MEXC P2P trading 2026 – fee structure and real user experience

MEXC is usually the place you go to hunt for the latest 100x gem before it hits the mainstream, but their peer-to-peer (P2P) desk is a different beast entirely. Pitched as the “zero-fee” gateway for turning your local cash into the fuel needed for those high-leverage moonshots.

Liquidity & Volume

5.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.0

Liquidity & Volume

4.0

Payment Methods

4.5

Liquidity & Volume

3.5

Payment Methods

4.5

Liquidity & Volume

3.5

Payment Methods

3.5

But as any seasoned crypto nerd knows, “zero fees” often comes with a side of hidden spreads or the soul-crushing silence of an empty order book.

We didn’t just want to read the marketing fluff; we wanted to see if the engine actually turns over when you turn the key. Armed with a $200 mystery shopping budget, we dove into the MEXC P2P marketplace. We weren’t there to window shop – we were there to execute. Our mission was simple: test the escrow’s speed, see if the support team actually breathes, and find out if “zero fees” is a genuine gift or just a clever siren song.

In this review, we’re peeling back the UI to see the raw mechanics. Did we get our USDT in record time, or were we left staring at a “Pending” screen while the market moved without us? Buckle up – this is our hands-on, subjective, and slightly caffeinated journey through the MEXC P2P ecosystem.

What MEXC P2P is

Unlike the main exchange, where you trade against an automated order book, here you’re dealing with individuals or “merchants.” MEXC acts as the chaperone, providing the escrow service that locks the crypto until the payment is confirmed. It fits into the broader ecosystem as a seamless bridge: once your trade is complete, the USDT lands in your P2P account, and with one internal transfer (which is instant and free), you’re ready to dive into the spot or futures markets.

Think of the P2P MEXC marketplace as the bustling “port of entry” for the entire MEXC ecosystem. While MEXC is famous for hosting thousands of niche spot pairs and high-leverage futures, you can’t play those games without chips. The P2P platform is where you swap your local fiat currency – be it USD, EUR, or VND – directly with other humans to get those chips (usually USDT).

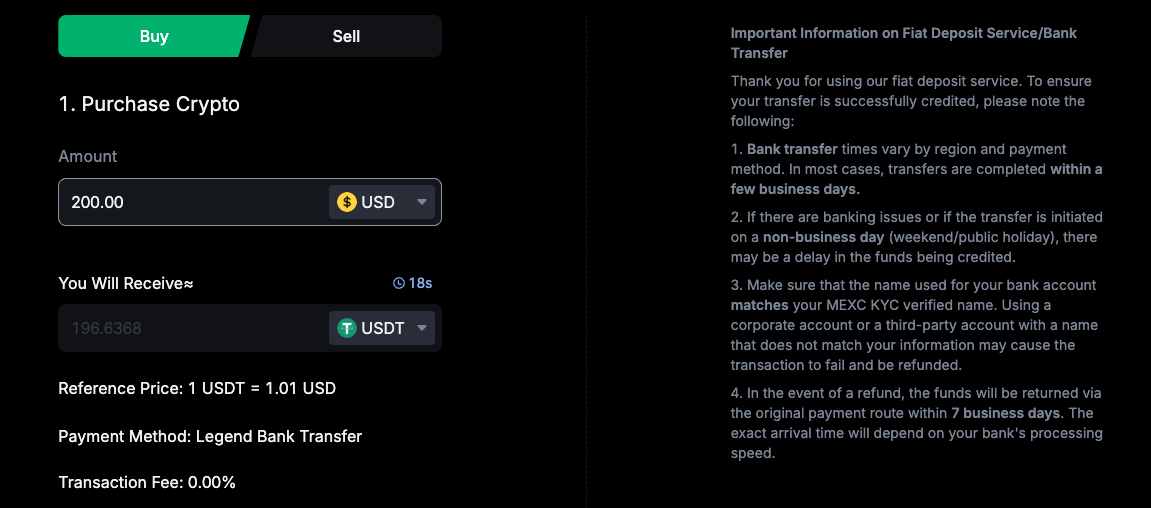

During our $200 mystery shopping test, we noticed that MEXC treats its P2P section as a loss leader. By offering a “zero-fee” environment for takers, they encourage you to onboard your capital there rather than paying the hefty credit card fees often found on other gateways. It’s a strategic gateway designed to get you onto the platform and into the action as fast as possible.

Supported assets & payment methods

If you’re expecting a massive supermarket of coins on the P2P side, you might want to adjust your sights. Unlike their spot market – which is basically the Wild West of altcoins – MEXC P2P trading is a more curated affair. It’s designed to be a streamlined on-ramp, focusing on the “big three” that actually move the needle: USDT, BTC, and ETH.

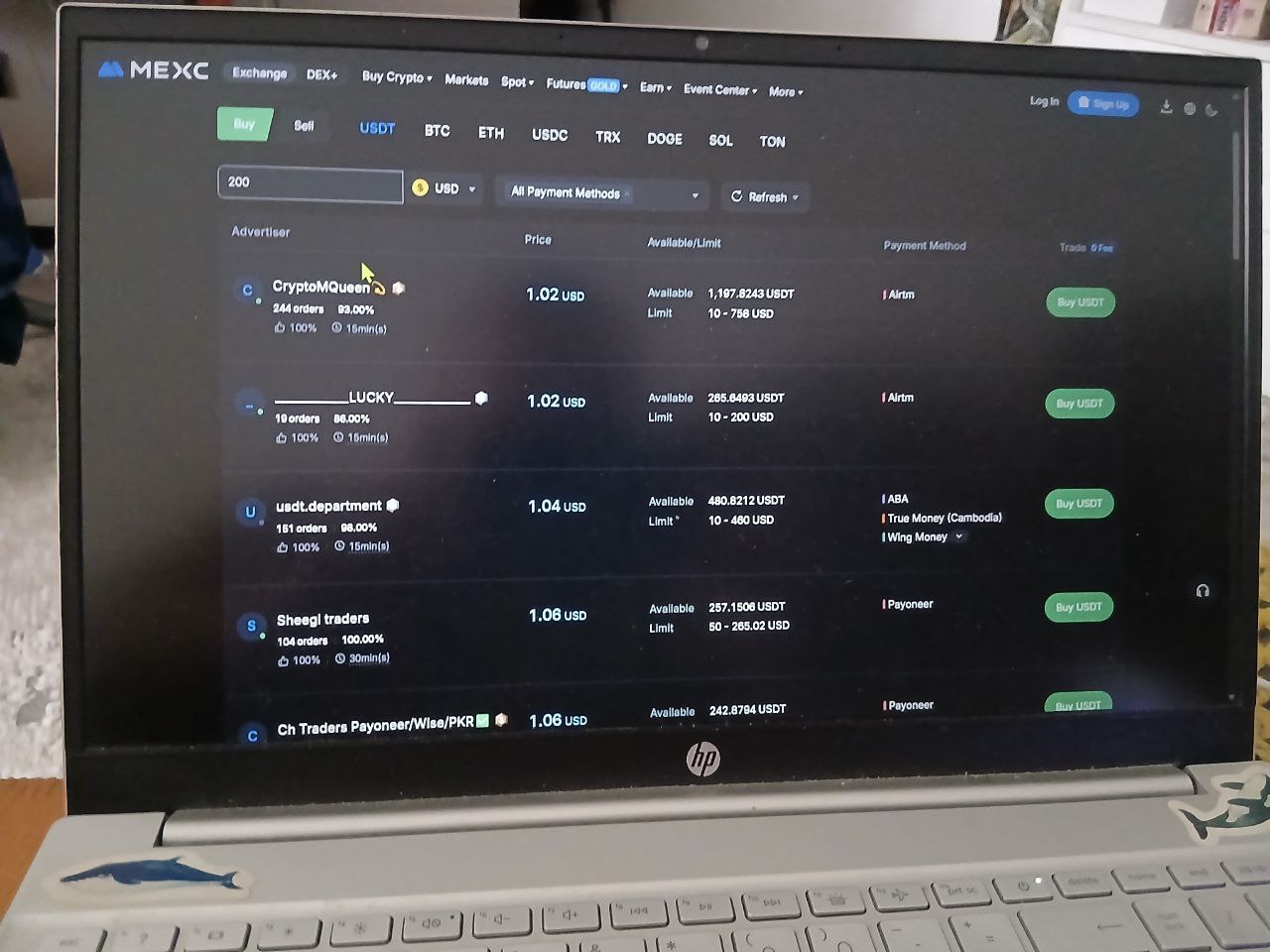

During our $200 mystery shopping test, we found that USDT is the undisputed king here. While BTC and ETH are listed, the liquidity for them can be hit-or-miss depending on your region. Most pros (and our team) just grab USDT and then use MEXC’s internal transfer to swap it for whatever obscure token they’re actually hunting in the spot market.

The fiat side is where things get interesting. MEXC supports an impressive spread of over 30 fiat currencies, covering everything from the heavy hitters like USD, EUR, and GBP to more localized options like VND, PHP, and RUB. The payment methods are equally diverse:

- Digital wallets: Wise, Revolut, Advcash, and various local e-wallets.

- Bank transfers: Standard SEPA, SWIFT, and instant local bank transfers.

- Specialty options: Depending on the region, you might even see options for cash-in-person or specific mobile top-up services.

The variety is solid, but here’s the nerdy reality: the “best” payment method is always the one with the most active merchants. In our test, we stuck to a fast digital wallet transfer to keep the escrow time under five minutes. If you pick an obscure bank transfer, be prepared for a wait that feels like an eternity.

How escrow and trade protection work

In the world of P2P, trust is a luxury you can’t always afford, which is why MEXC acts as the “middleman with a mallet.” The platform uses a standard escrow service to ensure that neither party can simply vanish with the goods. When a seller posts an ad and you initiate a trade, MEXC automatically locks the crypto assets from the seller’s account. They stay in a digital “limbo” until the seller confirms they’ve received your cash.

During our $200 mystery shopping test, we watched this process like hawks. The moment we marked the payment as “Sent,” the seller lost the ability to cancel the trade unilaterally. This is your primary shield: as long as the crypto is in escrow, the seller can’t run away with it while you’re waiting for your bank transfer to clear.

But what if things get messy? If a seller claims they never got the money (or just goes offline to take a nap), you hit the Appeal button. This is where MEXC’s dispute resolution team steps in. To win an appeal, you need to provide:

- Proof of payment: A clear screenshot of your bank or e-wallet receipt.

- Transaction ID: The specific reference number from your payment provider.

- Chat history: Any relevant communication with the seller inside the MEXC trade window.

As for MEXC p2p trading fees, here is the nerdy kicker: for “Takers” (people like us taking an existing offer), the fee is 0%. MEXC makes its money elsewhere in the ecosystem, so they let you onboard for free. However, don’t ignore the “hidden fee” – the spread. During our test, we noticed the P2P price was about 0.8% higher than the spot market price. It’s a small price to pay for the safety of a managed escrow, but it’s worth keeping an eye on if you’re moving more than just a couple of hundred bucks.

Pros, cons & limitations

How MEXC P2P compares to other peer-to-peer desks in daily use:

Strengths:

- The zero-fee gateway: For takers, the fee is a flat 0%, making it an incredibly cost-effective way to onboard capital. During our $200 mystery shopping test, we didn’t lose a single cent to platform commissions.

- Rapid-fire ecosystem sync: Because it’s natively integrated into the MEXC exchange, moving your newly acquired USDT to the spot or futures market is instant and free. We were ready to trade altcoins within seconds of the escrow release.

- Global fiat footprint: With support for over 30 fiat currencies and a massive array of local payment methods, it’s a highly versatile option for traders in emerging markets.

Weaknesses:

- The “hidden” spread: While the platform fee is zero, the exchange rate offered by merchants often carries a premium. In our test, we paid roughly 0.8% over the spot market price – effectively a “hidden fee” for the convenience.

- Ghost-town liquidity for niche coins: If you want to buy anything other than USDT, BTC, or ETH, you’re mostly out of luck. The order books for smaller assets are often empty, forcing you to buy USDT first and swap later.

- Merchant reliability roulette: Unlike a centralized order book, you’re at the mercy of the human on the other side. Some merchants are lightning-fast, while others can be slow to respond, potentially locking up your funds in escrow longer than expected.

- Strict regional compliance: Depending on your location, you may find yourself hit with sudden KYC requirements or restricted payment methods, which can be a jarring experience if you’re used to the more “Wild West” vibe of the main MEXC exchange.

Our p2p MEXC review shows the platform is a top-tier choice for high-speed onboarding into the MEXC ecosystem, though it requires a discerning eye to ensure the spread doesn’t eat into your “zero-fee” savings.

Trustworthiness check

When you’re dealing with an exchange that lists tokens faster than a printer on overtime, you have to ask: is the floor solid? For our $200 mystery shopping mission, we dug into the history of MEXC to see if they’ve ever folded under a real attack.

Unlike many of its peers, MEXC has managed to avoid a “Titanic-level” headline hack where the entire treasury vanishes. However, the narrative isn’t entirely without its plot twists.

MEXC prides itself on a “zero-breach” history regarding its core hot wallets, which is impressive given its volume. However, the “trust” conversation around MEXC usually shifts toward its aggressive listing style and regulatory agility.

- The “frozen funds” noise: In late 2023 and early 2024, a wave of social media reports surfaced from users claiming their accounts were frozen due to “abnormal trading activities.” MEXC countered that these were standard anti-fraud measures, but for a P2P trader, it’s a reminder that centralized power can be a double-edged sword.

- Proof of reserves (PoR): To fight the post-FTX “trust deficit,” MEXC maintains a Proof of Reserves page. During our test, we verified they claim a 1:1 reserve ratio for majors like USDT, BTC, and ETH. It’s the industry-standard way of saying, “Yes, we actually have your money.”

In the p2p MEXC marketplace, the “security incident” is rarely a hack and usually a “handshake gone wrong.”

- MEXC’s escrow is the primary defense. The most common “incidents” on the platform aren’t system-wide breaches, but rather social engineering attempts – like buyers sending fake SMS payment confirmations.

- We noticed that MEXC’s P2P interface is littered with warnings: “Do not release until you see the money in your bank account.” It’s a bit like a “Caution: Hot” label on a coffee cup – obvious to veterans, but essential for the $200 beginner.

MEXC is a fortress of utility, but it operates with a “move fast” mentality. Their security infrastructure has held up against external hackers, but the “trustworthiness” relies heavily on your own compliance with their rules. If you follow the escrow protocol to the letter, your $200 is as safe as houses. If you wander outside the chat for a “better deal,” you’re on your own.

GNcrypto’s overall MEXC P2P rating

| Criterion | Score |

|---|---|

| Escrow & Trade Safety | 4.0 |

| Liquidity & Order Book Depth | 3.5 |

| Fees & Payment Methods | 4.5 |

| Verification & Account Limits | 3.5 |

| Platform Performance & Reliability | 4.0 |

| User Experience & Trade Flow | 4.0 |

| Customer Support & Dispute Handling | 3.5 |

| Total | 3.95 / 5.00 |

How we test P2P platforms

At GNcrypto, we put transparency first when evaluating peer-to-peer (P2P) cryptocurrency trading platforms. Our reviews are based on hands-on testing and thorough analysis across all key dimensions that matter for safely buying and selling crypto directly with other users.

We do not audit platform solvency or guarantee user safety from all scams. Instead, our scores reflect observable escrow mechanisms, order book depth, and platform support quality. We do not accept payment for ratings or modify scores based on partnerships.

Categories & weights

We rate P2P platforms on seven criteria. Escrow and Liquidity are weighted heaviest because a platform that isn’t safe or has no one to trade with is useless, regardless of how pretty the UI is.

- Escrow & Trade Safety – 25%

- Liquidity & Order Book Depth – 20%

- Fees & Payment Methods – 15%

- Verification & Account Limits – 15%

- Platform Performance & Reliability – 10%

- User Experience & Trade Flow – 10%

- Customer Support & Dispute Handling – 5%

The material on GNcrypto is intended solely for informational use and must not be regarded as financial advice. We make every effort to keep the content accurate and current, but we cannot warrant its precision, completeness, or reliability. GNcrypto does not take responsibility for any mistakes, omissions, or financial losses resulting from reliance on this information. Any actions you take based on this content are done at your own risk. Always conduct independent research and seek guidance from a qualified specialist. For further details, please review our Terms, Privacy Policy and Disclaimers.