PEPENODE presale tops $2.2M – best altcoin to buy during the crypto crash?

Crypto rose about 4% in 24 hours on growing expectations of a Fed rate cut next month. Bitcoin traded near $91,000, while the PEPENODE token presale reported more than $2.2 million raised.

Cryptocurrency prices advanced about 4% over the past 24 hours amid rising expectations that the Federal Reserve will cut interest rates next month. Bitcoin traded near $91,000, and presale token PEPENODE reported more than $2.2 million raised.

Bitcoin gained roughly 5% on the day, while Ether rose about 4% and Solana added approximately 3.5%. The upswing followed a positive session for U.S. equities and came even as several large tokens remain below their levels of a week and a month ago.

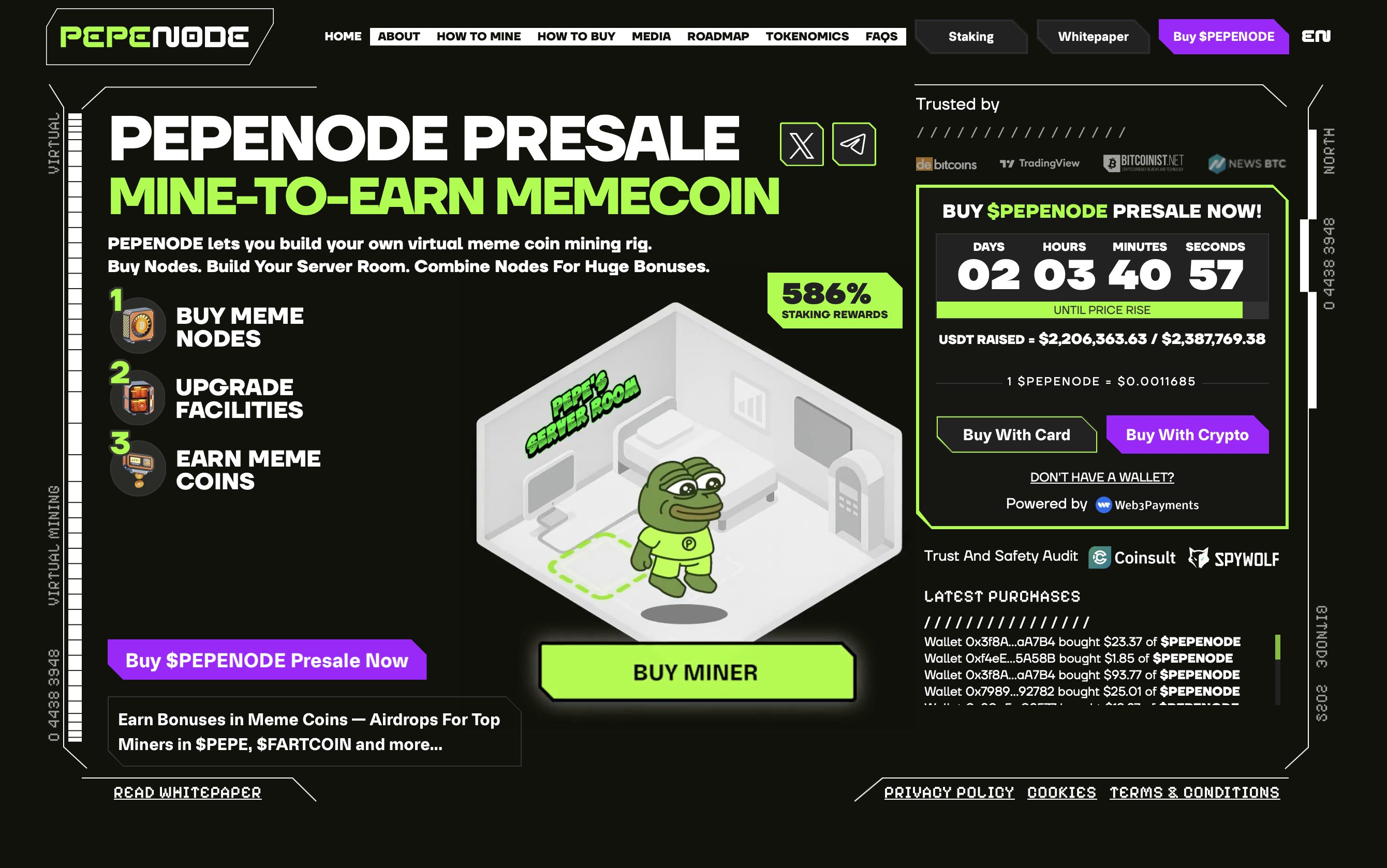

PEPENODE, an ERC-20 token, began its presale at the end of September and reports it has raised more than $2.2 million to date. Project materials describe a system aimed at making crypto mining more accessible by letting users create virtual mining rigs and add nodes by spending PEPENODE, with additional nodes intended to increase potential rewards.

According to the project, mining rewards are paid in external tokens such as Pepe and Fartcoin, with more coins planned later. The team advertises staking for PEPENODE with a current yield of 586% APY and says users can resell their virtual nodes after use.

The project lists a maximum supply of 210 billion PEPENODE allocated among marketing, development, listings, mining rewards, and a treasury. The presale price is $0.0011685 and is scheduled to increase in two days, with further incremental rises until the sale ends. Participation is available via the project’s website with a compatible wallet, and the team indicates exchange listings are planned in the coming weeks.

The broader market’s daily gains align with increased bets on easier monetary policy next month. Despite the latest rebound, many major cryptocurrencies remain lower over the past week and month.

As we reported earlier, decentralized exchanges set records in 2025, with DEX spot trading peaking near $24 billion in October and perpetual futures hitting about $903 billion that month. Researchers estimate DEXs handle roughly 26% of crypto futures, while the DEX-to-CEX perpetuals ratio reached around 11.7% in November 2025. Weekly DEX spot volume averaged about $18.6 billion in Q2, and unique wallets grew from roughly 6.8 million to 9.7 million by mid-2025. Activity centered on BTC and ETH pairs, with Solana and Ethereum Layer-2s gaining share. In Q1 2025, Web3 exploits led to losses exceeding $2 billion.

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.