October adds $3.6B to Bitcoin ETFs as trading surges

October closed with a simple but telling mix: flows green, price a headwind.

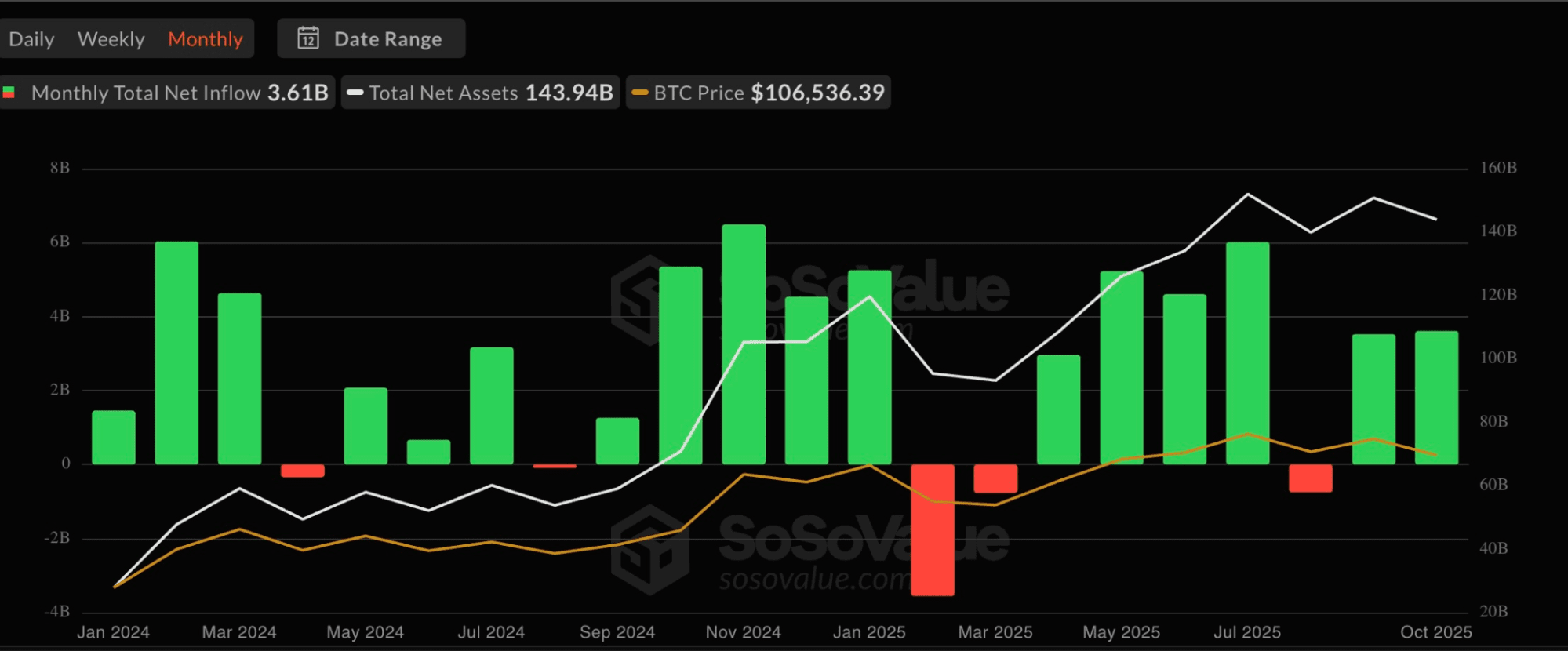

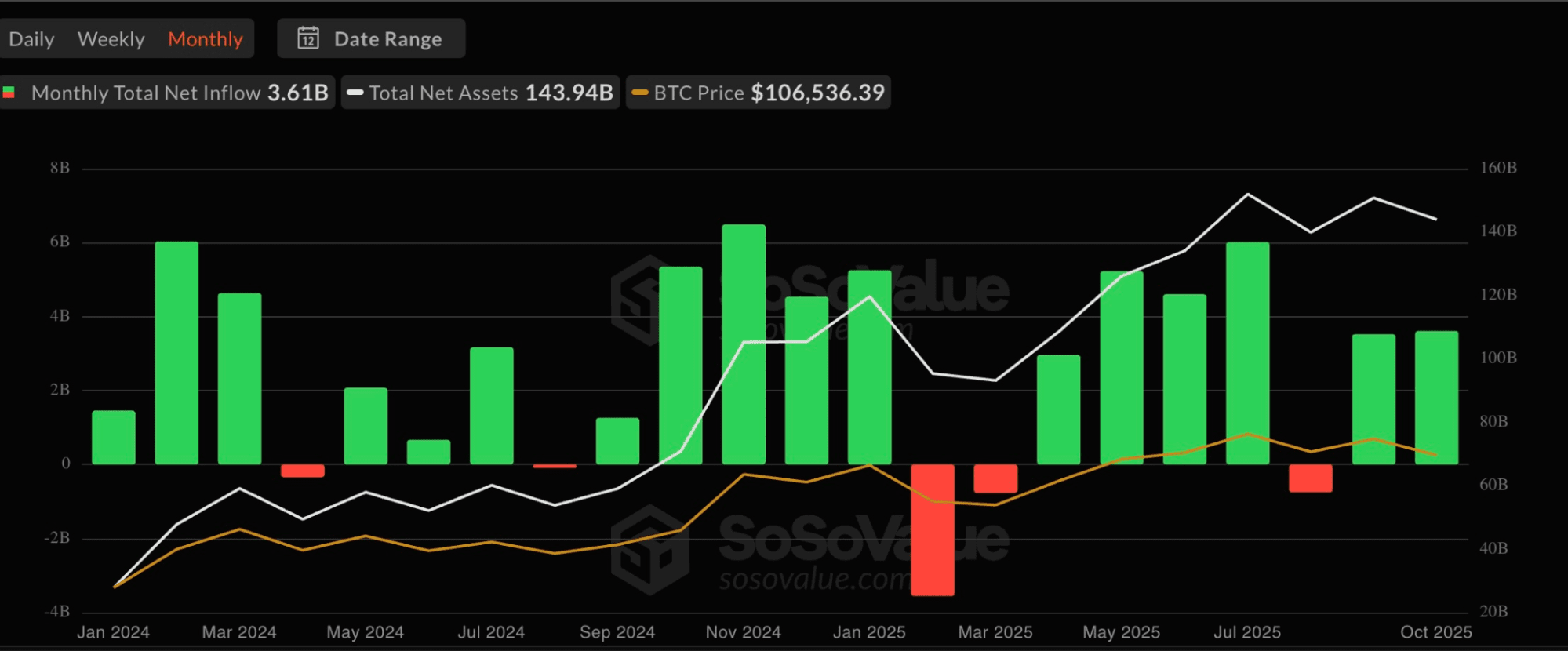

Net inflows summed to roughly $3.61B for the month, a touch above September’s $3.53B, yet assets under management ended around $143.94B – below September’s $150.77B – because BTC faded into month‑end. In other words, money kept coming in, but mark‑to‑market dragged the headline asset figure.

The participation backdrop strengthened materially. The estimated trading value for the segment climbed to about $133.45B, almost double September’s $72.91B. That shift turns October from a “quiet” green into an active one: investors kept using the ETF rails even as BTC price turned choppy.

October ended green: ~$3.61B into Bitcoin ETFs; AUM ~ $143.9B as price lagged. Source: SoSoValue.

Weekly prints inside the month traced a zig‑zag path – strong early inflows, a sharp risk‑off stretch mid‑month, a modest rebound, then a softer close – underscoring that the story was rotation on volatility rather than a disappearance of liquidity.

Leadership remained narrow and tilted toward one product. IBIT (iShares Bitcoin Trust) did the heavy lifting with an estimated $4.08B of October inflows – more than the month’s aggregate – while peers on balance were flat to slightly negative. Liquidity concentrated there as well: roughly $95.6B traded through IBIT out of the segment’s $133.5B, and month‑end AUM sat near $85.7B (about 59% of the group). Pricing stayed orderly with a small discount to NAV (−0.33%).

FBTC (Fidelity Wise Origin) closed the month in the green but on a smaller scale: about $176M of net inflow, $14.2B of value traded, and month‑end AUM near $21.9B with a similarly tight premium/discount (−0.38%). FBTC continues to provide depth and credible secondary liquidity, yet it did not set the tone; October’s outcome would have looked different without IBIT’s contribution.

Taken together, October was green and loud: flows similar to September, but with far higher engagement. The flywheel for November is straightforward. If BTC stabilizes, AUM should recover faster than flows alone would imply and modest net buying can keep the tape positive. If price pressure persists and leadership stays narrow, expect choppy prints where a single red day in the leader can still flip the aggregate.

Recommended