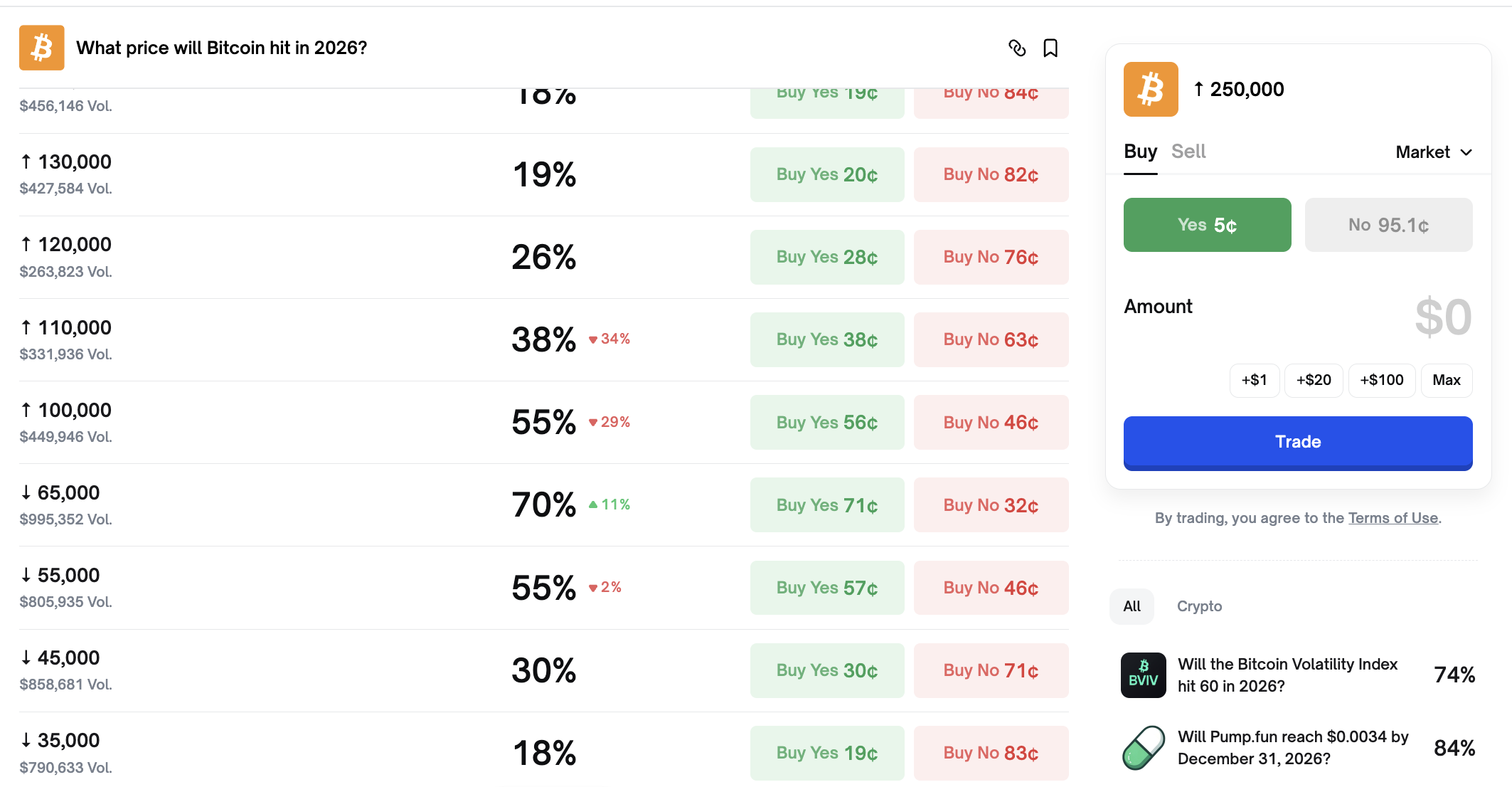

Polymarket traders price high odds of Bitcoin dipping below $65K in 2026

Polymarket odds for Bitcoin touching $65,000 or lower in 2026 climbed to about 72% after a weekend selloff that briefly pushed BTC under $75,000. Nearly $1 million has traded on the specific outcome, highlighting how quickly price expectations are shifting.

Bitcoin’s weekend slide did more than knock the spot price lower. It also changed the tone of the biggest crypto prediction markets, where traders are now leaning hard toward another leg down.

On Polymarket, the implied probability that Bitcoin will trade at $65,000 or lower at some point before the end of 2026 rose to 72% on Feb. 2, with close to $1 million in volume on that single threshold.

The contract is not based on an index average. It resolves “Yes” if any one-minute candle on Binance’s BTC/USDT pair prints a low at or below $65,000 during the market window. That detail matters because it turns the bet into a question about stress events and liquidity gaps, not just where Bitcoin settles on a given day.

Other big wagers on Polymarket also tilted bearish in the same session, including bets tied to a $55,000 downside level and a return to $100,000 by year-end, both priced near coin-flip territory. The shift fits a broader mood change after Bitcoin gave back gains that had followed President Donald Trump’s 2024 election win.

Some analysts see the selloff as part of a longer bear phase. CryptoQuant has argued the market flipped bearish in November 2025 after Bitcoin slipped below its 365-day moving average. The firm’s head of research, Julio Moreno, warned traders against trying to pick a bottom too early.

Others pointed to macro conditions. Quantum Economics CEO Mati Greenspan framed the move as noise around Bitcoin’s core purpose, while Raoul Pal has repeatedly tied crypto drawdowns to tight US liquidity rather than crypto-specific headlines.

The downside pricing stands out because several large firms have kept bullish 2026 targets on the board. For now, though, prediction-market traders are focused on nearer-term risk, while Polymarket itself faces state-level scrutiny in places such as Nevada and Tennessee.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.