$2.1B in token unlocks coming in November: SUI, HYPE, and WLD

The total value of token unlocks in November 2025 is set to exceed $2.1 billion.

The biggest unlocks include Sui ($146.5M), Aster ($85M), Hype ($74.8M), Worldcoin ($65M), Ethena ($47M), EigenLayer ($40M), Aptos ($39M), and Arbitrum ($30.5M).

The rise in large unlocks reflects the 2024 listing cycle, most of these projects launched tokens during last year’s autumn bull run and are now entering the active phase of their vesting periods.

Sui – the biggest unlock of the month

On November 1, the Sui network will unlock 127 million tokens worth $146.55M, or about 5.6% of its total supply. It marks the largest unlock of the month and one of the biggest in 2025.

The tokens will be distributed among investors, early contributors, the community reserve, and the Mysten Labs trust. The last three Sui unlocks were followed by price drops, and in recent days the token has already fallen 9% to $2.38.

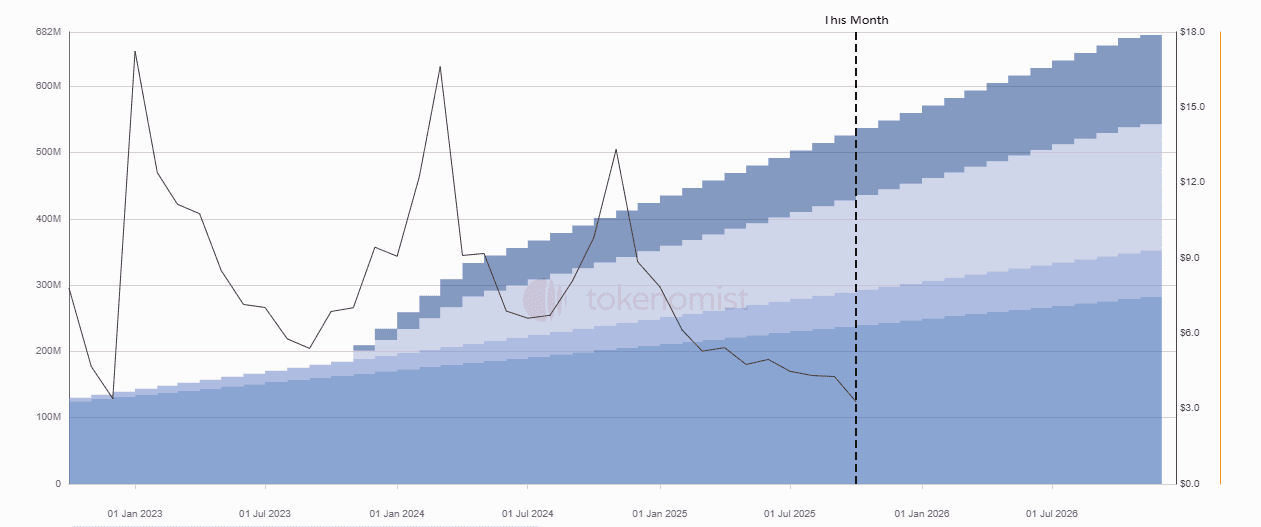

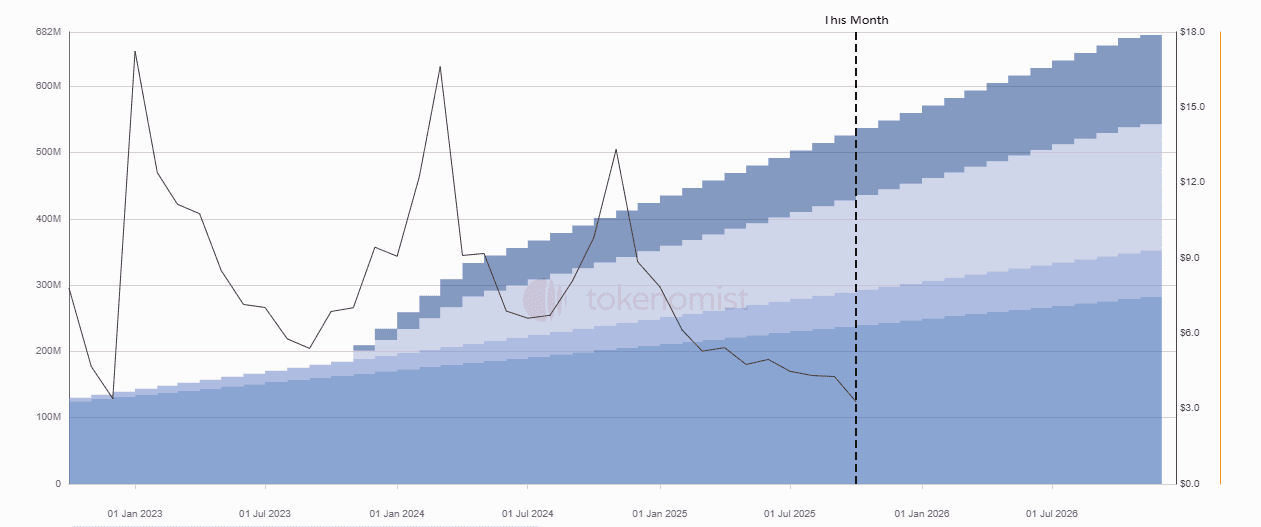

The last three SUI unlocks were followed by price declines. Source: tokenomist.ai

Although past unlocks have triggered short-term sell-offs, that trend may not repeat. With growing activity on Momentum DEX and new advisors joining the Sui Foundation, a local bottom may be forming. Investors should stay cautious and manage risk carefully.

HYPE and Worldcoin – new projects with major vesting events

The second-largest unlock in November comes from Hyperliquid ($74.8 million), one of the new DEXs that gained traction in 2025. Its tokens will be distributed among ecosystem funds and early investors.

Worldcoin (WLD) will unlock $65 million in tokens as it continues its incentive program for users and Orb device operators. Unlike Sui, Worldcoin has seen limited price pressure from previous unlocks, as part of its supply is used to drive real network activity.

Aptos, EigenLayer, and Arbitrum – steady performers

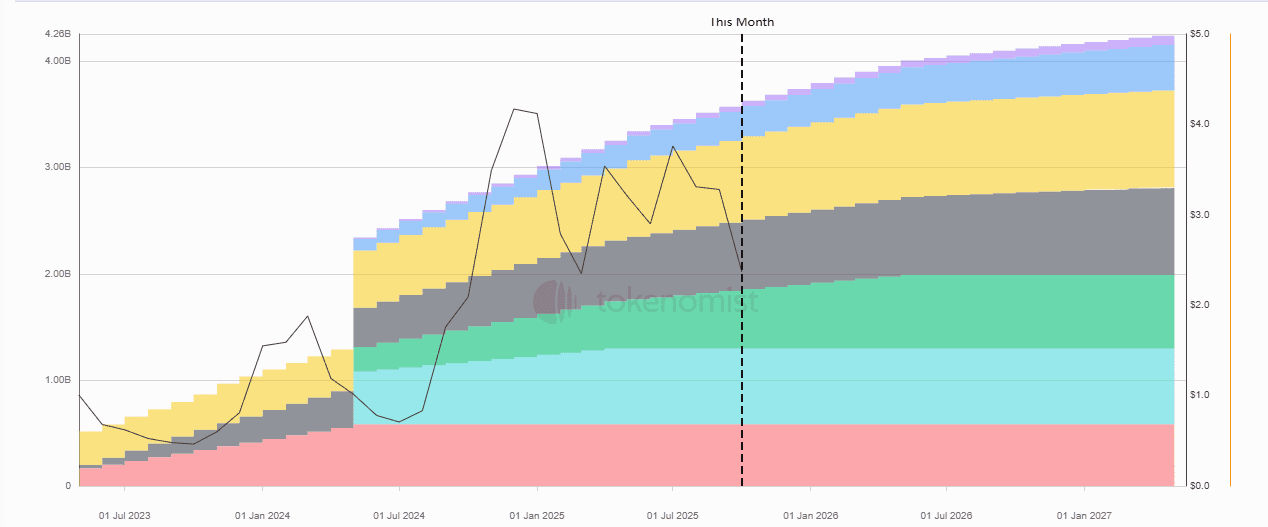

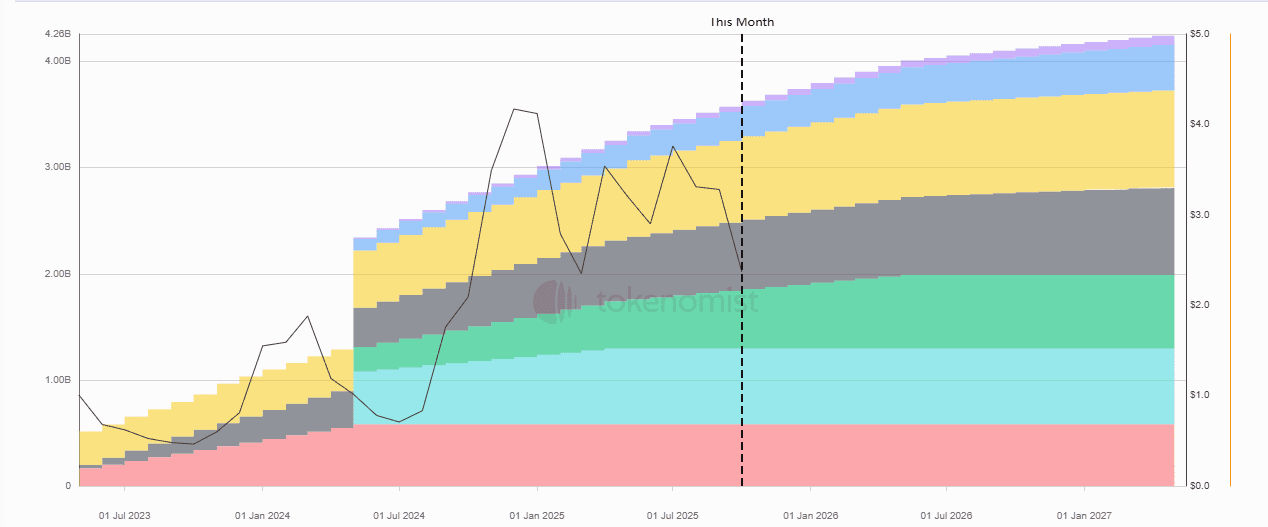

Mid-month, Aptos will unlock $39.1 million in tokens. Since November 2024, nearly every unlock has been followed by a price decline. However, that trend doesn’t guarantee another drop – it could just as easily serve as a trap and mark the start of a potential reversal.

APT price has fallen after every unlock since November 2024. Source: tokenomist.ai

EigenLayer ($40 million) and Arbitrum ($30.5 million) continue vesting on regular schedules with minimal volatility. Their unlocks mainly involve investors and team members, creating moderate but controlled selling pressure.

What it means for investors

November is typically an active month for token unlocks, as most tokens launched during the 2024 bull market are now reaching their one-year distribution marks.

Investors should keep a close eye on unlock schedules and the share of tokens entering circulation. Even in a stable market, unlocks exceeding 1–2% of total supply can spark volatility, particularly when liquidity is low.

Position sizing and risk management remain essential during periods of increased vesting activity.

Recommended