Predictit vs Polymarket 2026 comparison: fees, access, and best use cases

We compared both platforms using the same scoring model, then asked the only beginner question that matters: which one helps you trade cleanly and cash out without surprises in 2026. The answer depends on what you want to trade and how you want to fund your account.

After reviewing both platforms side by side, the split is clear. Polymarket feels faster and cheaper for crypto-native traders – if you already use USDC and don’t mind wallet setup, it’s the obvious pick for broad market coverage. PredictIt felt more structured but expensive – if your focus is U.S. politics and you want regulatory guardrails, the higher fees and extra withdrawal friction are the trade-off. The table below shows how each platform scores across our categories.

Polymarket vs PredictIt at a glance

| Category | Polymarket | PredictIt | Winner |

|---|---|---|---|

| Market Selection & Coverage | 5.0 | 4.7 | Polymarket |

| Liquidity & Volume | 5.0 | 4.4 | Polymarket |

| Fees & Total Cost | 5.0 | 3.2 | Polymarket |

| Resolution Quality & Speed | 4.8 | 4.8 | Draw |

| Market Pricing Efficiency | 4.8 | 3.9 | Polymarket |

| Regulatory Compliance & Access | 4.5 | 4.7 | PredictIt |

| Deposit/Withdrawal Methods | 4.7 | 4.0 | Polymarket |

| Tools & User Experience | 4.2 | 4.4 | PredictIt |

| Total Score | 4.8 | 4.3 | Polymarket |

Core differences between Polymarket and PredictIt

Both platforms let you trade Yes or No outcomes, but they operate on different rails.

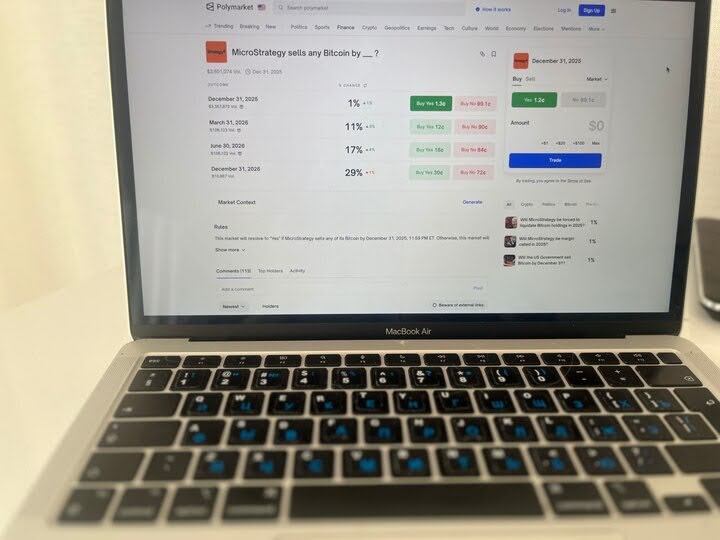

Polymarket is crypto-native. You trade shares that settle to $1 in USDC if correct, resolved through UMA Optimistic Oracle with an on-chain dispute process. The big practical upside is cost: no deposit or withdrawal fees, and most Polymarket markets have no trading fees. However, taker fees apply to certain products (notably 15-minute crypto markets). In testing, this meant keeping more of small wins, especially on liquid markets where spreads stay tight.

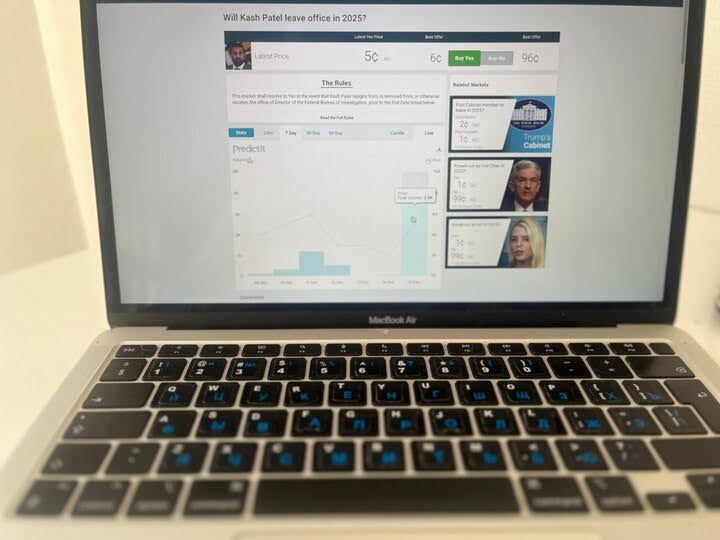

PredictIt focuses on U.S. politics and runs more centralized resolution. Contracts generally trade between $0 and $1, settling to $1 if correct and $0 if wrong. The fee structure punishes small accounts hard: 10% on profits, 5% on withdrawals, plus a 30-day hold after your first deposit. A $50 win becomes $42.50 after fees – this platform rewards patience, not frequent trading.

Accessibility splits cleanly. Polymarket requires crypto familiarity – you need USDC, sometimes bridging across networks, and wallet management. PredictIt is onboards like a standard web account, simpler upfront but locked to U.S. regulatory rules that have shifted over time.

Settlement risk diverges too. Polymarket’s dispute mechanism is transparent, but subjective markets (like “Will X happen?”) can spark controversy. Stick to objective outcomes tied to official sources. PredictIt writes rules on each market page, but resolution is centralized – read criteria like a legal contract before you trade.

If you are choosing Polymarket or PredictIt, the practical split is simple: Polymarket for lower costs and broader categories, PredictIt for U.S. politics depth and regulatory guardrails.

Strengths of Polymarket

In this PredictIt vs Polymarket comparison, Polymarket wins on what beginners notice first: market variety, liquidity on major events, and transparent costs.

Market selection is broad. You’ll find active markets across politics, macro, crypto milestones, sports, and culture. Beginners succeed on binary questions with clear resolution. Our practical approach is to start with markets where the outcome is tied to an official result, a timestamp, or a hard metric.

Liquidity matters more than volume stats. Polymarket often leads in headline volume, but there’s ongoing debate about quality and potential overcounting. What you can verify yourself: tighter spreads on major markets, faster fills during volatility. On the 2024 election night, spreads on Trump/Harris stayed under 1% even during the surge – that’s real depth.

Сosts stay low. Aside from taker fees on 15-minute crypto markets (introduced January 2026), Polymarket charges no trading fees on most markets. – your only drag is spread and slippage. Trade the most active markets, use limit orders, and size positions so you’re not forced to panic-exit.

The resolution is transparent but not foolproof. The UMA oracle system works well for objective markets, but subjective questions can spark disputes. Stick to outcomes with official sources.

Beginner plan: pick one liquid market, trade small ($50-$100), withdraw once to confirm your workflow end-to-end.

Strengths of PredictIt

PredictIt’s advantage is laser focus. If you only care about U.S. political events, this platform was built for you. Election outcomes, primary races, policy-adjacent markets – all framed as simple Yes/No questions.

Second, PredictIt operates inside a more structured U.S. regulatory perimeter than most offshore-style prediction markets. The key documents historically sit under a CFTC no-action framework, and the 2025 update removed the old 5,000-trader-per-market cap and set an allowable investment ceiling per contract tied to the federal campaign contribution limit (often cited around $3,500). We see these as useful guardrails, but we would not treat them as a suggestion to size up.

Third, the platform’s origin story can look confusing until you know the trick: regulatory letters were addressed to Victoria University of Wellington, while PredictIt is the market’s trade name. In our view, that context matters because it explains why PredictIt has always been closely tied to U.S. political markets and structured limits.

The trade-off is higher fees and withdrawal friction, so we think PredictIt works best for fewer, higher-conviction election trades rather than frequent in-and-out moves.

If you are deciding between PredictIt or Polymarket, we think PredictIt is the clearer pick when U.S. politics is your only priority.

Polymarket vs PredictIt – which should you choose?

If you are new to prediction markets, we think the best choice comes down to two questions: how you want to fund your account, and what you want to trade.

If you want the lowest explicit costs and the widest range of markets

Choose: Polymarket

Polymarket is usually the better fit if you are crypto-comfortable and want broad categories like politics, macro, crypto, sports, and culture. With no stated trading fees and no stated deposit or withdrawal fees, your main cost is spread and slippage, so you can often keep more of your edge.

If you mainly want U.S. politics and clearer guardrails

Choose: PredictIt

PredictIt is more focused on U.S. political outcomes, and it operates inside a structured U.S. regulatory perimeter. We think it works best when you want election-focused markets and you prefer a more traditional account feel, even if fees are higher.

If you plan to trade often and take small profits

Choose: Polymarket

PredictIt fees can eat into small wins because it takes a cut of profits and also charges for withdrawals. If you expect to enter and exit frequently, lower explicit fees matter.

If you want a simpler web style experience and are fine with making fewer, higher conviction trades

Choose: PredictIt

For beginners who do not want to deal with wallets and bridging, PredictIt can feel more straightforward. Our practical advice is to trade less, pick liquid political markets, and plan withdrawals so fees and the initial hold period do not surprise you.

Methodology – why you should trust us

We use a weighted, category-based model and combine public data with hands-on checks to rate prediction market platforms on a 1.0–5.0 scale (in 0.1 steps). Our focus is practical trading quality: fees, liquidity, access, how outcomes get resolved, and the day-to-day user experience.

How we collect data

- Public sources: fee pages, market lists, platform rules/resolution criteria, access and compliance disclosures, and official regulatory documents where relevant.

- First-hand checks: we place test trades, look at effective costs (fees + spreads), and review how easy it is to place, exit, and track positions.

We do not audit balance sheets or guarantee solvency. These ratings reflect usability, market quality, and how reliably a platform resolves outcomes – not whether it will exist forever.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.