Nexo debit card review 2026: credit mode vs debit mode costs

Nexo Card is one of the most talked-about crypto cards in Europe in 2026, but the real experience depends on one switch: Debit Mode vs Credit Mode. We compared both modes with real-world spending logic, looked at FX and ATM costs, and mapped the results to beginner scenarios so you can decide if the convenience is worth the trade-offs.

After running the Nexo Card through a beginner-style live test, the split is clear. Use Debit Mode if you want predictable spending from a balance. Use Credit Mode only if you deliberately want a crypto-backed credit line and you are ready to monitor loan health. For most readers, the biggest constraints are simple: EEA and UK availability, FX fees that can bite on weekends, and rewards that depend on tier.

How the Nexo Card works

We think the Nexo Card is best explained as one card with two personalities, both tied to your Nexo account. It is not a self-custody product. Your funds sit on the platform, and the card is simply the spending layer on top.

The key feature is the mode toggle. In Debit Mode, purchases are funded from assets you already have on Nexo. In real use, it feels closest to a normal debit card: you pay, the balance goes down, and you are done. This is the mode we would recommend for most beginners because it keeps the mental model simple.

In Credit Mode, the same card acts like a credit card linked to your Nexo Credit Line. Instead of selling assets to pay, Nexo uses your holdings as collateral and lets you borrow against them at the moment of purchase. That can be useful if you want to avoid selling during a dip, but it also means every swipe can increase your loan balance.

Our practical rule of thumb is simple. If you want predictable spending, stick to Debit Mode. If you want the option to spend without selling, use Credit Mode only when you are deliberately choosing a collateralized loan and you are ready to watch your loan health.

One beginner detail we would not ignore in our Nexo Card review: eligibility is limited to selected European countries, including the EEA and the UK, so the first step is checking whether the Card tab is even available in your app.

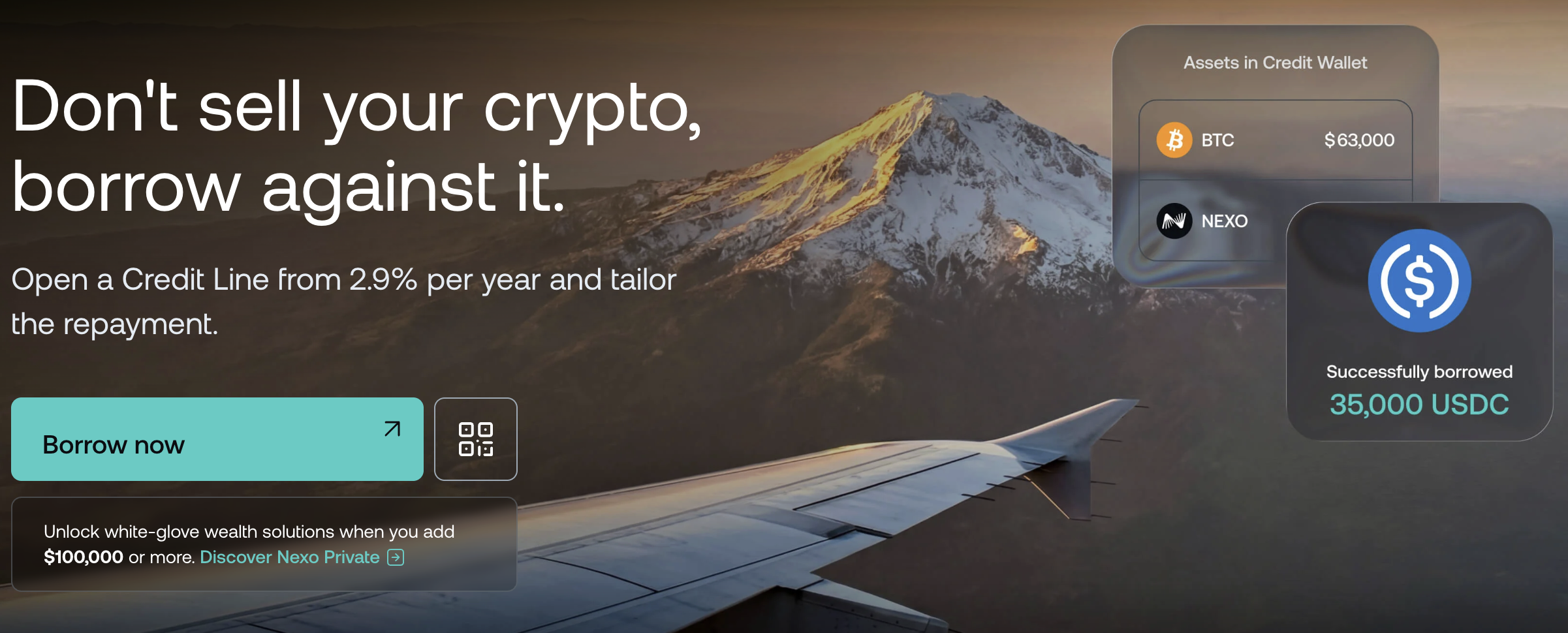

Using crypto without selling it

The core promise is spend without selling, and the honest translation is collateralized spending. You keep crypto in your Nexo account, Nexo extends a credit line against it, and the card charge is pulled from that credit line. You are not swapping coins at checkout in the debit card sense. You are borrowing.

Here is how it plays out in a beginner Nexo credit card review. You switch to Credit Mode, tap to pay, and the purchase increases your outstanding credit. Your collateral remains in place, but your loan metrics change immediately. If markets move against your collateral, your risk rises.

The two ideas beginners must understand are loan to value movement and liquidation risk. Loan-to-value simply means how large your loan is compared to your collateral value. If your crypto drops, the ratio worsens even if you do not spend another cent. If the ratio crosses Nexo thresholds, you may need to add collateral or repay, and in the worst case, part of your collateral can be liquidated.

A realistic scenario we think people underestimate: you use Credit Mode all weekend because it feels convenient, then Monday brings a sharp market drop. Your loan health worsens at the exact moment you least want to sell or top up. That is why we see Credit Mode as a tactical tool, not a lifestyle default.

Our safety rules are practical. Keep a big buffer. Do not use Credit Mode for routine groceries. Turn on alerts and check your loan health when markets are moving. And if you feel yourself using Credit Mode out of habit, switch back to Debit Mode and keep spending boring.

Interest, fees and repayments

In our Nexo debit card review, we think most surprises come from mixing up two types of costs: card usage costs and borrowing costs. Debit Mode is mainly about FX and ATM fees. Credit Mode adds interest.

Borrowing cost is where the marketing headline can mislead. Nexo promotes low-cost credit lines, with rates as low as 2.9% for Platinum and 5.9% for Gold, but those rates are conditional and depend on your Loyalty tier and on keeping your loan-to-value low. In practice, that means Credit Mode is not automatically cheap. If you are not actively managing the position, assume it will cost you something.

Card usage costs are easier to predict, but they matter most when you travel. Nexo states FX conversions are subject to either a low fee or a higher fee depending on the local currency, and weekend FX transactions carry an additional surcharge. In real life, that means the same foreign currency purchase can cost more on Saturday than on Tuesday. If you travel often, we would test a few small foreign purchases first, then decide whether the card fits your habits.

ATM withdrawals are also tier-based. There is a free monthly allowance that scales with Loyalty tier, then a percentage fee applies above the limit with a minimum charge. For beginners, the lesson is simple: if you never use ATMs, do not optimize for ATM perks. If you do use ATMs, track your monthly cash needs and do not get surprised by fees above the free threshold.

Repayments are the final beginner trap. Credit Mode spending is a loan. Even if Nexo does not force a fixed schedule, your balance can drift upward quietly. Our recommendation is to treat Credit Mode like a short-term tool: repay intentionally, keep your plan simple, and do not let a convenient card swipe turn into a long-running loan during a volatile market.

Pros and cons

We think the Nexo Card is easiest to like if you already use Nexo and you live in the EEA or the UK, because it gives you one card that can behave like simple debit spending or collateralized credit spending.

Strengths:

- Two modes for two mindsets: Debit Mode feels like normal spending from your balance, while Credit Mode can help you avoid selling crypto right now if you are comfortable managing loan risk.

- Fast start with a virtual card: you can begin with a virtual card and add it to Apple Pay or Google Pay, which is practical if you want to test real spending before waiting for plastic.

- Low commitment pricing: no monthly, annual, or inactivity card fees in the standard setup make it easier to try without feeling locked in.

- Rewards are clear, but tiered: the headline cashback depends on your loyalty tier and on whether you take rewards in NEXO or BTC, so your real outcome depends on how you use the platform.

- ATM allowances scale with tier: higher tiers can make cash withdrawals less painful, which matters for travel habits and cash-heavy countries.

Weaknesses:

- Not global: availability is mainly limited to selected European countries, including the EEA and the UK, so for many readers this is an instant deal breaker.

- Rewards have conditions beginners miss: the best rates depend on loyalty tier, and some reward rules are tied to how you use the card, so do not assume every purchase earns the headline percentage.

- FX fees can be the silent cost: foreign currency spending can cost more than expected, and the weekend surcharge can make the same purchase pricier on Saturday than on Tuesday.

- Credit Mode adds real downside: a market drop can push you into repaying or adding collateral at a bad time, so it is not a set and forget default.

- Physical card access can be stricter: many beginners may start virtual only, depending on current eligibility rules and account status.

Trustworthiness check

In our view, trust is earned through clear disclosures, how a company responds to scrutiny, and how predictable the rules feel over time. With Nexo, there are a few public events worth knowing before you decide to keep a meaningful balance on the platform.

- January 19, 2023 SEC settlement in the United States: regulators said Nexo agreed to pay penalties and stop offering its interest-bearing lending product to U.S. customers. The practical takeaway is that access and features can change by jurisdiction.

- January 12, 2023 Bulgaria investigation and raids: prosecutors announced an investigation and raids linked to alleged illegal activity. Even if you were not impacted, it is a reminder to keep only a spending float on any centralized platform.

- December 22, 2023 Bulgaria case closed: later reporting said the investigation was closed after finding no evidence of the alleged crimes. It is positive, but it also shows how long regulatory headlines can hang over a company.

- January 24, 2024, Nexo filed a $3 billion claim against Bulgaria: the company said the investigation harmed the business and sought damages. For card users, the point is context: legal disputes can be long and noisy even when the card still works day to day.

- January 2026 California DFPI action and $500,000 penalty: California’s regulator announced a penalty tied to unlicensed lending activity and published a consent order. Even if you live in Europe, it is another signal that compliance pressure can return.

One more nuance we watch: crypto card programs often rely on partner banks and program managers, so terms can change even when the brand stays the same. In our opinion, the safest beginner habit is to read in-app notices and keep your spending balance smaller than your long-term holdings.

GNcrypto’s overall Nexo Card rating

| Criterion | Score |

|---|---|

| Fees & Costs | 3.8 |

| Rewards & Cashback | 3.6 |

| Supported Currencies & Regions | 3.0 |

| Card Limits & Spending Controls | 4.2 |

| Security & Fraud Protection | 4.2 |

| User Experience & App Integration | 3.9 |

| Customer Support & Card Delivery | 3.6 |

| Total | 3.7 / 5 |

Methodology – why you should trust us

We score crypto payment cards using a weighted, seven category model and convert the results into a 1.0 to 5.0 rating in 0.1 steps. Our focus is practical: real fees, rewards that actually pay out, limits that do not block normal life, and whether the card works in your country.

We collect data from public sources such as fee tables, card terms, supported regions, and support documentation. We also use hands-on testing with real funds to check how top-ups, purchases, rewards, and in-app controls behave in practice.

We do not audit issuer solvency or promise regulatory compliance in every jurisdiction. These scores reflect practical usability and cost efficiency today.

Categories and weights:

- Fees and Costs – 25%

- Rewards and Cashback – 20%

- Supported Currencies and Regions – 15%

- Card Limits and Spending Controls – 15%

- Security and Fraud Protection – 10%

- User Experience and App Integration – 10%

- Customer Support and Card Delivery – 5%

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.