PredictIt review 2026: fees, limits, and trust signals for beginners

PredictIt looks simple at first: pick a political outcome, buy Yes or No, and wait. But for beginners, the real question is not how to click buy, it is how much fees and withdrawal friction can eat into small wins, and how stable the rules are in the United States. In this PredictIt review we break it down. GNcrypto rating: 4.3/5.

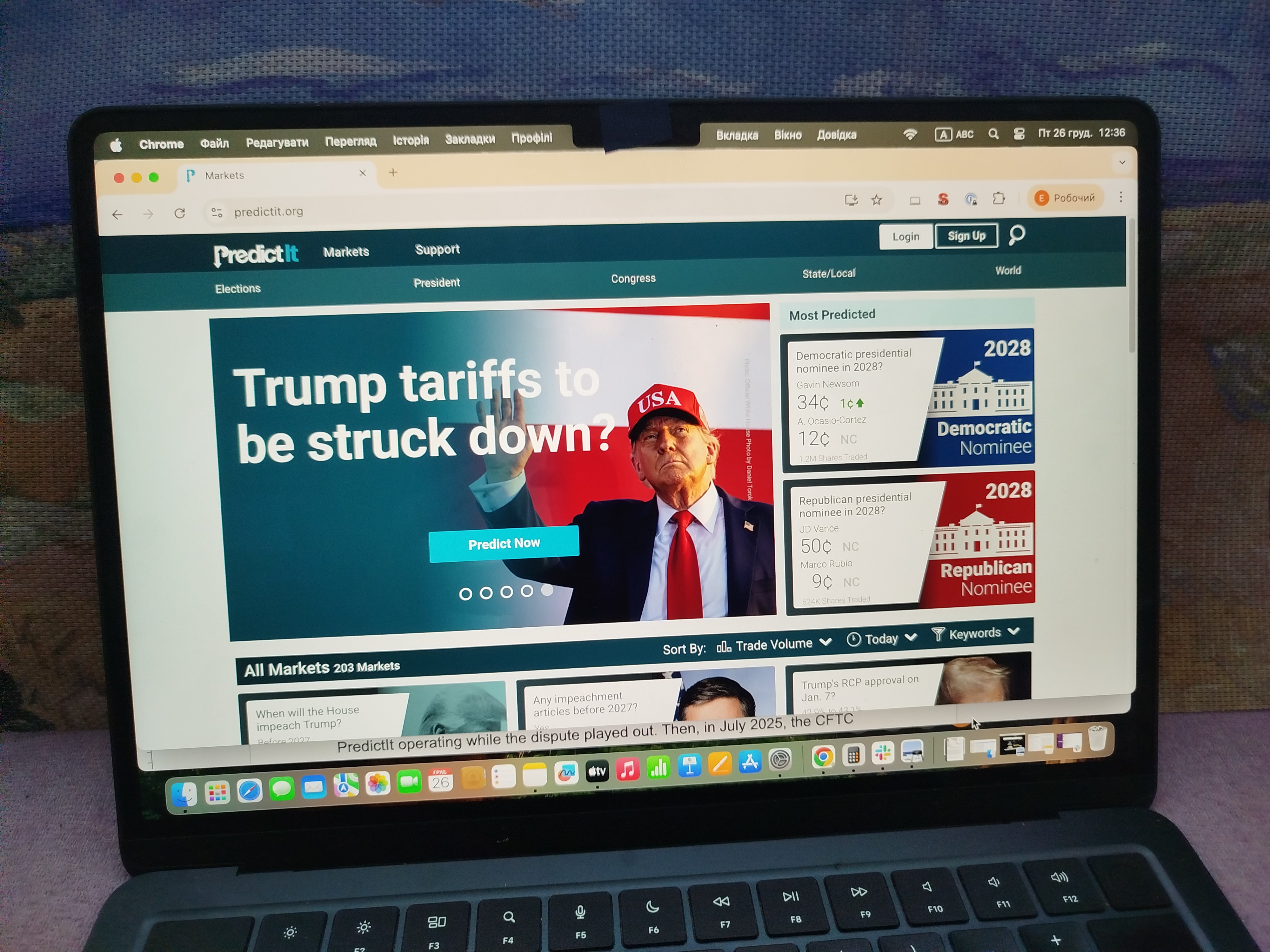

PredictIt is a U.S.-focused political prediction market where you trade simple Yes/No contracts on elections, nominations, and major government outcomes. In our review, the platform feels straightforward for beginners: prices work like rough probabilities, and you can exit early or hold to settlement. The main downside is cost and friction – PredictIt takes a 10% cut of profits on winning positions, charges a 5% withdrawal fee, and applies a 30-day holding period after your first deposit before you can withdraw. We think PredictIt suits U.S.-based beginners who want political markets in a clearer regulatory perimeter and don’t mind paying higher fees for access.

PredictIt overview

PredictIt is a real-money prediction market focused mostly on U.S. politics. Instead of placing a traditional “bet,” you trade simple Yes/No contracts tied to a specific outcome (for example, whether a candidate wins a primary or whether a nominee gets confirmed). In that sense, this PredictIt sports betting platform review may surprise beginners: we think PredictIt works more like a lightweight trading venue for political events than a classic sportsbook.

In our testing, the easiest way to understand PredictIt is to treat the contract price as a rough probability. If “Yes” is trading around $0.62, the market is roughly implying a 62% chance of that outcome. You can buy Yes (or No), then either sell early if the price moves in your favor or hold to settlement. When the event resolves, contracts typically settle to $1.00 if you’re right and $0.00 if you’re wrong.

What we’d emphasize for first-time users is the practical checklist: pick a market with clear rules, read the resolution criteria before you click buy, start with a small position, and avoid thin markets where you may struggle to exit at a fair price. Overall, we see PredictIt as strongest for beginners who specifically want political markets – not broad, “anything goes” coverage.

Fees, limits & costs

Costs are the main trade-off on PredictIt, and they matter a lot if you’re starting small. In this PredictIt prediction market platform review, our takeaway is simple: you should treat fees and spreads as part of your “edge” calculation before you place a trade.

The headline fee is a 10% cut of profits whenever you exit a position at a gain. This isn’t a per-trade commission in the usual sense – it’s closer to a performance fee. A quick example: if you put $100 into a market and end up with $120 when you close out, your profit is $20 and the fee would be about $2, leaving you with $118 (before any withdrawal fee).

Then there’s the 5% withdrawal fee, which can sting on small balances. If you withdraw $200, the fee is roughly $10. Practically, we think this pushes beginners toward fewer, larger withdrawals instead of “cashing out” after every small win.

PredictIt also applies a 30-day holding period after your first deposit before you can withdraw, which is easy to miss if you’re testing with small amounts.

Don’t ignore the hidden cost: bid–ask spreads. Even before platform fees, a wide spread can function like an invisible cost. Our practical approach is to (1) stick to the most active markets, (2) use limit orders instead of chasing the current price, and (3) size positions so you can exit without panicking if liquidity dries up.

On limits, PredictIt historically had a 5,000-trader cap per market, which could make popular contracts feel constrained. The 2025 CFTC no-action update removed that trader cap and set an “allowable investment” ceiling per contract tied to the federal campaign contribution limit (often cited around $3,500). For beginners, we’d treat this as a hard maximum, not a target: start with a small, comfortable amount and scale only after you’ve learned how prices move and how settlement works.

A quick “total cost” rule we use: estimate your expected profit, subtract 10%, and assume you may give up a bit more to spreads – then decide if the trade is still worth it.

Pros and cons of using PredictIt

Based on our testing, our view is that PredictIt can be a practical starting point if you care about U.S. political markets and you’re okay paying a premium in fees for that access. But it’s not the cheapest place to learn, and it’s not designed for “trade everything” users.

Strengths:

- Clearer U.S. access framework (relative to offshore sites). PredictIt operates under a CFTC no-action structure, which we think reduces the “am I even allowed to use this?” anxiety for U.S.-based beginners.

- Strong coverage in politics. You’ll usually find plenty of election, nomination, and policy-adjacent markets, which is where PredictIt is most useful.

- Beginner-friendly contract model. Yes/No contracts make it easy to think in probabilities and build good habits (read rules, size positions, set an exit plan).

- Public market data ecosystem. If you ever want to go deeper, there’s a community of trackers and tools built around PredictIt’s market data.

Weaknesses:

- Fees can eat small wins. The 10% profit fee plus the 5% withdrawal fee means you need a meaningful edge to come out ahead.

- Liquidity is uneven. Major markets can be workable, but smaller ones may have wider spreads and tougher exits.

- Narrow scope. If you want sports, crypto, or macro in the same place, PredictIt may feel limited.

- Regulatory history adds uncertainty. Even if day-to-day trading feels stable, rules around the platform have changed before, which is worth keeping in mind.

Trustworthiness check

For beginners, we think “trustworthiness” on PredictIt is less about fancy trading tools and more about how the platform is allowed to exist in the U.S. and whether the rules around it look stable.

Here’s the key point we’d explain upfront to avoid confusion: the core regulatory documents are addressed to Victoria University of Wellington, because the original CFTC staff no-action relief (Letter 14-130, issued in 2014) was granted to that institution – while the market itself has been operating under the trade name PredictIt. In other words, the paperwork names the operator, not the website brand.

That same regulatory history also shows real headline risk. In August 2022, the CFTC withdrew the 2014 no-action position and asked for contracts and positions to be wound down. In 2023, the Fifth Circuit said a preliminary injunction was warranted and sent the case back for it to be entered, which kept PredictIt operating while the dispute played out. Then, in July 2025, the CFTC issued an updated letter (25-20) that amended the earlier framework, including removing the old 5,000-trader-per-market cap and setting an “allowable investment” ceiling per contract tied to the federal campaign contribution limit (often cited around $3,500).

Our practical takeaway for new users:

- Don’t treat access as “guaranteed forever” – rules can change.

- Keep your starting balance small and avoid leaving idle funds on-platform.

- Prefer markets with clear written resolution criteria and official sources.

Is PredictIt a good choice?

In our view, PredictIt is a “yes, but” platform. If you’re a U.S.-based beginner who mainly wants to trade political outcomes in a more clearly defined legal framework than most offshore sites, it can be a reasonable place to start. That said, any PredictIt sports betting review should be honest about the trade-offs: fees are high, and the market selection is narrow outside politics.

We’d consider PredictIt a better fit if:

- You’re focused on major U.S. political events (presidential race, primaries, confirmations).

- You’re comfortable paying for access and you’re not trying to scalp tiny price moves all day.

- You’re willing to read market rules and treat each contract like a mini “terms sheet.”

We’d skip it (or use it only for a small experiment) if:

- You want low fees and frequent withdrawals.

- You prefer a wide range of categories beyond politics.

- You need consistently deep liquidity in niche markets.

If you do try it, our practical starter plan is: begin with a small deposit, pick one or two high-activity markets, place limit orders, and write down your exit plan before you enter (sell if the price moves to X, or hold to settlement). Finally, because PredictIt’s operating conditions have shifted in the past, we’d keep an eye on policy updates and treat PredictIt as a shorter-horizon venue rather than a place to park cash.

GNcrypto’s overall PredictIt rating

| Criteria | Rating |

|---|---|

| Market Selection & Coverage | 4.7 |

| Liquidity & Volume | 4.4 |

| Fees & Total Cost | 3.2 |

| Resolution Quality & Speed | 4.8 |

| Market Pricing Efficiency | 3.9 |

| Regulatory Compliance & Access | 4.7 |

| Deposit/Withdrawal Methods | 4.0 |

| Tools & User Experience | 4.4 |

| Total Score | 4.3 |

Methodology – why you should trust us

We use a weighted, category-based model and combine public data with hands-on checks to rate prediction market platforms on a 1.0–5.0 scale (in 0.1 steps). Our focus is practical trading quality: fees, liquidity, access, how outcomes get resolved, and the day-to-day user experience.

How we collect data

- Public sources: fee pages, market lists, platform rules/resolution criteria, access and compliance disclosures, and official regulatory documents where relevant.

- First-hand checks: we place test trades, look at effective costs (fees + spreads), and review how easy it is to place, exit, and track positions.

We do not audit balance sheets or guarantee solvency. These ratings reflect usability, market quality, and how reliably a platform resolves outcomes – not whether it will exist forever.

Categories & weights

- Liquidity & Volume – 25%

- Fees & Total Cost – 20%

- Regulatory Compliance & Access – 15%

- Resolution Quality & Speed – 12%

- Market Selection & Coverage – 10%

- Deposit/Withdrawal Methods – 8%

- Pricing Efficiency – 6%

- Tools & User Experience – 4%

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.