose NinjaTrader if you prefer exchange-listed crypto futures with expiries and per-contract fees rather than perpetual funding cycles. It is also a clean fit if you want a simulator-first runway and a more rules-based environment.

If regional access is your main constraint and you need the smoothest works-for-me setup

Choose: Binance Futures or WhiteBIT

We would pick based on what is fully available in your jurisdiction (KYC, limits, product access). The best PrimeXBT alternative is the one you can actually use consistently, without surprise restrictions.

Top PrimeXBT alternatives 2026: side-by-side comparison

| Exchange | Score | Standout | Fees | Assets | Fiat | PoR | Best for |

|---|---|---|---|---|---|---|---|

| PrimeXBT | 4.0/5 | High-leverage, retail-friendly futures-style flow (PXTrader 2.0) | Maker 0.01%; taker starts 0.02% (VIP lower); 8h funding | 130+ crypto assets (PXTrader 2.0) | Varies by region | No routine PoR shown on core futures pages; strong security disclosures | Beginners who want a simple perp-style workflow + demo before going live |

| Binance Futures | 4.4/5 | Liquidity “baseline” on BTC/ETH; deep majors execution | Tiered maker/taker + 8h funding (check latest schedule by region) | Very large futures universe (majors + long tail) | Varies by jurisdiction | Publishes PoR (Merkle-style) | Traders who prioritize tight spreads, fast fills, and broad contract coverage |

| Bybit | 4.3/5 | Best-in-class trade management toolkit (conditional/OCO/trailing) | Competitive maker/taker + 8h funding (can change in stress) | Large derivatives lineup | Varies by jurisdiction | Publishes PoR reports | Beginners who want guardrails (advanced orders + demo/testnet) while scaling up |

| BitMEX | 4.1/5 | Derivatives-native mechanics + “engine clarity” mindset | Maker/taker varies by contract; 8h funding on perps | Broad derivatives product set (perps/futures/options, etc.) | Mostly crypto rails | Publishes transparency materials (PoR/Liabilities) | Traders who care about liquidation/mark-price mechanics and pro-style execution |

| WhiteBIT | 4.1/5 | TradingView workflow + clear retail futures controls | Maker 0.01%; taker up to 0.055% (by pair); 8h funding (00:00/08:00/16:00 UTC; adjustable) | ~280+ perp pairs (CoinGecko lists 288) | Varies by region | PoR audit report (Hacken); WhiteBIT states 96% cold storage + insurance fund up to $30M | Chart-first beginners who want perps + protective orders without a heavy pro-terminal |

| NinjaTrader | 4.1/5 | Regulated brokerage route to exchange-listed crypto futures (no perp funding) | Per-contract commissions + exchange/clearing fees; no 8h funding | BTC/ETH futures families (CME + micro; plus “nano” sizing via Coinbase Derivatives) | Region-dependent (brokerage rails) | Not PoR; regulated FCM/NFA disclosures | Beginners who want regulated crypto futures, simulator-first learning, and rules-based margin |

Methodology – why you should trust us

We reviewed PrimeXBT and its main alternatives using our weighted, category-based model designed for leveraged crypto trading. As a consistent benchmark, we use a small-balance scenario (around $200) and place retail-size leveraged trades (typically 10x to 50x) on major perpetual markets like BTC and ETH where access is available. We track funding across multiple 8-hour cycles, check stop-loss behavior during volatility, compare spreads across US and Asia trading hours, and verify basic withdrawal flows when possible. We rate platforms across seven weighted criteria from 1.0 to 5.0, focusing on real execution quality and risk tooling, not marketing claims.

Read our full methodology: How We Test Crypto Futures Trading Services

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.